‘With hot stamping technology, we can reduce anywhere between 50-75kg in a car’s body.’

Spanish supplier of vehicle body parts, hot-forming, patchwork blanks and laser-welded blanks, looks to bring roll forming of hardened steel to its Indian plants, says Raman Nanda, Country Head & President, Gestamp Services India.

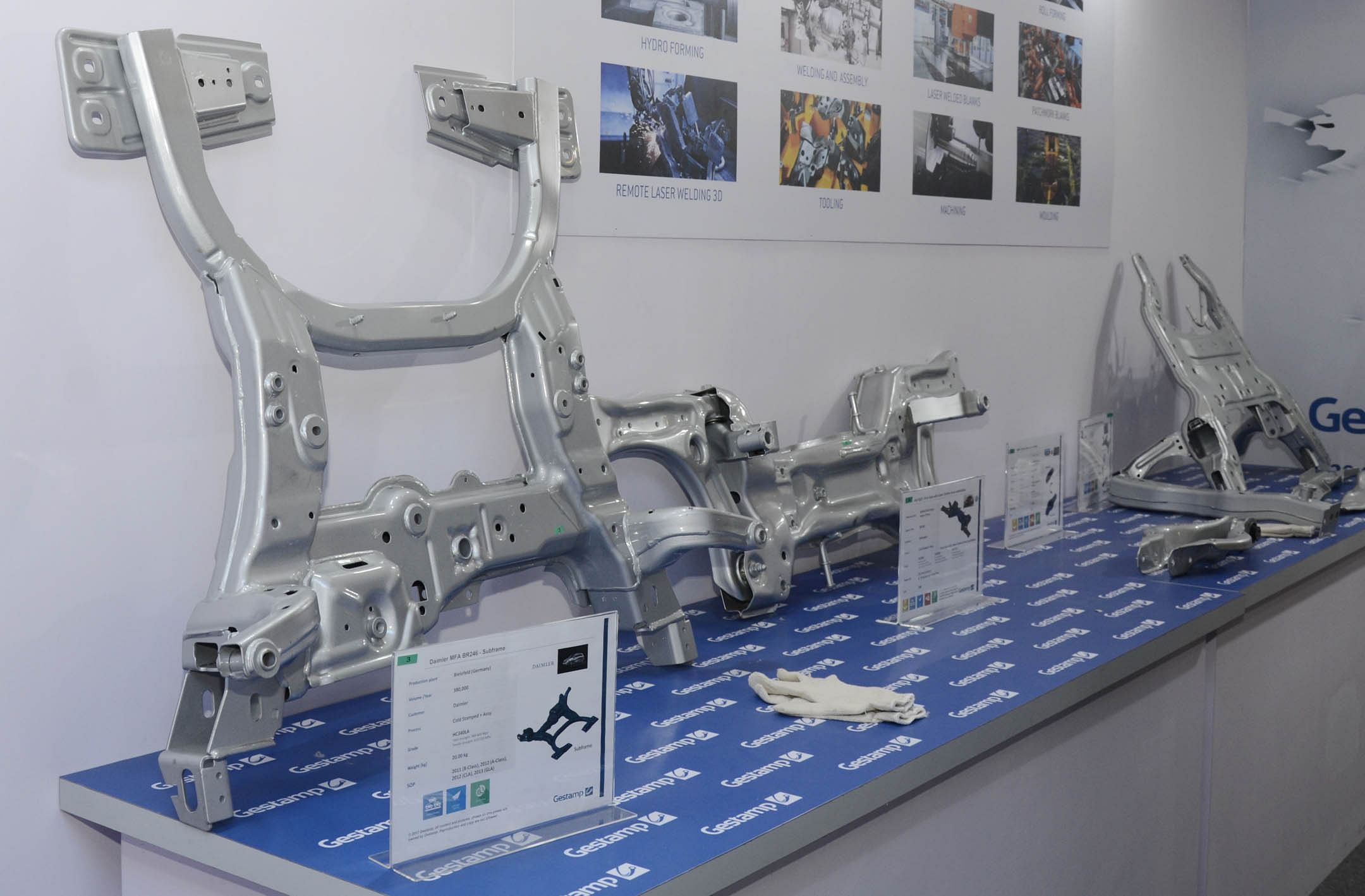

The Spanish supplier of vehicle body parts, which showcased technologies like hot-forming, patchwork blanks, and laser-welded blanks recently at SIAT 2017 in Pune, looks to bring its fourth technology – roll forming of hardened steel – to its Indian manufacturing plant(s) soon. In his first-ever media interaction, Raman Nanda, Country Head & President, Gestamp Services India, spoke to Autocar Professional's Amit Panday .

Can you detail Gestamp’s journey in India in the past seven years?

Gestamp’s journey in India has been as exciting as it can be. We started off with the Volkswagen India plant (Chakan) going into production in early 2010 along with the launch of the Polo and Vento cars. We invested almost Rs 500 crore in a single location then in setting up the plant, which is just adjacent to the VW India plant in Chakan.

Our plant has, therefore, been operating since the past seven years and we have achieved all the benchmarks that our customer(s) want us to achieve in terms of quality and productivity. We have been awarded with all-new business; for example, 100 percent of the Ameo business is with us (in its product line). Our plant makes skin panels, and VW has one of the highest quality levels for skin.

Our Chakan plant was just two years in operation when we had to set up our second plant in Chennai for our customers located in the Chennai region, largely Ford India and Renault-Nissan. We cater to their key models such as the EcoSport from Ford and the Duster, Micra, Sunny and others from Renault-Nissan. In the past four years, we have had four expansions in the Chennai plant already. That was obviously based on the new business and customers’ business growing up (including exports) every year.

The most exciting landmark for us now is the Talegaon plant for the hot stamping business. The plant commenced its operations in the form of trial production three months ago. It is now already running in full-scale trial production. We are expecting mass production to begin around May-June 2017.

The technology this new plant brings becomes interesting because, as you know, we have new crash regulations, fuel efficiency mandates, emission norms and Bharat NCAP coming. With these new legislations targeted at passenger cars, the OEMs are equally excited to look at the new technologies. Due to these new legislations, I feel that the OEMs will put much more focus on the body area of the vehicles (primarily due to Bharat NCAP) over the next 5-10 years, and Gestamp is uniquely placed to support the customers in that.

We have almost 100 manufacturing units globally and another 10 plants about to go on stream, all those are greenfield units. Our turnover last year was US$ 8.5 billion (Rs 53,694 crore). We have the bandwidth and the resources to absorb the growth easily.

We have three production plants in India currently and supporting all of them is our R&D unit located in Pune, where we have more than 30 skilled employees. We also support global programs from there.

We have seven customers in India already and we are working to have more onboard with us soon.

Are you following any specific strategies as you are consolidating your existing business and also adding new customers on board?

Yes, we are working with them in converting the cold stamped parts into hot stamped parts to reduce weight and to make them safer. Secondly, we are teaming up with our customers in co-development of products at the design stage itself; our design and R&D teams get involved so that they can fully reap the benefits of the technology.

Further, in the case of new programs with existing customers, we are their vendor of first choice (in our product lines). So these are our three strategies that we are pursuing to grow our business.

How open are customers to technology transition like switching from cold stamping to hot stamping of body parts to make them lighter and safer? What kind of weight savings are possible by embracing hot stamping (of sheet metal parts) technology?

The openness of customers is now rather defined by our hot stamping plant, which is on the ground. We are not throwing specs on paper and pitching about the expertise of some foreign center from our global footprint. Instead, we are showing them what we can really produce locally in India.

So with that credibility and our relationships with the OEMs, it’s relatively easy to convince to them about the benefits of the advanced technology. It’s a win-win situation for both the parties. They want to reduce the overall vehicle weight, and with hot stamping technology, we can reduce anywhere between 50-75kg in a car’s body. That’s a substantial number considering that component makers are working towards cutting down on grams across critical parts. Therefore, I think the OEMs have been open in terms of sharing the data with us and showing interest in the technology.

On the other hand, estimation of weight savings by switching to hot stamping (from cold stamping) of similar parts depends on their geometry, design and other factors. What we have seen is that we are achieving as high as 25-30 percent weight savings. So for example in a B-pillar, we have achieved 25-30 percent weight savings.

In some of the other parts, the savings is less, say, 10-15 percent. Occasionally, there could be weight savings of 5-10 percent also. Hence it varies as per the requirements of these parts. When customers ask us to move from cold to hot stamping (produce a part using hot stamping technology), they also specify their new requirements. For example, they may say – crash requirements are x, we need to make it 1.25x. So we need to take that in account as well while designing a part.

How much has the company invested in India since the beginning of its operations?

Our investments in India stand at more than Rs 1,000 crore.

How much of that has gone into setting up the all-new hot-stamping unit in Talegaon?

The hot stamping unit has cost more than Rs 200 crore, which is in the range of 20-25 percent of our investments.

What was the last annual turnover for Gestamp in India? What kind of growth are you looking at?

In the past seven years, we have moved from zero to about Rs 1,100 crore, which is the annual turnover now. We hope to have a 40-50 percent jump on the current turnover over the next two years. So by 2018-19, we should be able to cross the Rs 1,500-crore mark. We want to be faster than the industry. Our growth is linked with the three strategies I had earlier mentioned to you and they are working well for us.

In the context of co-developing vehicles with OEMs, do you think they are paying enough attention to reducing overall vehicle weight especially in the wake of meeting upcoming BS VI emission norms?

I think the awareness is increasing. There are customer representatives who saw our products first (at SIAT 2017) and then decided to visit our plant. We had to organise urgent plant visits for them. So, I would say that the urgency is creeping in.

People are clearer that the deadlines are getting closer, and that Gestamp’s products are one of the best options that can help them achieve weight savings. We are one of the top 30 largest global automotive suppliers.

Can you throw some light on Gestamp India’s 2020 roadmap?

It is a bit too early given that customer’s orders come almost two years before mass production in our business. So I have reasonable clarity on business roadmap until 2018-19. For 2020, certain business may or may not happen, our volumes may reach x units or 2x units. However, the bottom line remains that we have to grow faster than the industry. It won’t be fair to claim anything more than that.

What is the impact on the cost front for similar components – one made using cold stamping and the other made using hot stamping process?

To answer this question, let’s take an example. Say for VW India, we are making roughly 300 parts. In the stamping process, there is a whole range of parts, from underbody to upper body to A-pillars, B-pillars and others. Each OEM’s design philosophy, material selection and choice of manufacturing technology are different. Therefore, to just summarise and answer your question in a standard replay is unfair. This is so because the cost impact clearly depends on the geometry, program volume, OEM’s selections and so on.

I have to tell you that in the developed markets like the USA and Europe, 35-40 percent of the (car) bodies are hot formed, and they are almost 20 years ahead of us in terms of safety and several parameters. In India, on the other hand, I would say that mostly we could be cost neutral if involved from the development stage(s). This means that hot stamping manufacturing technology may not add to the cost burden of the OEM if we engage from the beginning of program(s).

However, if once some part is developed and to convert that, it may cost plus-minus 10 percent. All in all, it’s hard to answer in terms of a standard number.

Do you think that large passenger car makers like Maruti Suzuki, Hyundai Motor and others are opening up in terms of improved quality, new features and are relieving cost pressures on their suppliers with newer projects?

There is a trend the world over that as OEMs move from A to B to C segments and so on, the profitability for the OEM per car keeps going up. This is also directly linked to the quality and new features. I think Indian industry is also moving from mostly A-segment to a mix of A, B and C segments. I think this is a gradual progression of the economy and buying power of the people.

Simultaneously, the focus of OEMs in terms of offering improved quality, newer features and superior packages is also increasing. I can’t say that the focus on the costs has gone away, that remains as it is and will be so in the times to come. However, I can say that it is important for a supplier to also think like an OEM and keep bringing in those cost economies in the house. For example, I need to work with my suppliers equally proactively to address my commitments to my OEMs. If I have committed to my customers that I will bring my cost down by, say, 2 percent every year, then I need to have a plan in advance with my suppliers to keep my costs in check. I think this is one of the major factors that contribute to the success and failure in our industry.

On the other hand, many OEMs work closely with us to reduce our costs – and therefore their costs – without affecting our margins. This kind of open attitude is there. Having said that, I think it’s every OEMs job to push on the cost front. We should work with our suppliers to push out all the unnecessary elements from the system as much as we can. That is the only way we can survive. We have this practice called productivity roadmap (PR), which exists for every single cost factor in our system. We keep a very close track of this roadmap, and I think that is the only way we will be aligned to our customer’s approach.

RELATED ARTICLES

'India Can Become a Major Pillar for Us' - Marquardt Group

Björn Twiehaus, CEO of Marquardt Group, and Vishal Narvekar, the company's India GM, share their outlook on the Indian m...

Luxury Car Market to Slow in 2025: Mercedes-Benz Sees Flattish Numbers

In Jan to March of 2025, the market may witness its slowest growth since COVID-19, and if the weakness continues, the se...

‘We Must Have More Women Leaders in the Auto Sector:’ Anjali Rattan

The chairperson of the New Delhi-headquartered RattanIndia Enterprises believes that with their multi-tasking nature, wo...

28 Jan 2017

28 Jan 2017

19690 Views

19690 Views

Darshan Nakhwa

Darshan Nakhwa

Prerna Lidhoo

Prerna Lidhoo