India’s 2-wheeler industry sells over 20m units for the first time in a fiscal

Cumulative sales numbers of the Big Four along with Royal Enfield and Suzuki reveal that Indian two-wheeler OEMs are firing on all cylinders: 20,006,406 units and counting.

Apex industry body, the Society of Indian Automobile Manufacturers (SIAM), has confirmed Autocar Professional's sales analysis of the two-wheeler industry's domestic sales. Final sales numbers for FY2018 are: 20,192,672 units, which marks the first time that the industry has surpassed the 20-million sales milestone.

The just-ended FY2018 is turning out to a fiscal year full of new milestones. While Maruti Suzuki India and Hero MotoCorp have notched their very own highs in the domestic market, the Indian two-wheeler industry, which comprises 12 OEMs who reveal their monthly sales to apex body SIAM, has crossed the 20-million unit sales milestone for the first time.

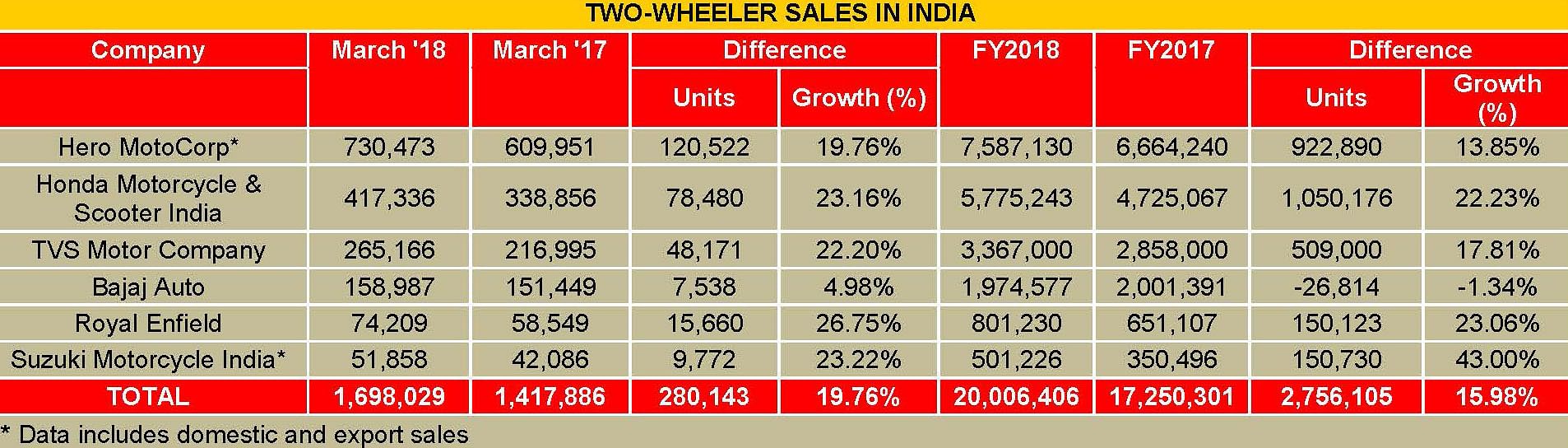

As per industry statistics compiled by Autocar Professional, cumulative sales data of the top six OEMs which have announced their domestic market numbers for fiscal year 2017-18 stacks up to 20,006,406 units (see sales table below), which is a robust 15.98 percent year-on-year growth. The Big Four – Hero MotoCorp, HMSI, TVS Motor Co and Bajaj Auto – along with Royal Enfield and Suzuki Motorcycle India.

Surpassing the 20-million mark also means that the Indian two-wheeler industry is poised to post double-digit growth after six years. The last time was in FY2012 when it grew 12.25 percent with sales of 13,435,769 units. What’s more, the 20-million sales mark has been breached by cumulative numbers of only six OEMs. The remaining six have yet to reveal their fiscal performance, which means the big number for FY2018 will get bigger.

This achievement comes as a result of the top players notching their best-ever sales in a fiscal, starting with market leader Hero MotoCorp. The world’s largest two-wheeler manufacturer has stuck true to its title with humongous sales of 7,587,130 units or 37.92 percent of the record 20,006,406 units sold by the six OEMs under review. This is a world record for any two-wheeler maker and constitutes sale of 20,786 units sold on each day in FY2018. This also means every 20 seconds a Hero product was sold somewhere in the country. It is also the company’s best performance ever since its incorporation as Hero Honda Motors in 1984.

Commenting on the company’s performance, Pawan Munjal, CMD, Hero MotoCorp, said: “2017-18 has been a period of high growth where Hero MotoCorp achieved significant milestones, and set new benchmarks in the two-wheeler industry. Achieving the landmark 7 million annual sales milestone in both the calendar year 2017 and fiscal year 2017-18 is a clear indication that Hero continues to be the preferred choice of customers across markets. Our overall global sales growth has given further impetus to our global expansion plans. We are determined and focused on bringing technologically-advanced products for our customers across the globe, building our production capacities and expanding our customer touch points.”

Hero recently laid the foundation stone of its eighth manufacturing site at Chittoor (Andhra Pradesh). The last fiscal also witnessed Hero MotoCorp start operations at its Bangladesh-based assembly unit (in May 2017).

FY2017-18 highlights a critical change in Hero MotoCorp’s direction, revealed through new product unveils and strategy. In H2 FY2018, it unveiled premium products such as the 200cc XPulse and Xtreme 200R motorcycles and the 125cc Maestro Edge 125 and Duet 125 scooters. To drive sales at the entry level, the company has recently infused new, updated models to its commuter motorcycle portfolio strengthening the Passion and Splendor brands in the form of the 110cc Passion Pro, Passion XPro and the 125cc Super Splendor.

Honda is biggest volume gainer in FY2018

Meanwhile, Honda Motorcycle & Scooter India (HMSI) stands out as the biggest volume gainer, surpassing Hero MotoCorp. HMSI has added new volumes of more than one million units in the 12-month period of FY2017-18, a commendable sales record. In FY2018, the company sold 57,75,243 units, thereby registering, according to HMSI, a new world record of adding new sales of over a million units in a single fiscal – additional volumes of 1,050,176 units over its FY2016-17 sales of 4,725,067 units.

According to Yadvinder Singh Guleria, senior VP (Sales and Marketing), “Honda 2Wheelers India is the only two-wheeler company in the world to grow at a pace witnessed never before, adding over 1 million incremental customers in a single year. With four brand-new models, new capacity infusion, addition of 500 new network outlets increasing our reach to hinterlands, Honda successfully consolidated its leadership further in scooter segment while aggressively gaining new motorcycle customers.”

Honda’s growth comes on the back of the ever-growing popularity of its iconic Activa scooters, its class-leading 125cc CB Shine models and the new-found traction in the premium 160cc commuter motorcycle segment via CB Hornet 160R and CB Unicorn 160. And in an effort to further boost its presence in the growing 160cc motorcycle segment, it recently rolled out the stylish X-Blade, which borrows the engine from other 160cc siblings.

The company is also recording good traction in the premium 125cc scooter segment with the Grazia riding into the popular charts within a month of its domestic launch. Autocar Professional estimates the Grazia scooter is garnering additional volumes of 20,000-25,000 units every month. This appears to be a good sign for the company as rivals like Hero MotoCorp, TVS and Suzuki are eye the surging 125cc scooter segment.

It is noteworthy to mention that Honda has gone a step further by introducing the 2018 edition of its 250cc CBR 250R and the 160cc CB Hornet 160R with much-desired safety feature of the anti-lock braking system (ABS). Other new additions to its vast portfolio includes the 2018 edition of the 125cc CB Shine and the 110cc Livo and Dream Yuga models aimed at boosting sales at the entry level.

TVS notches record sales, Jupiter shines brighter

India’s third largest two-wheeler company, TVS Motor Co, sold 3,367,000 units in FY2018, up 17.81 percent (FY2017: 2,858,000). Credit for this strong performance goes to the 110cc Jupiter scooter, which is leading from the front along with the iconic moped (TVS Super XL) as the bestselling two-wheeler models from the Chennai-based manufacturer.

The company is working hard to push its presence in the premium segments, amply seen in its new product launches. It has added three new models under its premium motorcycle Apache brand including the 310cc Apache 310 RR as its flagship model in December, followed by the updated RTR 200 4V version 2.0 in January and the RTR 160 4V in March. On the scooter front, TVS has forayed into the 125cc segment with its NTorq 125, which offers a host of unique features.

The company has high hopes from the entry-level Apache model – the RTR 160 4V – which is understood to be the bestselling motorcycle under the Apache brand.

Bajaj Auto feels the heat in India, but is a king in exports

Bajaj Auto, India’s fourth largest two-wheeler player, missed the two-million unit sales mark by a whisker, selling 1,974,577 units in FY2017-18, a marginal decline of 1.34 percent YoY. The company recently rolled out the 2018 edition of its popular range including the Pulsar, Avenger and has also launched new models under its Discover umbrella to boost sales.

At the premium end, while its 375cc Dominar model has failed to garner a good response from the domestic market, the KTM range appears to be in consistent demand among the select customer profiles looking for premium street and sport bikes. It remains to be seen how Bajaj Auto responds to the changing dynamics of the motorcycle market and defines the future roadmap of its bestselling range – the Pulsar umbrella.

Bajaj Auto though is the No. 1 export player. Its shipments grew substantially by 14 percent to 1,394,757 units in FY2018 (FY2017: 1,218,541). As a result, the gap between domestic sales and exports has reduced substantially from 782,850 units in FY2017 to 579,820 units in FY2018.

Royal Enfield guns for sales, implements expansion plans

Continuing with its month-on-month growth, Royal Enfield reported sales of 74,209 units in March 2018. This marks a YoY growth of 26.75 percent for the iconic motorcycle brand which once barely sold 10,000 units in a year.

On the cumulative sales front, it has delivered 801,230 units in FY2018, growing by an impressive 23.06 percent YoY. The company’s growing yearly sales appear to be perfectly aligned with its capacity expansion program. Almost at par with its growing sales, the company had plans to scale up its production capacities to 825,000 units by end-FY2017-18. It has now announced fresh investments of Rs 800 crore as capex for FY2019. This, according to the company, will include the expansion of production capacity under phase II at its Vallam Vadagal facility in Tamil Nadu, augmenting total capacity to 950,000 units.

Speaking on the company’s investment plans, Siddhartha Lal, MD & CEO, Eicher Motors said, “Our demand continues to exceed supply, and we continue to see strong growth from all our markets. Therefore, we have decided to expand our production capacity with the second phase of our Vallam Vadagal plant near Chennai, Tamil Nadu. We will also complete construction of our Technology Centre in Chennai this year, and invest further in the development of new products to meet upcoming regulations and to expand our portfolio for our global markets.”

Suzuki Motorcycles India: the dark horse

Completing its annual target of selling 500,000 units during FY2018, Suzuki Motorcycle India sold a total of 501,226 units, up 43 percent YoY, which is a result of robust consumer demand for its bestselling model – the Access 125 scooter. Meanwhile, the Gixxer series (all powered by the 155cc engine) has given a strong foothold to the company in the premium commuter motorcycle category. The company has reiterated its focus of continuing to work towards bringing more premium products to the domestic market in near future too.

Commenting on the record sales performance, Sajeev Rajasekharan, EVP, SMIL said, “We have taken the first step successfully towards our objective of achieving 1,000,000 unit sales in FY 2019-20. The onus is now on us to sustain the momentum generated by this growth and continue to scale higher peaks. We have a well-rounded and an exciting portfolio of premium scooters and motorcycles including the upcoming Burgman Street, and the new Intruder FI, which is already in the market to complement the successful carburetted variant.”

It is to be noted that while the market will continue to see new model launches and facelifts, all companies are gearing up for the incoming safety norms (for the existing two-wheeler model range) and the BS VI emission norms in near future on priority. It would be interesting to see how the market demand fares during the Q1 FY2018-19 period, which has inherited a good growth momentum from Q4 FY2017-18.

Read more:

Movers and shakers in the Indian two-wheeler industry

RELATED ARTICLES

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

Daimler India CV and BharatBenz deliver 200,000th truck

Daimler India Commercial Vehicles' portfolio includes truck models ranging from 10 to 55 tonnes for a wide variety of ap...

04 Apr 2018

04 Apr 2018

68417 Views

68417 Views

Autocar Professional Bureau

Autocar Professional Bureau