IMF and World Bank say India will drive ahead of China in growth race

The International Monetary Fund (IMF) and the World Bank have both voted for the growth story in India and forecast that the country will drive ahead of China by 2016.

The International Monetary Fund (IMF) and the World Bank have both voted for the growth story in India and forecast that the country will drive ahead of China by 2016.

The IMF’s World Economic Outlook report released yesterday and the World Bank’s South Asia Economic Focus report both are optimistic about India’s GDP performance, mainly driven by ongoing reforms.

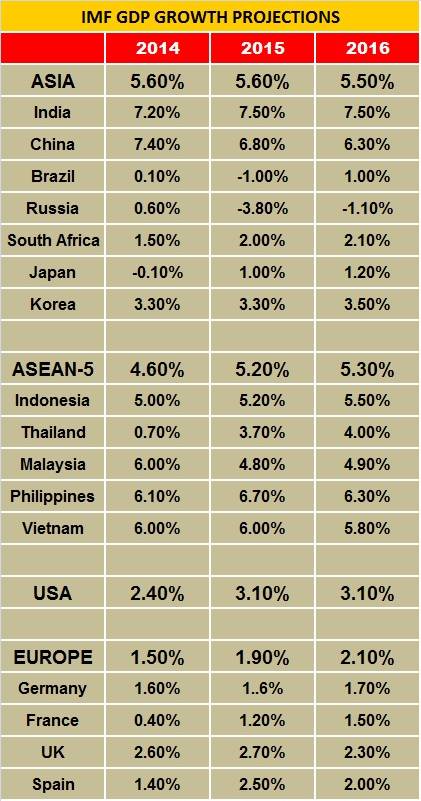

The IMF has forecast that the Indian economy will grow by 7.5% this year, up from 7.2% in 2014, and maintain 7.5 percent growth in 2016. In comparison, the slowing Chinese economy will see its GDP drop from 7.4% in 2014 to 6.8% this year and further to 6.3% in 2016 “as previous excesses in real estate, credit and investment continue to unwind.”

Commenting on the India story, the IMF report says, “Growth will benefit from recent policy reforms, a consequent pickup in investment, and lower oil prices.”

Meanwhile, the World Bank report says, “India’s GDP growth is expected to accelerate to 7.5 percent in fiscal year 2015/16. It could reach 8.0% in FY2017/18, on the back of significant acceleration of investment growth to 12 percent during 2016-2018. The country is attempting to shift from consumption- to investment-led growth, at a time when China is undergoing the opposite transition.”

It adds that South Asia, which is now the fastest-growing region in the world, could take greater advantage of cheap oil to reform energy pricing. Driven by strong expansion in India, coupled with favorable oil prices, economic growth in South Asia is expected to accelerate. The region is among the greatest global beneficiaries from cheap oil, as all countries in it are net oil importers.

However, the export performance of the region has disappointed, the World Bank report says. “After a promising rebound last year, exports are now slowing down. By end-2014, export growth was close to zero across the region.”

“The biggest oil price dividend to be cashed in by South Asia is one yet to be earned, but it is not one that will automatically transit through government or consumer accounts” said World Bank South Asia chief economist Martin Rama. “Cheap oil gives the opportunity to rationalize energy prices, reducing the fiscal burden from subsidies and contributing to environmental sustainability,” he added.

The report notes that India has already taken encouraging steps to decouple international oil prices from fiscal deficits and to introduce carbon taxation to address the negative externalities from the use of fossil fuels. The challenge will be to stay the course in the event of oil price hikes – something that may well happen in the medium term.

In comparison to growth in South Asia and India, global growth is forecast at 3.5 percent in 2015 and 3.8 percent in 2016, with uneven prospects across the main countries and regions. Growth in emerging market economies, other than India, is softening, reflecting an adjustment to diminished medium-term growth expectations and lower revenues from commodity exports, as well as country-specific factors.

In the ASEAN-5, Indonesia (up from 5.2% in 2015 to 5.5% in 2016) and Thailand (up from 3.7% in 2015 to 4% in 2016) are seen to be the promising markets while growth is forecast to be slowing down in Malaysia, the Philippines and Vietnam.

Growth in the United States and Canada remains solid. However, while lower energy prices have boosted growth momentum in the United States, they pose downside risks to the Canadian economy owing to the relatively large size of its energy sector. Growth in the US has been energetic, averaging 3.9 percent annualized in the last three quarters of 2014. Consumption—the main engine of growth—has benefited from steady job creation and income growth, lower oil prices, and improved consumer confidence.

In Europe, the IMF report says, there are signs of a pickup and some positive momentum in the euro area, reflecting lower oil prices and supportive financial conditions, but risks of prolonged low growth and low inflation remain.

RELATED ARTICLES

Marelli Talbros Chassis Systems wins Rs 1,000 crore business from European OEM

The order, to be executed over an eight-year period, is for the supply suspension arms tailored for both conventional in...

Kia launches customised NBA display themes for North American market

Display Themes is a customised service that supports a personalised vehicle experience, allowing users to customise the ...

Antolin and VIA Optronics unveil versatile vehicle cockpit concept

The Sunrise vehicle concept cockpit, which is engineered for seamless transitions between manual and autonomous driving ...

By Autocar Pro News Desk

By Autocar Pro News Desk

15 Apr 2015

15 Apr 2015

2582 Views

2582 Views