Association of Indian Forging Industry foresees healthy growth for the forging industry

AIFI says despite the industry witnessing growth in the recent past, there are few concerns which seems to hamper the overall growth in the long run

The Indian automobile sector is currently driving in growth lane in the new fiscal year with robust sales growth across all vehicle categories, and the forging industry too opened the year 2018 on a robust note. The Association of Indian Forging Industry (AIFI) says compared to the usual trend of low production during the April-May in a fiscal year, in 2018-19 the industry witnessed a continued higher demand during the first quarter.

The surge in auto sales especially, the commercial vehicle and tractor sales resulted in an improved demand/growth for the Indian forging industry. According to the latest SIAM report, the commercial vehicle segment, which recorded smart growth since last few months, grew by 55.67 percent during the April-July 2018 over April-July 2017.The passenger vehicles segment though showed a slight decline last month due to Kerala floods and delayed festive season, however the overall segment rose by 9.32 percent in April- July 2018, compared to same period last year. For the tractor segment total sales in April- July 2018 was 307,000 units registering a 24.09 percent growth.

Sharing his thoughts Yash Munot, chairman – Western Region, Association of Indian Forging Industry, said, “The Indian forging industry is one of the key players in the auto component manufacturing sector and a major contributor to the government’s Make in India initiative. The growth in the new fiscal can be attributed to the surge in sales of vehicles across all segment in the last quarter which is continuing this quarter as well so far. It has provided a strong impetus to the forging industry and as a result, the demand for forgings has been on the rise in domestic market. The export of forging has also witnessed an increase in demand from both Europe and North American markets. Backed by these strong demands the forging industry is likes witness to a growth of more than 10 percent in the new fiscal year.”

The industry body says that another key aspect is the government’s big push for infrastructure growth which has created positive economic sentiments amongst the business community. It says that many global OEMs and Tier 1 players are setting up offices in India and are looking at procuring high standard quality products. This will open doors for lots of Indian manufacturers. Additionally, several auto OEMs are also looking at India as a base for exports to the other Asian, African and even European markets, which will push the growth for auto component industry as well.

India gears up to host 7th Asia Forge Meet 2019

The Association of Indian Forging Industry (AIFI) says it has always been at the forefront of undertaking proactive initiatives targeted towards improving the business environment for its members, thereby contribute to increasing their competitiveness through mutual cooperation and understanding of all parties concerned. The governing body will be hosting the Asia’s biggest forging congress -7th Asia Forge Meet 2019 India – during January 18-22, 2019 in Chennai, Tamil Nadu.

Previously AIFI had successfully hosted two editions of the International Forging Congress (IFC) in 1990 in New Delhi and in 2011 in Hyderabad along with 2nd Asia Forge Meet 2008 in New Delhi. This forum intends to bring together the entire forging industry and other allied industries on a common platform to share, demonstrate, network, exchange ideas, understand the latest trends worldwide, benchmark their company with the industry stalwarts and being updated on latest developments in forging technologies.

Key challenges and concerns

AIFI says despite the industry witnessing growth in the recent past, there are few concerns which seems to hamper the overall growth in the long run including the rising steel prices and demand supply gap, high electricity tariff rates in Maharashtra region, rising fuel prices, government’s thrust on electric vehicles and technology upgradation and modernisation.

Steel prices and demand supply gap: The forging industry in India has been showing a growth trend since last one year. However, there seems to be a huge demand supply gap, which exists, which is not being met by the steel manufacturers in India. Some of the reasons that can be attributed to the demand supply gap include -major players reeling under high debts, lower coal production by Coal India, as compared to the demand and gap in the quality standards to meet the higher level of demand in the automobile and significant rise in prices of graphite electrodes, an immensely vital raw material for steel manufacturers.

Forging industry says it is also concerned over the continuous rise of steel prices in India and is living under constant fear that if this trend continues, then it will defeat the ‘Make in India’ project and China will get a competitive edge in the world steel market, which as of now is the biggest steel exporter. The steel prices have inflated by around 25.5 percent in the last one year. The price of steel has gone up to Rs 47,740 per tonne, compared to Rs 38,000 per tonne in November 2017. Even though the global steel prices also witnessed immense the quantum influences was not as high.

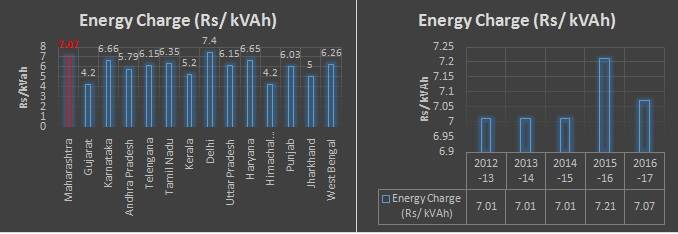

High electricity tariff rates in Maharashtra: On one hand manufacturing industries across India are extensively promoting the government’s Make in India initiative and on the other hand the manufacturing industries in Maharashtra are grappling with serious concerns related to high electricity tariff rates. According to the figures released by Maha discom last year, the state has lost about 500 consumers, which includes some the big names. Though, last year, the Maharashtra government reduced the power tariff for industries however, it has still not made the state a competitive destination as compared to neighbouring states like Gujarat, Karnataka, Andhra Pradesh and others which offer electricity at cheaper rates.

State-wise comparison chart highlighting power tariff rates and power tariff rates in Maharashtra in the last five years

Modernisation: Compared to the European, Japanese and American counterparts and companies from China, Korea and Taiwan the technology and automation levels is much lower (barring a few bigger forging companies)in India. According to a recent survey of the Indian forging industry, about 70 percent of the forging units in India are MSMEs who need to upgrade their technologies. For this, the industry needs huge government support in terms of further interred subvention and technology upgradation fund.

Electric vehicles: Another key issue concerning the future of the industry is the government’s renewed focus on electric vehicles and a move to eliminate petrol/diesel cars by 2030. It says the situation seems to be fluid and will require the government to draw a clear road map for the same. The introduction of EVs will have an adverse impact on Indian forging industry as around 60 percent of the forging units are into manufacturing of auto components and a majority for engine and transmission related application. The Internal Combustion Engines (ICEs) have approximately 2,000 moving parts as compared to only 20 moving parts in EVs and it does not have engine and transmission parts. It only comprises steering components, suspensions and axles out of the forged auto components. As a result, on an average 40-50 percent of demand for forged auto components would decline resulting in job losses and unit shutdowns.

AIFI suggests that the need of the hour is for a aggressive and assertive political action that will provide a level playing field to Indian manufacturers to become competitive in the global platform and other relevant policy reforms to foster ease of doing business.

“Despite the overall business environment looking up and anticipating good demand the industry is still faced with challenges in steel pricing, steel availability and impact due to the GST implementation issues and technology upgradation, government focus on electric vehicles, etc. The forging units need support from the government by aggressive assertive political action in solving the above issues,” said Munot.

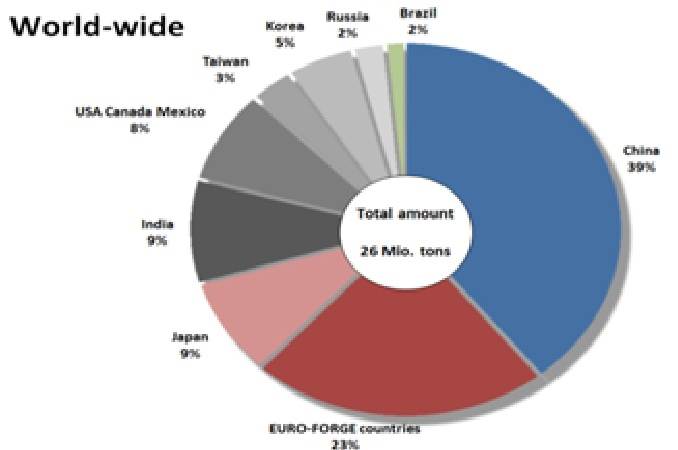

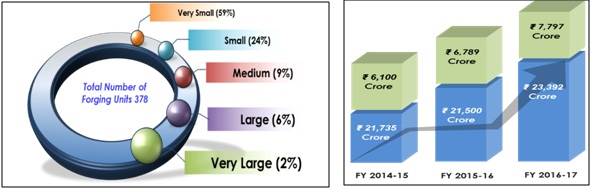

India is the 3rd largest manufactures of forgings in the world, after China and the European nations (led by Germany).The forging industry is one of the major contributor to the Indian manufacturing industry. According to a recent survey conducted by the forging association, the installed capacity has increased from 38.5 lakh MT in 2016-17 to 39.4 lakh MT in 2017-18 with overall production of forgings increased from 23.98 lakh MT to 25.24 lakh MT.

In the western region AIFI says there are around 147 forging units, which account for an annual turnover of Rs 15,000 crore, having a total installed capacity of 18.07 lakh MT accounting for 47 percent of the total installed capacity in India. The Hot Closed Die process of forging is the most common process contributing to an installed capacity of 24.14 lakh MT, where the region account for 45 percent of the same. The survey depicts 100 percent forming process to be adopted only in this region, and these units have an average utilisation capacity of 61 percent.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

By Autocar Pro News Desk

By Autocar Pro News Desk

10 Sep 2018

10 Sep 2018

24452 Views

24452 Views