Carmakers see tepid growth in September as fuel prices bite, consumer sentiment dips

Wallet-busting petrol and diesel prices, a high year-ago base and a lowered consumer sentiment impact sales. Carmakers look towards festive season with fingers firmly crossed.

Even as key growth factors such as a bountiful monsoon and an improved economy favour its cause, passenger vehicle sales in India in September 2018, as per the numbers released by major OEMs today, point to tepid growth and slightly worrying at that. PV industry captains will be looking to the festive season to drive up demand.

While overall numbers project a safer picture, relative growth has been slow, primarily due to the high year-ago base created by a rush in PV sales after GST implementation in July 2017 and, more recently, the continuing impact of devastating floods in Kerala, a major car market. Also, it is to be noted that the festive occasion of Navratri, when much car buying happens in India, was in September 2017. Thus, with 2018’s Navratri coming up on October 10, expect industry to perform much better.

Meanwhile, a relentless surge in fuel prices over the past few months is also playing sales spoilsport, where petrol nudged the Rs 90 mark in Mumbai on September 24 to retail at Rs 90.17 for a litre in the city, while diesel clambered to Rs 78.67 per litre, making it a continuous upward rally in prices since July.

In totality, while passenger vehicle manufacturers have seen good relative growth in Q1 of FY2019, it has slightly been mellowed in Q2 owing to the GST effect. In July, SIAM’s deputy director general, Sugato Sen had given a similar outlook for the next few months to follow and had said, “We expect August and September sales to remain slow as well, again owing to the prolonged effect of the GST where there was a boost in PV sales during the same period in FY2018.”

“Growth will be back October onward because of the diffused effect of GST-led benefits, as well as the festive season driving sales,” Sen had added.

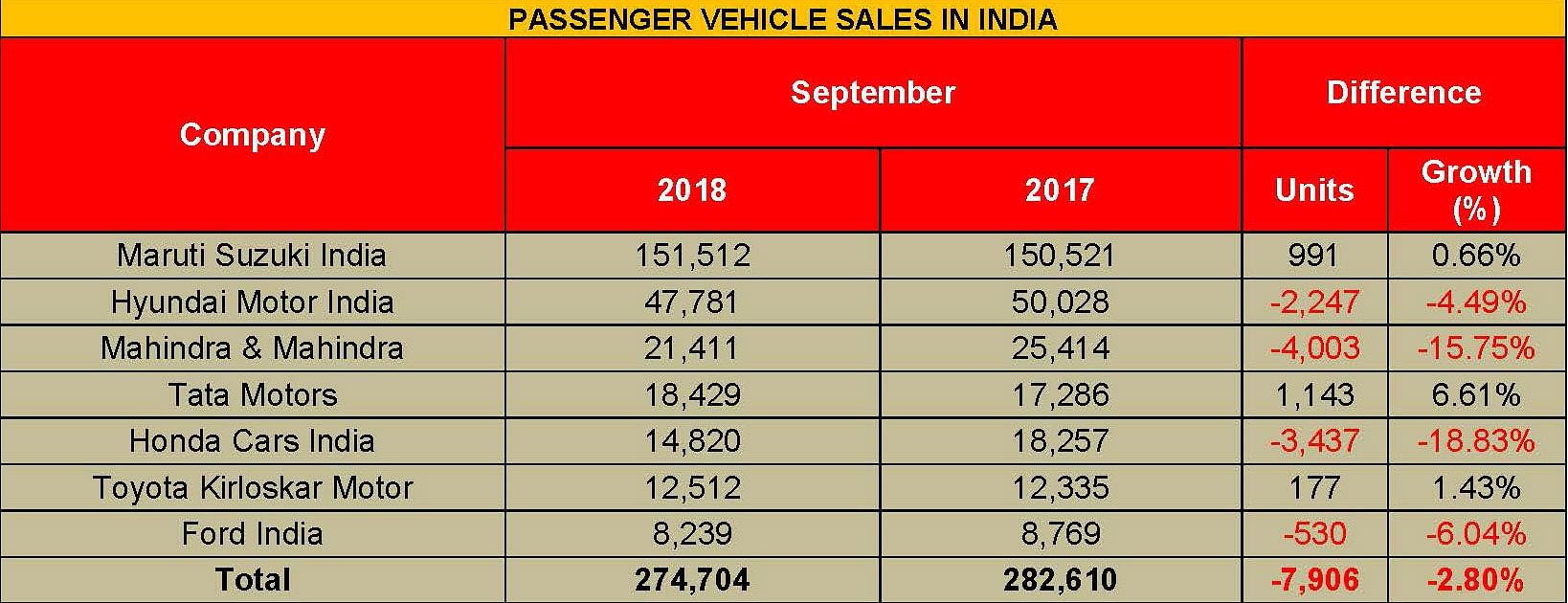

Here’s looking at how India's carmakers have fared in September 2018

Maruti Suzuki India: Maruti Suzuki India has reported flat sales for September 2018. The country’s leading carmaker sold a total of 151,512 passenger vehicles (+0.7%), which is slightly more than the 150,521 units sold in September 2017.

Given that sales of passenger cars is down 1.4 percent at 115,228 units (September 2017: 116,886), demand for the company’s utility vehicles have saved the blushes for the company. Maruti sold a total of 21,639 UVs last month, which is 8.7 percent growth over September 2017’s 19,900 UVs.

While its entry-level Alto and Wagon-R went home to 34,971 buyers, declining a notable 9.1 percent (September 2017: 38,479), its quintet of compact cars – the Swift, Celerio, Ignis, Baleno and Dzire – clocked 74,011 units and grew by a marginal 1.7 percent (September 2017: 72,804) in the month.

The Maruti with the fastest-growing sales, surprisingly, came in the form of the Ciaz midsize sedan which, in its facelift avatar launched in August 2018, is being seen regaining lost ground in the domestic market. Being the most value-for-money offering in the segment and sold only through the company’s premium Nexa retail channel, the Ciaz registered sales of 6,246 units in the month, growing a respectable 11.5 percent (September 2017: 5,603). Meanwhile, the Omni and Eeco continue to do decent numbers: 14,645 units in September 2018, which is a 6.6 year-on-year growth (September 2017: 13,735).

Hyundai Motor India: The No 2 player by sales volumes, Hyundai Motor India sold 47,781 units in September, de-growing by a considerable 4.5 percent (September 2017: 50,028). The Korean carmaker has been seeing good demand for its Grand i10 and i20 hatchbacks, and has cumulatively sold 274,177 units across models between April-September, registering a growth of 3.67 percent (April-September 2017: 264,465).

According to Vikas Jain, national sales head, Hyundai Motor India, “Despite some on-going market challenges, we expect this festival season will induce positive sentiments among customers and the industry would witness a strong positive growth.”

Tata Motors: Tata Motors, which has been riding a wave of demand since some time now, continued in the same vein in September. With sales of 18,429 units, it saw notable 7 percent over last year (September 2017: 17,286). The company has clocked overall sales of 106,865 units over the first two quarters of FY2019, up a strong 31 percent over the year-ago performance when it sold 81,417 units between April and September 2017.

The growth comes on the back of good traction received by some of its contemporary products in the market, including the popular Tiago hatchback, Tigor compact sedan as well as the Nexon compact crossover. The company expanded these brands by introducing the limited edition Nexon Kraz, as well as the Tiago NRG – a compact crossover iteration of the hatchback.

Mahindra & Mahindra: Home-grown UV specialist, Mahindra & Mahindra clocked 21,411 units in PV sales, albeit significantly declining by 16 percent (September 2017: 25,414). While its passenger cars registered an uptick of 17 percent with sales of 1,526 units (September 2017: 1,305), the utility vehicles including the TUV 300, Scorpio and the XUV 500 considerably declined by 18 percent with sales of 19,885 units (September 2017: 24,109).

According to Rajan Wadhera, president, Automotive Sector, M&M, “Our recently launched Marazzo has been receiving a good response from customers. The month of September has been muted for passenger vehicles due to factors such as low consumer buying sentiment, high fuel prices and the effects of monsoon in many parts of the country. We remain hopeful that the upcoming festive season will augur well for us as well as the automotive industry.”

Honda Cars India: Honda too is feeling the heat of poor consumer sentiment. The company recorded monthly domestic sales of 14,820 units in September 2018, down 18.83 percent (September 2017: 18,257).

Commenting on the numbers, Rajesh Goel, senior vice-president and director, Sales and Marketing, Honda Cars India, said: “HCIL registered cumulative growth of 3.5 percent in the first half of fiscal year 2018-19 backed by strong demand for the new Amaze. The subdued market sentiment combined with higher base of September 2017 and onset of Shradh period in Northern India from last week resulted in lower sales in September compared to last year. In order to keep the dealer stock within our norms, we rationalised the wholesale dispatches in September. We expect that the festival period improves the market sentiment and results in positive sales in the coming month.”

Toyota Kirloskar Motor: Japanese carmaker Toyota Kirloskar Motor recorded cumulative sales of 12,512 units in September, maintaining flat sales, which stood at 12,335 units in September 2017.

Commenting on the sales performance, N Raja, deputy managing director, Toyota Kirloskar Motor, said,” We are happy to have sustained a positive growth momentum of 17 percent from April to September 2018, as compared to the same period last year. This growth can be attributed to the strong demand of the Innova Crysta, Fortuner, Yaris and the Etios Liva. We have reached a significant milestone of more than 400,000 happy customers for Etios Series in the month of September 2018. Etios Liva has seen a positive sales growth of 10 percent during April-September 2018 as compared to same period last year.”

“Customer demand in the auto industry has temporarily dampened owing to rising fuel prices, floods in different parts of the country and impact of currency weakness. However, we are confident that the buying sentiments will improve in the festive season with a strong customer demand,” Raja added.

Ford India: The American carmaker registered cumulative domestic sales of 8,239 units in September, declining 6 percent over last year, when sales stood at 8,769 units in September 2017.

Between April and September 2018, the company clocked overall sales of 49,038 units, up 7.84 percent (April-September 2017: 45,472). According to Anurag Mehrotra, president and managing director, Ford India, “The festival season has started on a lower than expected note, owing to floods in Kerala, rising fuel prices and rupee depreciation, the industry is looking forward to closing the festive season on a higher note.”

Also read: Two-wheeler OEMs clock strong numbers in September

CV sales moderate in September but are still up 23%

RELATED ARTICLES

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

New ZF SELECT e-drive platform gives EV makers a choice in 100 to 300 kW range

Modular e-drive platform optimally matches 800-volt overall system and components such as the electric motor and power e...

Daimler India CV and BharatBenz deliver 200,000th truck

Daimler India Commercial Vehicles' portfolio includes truck models ranging from 10 to 55 tonnes for a wide variety of ap...

01 Oct 2018

01 Oct 2018

6423 Views

6423 Views

Autocar Professional Bureau

Autocar Professional Bureau