Europe Sales: Big 5 markets see strongest H1 performance since 2008

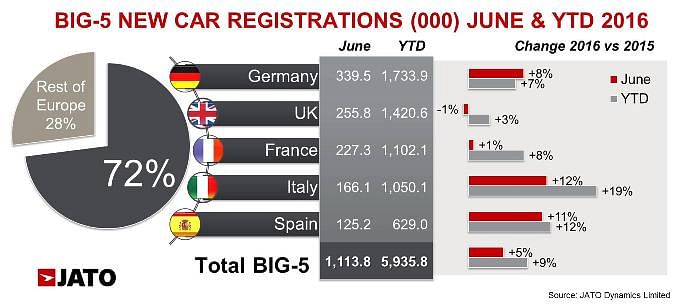

Europe's top five markets posted overall growth of 8.9% for the first half of 2016 and 5.3% in June.

First half sales in 2016 for Europe's 'Big 5' markets – the United Kingdom, France, Italy, Spain and Germany – showed that overall the market is performing strongly.

The total volume of new sales in the first six months of the year grew by 8.9% as a result of double-digit growth in Italy and Spain. Both countries posted their best half-year results since 2008 thanks to improved economic conditions and increased consumer confidence. Four of the five markets surpassed the one-million-unit mark for H1, while June saw a 5% rise to 1.11 million units sold across the five countries.

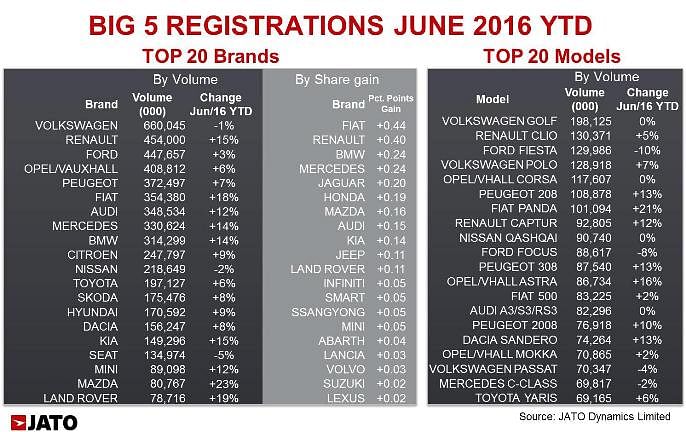

Volkswagen continues to lead the market

Volkswagen led the market with 660,000 units and an 11.1% market share, following a slight drop of 0.5% in volume over the same period of 2015. The German brand saw its lowest first half year market share since 2008 as the carmaker recorded the biggest market share drop compared to H1 2015 (12.2%). Despite the 17% growth seen in Italy, Volkswagen lost ground in the UK, Germany and France, recording drops of 8.7%, 1.4% and 0.4% respectively. Volkswagen's top-seller, the Golf, maintained its overall sales volume but also lost market share. The continued market shift towards SUVs is a key factor in the manufacturer's loss market share, SUVs accounted for only 9% of Volkswagen sales, compared to an industry average of 25%.

Renault and Fiat the big winners

Other mainstream brands benefitted from lower demand for Volkswagens. Renault became the second best-selling brand (with the second biggest market share), outperforming Ford, which took third place. The French brand's sales grew by almost 15% during the first half of 2016 thanks to outstanding results in Italy, where it has been the second best-selling brand for the last two months, and double-digit growth in the rest of the 'Big 5' countries. In recent months, Renault has successfully updated much of its product line, with a focus on the SUV segments - the Captur is the best-selling SUV in the 'Big 5', and the Kadjar, the second best-selling C-SUV.

Fiat made the biggest gain in market share during the first six months of this year due to its strong momentum in the Italian market in particular. The Italian brand's market share jumped from 5.5% in H1 2015 to 6% in H1 2016 following a 17.6% growth that predominantly came from Italy, which accounted for 63% of its 'Big 5' sales. Ford, Opel/Vauxhall and Peugeot were positioned ahead of Fiat in the ranking, while the three German premiums and Citroen completed the top 10.

Audi best-selling luxury brand

Audi was the best-selling premium brand with 5.9% market share and an increase in volume of almost 12%. Mercedes followed with a 5.6% market share and 13.7% growth, while BMW remained in third place among the premiums with a 5.3% market share and 14% increase. The three German premiums' volumes were mostly boosted by their SUV ranges which saw a 36% increase in sales and accounted for almost 23% of the total. Other brands posting significant growth included Kia, Mazda, Land Rover, Honda and Jeep.

SUVs account for 25% of total sales

The SUV boom continued through the first half of the year thanks to a number of new launches. One in every four cars registered in the 'Big 5' markets during H1 2016 was an SUV - more than the total sales of Subcompact cars (B-Segment) or Compacts (C-Segment).

More than 1.47 million SUVs were sold during the first half of the year and the smaller category (B-SUV) took the lead for the first time with 587,000 units and 24% growth. They were closely followed by the compact SUVs (C-SUV) at 582,000 units (+21%) and far behind the D-SUV with 207,000 units (+29%) and their larger counterparts (E-SUV) at 102,700 vehicles (+25%). Nissan and Renault continued to dominate this segment.

The rest of the segments, with the exception of sports cars, lost market share. Felipe Munoz, JATO's global industry analyst, commented: "Europe's largest markets continue to follow the trends we've seen in the US and Chinese car markets in terms of segment composition. SUVs will clearly dominate the roads, with their market share set to surpass 30% in the mid-term."

VW Golf remains the best-selling model

The model table was once again topped by the Volkswagen Golf, with its volume almost at the same level as last year's first half. There was a change in second place, from the Ford Fiesta in H1 2015 to the Renault Clio this year. The Ford and Opel/Vauxhall Corsa posted negative growth, while the Volkswagen Polo kept its fourth position thanks to a 7% increase.

However, the most significant changes occurred outside the top 5, as the Peugeot 208 posted a 13% increase, and the Fiat Panda and Renault Captur outsold the Ford Focus and Nissan Qashqai. In fact the Panda recorded the highest market share gain amongst the top ten models, while the Captur became the best-selling SUV.

Tucson and Kadjar see highest jump in market share

In terms of market share, the clear winners were the Hyundai Tucson and Renault Kadjar, which were particularly popular in France and Italy and gained important positions in the C-SUV segment. In the case of the Renault, it even outsold the popular Volkswagen Tiguan. The Mercedes GLC recorded the highest market share gain amongst premium models, whereas Fiat's B-SUV 500X gained 0.41 percentage points of share. The old Hyundai ix35, Ford Fiesta, Volskagen Golf, Ford Focus and Renault Scenic were some of the models that suffered as a consequence.

"The rise of SUVs has allowed some mainstream brands not just to take the lead in that segment but to be better positioned against the historic dominance of Volkswagen in Europe. Renault and Fiat are good examples of brands that have adapted to benefit from increasing SUV demand," concluded Munoz.

You may like:

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

13 Jul 2016

13 Jul 2016

4359 Views

4359 Views

Ajit Dalvi

Ajit Dalvi