Q1 FY2017 scooter sales in India notch 27.12% growth

Robust growth for Honda as Hero MotoCorp and Yamaha push hard on scooter sales, TVS Motor a slow player in the fast-growing market.

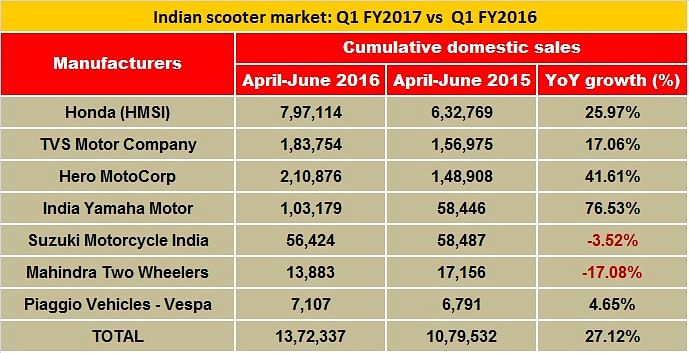

Continuing to grow, the Indian scooter market has recorded a healthy 27.12 percent YoY growth in Q1 FY2017. The size of the total scooter market (including small scooters – scooterette) stood at 1,372,337 units during Q1 FY2017 as compared to 1,079,532 units sold in Q1 FY2016.

While the growing scooter market continues to alter the dynamics of the Indian two-wheeler segment, there is little doubt as to the increasing penetration of scooters in the regional markets.

For Q1 this fiscal, it’s no surprise that Honda Motorcycle & Scooter India (HMSI) secured the maximum gains in terms of sheer volume, which stood much more than what the remaining players jointly registered.

Honda grows by 25.97% YoY

Honda recorded total sales of 797,114 scooters during Q1 FY2017, growing at 25.97 percent YoY and bagging additional sales of 164,345 units for the three-month period this year compared to Q1 FY2016. The successful Activa brand sold 697,938 units in Q1 FY2017 as compared to 557,827 units in Q1 FY2016. Activa scooter sales alone constitute 87.56 percent of Honda’s total scooter sales for Q1 this fiscal.

Meanwhile, the Dio and Aviator scooter models continue to fetch substantial sales for HMSI. While the Dio garnered 58,728 unit sales (up by 21.19 percent YoY), the Aviator sold 27,605 units (up by 4.24 percent YoY) in Q1 FY2017. Interestingly, the company has sold total of 12,843 units of its newly launched Navi models, which averaged 4,281 units per month during Q1 this fiscal. Although it would be too early to judge if the Navi has turned out to be a successful project for Honda, the average monthly sales do indicate a positive realisation for the company as it attempted to create an all-new two-wheeler category.

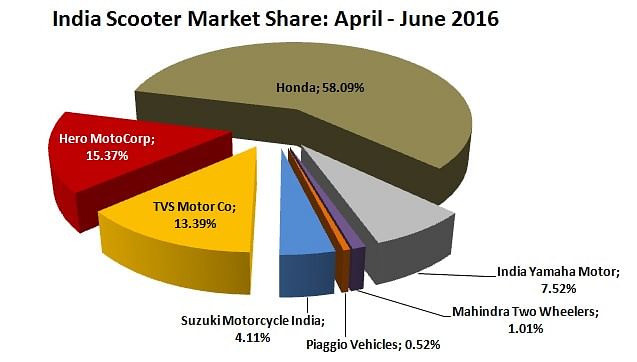

The company, for Q1 this fiscal, commands a dominating share of 58.08 percent in the Indian scooter market.

Hero MotoCorp marches ahead with 41.61% percent YoY growth

The second largest scooter manufacturer in India, Hero MotoCorp sold a total of 210,876 units in Q1 FY2017, up by 41.61 percent YoY. The company had recorded sales of 148,908 scooters in Q1 2016. The increased sales have come on the back of the two new scooter models – Hero Duet and Hero Maestro Edge – which were launched in September last year. While both the models witnessed instant acceptance in the market, they also served the company in terms of garnering additional volumes and market share in the highly-competitive scooter segment.

The 10-month-old family scooter model – the Duet – has now become the largest selling scooter for Hero MotoCorp in India. This full-metal bodied scooter model has sold 96,592 units in Q1 this fiscal, averaging sale of over 32,000 units per month, which is a great start for a product completely developed in-house by the engineering team at Hero MotoCorp.

Pawan Munjal, chairman, MD and CEO of Hero MotoCorp, with the Duet and Maestro.

The Maestro Edge is also gaining a foothold in the market by consolidating the Maestro brand and its customer base as the company aims to phase out the old model. The Maestro brand sold a total of 85,315 units during Q1 FY2017, averaging close to 28,500 units per month. However, Maestro scooters had sold 112,221 units in Q1 FY2016. The Hero Pleasure too has seen a decline for Q1 this fiscal. It accumulated sales of 28,969 units for the period as against 36,687 units sold in Q1 FY2016, down by 21.04 percent YoY.

Nevertheless, the prospects of Hero MotoCorp look stronger than what the statistics say on paper. The company is understood to have designed a compact product plan, which it is working upon and several new products are expected to be rolled out in the coming years. Meanwhile, Hero MotoCorp continues to scale up its scooter production capacity.

Building up on its Q1 FY2016’s market share of 13.79, Hero MotoCorp now commands a share of 15.37 percent in the domestic scooter segment.

TVS Motor outsells Q1 FY2016 by 17.06% YoY

TVS Motor Co, the third largest scooter manufacturer in India, sold 183,754 units (including scooters and scooterettees), adding an additional sales volume of 26,779 units for Q1 FY2017. The company’s overall scooter growth stood at 17.06 percent YoY for the first quarter this fiscal year. TVS’ progress in the scooter segment is highly dependent on the Jupiter model, which accounts for more than 70 percent of its total scooter sales in India. All other models – Scooty Pep+, Wego and Zest – have shown a YoY decline for Q1 this fiscal.

The Jupiter, also TVS’ bestseller in the domestic market, sold 133,268 units during Q1 FY2017, growing by 33.91 percent YoY for the period. The popular model had sold 99,519 units for the corresponding quarter last fiscal.

The Scooty Pep+, which also happens to be the second best-selling model in its scooter-portfolio, sold 20,719 units during Q1 FY2017, down by 9.24 percent YoY. The model had sold 22,828 units in Q1 FY2016.

Although the company has not commented on the reasons behind the falling sales of its small scooter(s), industry experts have hinted that many Scooty customers may have moved to the 110cc Zest. The latter has become the third best-selling scooter model from TVS’ stable. It sold 17,579 units in Q1 this fiscal, down by 12.37 percent YoY.

At 12,188 units, even the Wego’s quarterly sale has declined by 5.72 percent YoY this fiscal.

Despite recording overall YoY growth, TVS Motor’s market share has now fallen from 14.54 percent (Q1 FY2016) to 13.39 percent (Q1 FY2017).

India Yamaha revs up with 76.53% YoY growth

Recording handsome returns on the back of its increasing scooter sales, India Yamaha Motor sold a total of 103,179 units, up by 76.53 percent YoY for Q1 FY2017. The company had registered sales of 58,446 units Q1 FY2016. The 113cc Fascino has emerged as the largest-selling scooter model for the company with sales of 58,519 units, and the Ray variants together contributed by 33,623 units (up by 22.67 percent YoY) in Q1 FY2017.

Howeve4r, sales of Yamaha’s family scooter, the Alpha, have declined by 51.74 percent YoY. The model, which had sold 22,870 units in Q1 FY2016, garnered only 11,037 units in Q1 FY2017. The company, which follows the calendar year, is working towards to extend its current network of 2,200 dealerships, to 3,000 this year. Senior management at Yamaha have hinted that expanding its network will translate into a substantial boost in the sales volumes of its existing products.

The Fascino and Ray scooters have together cemented Yamaha’s Q1 FY2016’s market share of 5.41 percent to 7.52 percent in Q1 FY2017.

Suzuki, Mahindra volumes decline in Q1 FY2017

Suzuki Motorcycle India and Mahindra Two Wheelers have recorded declining sales for Q1 FY2017. While Suzuki recorded sales of 56,424 scooters (down by 3.52 percent YoY), Mahindra sold only 13,883 scooters (down by 17.08 percent YoY) during the period.

While Suzuki’s bestselling scooter model – the Access 125 – a one-time popular rival of Honda’s Activa, bettered its YoY sales to 51,910 units (up by 17.24 percent) in Q1 FY2017, Mahindra top-selling scooter – 110cc Gusto recorded a decline for the period this fiscal. The latter sold 13,141 units in the domestic market as against sales of 15,056 units in Q1 FY2016.

Thriving on a single-model (Access 125), Suzuki’s market share has fallen from 5.42 percent (Q1 FY2016) to 4.11 percent in Q1 FY2017.

Piaggio’s premium Vespa grows by 4.65 percent YoY

Piaggio Vehicle’s premium range of Vespa scooters, which are also the most expensive models in the Indian scooter market today, recorded marginal growth of 4.65 percent for Q1 FY2017. This growth came on the back of its 150cc Vespa models, which garnered sales of 2,247 units in Q1 this fiscal. The 125cc Vespa models sold 4,860 units (down by 28.43 percent YoY) during the said period.

The company, which is planning to launch a new scooter model under the Aprilia brand later this month, is expected to catch up fast with the booming scooter market, thanks to its competitive pricing of Rs 65,000 (ex-showroom, Maharashtra). With the upcoming Aprilia scooter model SR 150, Piaggio will compete aggressively with its main rivals such as Honda, Hero, and Suzuki. It would be interesting to see if the Aprilia SR 150 will bring Piaggio’s name in the list of serious players in the Indian scooter market in the coming months.

RELATED ARTICLES

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

By Amit Panday

By Amit Panday

01 Aug 2016

01 Aug 2016

16030 Views

16030 Views