Indian car makers post robust sales, cross 3m for the first time in a fiscal

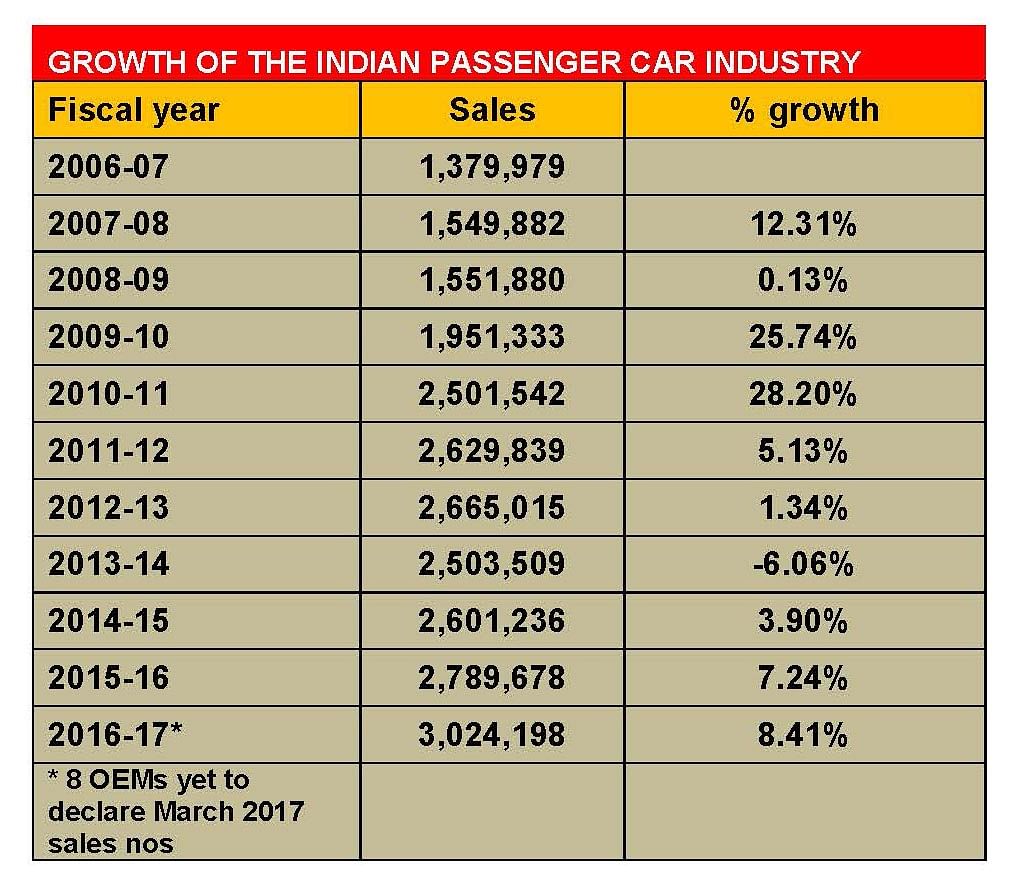

The Indian passenger vehicle industry has crossed the 3- million unit sales mark for the first time, driven by new model launches, a surge in SUV sales and increased offtake by app-based taxi service providers like Ola and Uber.

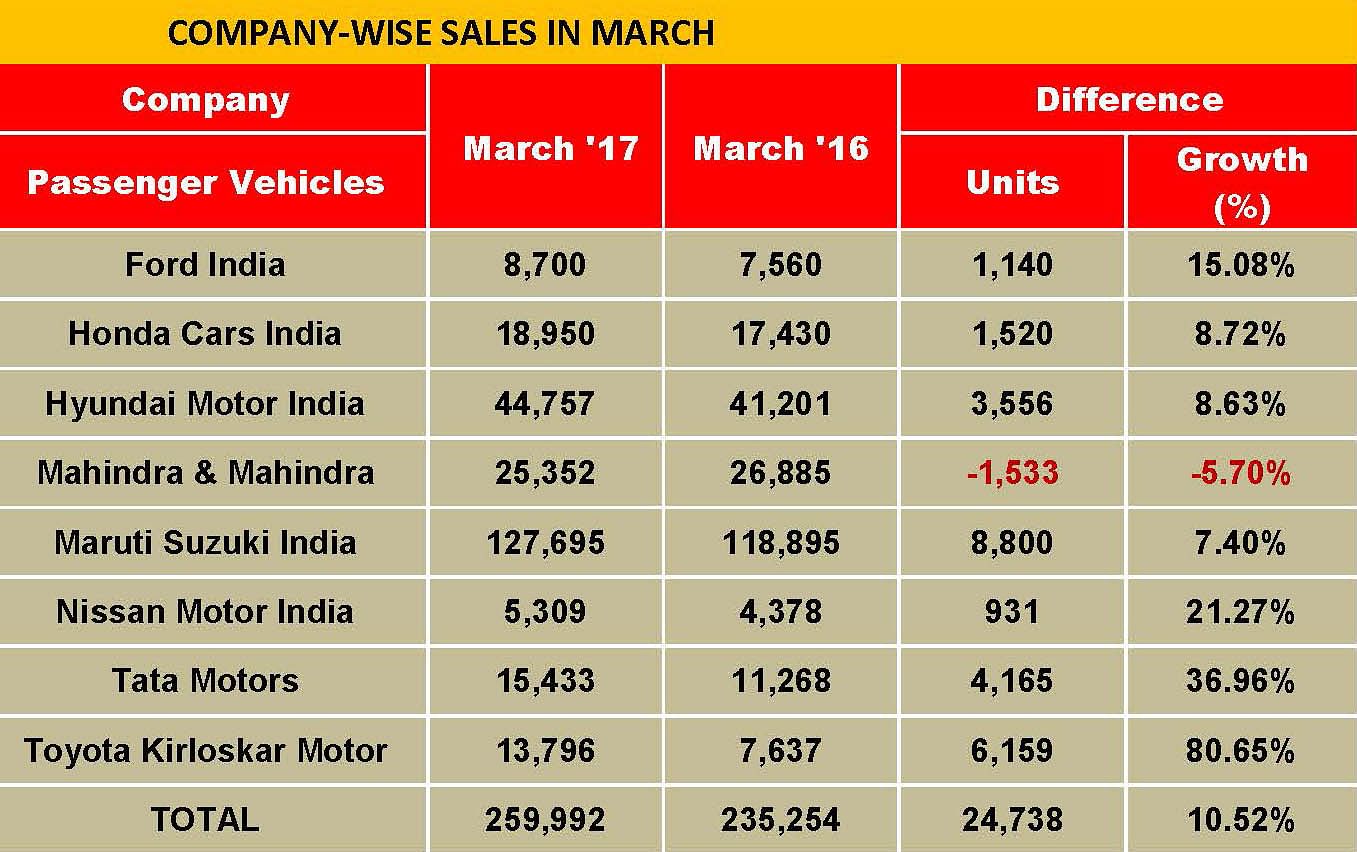

The Indian passenger vehicle (PV) has recorded robust sales in the last month of the fiscal year 2016-17. As per the sales numbers revealed by eight of the 16 carmakers, who declare their monthly sales registrations to apex industry body SIAM, the PV industry has recorded 10.52 percent year-on-year (YoY) growth. The continuing surge in SUV sales and increased offtake by app-based taxi service providers like Ola and Uber have helped drive gains.

For the 11-month April 2016-February 2017 period, the PV industry had registered total sales of 2,764,206 units, or 235,794 units short of the 3-million mark. Thus, as per the latest industry sales update of these eight OEMs (detailed below) which have sold a total of 259,992 units in March 2017, the three-million mark has been breached for the first time and is headed for higher numbers when the other eight OEMs announce their March sales. The final, official sales tally for the PV industry will be revealed by SIAM next week.

A quick analysis of PV sales over 11 years (above) reveals that the segment has taken nine years to double sales from the 1,549,882 units in 2007-08 to over 3 million in 2016-17. What helped is the surge in sales in March 2017. Here's looking closer at how individual carmakers fared in the month of March and in FY2016-17.

Maruti Suzuki India, the leading PV maker, is striding confidently towards its targeted 2 million sales in 2020. In 2016-17, the carmaker crossed the 1.5 million sales landmark for the first time ever. In March 2017, the company sold a total of 139,763 units, comprising 127,999 units in the domestic market (+7.40%) and 11,764 units in exports (12.6%). With this, it has ended 2016-17 with its highest ever total sales of 1,568,603 units, a growth of 9.8 percent and includes its highest ever domestic sales of 1,444,541 units. The export sales were 124,062 units, registering flat year-on-year growth of 0.1 percent.

In March, the entry level, bread-and-butter duo of the Alto and Wagon R, sold 30,973 units, down 15.6 percent (March 2016: 36,678). Sales of the six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire posted 29.7 percent growth at 60,699 units (March 2016: 46,786). The Dzire Tour, which is sold only as a taxi, sold 1,166 units, down 61 percent (March 2016: 3,161). The Ciaz premium sedan, which is now to be sold from the premium Nexa channel, went home to 4,918 buyers, down 10.3 percent (March 2016: 5,480). The two vans – Omni and Eeco – sold 11,628 units, down 9.8 percent (March 2016: 12,896).

Where Maruti is stretching the lead versus its competitors is in the UV segment, thanks to surging sales of the Vitara Brezza. Its total UV sales (Gypsy, Ertiga, S-Cross, Vitara Brezza) rose 31.8 percent YoY to 18,311 units (March 2016: 13,894). UV sales, which have doubled in the past year, have given Maruti the boost in its fiscal numbers. In FY2016-17, as a result of huge consumer demand for the Vitara Brezza – Maruti’s first compact SUV – and also the Ertiga MPV, UV sales jumped 107 percent to 195,741 units (2015-16: 94,416).

The compact cars (Swift, Ritz, Celerio, Ignis, Baleno, Dzire) were the biggest contributor to domestic sales at 584,850 units, up 7.9 percent YoY (2015-16: 541,951). The Baleno, which has crossed 150,000 sales in the domestic market, clearly is the star performer in this lot.

The premium Ciaz sedan was also a strong performer in the fiscal, going home to 64,448 buyers, up 18.8 percent YoY (2015-16: 54,233). The Ciaz, like the Baleno, has also crossed the 150,000 sales landmark last month.

The two vans – Omni and Eeco – contributed their mite to overall numbers. They sold 152,009 units, up 6 percent YoY (2015-16: 143,471) .

What’s worrying for Maruti is that the Alto and Wagon R are seeing demand waver. The two cars saw sales of 413,981 units, down 4.4 percent (2015-16: 432,977).

And, Maruti’s Super Carry, its entry model into the LCV segment, sold a total of 900 units, indicating that the commercial vehicle sector is yet to show its fondness for a different type of Maruti.

Hyundai Motor India, which crossed the milestone of 5 million sales for the first time in a fiscal, sold 44,757 units in March, up 8.6 percent YoY (March 2016: 41,201). For 2016-17, it sold a total of 509,707, recording a YoY growth of 5.2 percent (2015-16: 484,324).

Commenting on the sales, Rakesh Srivastava, senior VP (Sales and Marketing), said , “The Grand i10, Elite i20 and Creta achieved record sales of over 10,000 units each in a single month. Highest-ever sales of 509,707 units in a fiscal year, creates a strong momentum for the next year."

Mahindra & Mahindra, which sold 25352 PVs in March 2017, down 6 percent Yoy (March 2016: 26,885), sold a total of 236,130 units in 2016-17, to record zero or flat growth (2015-16: 236,307). Rajan Wadhera, president, Automotive Sector, M&M, said, “We are happy that our new brands are gaining traction as together the KUV100 and TUV300 crossed the 100,000 sales milestone since their launch. However, the auto industry continues to see mixed reactions due to several external challenges and the more recent one being the unexpected verdict on the sale of BS III vehicles that has derailed many planned operations. Going forward, factors such as the likely softening of interest rates, revision in fuel prices, GST implementation and the Union Budget’s focus on rural are expected to bring back demand.”

Honda Cars India reported domestic sales of 18,950 units in March 2017, a year-on-year growth of 8.7 percent (March 2016: 17,430). New models like the 2017 City sedan and the WR-V crossover were major contributors to overall sales. While the City with 6,271 units was the biggest seller, the WR-V with 3,833 units was the next best. The others included the Jazz (3,527), Amaze (3,296), Brio (540), BR-V (1,436), CR-V (19) and the Accord Hybrid (28.)

Commenting on the sales, Yoichiro Ueno, president and CEO, Honda Cars India, said, “Strong sales momentum for our latest offerings in the market, the new Honda City 2017 and Honda WR-V, helped us achieve a good sales result during March 2017. We are confident of a strong show in 2017-18 with a robust product-portfolio and good demand from the market.”` Honda Cars India, however, needs its sales to grow faster. While the March 2017 sales show an uptick, overall FY2016-17 sales of 157,313 units are down 22 percent on 2015-16 sales of 192,059 units.

Tata Motors, which is riding a new wave of demand for its PVs, sold 15,433 units in the domestic market in March 2017, a growth of 84 percent over March 2016. The company says this is due to the continued strong demand for the Tiago hatchback. It has also received an encouraging customer response for its recently launched Hexa SUV and the Tigor. Cumulative PV sales for the fiscal were 153,151 units, a growth of 22 percent (2015-16: 125,946).

Commenting on the sales performance, Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, said, “The sales in March have been encouraging with a robust growth of 84 percent due to continued demand for the Tiago and the Hexa. The Hexa, Tiago AMT and Tigor have set new benchmarks in their respective segments signifying Tata Motors as one of the fastest growing manufacturers in India.”

Toyota Kirloskar Motor has announced its domestic market sales for the month of March 2017. At 13,796 units, the carmaker has registered 81 percent year-on-year growth (March 2016: 7,637 units). The company also says it has posted a 12 percent growth in sales in FY2016-17. While it has not provided total fiscal numbers, considering it sold 128,494 units in FY2015-16 (-9%), its sales for the just-concluded FY2016-17 will be around 143,913 units.

This growth can be attributed to the overwhelming response the Innova Crysta has received. In just less than a year, the Crysta has sold close to 75,000 units in India. The Camry Hybrid too has been seeing growing sales, reinforcing customer acceptance towards hybrid technology. In the April 2016-February 2017 period, the Camry Hybrid has sold 1,146 units.

Commenting on the monthly sales, N Raja, director and senior VP (Sales & Marketing), Toyota Kirloskar Motor said, “Both the new Fortuner and Innova Crysta have attributed to this growth. In just five months, the new Fortuner has been able to clock more than 10,300 units which further reiterates its popularity amongst our customers.

“The Platinum Etios and the new Liva Dual Tone have also contributed to our monthly sales growth. We also launched the new Corolla Altis this month and are confident that our customers will appreciate it.”

Ford India sold 8,700 units in the domestic market in March, up 15.07 percent YoY (March 2016: 7,560). For the fiscal year, total sales were 91,405 units, up 14.33 percent (2015-16: 79,944). “We continued to delight Indian families with products that promise safety and compelling value for money,” said Anurag Mehrotra, executive director, Marketing, Sales & Service at Ford India. “Furthermore, our efforts in addressing the cost of ownership perception and the promise of a differentiated and transparent experience helped us deliver above industry growth rate in the first quarter.”

Nissan Motor India sold a total of 5,309 vehicles in March 2017, an increase of 21 percent over March 2016. The company also announced total domestic sales of 57,315 units in FY2016, registering growth of 45 percent over the previous financial year, and the highest-ever volume achieved by the company in India.

Commenting on the results, Guillaume Sicard, president, Nissan India Operations, said, “FY2016-17 has been a remarkable year for Nissan India. We are delighted by the progress and the acceptance of our products and services by our customers. The Datsun Redigo has been our most significant new model launch in the last year and has been a key driver of our success and raising brand awareness. In the medium-term, Nissan India plans to launch 8 new products in India by 2021 with an aim to achieve 5 percent market share in India.”

Arun Malhotra, managing director, Nissan Motors India, said, “The positive year-end results signify our efforts to engage with more customers by strengthening our sales and aftersales network across India. Additionally, we have significantly raised our customer and sales satisfaction scores.”

Currently, Nissan’s sales and service network comprises 279 customer touchpoints across 174 cities in India.

RELATED ARTICLES

Legacy OEMs outsell Top 20 electric 2W startups, command 55% market share in April

With sales of 50,166 electric scooters in April 2025 and a 55% share of the 91,791 e-two-wheelers sold in April 2025, TV...

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

By Autocar Professional Bureau

By Autocar Professional Bureau

03 Apr 2017

03 Apr 2017

12170 Views

12170 Views