Honda increases its India scooter market share to 58%

Further increasing the domestic scooter sales gap with TVS Motor Co,Honda Motorcycle and Scooter India (HMSI) has continued its dream run in Q1 (April-June 2015) of the ongoing fiscal year.

Further increasing the domestic scooter sales gap with TVS Motor Co, the No. 2 scooter player in India, Honda Motorcycle and Scooter India (HMSI) has continued its dream run in the first quarter (April-June 2015) of the ongoing fiscal year.

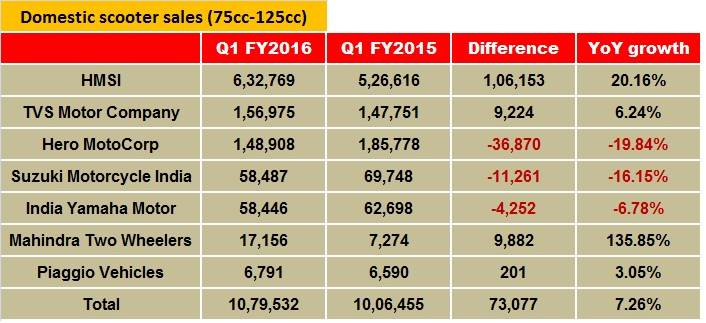

Having registered total sales of 632,769 units in Q1, the wholly owned Indian arm of Japan’s Honda Motor Company now leads the domestic scooter market (75cc-125cc) with an overwhelming market share of 58.62 percent (HMSI’s scooter market share in Q1 FY2015 was 52.32 percent.)

It is leading its immediate competitor, TVS Motor Company now as against Hero MotoCorp in Q1 FY2015, by a whopping 475,794 units – more than three times the sales volume of the number two player. The company has shown a growth of 106,153 units over sales in Q1 FY2015 (526,616 units), recording a YoY growth of 20.16 percent.

This growth comes at a time when three (Hero MotoCorp, Suzuki Motorcycle India and India Yamaha Motor) of the major seven scooter manufacturers in India have reported a decline in their Q1 FY2016 sales volumes. Honda’s insurmountable growth in the scooter segment is the result of its top-notch products and the ever increasing recognition of its brand, specifically for its scooters.

Talking to Autocar Professional, YS Guleria, senior vice-president (sales and marketing), HMSI, said: “We are the No. 1 player (overall two-wheelers) in the top 35 cities in India. We were the No. 1 two-wheeler company in five states so far. But now after the Q1 FY2016 results, we are the largest player in seven states and a Union territory (Chandigarh) now. We added Gujarat and Delhi in the past quarter. Q1 FY2016 was the first ever Q1 across any financial year when we sold more than one million two- wheelers.”

HMSI clocked total sales of 10,56,810 units (domestic + exports) in Q1 FY2016.

Honda which, according to the company, adds close to 75,000 female customers (who buy scooters) every month, has plans of rolling out 15 new models in CY2015. “With the Livo 110cc motorcycle (launched on July 10), we have now already rolled out 9 models so far in this year,” added Guleria.

Honda has been consolidating its India-specific portfolio regularly along with making efforts of making inroads into the rural markets. While expanding its local network, which currently stands at 3,950 as of end-June 2015, to a footprint of 4,600 outlets by end-March 2016, the company is also tying up with nationalised banks, non-banking financial corporations (NBFCs) and gramin banks to reach the potential buyers via convenient two wheeler financing schemes.

TVS is second largest scooter player in Q1 FY2016

Q1 FY2016 saw a remarkable achievement by TVS Motor Company. Surpassing Hero MotoCorp, it became the No. 2 player in the scooter segment. But this obviously is on the back of the contribution made by the sales of its 75cc-90cc small scooters such as the Scooty Streak and the Scooty Pep+. Targeting first-time riders (students, females), both these models are powered by a four-stroke, single-cylinder, 87.8cc engine that churns out a peak power output of 5bhp.

The company sold a total of 156,975 scooters during Q1 FY2016, which includes sales of 24,468 units and 132,507 units in the scooter categories of 75cc-90cc and 90cc-125cc respectively.

TVS Motor Company has lost substantial ground in the small scooter space. It reported a fall of close to 44 percent YoY in the sales of 75cc-90cc scooter category. However, banking on the robust sales of its 109.7cc Jupiter model (pictured above), the company has reported a healthy growth of 27.56 percent in the bigger, 90cc-125cc scooter category.

On an overall basis, the company has shown a reserved YoY growth of 9,224 units over its Q1 FY2015’s sales of 1,47,751 units. This accounts for a YoY growth of 6.24 percent.

Slipping to number three position, the two-wheeler industry leader Hero MotoCorp sold 148,908 scooters in the domestic market during Q1 FY2016, which is down by 19.84 percent YoY (Q1 2015: 185,778).

Impacted by the absence of no new scooter models for some time now, Hero continues to offer only two models in its scooter portfolio – Pleasure and Maestro – which cater to the sub-categories of 102cc and 110cc scooter buyers respectively. This is against Honda’s current scooter portfolio of five models, which have seen regular facelifts over time. While Hero’s last major scooter launch was in 2012 when it had launched the Honda Activa-rival, Hero Maestro, it has only rolled out facelifts and new colour schemes on the two models over the past three years.

However, this is expected to change as the company has lined up new scooter launches in Q2 FY2016. The company is working towards expanding its annual scooter production capacity also, which, as company officials say, is currently close to 80,000 units per month or one million units per year.

Suzuki and Yamaha are two players in this segment which registered a decline YoY. While Suzuki sold 11,261 units less than its Q1 FY2015 sales of 69,748 units, at 58,446 units Yamaha’s Q1 FY2016 sales were lower by 4,252 units as compared to its Q1 FY2015 sales.

Industry analysts say that a decline in the last quarter’s sales volume of Hero MotoCorp, Suzuki and Yamaha can be attributed to the increasing penetration of Honda’s popular Activa and TVS’ Jupiter models across various urban and semi-urban markets.

Mahindra Two Wheelers, a relatively smaller player in this segment, has shown a growth of 9,882 units over its Q1 FY2015 sales of 7,274 units, on the back of its new 110cc scooter model – the Gusto. Launched last year in September-October, the company had decided to execute the all-India rollout of this model under different phases.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

13 Jul 2015

13 Jul 2015

11069 Views

11069 Views

Autocar Pro News Desk

Autocar Pro News Desk