Global new car sales: the key trends and what they mean for the future

The latest figures are in and they offer a fascinating insight for what's to come.

In a world characterised by political uncertainties, the automotive industry provides one global constant – the onward march of China’s new car market.

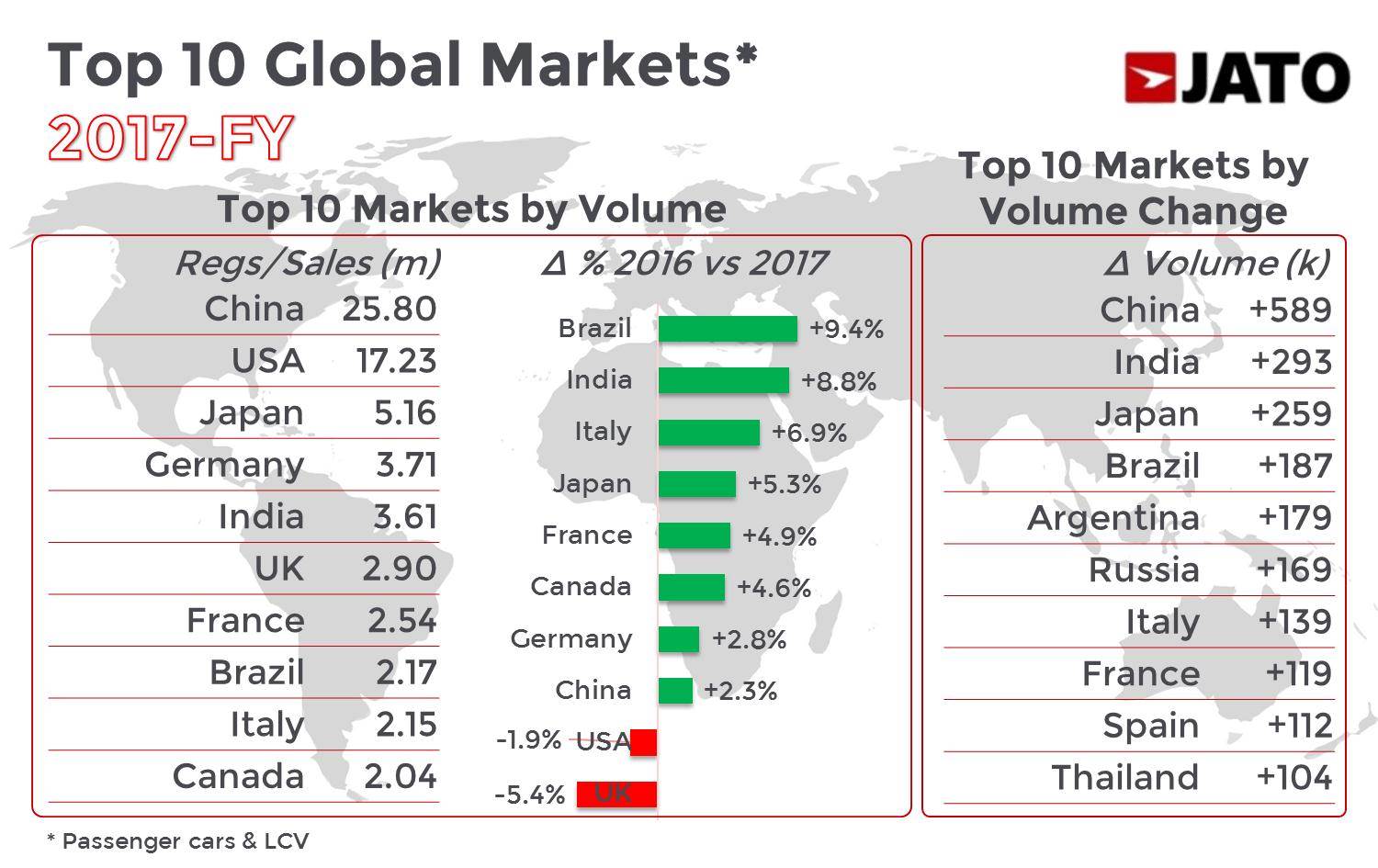

China overtook the US as the world’s biggest car market in 2010 and last year consolidated that position with 25.7 million cars sold – that’s eight million more than the US. Chinese car buyers are flocking to SUVs and city cars, especially local market electric vehicles; while, at the other end of the affordability scale, demand for luxury models rocketed.

For China, however, last year was actually a modest one, with growth of just 2% compared with 2016, but the contrast with the US was stark. A total of 17.2 million units were sold in the US, 300,000 fewer than in 2016. This was the first time sales have tailed off there since the 2008 recession.

The damage to the US market was wrought in the summer when SUV and pick-up sales dipped.

All of the data featured below comes from automotive industry analyst JATO Dynamics. Most of the figures are actual year-end sales, but in some cases include December forecasts. This is because the final month’s official figures in some markets can take a while to filter through.

Luxury cars boom, sports cars decline

Demand in China made the luxury car market the biggest-growing segment in the world last year. Cadillac and Lincoln were the major winners, alongside Porsche.

Car enthusiasts won’t be so pleased to see the sports car market take such a hit, but declining demand for the Chevrolet Corvette and Ford Mustang hit the segment hard.

People carriers and vans continued their respective slides in popularity, with a decline of up to 10% globally for MPVs being more than offset by the growth of SUVs, which swelled by nearly 12%.

About 27.6 million SUVs were sold in 2017, making up a quarter of all global sales.

The top 10 nations: winners and losers in 2017

We have already discussed China’s onward march as the biggest car market. In contrast, the UK went into retreat in 2017 with the biggest percentage drop of any global market, down 5.4% to 2,902,754 sales as a result of economic uncertainties and new motoring taxes.

The decline at least wasn’t sufficient to push the UK behind France, where 2,539,826 cars were sold, but a drop of 166,000 units repeated in 2018 alongside a rising French market would put the UK’s position under threat.

EV sales are up, but market share is tiny

Much has been written about global electric vehicle sales accounting for 1% of the total global market in 2017, a significant indication of the growing acceptance of battery-powered vehicles. But JATO’s numbers suggest this isn’t quite the case.

“The final figures are still not confirmed,” says JATO global auto analyst Felipe Munoz, “but preliminary data shows 581,000 EV cars were sold – that’s about 0.8% of the global market.”

So close, but no cigar, to reaching the 1% considered the ‘tipping point’ for a technology to become permanent.

In its run-out year, the Nissan's Leaf Mk1 lost its number-one crown the cheaper BAIC EC, a little-known Chinese EV with a 20kW battery and price tag starting at £17,000. That the executive-priced Model S also outsold the Leaf is a testament to the power of Tesla’s appeal.

China’s ZD Zhidou was fourth, outselling the Renault Zoe and Tesla Model X.

SUVs on the march to world domination

“Yes, they are taking over the world, everywhere,” says Munoz. “It is a long-term trend that is now also impacting India, Brazil and south-east Asia.”

Every SUV market segment is growing, with the biggest expansion coming from mid-size and large SUVs. In China, a number of 5+2 and full seven-seat SUVs were launched last year.

Which countries are buying the most electric vehicles?

With 332,994 EVs sold, China was the number-one market last year, well ahead of the US and Europe. “Demand also doubled in 2017 in China,” says Munoz, “while US interest was 14% lower.”

Supercars still make a bang

The gold standard for loud and expensive fast cars remains the Porsche 911 with 30,700 examples sold last year, an increase of 4% compared with 2016. In fact, the 911 dominates its segment like no other model – the second best- seller is the Mercedes-Benz SL with 5800 units (down 14%).

Ferrari and Aston Martin enjoyed year-on-year sales growth of 10.1% and 58.1% respectively. Lexus made a remarkable jump up the charts. The LC (5700 sales) grabbed third spot from the Mercedes-AMG GT (5100 sales).

Total global volume was 75,400 units, a year-on-year rise of 5.3% – highly respectable given that this is a segment of cars with starting prices around £80,000.

The demise of the three-box saloon

The rise of SUVs has historically meant a corresponding slide in conventional saloons. And although isolating sales of four-door saloons from those of hatchback and estate body styles is not easy, JATO’s figures suggest that trend continued globally, with the exception of China.

Three of the four main saloon/hatchback/estate segments in China actually expanded last year: mid-size (10% year-on-year growth), executive (14%) and luxury (109%). Only the compact segment decreased (-5%).

The opposite is true in America, where all four segments posted declines, and Europe, where both mainstream and premium compact and mid-size segments fell.

Luxury is buoyant – all thanks to China

Mercedes-Benz S-Class - 72,613 sales - The great secret success story of global luxury car sales is Cadillac. Invisible in Europe, the storied US brand has three models in the global luxury top ten best- sellers list.

The explanation, according to JATO Dynamics, is the rapid growth in the number of billionaires in China.

Cadillac XTS - 60,980 sales - Mercedes’ mighty S-Class takes top spot, as always, but its lead over the Cadillac XTS narrowed last year.

When Lincoln is included, there are two American brands in the top five. Where are Rolls-Royce and Bentley? Of course, it’s all down to price and volume.

BMW 7 Series - 55,990 - More food for thought: there’s a case for including the Range Rover in this list – it would feature in the top three if it did. Also consider Jaguar, as it readies a new XJ saloon, which is expected to be pure electric. It would need to find 25,000-plus units to enter the top five.

Europe recovers: Germany top, UK falls

Growing sales in Italy, Spain, Poland, France and, to some extent, Germany and France put Europe’s new car market back on track. Germany was top, with 3,432,928 cars sold. SUVs became the biggest-selling segment in 23 of 29 Western European markets, according to JATO, largely at the expense of MPVs, which lost 11% of market share.

“Most of Europe is enjoying economic stability, which improves consumer confidence,” says Munoz. Even sales in Greece, where the economy was wrecked by the debt crisis, improved by 15%.

But there are some warning signs for 2018: Italian sales last year are suspected of being boosted by self-registrations.

5 global market trends that shrank in 2017

This might sound like a nightmare football World Cup result, but not often does the UK new car market come unstuck to minnows such as Mexico and Puerto Rico. Due to the sales slide at home, the UK ended 2017 as the market with the third-biggest year- on-year percentage decline. The bow wave of Brexit and poor euro-sterling exchange rates hit Ireland even more acutely, with buyers choosing used imported cars over new ones. The US also suffered, with a 1.9% decline.

The death of a home-grown car industry

Last year the sole remaining local production plant in Australia was closed. What went wrong? “Demand for Australian-built vehicles has been in a continuous decline since 2006,” says Munoz.

He lists three main reasons. First, plants pumped out saloons and pick-ups that catered specifically to the local market and couldn’t be exported.

Second, the industry didn’t switch to SUV production to match changing tastes. Just one local SUV, the Ford Territory, ever went into production, despite SUVs accounting to 45% of the Australian market.

Third, Munoz says poorly drawn free-trade agreements excluded the automotive sector – resulting, for example, in Thailand becoming a regional hub for pick-up exports.

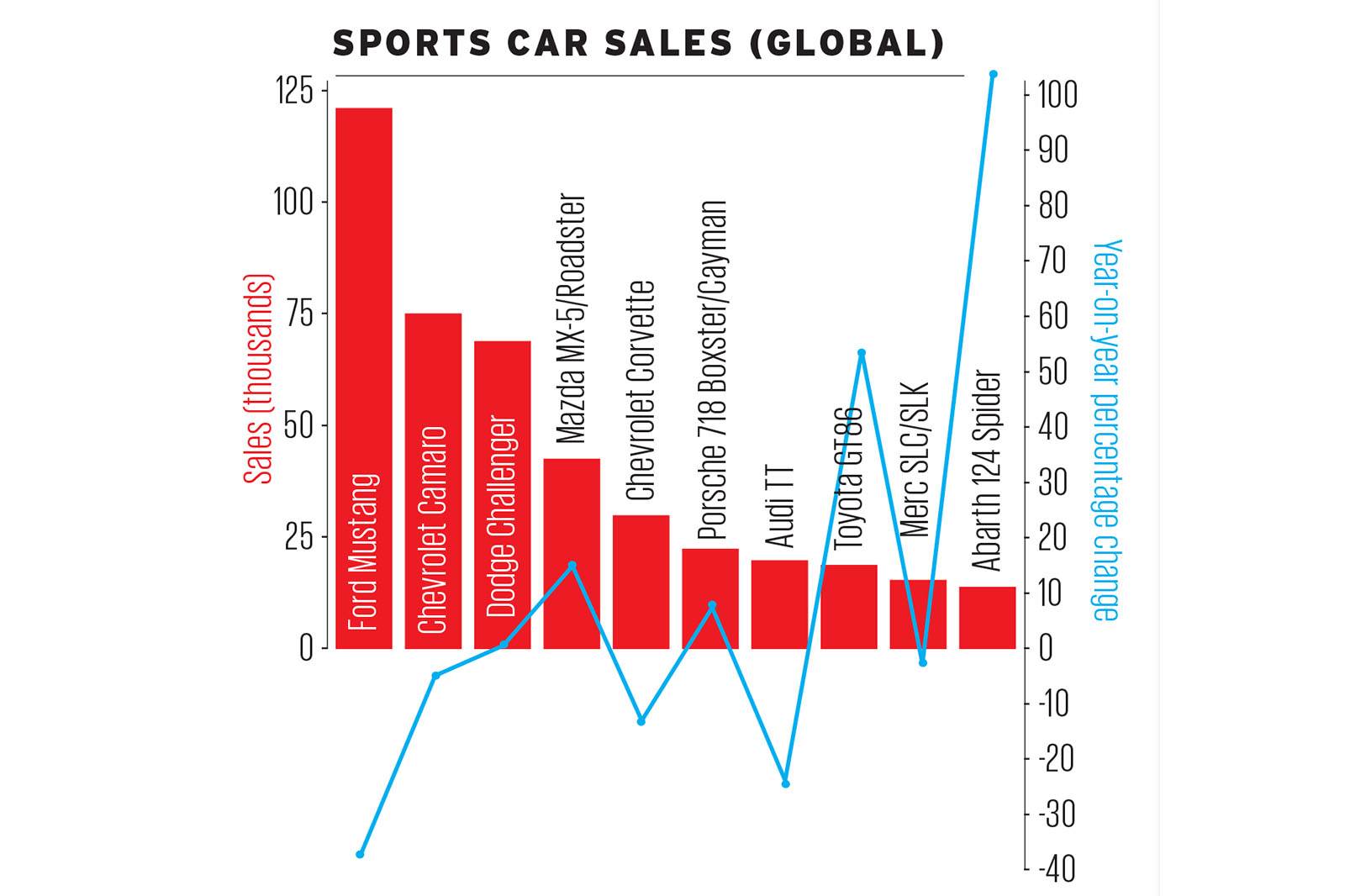

Sports cars: demand in some areas dwindling

Highlights of the sports car segment were continuing strong sales of Mazda’s fine-handling MX-5 (nearly 40,000 units), while Porsche's 718 family was also on the up.

Abarth's new 124 Spider had a strong first year of full sales, claiming 10th spot, and fell only just short of the well- established Mercedes SLC. Meanwhile, Toyota's GT86 found new support as it approaches run-out years.

But, overall, the segment suffered from a drop in demand for US muscle cars, led by the Ford Mustang and Chevrolet Corvette, and, in Europe, the Audi TT.

EMERGING MARKETS: India posts second highest volume increase, now just behind Germany

Last year was a good one for the 12 countries considered to be emerging markets, which increased total sales by 7%.

India was just behind Germany, the fourth-biggest global market, and ahead of the UK. The passenger vehicle market in India posted world's second highest volume increase in 2017, after China.

Emerging markets have historically suffered from volatile economies, with new car sales falling dramatically in response, but JATO suggests this may be the in the past.

This year, the battle for brand leadership among emerging markets will be intriguing. CanVWand Toyota close on market leader Renault-Nissan?

US pick-ups and SUVs: a love affair that goes on and on and on

Last year, US car sales fell by 1.9%, driven by drops in all car segments. The only two segments that posted an increase were the top two, SUVs (+5.8%) and pick-ups (+4.8%) according to JATO.

Both segments combined accounted for 57% of total US sales, an increase on 2016.

The reasons? Low petrol prices, bigger ranges of models and local production. JATO’s analysts expect this trend to continue in the coming years.

RELATED ARTICLES

Antolin unveils sustainable tech solutions at Beijing Motor Show

In line with its China market roadmap, Antolin is showcasing its latest advances in lighting, HMI, electronics, and sust...

Visteon wins $1.4 billion in new business in Q1 2024, launches 26 new products

Digitisation of vehicle cockpit megatrend is a key growth driver for Visteon with over $400 million of displays wins; Vi...

BMW uses Catena-X ecosystem using real-world CO2 data to enhance quality

Working together with partners and suppliers, the company has modelled a complete data chain for the first time using re...

18 Feb 2018

18 Feb 2018

11214 Views

11214 Views

Autocar Pro News Desk

Autocar Pro News Desk