M&HCV sales skid for second month in a row

After sustained sales in the first 7 months of FY2019, the critical medium and heavy commercial vehicle segment sees de-growth for the second straight month in December, due to high inventory levels and impact of the revised axle-load norm.

Is India’s M&HCV growth story slowing down? It clearly seems so. This even as LCV numbers are helping buffer overall CV sales. After sustained growth for the first seven months of FY2019, the CV industry is feeling the impact of moderating sales, particularly in the medium and heavy commercial vehicle segment.

While the cumulative overall CV industry sales of 647,278 units in April-November 2018 show strong YoY growth of 31.49 percent with M&HCVs up 34.45 percent and LCVs by 30 percent, November 2018’s M&HCV sales of 25,363 units (-10.97%) were the first month when they were down after several months of growth.

Now, it looks like M&HCV sales in December have followed the same declining trend. Both Tata Motors and Ashok Leyland, the two dominating players in the segment, have registered a fall of over 25 percent in their M&HCV sales.

A number of factors are impacting overall automotive sales including liquidity crisis in the industry, higher interest rates and fuel costs (albeit they have dropped in the past month). The steep fall in the M&HCV segment is partially due to a drop in cargo sales and also additional capacity in the current heavy truck parc where vehicles are registered for higher payload due to the increase in axle load norms.

Commenting on the sales slowdown, in a recent interview with Autocar Professional, the president of the apex industry body Society of Indian Automobile Manufacturers (SIAM), said: “I think the full effect of the change in axle-load norms, which has allowed fleet operators to get additional capacity, now looks to have settled down across the country from being only in a few pockets earlier. So, firstly, the axle-load norms have hampered the growth of heavy commercial vehicles (HCVs). Secondly, easy availability of finance is not there as the NBFCs are unable to lend because of the ongoing financial issue. Also, there is no adequate compensation to the fleet owner due to the increase in fuel prices. So, all these three factors together have slowed down growth. Moreover, the slowdown in the passenger vehicle segment is also impacting sale of trailers which are used for the movement of these vehicles across the country. Within the HCV segment, there is no perceptible growth from trailers and haulage trucks, with the only possibility coming in from tipper trucks as infrastructural spend continues to be there.”

“I would presume that growth in the next quarter (Q4 of FY2019) will be lower. However, there will be a rush of sale sometime around the second half of FY2020 as people will look to replace their existing BS III vehicles, which are there in large numbers and will become two generations older than BS VI, in order to escape low resale value once BS VI norms kick in. Having said that, I am not sure if the upcoming elections would see any meaningful announcements that give the segment a blip,” he added.

IFTRT, which tracks the monthly freight rates on key trucking routes in India, says, “Despite a steep daily drop in diesel price in December and continuing drop in diesel price during October and November 2018, truck rentals during December 2018 and retail parcel freight dropped by 5-6 percent on trunk routes with a drop in cargo offerings from factory gates. Supplies of fruits and vegetables to APMCs went up by 10-15 percent but oversupply of the truck fleet has also suppressed truck rentals and part-load freight charges, resulting in an almost 22-25 percent drop in HCV sales during December 2018 over the same period last year.”

However, even as the overall customer and fleet buyer sentiment remains subdued and the muted festive session impacted M&HCV sales, LCV sales remain fairly positive due to stronger demand for last-mile connectivity and rural market demand.

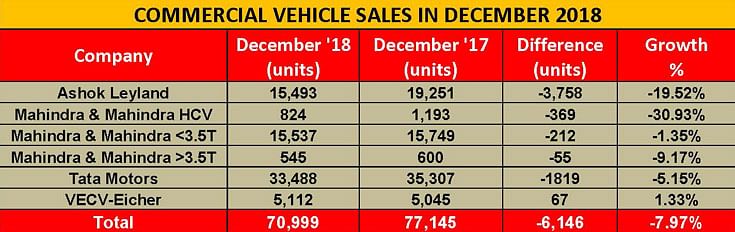

How the OEMs fared in December

Commercial vehicle market leader Tata Motors sold a total of 36,180 units in December 2018, which constitutes a drop of 11 percent (December 2017: 40,447). Its M&HCV truck sales fell sharply by 27 percent to 11,506 units (December 2017: 15,828) and ILCV number were down by 5 percent with 4,846 units YoY. What helped Tata was the demand for its SCV cargo carriers and pickups which together sold 16,367 units (+ 8%). The commercial passenger carrier (bus) segment saw sales of 3,461 units (-22%); this sector has borne the brunt of slow STU buying and permits for private hiring.

Ashok Leyland too recorded a steep decline in overall sales – 15,493 units in December 2018, a YoY de-growth of 20 percent (December 2017: 19,251). Its M&HCV sales fell 29 percent YoY at 11,295 units albeit its LCVs recorded healthy 27 percent YoY growth at 4,198 units sold (December 2017: 3,303).

Mahindra & Mahindra’s overall CV sales declined marginally by 4 percent to 16,906 units (December 2017: 17,542). Its M&HCV numbers, at 824 units sold, were down 31 percent YoY (December 2017: 1,193). Sales in the below-3.5T GVW segment remained flat at 15,537 units (December 2017: 15,749), while those in the above-3.5T GVW segment were down 9 percent at 545 units (December 2017: 600).

Meanwhile, VE Commercial Vehicles slipped into single-digit growth; the company sold 5,112 units in the domestic market last month, up 1.3% (December 2017: 5,045 units).

With three months left to go for FY2019, will the CV industry cross the one-million sales mark for the first time in a fiscal? Difficult to say right now, but in an election year, plenty of e-commerce industry demand for LCVs and SCVs and the continuing infrastructure spend by the government, there’s no saying why it shouldn’t, fingers firmly crossed of course.

Also read: Car sales remain in slow growth mode, OEMs look to January to jump-start numbers

RELATED ARTICLES

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

Daimler India CV and BharatBenz deliver 200,000th truck

Daimler India Commercial Vehicles' portfolio includes truck models ranging from 10 to 55 tonnes for a wide variety of ap...

02 Jan 2019

02 Jan 2019

19828 Views

19828 Views

Autocar Professional Bureau

Autocar Professional Bureau