Growing LCV sales pointer to green shoots of recovery

Considerable part of the LCV sales happen in semi-urban and rural areas and this year’s Budget’s focus on rural economy and strengthening road infrastructure will help boost rural consumption and give a fillip to LCV sales.

The light commercial vehicle segment, after two years of a prolonged slump, is seeing green shoots of recovery. However, it is early days yet and the segment remains weak and susceptible to financing issues and also overcapacity due to lack of sustained demand.

Continuous growth in the Medium and Heavy Commercial Vehicle (M&HCV) segment over the past 18 months has come about due to the overall buoyancy in the economy and increased focus on infrastructure activities. The Union Budget’s increased allocation to infrastructure and roads and highways development will also drive numbers in this critical vehicle segment.

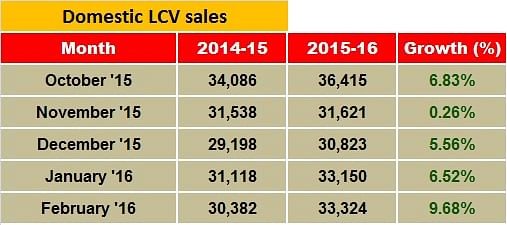

It was in October 2015 that overall LCV sales turned positive for the first time after more than 2 years of negative growth, increasing by 6.83% with total sales of 36,415 units. Since then, over the past five months, the segment has seen its sales growth month on month. For November, December, January and February, the segment has grown 0.26%, 5.56 %, 6.52% and 9.68%, year on year, respectively.

Commenting on the LCV industry’s growth, R Ramakrishnan, senior vice-president, Commercial Vehicles, Product Strategy and Planning and Customer Value Creation, Tata Motors, says, “LCV sales so far has been negative but there was small growth in the past couple of months. There is still a considerable amount of growth to come for LCVs but it will not be sudden or large as M&HCVs because financiers are still cautious and rightly so. I think LCVs will take some time before they start recovering on larger volume or percentage growth. But it definitely the sector is on the positive track and after another few months we will able to say confidently that the worst is behind us. Right now, I will be little guarded on LCVs.”

Although, there is month on month growth since October 2015, overall LCVs sales during April 2015 to February 2016 remain negative; this hints that the segment is still under stress and yet to see complete recovery. During April 2015-February 2016, the segment decline 1.45 percent with total sales of 340,603 units against 345,619 units.

According to ICRA, the decline in LCV sales has been led by a sharp contraction in small commercial vehicles (SCVs) where financing plays a critical role and has dried down due to sharp rise in delinquencies. Accordingly, financiers have tightened the lending norms, reduced the Loan-To-Value (LTV) ratio and shifted focus on collections rather than disbursals.

Considerable part of the LCV sales happen in semi-urban and rural areas and this year’s Budget’s focus on rural economy and strengthening road infrastructure will help boost rural consumption and give a fillip to LCV sales.

Mixed bag for OEMs

During April 2015-February 2016, the LCV passenger carrier segment has grown 8.8% selling 42,011 units against 38,611 units in the same period the previous year, with almost every OEM recording growth. However, the LCV goods carrier segment, which comprises big volumes since it involves last mile delivery vehicles, has declined 2.74 percent with total sales of 298,592 units, signaling that the sector is yet to recover fully.

In the LCV goods carrier segment, Ashok Leyland with its best-selling Dost, continues to perform well. The company has a market share of 8.29 percent in the category and registered growth of about 9.27% selling 24,766 units. Mahindra & Mahindra, with strong performance of its pick-ups, maintained its leadership in the segment with 47% market share in the category. The company sold 141,246 units during April 2015-February 2016, growing by 5.66%. Tata Motors, which has a strong presence in the LCV goods carrier market with its Ace range of small trucks and a 39% market share, has seen its sales decline. The company sold 117,011 units de-growth of 14.1%. VE Commercial Vehicles, with market share of 2 percent in the category, posted 31.7% growth in the segment with sales of 6,210 units.

If the past five months’ sales are anything to go by along with the reducing rate of decline, then the LCV segment is headed for improved times. The boom in the e-retailing business, which banks on SCVs to deliver their goods to town and country, is expected to translate into bigger numbers for the sector.

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

By Kiran Bajad

By Kiran Bajad

14 Mar 2016

14 Mar 2016

4783 Views

4783 Views