Dr Terrie Romano: ‘Ontario welcomes collaboration with Indian OEMs and suppliers.’

Ontario, the second largest province in Canada, has five auto assemblers, 700 parts suppliers and 500 tool, die and mould makers.

Dr Terrie Romano, Counsellor (Economic Affairs – Ontario), speaks about Ontario’s expertise in connected and autonomous vehicle tech, AI, connectivity, cybersecurity, and quantum computing and how it can help India Auto Inc.

The province of Ontario is the largest automotive hub in North America. How much potential do you foresee for Indian automotive companies to set up manufacturing or R&D operations there?

With the advent of electric vehicles and the green mobility drive in India and globally, the automotive landscape is set to change fundamentally. This is a key driver for innovation for Indian automotive companies.

Being home to the second largest IT cluster in North America and as the largest automotive manufacturing centre, Ontario provides a seasoned R&D ecosystem – combining facilities, academia, private enterprise and professional associations. We feel there is subsequently strong potential for Indian auto companies to set up operations in the province.

The largest global automotive players have invested significantly in R&D activities in Ontario to leverage this advantage – CISCO is investing $4 billion (Rs 26,918 crore) to create an R&D facility in Ottawa, Ford is investing $590 million (Rs 3,970 crore) to expand its Powertrain Engineering R&D Centre at its engine plant in Windsor, and IBM CAS has software labs in Toronto and London (Ontario).

Ontario is betting big on AI, connected, electric and shared mobility to drive future mobility. How many companies are working on such projects?

Ontario companies are already working on mobility concepts and technologies for the future. In 2017, Uber established a research base in Ontario for the ongoing development of autonomous vehicles, tapping on the province’s leadership in artificial intelligence.

Magna International recently introduced its Icon Radar system with potential applications for autonomous vehicles. Icon is an advanced military-grade radar which has a range of almost 300 metres and can scan its surroundings 50 times faster than a human can blink.

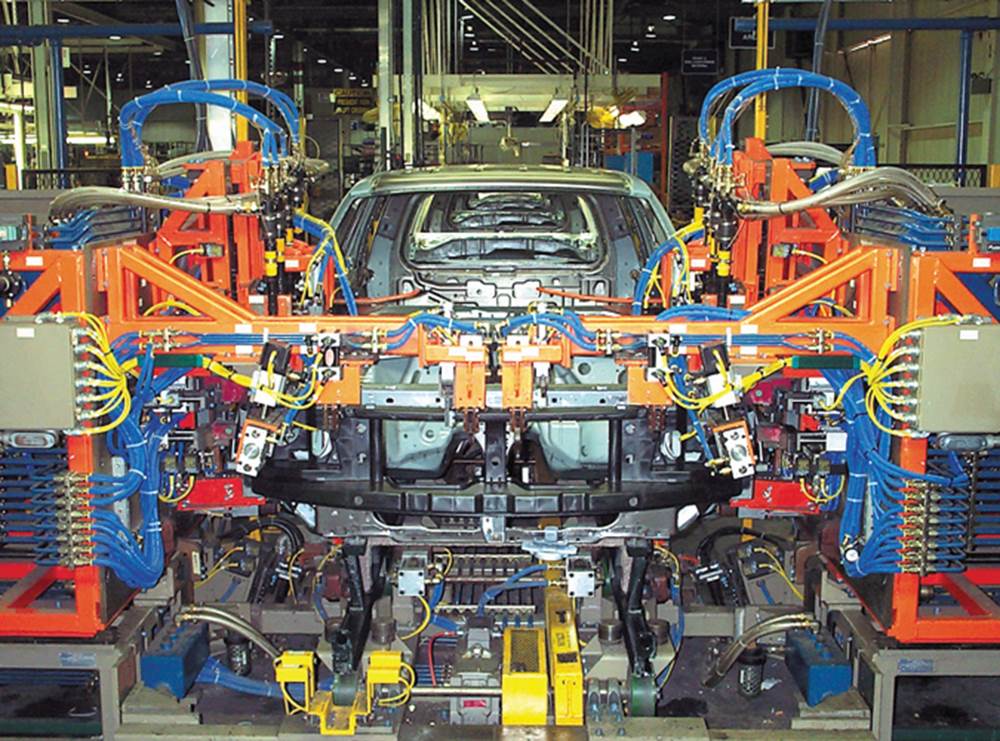

An automated production system from the Windsor, Ontario-based Valiant TMS.

Cars becoming increasingly computerised and connected has also necessitated the development of complex cybersecurity offerings. Ontario-headquartered Blackberry has a 60 percent share in the automotive cybersecurity market and recently launched Blackberry Jarvis, a cybersecurity product that helps automakers secure their software supply chain.

Blackberry QNX has also opened its Autonomous Vehicle Innovation Centre (AVIC) in Ottawa in 2016, and is looking to tap into the market for embedded intelligence in cars of the future.

Ontario is also home to more than 350 automation and robotics-based companies. Manufacturers based in the province are poised to take advantage of the benefits this offers, reflected in the fact that the Ontario automotive industry accounts for 57 percent of the robots used in the province. It is also expected to be a base for the development of wide-ranging solutions in mobility technology, from deep machine-learning to AI. Ontario has launched the first automated vehicle (AV) pilot program in Canada, led by The University of Waterloo, the Erwin Hymer Group and BlackBerry QNX. Ontario companies are already leading in lightweight materials, mobile communications, sensors and controls, software development, cybersecurity and advanced battery research – all prerequisites to building the car of the future. So we are excited about the opportunities.

How is Ontario promoting R&D in future mobility? What are the steps you think India can possibly replicate to facilitate a similar scenario?

In addition to maintaining the province’s R&D infrastructure (including facilitating public and private sector research, publicly funded research organisations, labs and prototyping facilities), the provincial government has prioritised investments in key areas driving the future of mobility, especially in AI and its applications in connected and autonomous vehicle (CV/AV) development.

In March 2017, the government announced a $50-million investment in Toronto's Vector Institute for Artificial Intelligence. Vector – also supported by the federal government and 30 companies – which will train, attract and retain top researchers who will also have the flexibility to work on commercial applications with companies or in their own start-ups. An additional $30 million investment was also announced later that year to grow the number of professional Applied Master's graduates in artificial intelligence.

To accelerate the evolution and deployment of self-driving cars, the government has also created the Autonomous Vehicle Innovation Network (AVIN) to develop, test, demonstrate and validate new CV/AV technology.

India’s state-run energy efficiency company EESL has recently invested in Canadian Energy Storage Project along with EnergyPro. What are the implications of this project for Canada along with benefits for India?

EESL EnergyPro Assets Limited (EPAL)’s partnership with Deltro and Leclanché is an important step with strategic significance for India and Ontario. This collaboration is a positive step towards realising the Indian government’s target to achieve 175 GW of renewable energy by 2022, to meet its commitment under COP21. To meet this requirement, India will need to channel investments into advanced battery storage solutions.

Storage solutions are key to the future development of clean and renewable energy and really required to meet our targets to reduce our carbon footprints for all jurisdictions. That is why storage projects are a natural area for collaboration.

How do you see electric mobility shaping up globally?

Electrified transportation is an important solution for us to meet greenhouse gas reduction targets globally. With heavy investment needed in battery storage solutions, public charging infrastructure, as well as in R&D and subsequently commercialisation, EV policies necessitate a long-term roadmap that brings together stakeholders from across the transportation spectrum – drivers, government, automotive manufacturers and others.

To meet provincial targets, the government of Ontario has announced a $20-million (Rs 134 crore) investment in public charging infrastructure, under the Electric Vehicle Chargers Ontario (EVCO) grant program, as well as its Electric Vehicle Incentive Program. At the moment, we would all agree that the future of mobility is electric. How quickly we can arrive at that future is not yet clear, but in Ontario we are creating policies to promote e-mobility as part of our overall climate strategy.

In terms of priority for the province of Ontario, where do Indian automotive companies stand? And in your engagement with these companies, what are the key trends that you have seen?

A global automotive powerhouse, Ontario is home to a unique ecosystem of world-leading vehicle assemblers, parts manufacturers and research centres that have been meeting the needs of international customers for more than 100 years. We are an open jurisdiction and welcome collaboration with Indian OEMs and suppliers.

In terms of investments, though there are currently no Indian companies that produce vehicles in Canada, Indian auto majors like the Tata Group and Mahindra & Mahindra are present in Canada.

We see interest from around the world in our capabilities in AI, autonomous vehicles, lightweighting and the convergence of IT with mobility.

Do you foresee any collaboration between Ontario and Indian states for mobility?

India and Ontario have a long history of working together. India is Ontario’s 18th most important goods export market, accounting for 0.22 percent of Ontario’s global goods exports in 2016. Ontario goods exports to India totalled C$449.5 million (Rs 2,366 crore) in 2016, growing 5.6 percent from C$425.8 million (Rs 2,241 crore) in 2012.

India is amongst the priority markets for Ontario automotive parts manufacturing companies. Our companies continue to explore business opportunities in India. We have a presence of more than 15 Ontarian companies in the automotive and auto components sectors that have subsidiaries, distributors/brokers, franchisees and joint ventures here in India.

The Automotive Parts Manufacturers Association's connected vehicle technology demonstrator is an Ontario-built Lexus RX350 fitted with integrated connectivity components from 13 Canadian sources.

For example, Linamar currently operates a manufacturing facility and sales centre in India. Likewise, Magna operates eight manufacturing facilities and five engineering/product design/sales centres in India. Other companies present are Litens Automotive Group, Valiant, Samco Machinery, Mould Masters, Linamar Corporation Inc, Magna International Inc and L&P Automotive. These companies now have manufacturing operations in India with the presence in eight Indian states – Karnataka, Haryana, Maharashtra, Tamil Nadu, Uttar Pradesh, Gujarat, New Delhi and West Bengal – and a few of them are using their Indian facilities to service demands from other markets as well.

Also, during the visit of the Premier of Ontario, Kathleen Wynne to India in 2016, MoUs were signed with Indian states of Telangana, Punjab, Andhra Pradesh and Maharashtra on economic cooperation and skills development in the field of advanced manufacturing and other priority sectors.

Recently, at the time of Auto Expo 2018, there was also an automotive trade mission to India where the participants included Leggett & Platt, Sputtek, ATSI Robotics, FleetCarma, CaseBank Technologies (a division of ATP), Invision.AI, GBatteries and others.

In terms of alternative green fuels, hydrogen is also seen as a potential source for achieving green mobility. Is the province of Ontario seeing similar research or focus on this technology?

Ontario companies are realising the potential of hydrogen as an alternative green fuel. For example, Hydrogenics Corporation headquartered in Mississauga, Ontario, is a worldwide leader in designing, manufacturing, building and installing industrial and commercial hydrogen generation, fuel cells and MW-scale energy storage solutions. Hydrogenics provides hydrogen generation, energy storage and hydrogen power modules to its customers and partners around the world towards building the technologies required to enable the acceleration of a global power shift.

Ontario universities provide a deep pool of qualified post-graduation and doctoral candidates who are available to apply their superior skills to critical manufacturing projects. Ontario has attracted world-leading researchers such as Dr Ali Emadi, and Dr Norman Zhou to improve products for business. Dr Emadi, one of the world's foremost developers of electric and hybrid powertrain technology, heads the McMaster Institute for Automotive Research and Technology (MacAuto) while Dr Norman Zhou of the University of Waterloo's Centre for Advanced Materials Joining (CAMJ) works on solutions to joining dissimilar materials.

The R&D effort to tackle today's challenges requires access to state-of-the-art facilities to create the products of the future. Here are a few examples of facilities that provide a new understanding of complex materials and product improvements in the automotive sector.

-The Automotive Centre of Excellence at the University of Ontario Institute of Technology is one of the largest and most sophisticated climatic wind tunnels on the planet where test winds reach speeds of 240 kilometres per hour, temperatures range from -40 to +60deg C and relative humidity ranges from 5-95 percent.

-Canmet MATERIALS Lab in Hamilton, along with its lab in Calgary, is the largest research centre in Canada dedicated to metals and materials fabrication, processing and evaluation.

-The Fraunhofer Project Centre for Composites Research in partnership with the University of Western Ontario is developing materials that are lightweight or have low lifecycle impact for manufacturers in the automotive, transportation, construction, defence and renewable energy sectors.

-The Waterloo Centre for Intelligent Antenna and Radio Systems (CIARS) provides researchers with an inspiring exploration and development environment for innovation in all aspects of electromagnetic communication and sensing science and engineering.

What are the key areas where you foresee Ontario collaborating with Indian companies or the government in the future?

We foresee tremendous potential in high-focus sectors that provide opportunities to match Ontario technological capabilities with key opportunities presented by the Indian government’s long-term focus on Policy Priorities including: Urban Infrastructure (Smart Cities); ICT (Smart Cities and Digital India); Cleantech, including water treatment (Clean India); Automotive (Make in India) and Renewable Energy (addressing the need for energy security).

(This interview was first featured in the 15 April 2018 issue of Autocar Professional)

RELATED ARTICLES

BRANDED CONTENT: 'We aspire to be among the leading sensors and electro-mechanical products manufacturer'

P. Parthasarathy, Founder & Managing Director, Rotary Electronics Pvt Ltd shares the company's commitment and vision to ...

‘Big opportunity for startups lies in products in India’: Detlev Reicheneder

As electrification levels the playing field, the focus on tech and R&D to bring innovative products is the mantra for st...

'I hope my journey makes people say — I can do this too'

Ranjita Ravi, Co-founder of Orxa Energies — the maker of Mantis e-bikes — shares the challenges of building a startup an...

13 May 2018

13 May 2018

15544 Views

15544 Views

Autocar Pro News Desk

Autocar Pro News Desk