April sales of 2.3m units point to strong fiscal but costly fuel could be a dampener

India Auto Inc opens FY2019 on a peppy note with all vehicle segments posting strong sales, albeit on a low year-ago base. Now, with oil on the boil, the already highly priced petrol and diesel could get dearer.

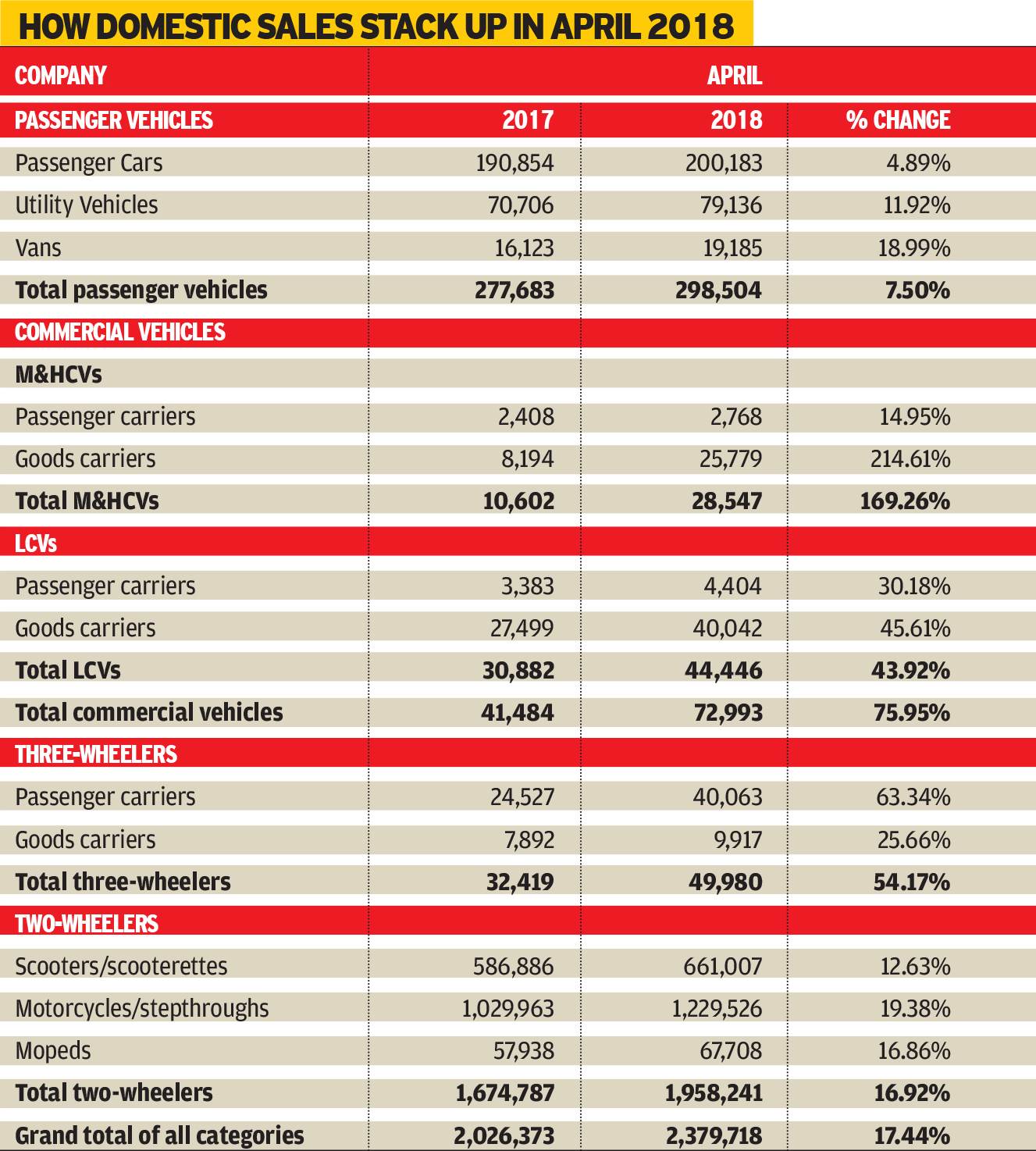

The new fiscal has opened on a happy note for India Auto Inc, continuing from where FY20018 ended. Total vehicle sales across segments in April 2018 stand at 2,379,718 units, registering strong 17.44 percent year-on-year growth, with passenger vehicles (298,504 / +7.50%), commercial vehicles (72,993 / +75.95%), three-wheelers (49,980 / + 54.17%) and two-wheelers (1,958,241 / 16.92%), all registering significant growth.

While the growth per se is robust, it’s worth noting that it comes on the back of a low year-ago base, when sales, especially in the CV and three-wheeler segments, were dramatically down in April 2017 when India was implementing the regulatory shift from BS III to BS IV.

While sales in some key vehicle categories stayed on pedal-to-metal mode, the high grossers from the last fiscal – both UVs and scooters – saw a slight moderation. UVs cumulatively sold 79,136 units (+11.92%) and scooters 661,007 units (+12.63%). In comparison, they were gunning at a significant 20 percent growth rate up until end-FY2018. Their performance could be attributed to a slight shift in consumer demand returning towards passenger cars and motorcycles, both of which showed improvement in their growth rates than what they registered in the past few months. While passenger car sales totalled 200,183 units (+4.89%), motorcycles brought in cumulative volumes of 1,229,526 units (+19.38%) and seem to be recovering from being overshadowed by their scooter counterparts.

Within the CV space, goods carriers maintained their solid performance with total sales standing at 25,779 units (+214.61%) in the M&HCV category and 40,042 units (+45.61%) in the LCV category respectively. Passenger carriers, which were looming in the dark, finally seem to have recovered, with M&HCV passenger carriers selling 2,768 units (+14.95%) and LCV passenger carriers bringing in substantial growth with sale of 4,404 units (+30.18%).

According to Sugato Sen, deputy director general, SIAM, “Numbers for all segments are quite encouraging, but it has to be kept in mind that April 2017 was a watershed month as the industry moved from BS III to BS IV emission norms. As a result, vehicle production, especially of CVs, was significantly down last year due to constraints in immediate supply of BS IV parts. Hence, we can see that significantly positive growth is reflected in April 2018 with production surging by 17.95 percent. The PV segment is the one showing the closest reality with a relatable growth of 7.50 percent.”

“While consumer confidence is intact as of now, a lot of what happens to the growth through the rest of the year will also depend upon how the monsoon shapes up,” he added.

Rising fuel prices a shocker

Even though the industry is on a growing trend, the short-term impact due to rapidly escalating fuel prices can very well be seen in the shifting trends. The positive tilt in passenger car and motorcycle sales could be the case of the consumer giving a good thought again to these vehicles because of the higher fuel efficiency they offer compared to their UV and scooter siblings.

All is not well on the global crude oil market front, what with crude oil prices scaling upwards of $70 a barrel as a result of geopolitical issues, and OPEC and Russia reducing supplies. And with President Donald Trump pulling out the nuclear deal with Iran, the stage is set for oil to be on the boil.

For India, the world’s third largest importer, and its vast populace of motorists, this spells bad news both in terms of tanking up on fuel and from the general inflation point of view. As is known, in the past fortnight, prices of petrol and diesel in the country have surged and are currently running at Rs 82.48 for a litre of petrol (the highest in 55 months) and Rs 70.20 a litre for diesel (a 44 month high after Rs 67.26 per litre in August 2014). The current price difference between petrol and diesel is Rs 12.28 a litre, the narrowest it has got since 2017. What’s also apparent is that within three years, the price of petrol per litre has risen by Rs 11 a litre, while diesel, once touted as the ‘common man’s fuel’ is costlier by Rs 15 a litre.

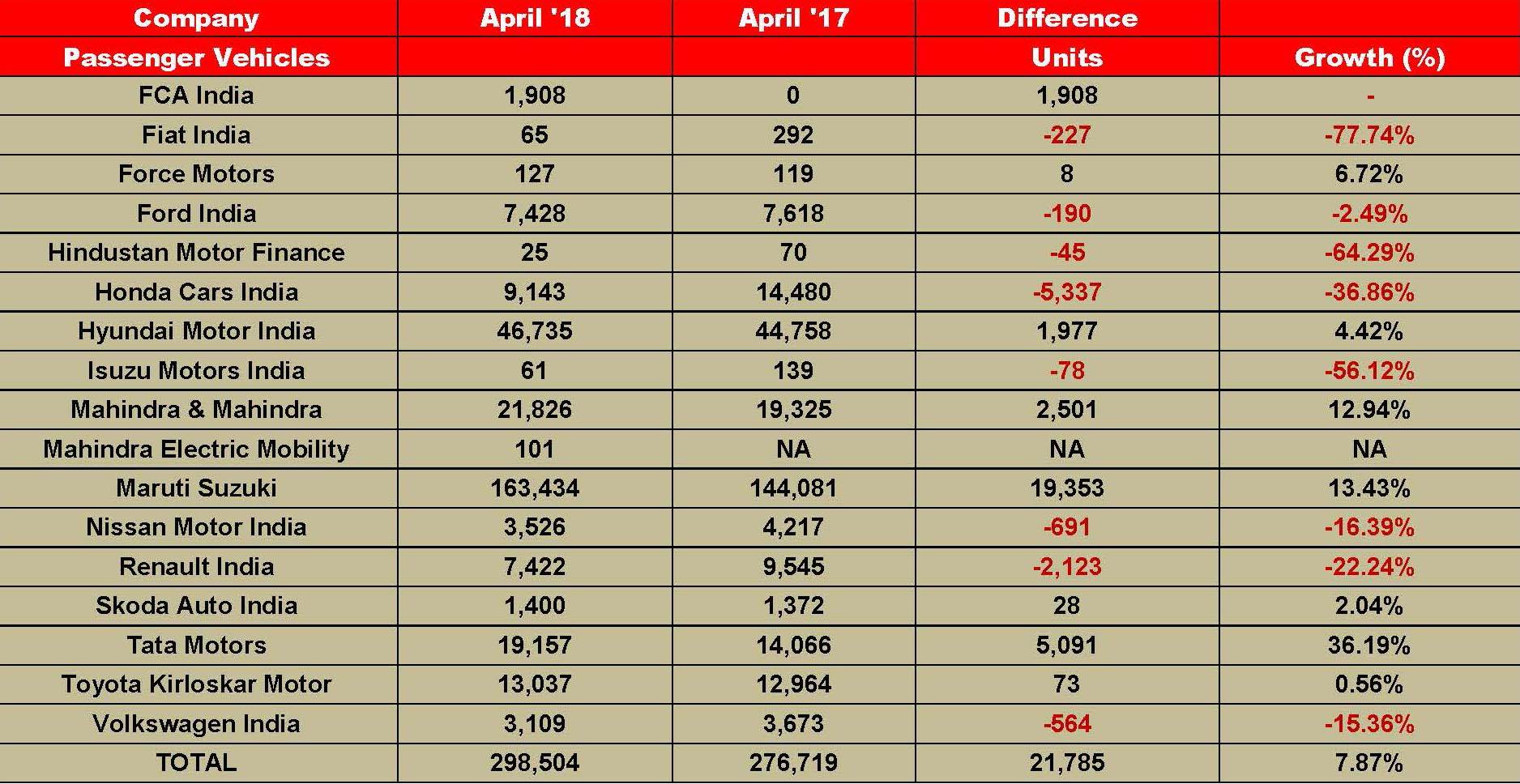

HOW THE PASSENGER VEHICLE SEGMENT FARED

Maruti Suzuki India registered cumulative sales of 163,434 units in April 2018, its best performance ever in a month, posting notable growth of 13.4 percent (April 2017: 144,492). The significant volumes imply that the bellwether of the Indian passenger vehicle segment sold an average of 5,447 units every day last month. The growth, however, could primarily be attributed to surging sales of its range of compact cars, which include the Swift, Ignis, Celerio, Baleno and the Dzire. The collective sales of these models stood at 83,834 units, a substantial jump of 31.8 percent over the year-ago sales of 63,584 units.

The recently introduced new Swift hatchback is the one leading the charge, having received a strong market response and selling 17,291 units in its maiden month in February (February 2017: 12,328 / +40%). Its compact sedan sibling, the Dzire, which was launched in May 2017, is also one of the major growth drivers in the compact segment for the company.

Hyundai Motor India sold 46,735 units in April, growing 4.42 percent (April 2017: 44,758). The Korean carmaker has been seeing consistent demand for its two hatchbacks – the Grand i10 and the i20 – and also for the Hyundai Creta SUV, all of which have been making their way into the Top 10 best-selling PVs’ list month on month over the last fiscal. While the Creta has surpassed sales of 250,000 units in the domestic market since its launch in March 2015, the company recently introduced the updated avatar of the i20, giving it a slew of cosmetic tweaks, and a new CVT option in its petrol avatar.

Honda Cars India has begun the new fiscal with an average performance, selling 9,143 units, down a substantial 37 percent (April 2017: 14,480). The primary reason for the significant drop is zero dealer dispatches of its Amaze compact sedan last month. The car is due for a generational change and the second-generation model is to be launched on May 16.

According to Rajesh Goel, SVP and director, Sales & Marketing, Honda Cars India, “Honda Cars India’s sales in April are as per plan. We are preparing for the launch of the all-new Amaze this month and did not have stocks of the outgoing Amaze. Besides, the City and WR-V which were launched last year had witnessed new model sales spurt around this time. Both these reasons are reflected in lower wholesales in April this year as compared to last year. It’s a temporary phenomenon. There is a very strong interest from the market for the all-new Amaze and we are confident that overall sales will be robust after the introduction of the new model.”

While the City sedan was the best-seller for Honda last month with 3,366 units, the Jazz-based WR-V crossover went home to 2,949 buyers, with the Jazz itself selling 1,747 units in the month. What would be interesting to see in the coming months is the performance of the City as arch rival Toyota Kirloskar Motor has just introduced its competent Yaris sedan, pitched directly against Honda's segment best-seller.

Tata Motors sold 19,157 units last month, a substantial increment of 36.19 percent over year-ago sales of 14,066 units. While it saw continued demand for the Tiago hatchback, Tata Motors also witnessed a three-fold growth in its UV sales based on the strong performance of the Nexon compact SUV. In FY2018, barely within seven months of its launch, the snazzy Nexon has sold a total of 27,747 units, comprising for 53.47 percent of Tata Motors' total UV sales of 51,891 units. The company is now set to introduce AMT variants in both the petrol and diesel versions of the crossover.

Meanwhile, UV specialist Mahindra & Mahindra (M&M) recorded good growth with its PV sales notching 21,826 units, up 13 percent (April 2017: 19,325). According to Rajan Wadhera, president, Automotive Sector, M&M, "After a good FY2018, we have had a strong start to FY2019, having registered a good overall growth of 22 percent for April 2018. We have also seen an encouraging response to our recent launch of the plush new XUV500.”

Ford India reported domestic market sales of 7,428 units, remaining consistent in performance to April 2017, when it had sold 7,618 vehicles. According to Anurag Mehrotra, president and managing director, Ford India, “Increasing inflation trajectory which might weigh on customer’s access and cost to credit, coupled with increasing crude prices, could lead to passenger vehicle industry growing at low single digits so far this year.”

Toyota Kirloskar Motor’s FY2019 has begun with sales of 13,037 units, which marks flat growth (April 2017: 12,964). While the Innova Crysta MPV and the Fortuner SUV have been its top grossers month-on-month, the company, for the first time ventured into the C-segment space in India, introducing its new Yaris sedan.

According to N Raja, deputy managing director, Toyota Kirloskar Motor, “Last month was quite eventful for us with the bookings opening for the Toyota Yaris. The Yaris is loaded with first-in- segment features and offers a great value proposition in terms of best-in-segment quality, comfort safety and performance.”

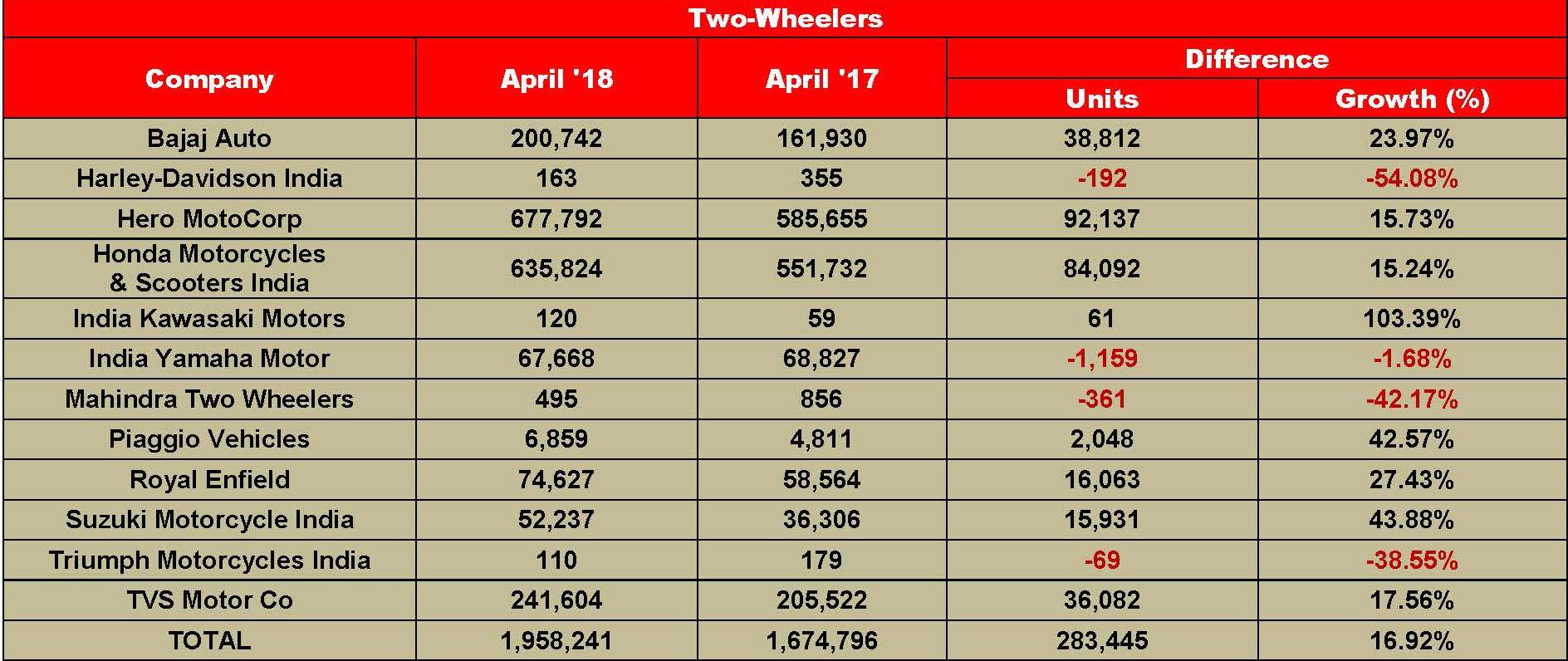

TWO-WHEELER OEMS OFF TO AN IMPRESSIVE START

April 2018 has been a good month for two-wheeler OEMs, with overall numbers nearly hitting the 2 million mark – 1,958,241 units (+16.92%). Of this, the Big Four – Hero MotoCorp, HMSI, TVS Motor Co and Bajaj Auto – have between them contributed 1.75 million units.

Off to a good start in the new fiscal, Hero MotoCorp sold 677,792 units in April, thereby recording a YoY growth of 15.73 percent.

The company, which claims to maintain its dealership inventory for about four-six weeks currently, had recently introduced three new motorcycle models in the mass commuter segment – 125cc Super Splendor and the 110cc Passion XPro and Passion Pro. The updated models are aimed at boosting monthly sales, and the impact can be seen in the sales of its Passion brand, which recorded some revival in March 2018.

The company plans to launch four new products – two motorcycles in the 200cc class (XPulse and Xtreme 200R) and two scooters in the 125cc category (under Maestro and Duet monikers) – later in FY2019.

Hero MotoCorp’s management expects the growth momentum to continue in the wake of good demand from the rural markets. “The senior officials expect that the two-wheeler industry will go on to record double-digit growth in FY2019 too. Hero MotoCorp forecasts its own growth aligned with that of the industry’s in the ongoing fiscal,” analysts told Autocar Professional.

Honda Motorcycle & Scooter India (HMSI) reported sales of 635,824 units (+15.24%), its highest ever run in the domestic market for a single month. Notably, Honda has also breached the 600,000 unit mark in its monthly sales for the first time (domestic sales). According to the company, its scooter as well as motorcycle sales breached the 400,000 and 200,000 unit marks in its monthly sales for the first time. Its scooter sales stood at 423,527 units (+15%) while motorcycle sales recorded 212,284 units (+16%).

According to Yadvinder Singh Guleria, senior VP (Sales and Marketing), HMSI, “Honda 2Wheelers India has made a cracker of a start of FY2019 with record breaking sales in April.”

TVS Motor Company, India’s third largest two-wheeler manufacturer, has reported total domestic sales of 241,604 units for April 2018 (+17.6%). Motorcycle sales comprised 131,704 units (+31.8%), likely powered by the latest launches particularly the Apache RTR 160 4V, the entry-level model for the Apache brand, which is now seeing plenty of activity. TVS’ scooter sales continued to grow at a decent 9.6 percent YoY rate to reach 89,245 units in April 2018.

Pune-based Bajaj Auto has reported domestic motorcycle sales of 200,742 units in April 2018 (+24%). Pumping new life in its Pulsar range, the company had introduced an updated Pulsar 150, which was once the top selling model in the entire Pulsar range, around the end of March 2018. The updated Pulsar 150 now comes equipped with a bigger front disc brake and a disc brake on the rear wheel too. The company had also recently (in February 2018) added the Avenger 180 to its cruiser bike portfolio with an aim of boosting sales.

Continuing to grow with a healthy double-digit rate, Royal Enfield has reported sales of 74,627 units in April 2018 as against 58,564 units sold in April last year. The company has posted YoY growth of 27 percent.

The company had recently announced capital expenditure of Rs 800 crore for FY2018-19. The capex will majorly cover the expansion of production capacity under phase II at its Vallam Vadagal plant near Chennai along with the focus on the completion of its upcoming technology center in Chennai and development of new products to meet the upcoming regulatory norms. The company says that its annual production capacity in FY2018-19 will be about 950,000 units per annum. It is known that Royal Enfield’s Vallam Vadagal plant is already brimming with full capacity utilization under phase I. The company is also working on further optimizing its productivity at its Oragadam plant.

Suzuki Motorcycle India sold 52,237 units in April 2018, up a remarkable 43.8 percent YoY. Commenting on the sales performance, Sajeev Rajasekharan, EVP, Suzuki Motorcycle India said, “After recording our most successful fiscal in FY2018, it was extremely important for us to sustain this momentum into the new year as wellBuoyed by this positive start, our outlook remains optimistic in pursuit of 700,000 unit sales domestically, in this financial year.”

To cater to the growing demand for its products, the company has increased its all-India footprint to 1057 dealer points, including 512 dealerships.

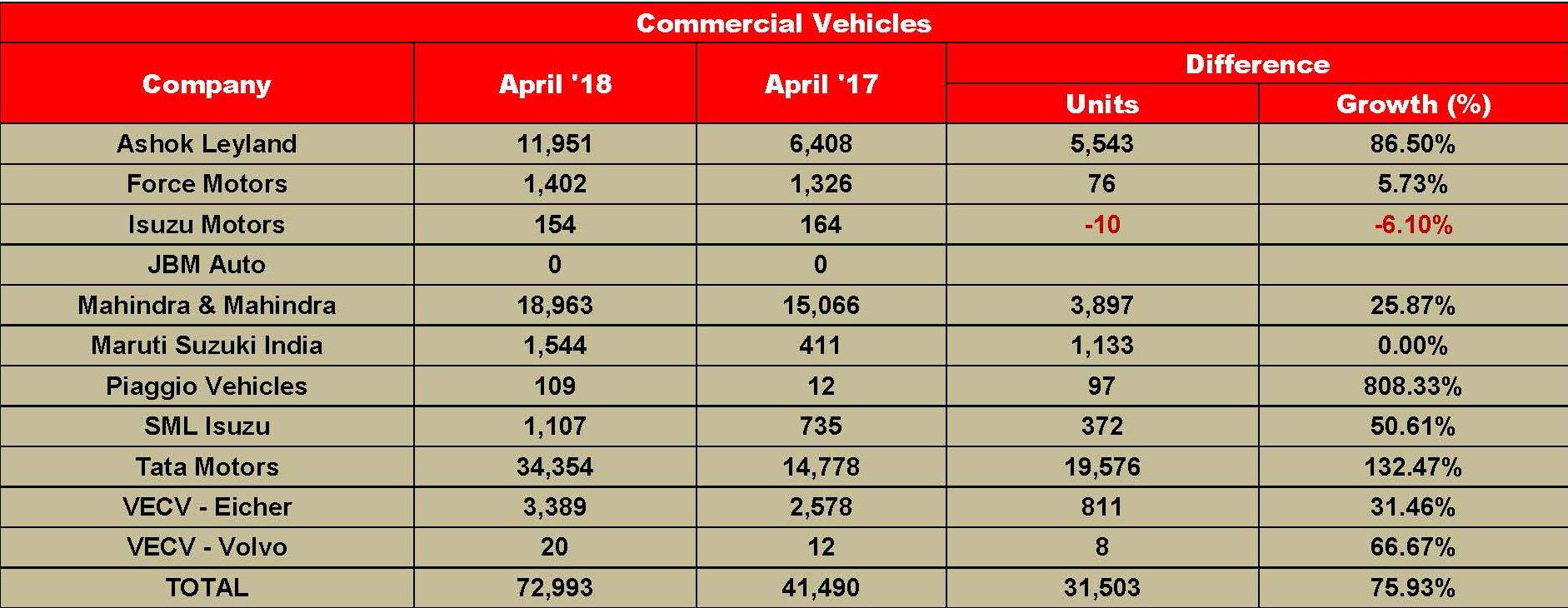

COMMERCIAL VEHICLE SALES STAY IN FAST LANE

Like the PV segment, the commercial vehicle (CV) industry is firing on all cylinders on the sales front. OEM-reported numbers for April indicate handsome growth albeit on a low year-ago base of April 2017 when BS IV emission norms kicked in. All the major OEMs, including Tata Motors, Ashok Leyland, VE Commercial Vehicles and Mahindra & Mahindra have doubled their M&HCV sales last month.

As is known, April 2017 saw CV sales plunge to a new low due to pre-buying in March and customer delaying their buying decisions, expecting price increases for BS IV trucks. Also, fleet operators were awaiting further clarity on GST in expectation of prices moderating.

In April 2018, the government has mopped up a record Rs 100,000-plus crore of revenue from GST, the highest since the landmark tax reform was introduced in July 2017. One of the reasons for the higher collection is the successful introduction of the e-way bill for transporters which has helped drive efficiency, better compliance and speedier shipments of goods.

Tata Motors’ overall CV sales 36,276 units, an increase of 126 percent (April 2017: 16,017). The startling rise is due to the lower base of last year owing to the BS III to BS IV transition when sales were affected as there was huge pre-buying in March 2017.

According to Tata Motors, “The growth in April 2018 was on the back of various macroeconomic factors like investment in infrastructure development, improved industrial activities, and robust demand in private consumption-led sectors. Factors like lower interest rates, inflation under control are boosting the economy thereby leading to continuing demand.”

For Tata, its M&HCV trucks continued to see growth momentum with sales of 14,028 units, a YoY increase by 317 percent. This is on the back of the government’s focus on infrastructure development, road construction, building of irrigation facilities and housing projects across the country. Additionally, the restrictions on overloading in Utter Pradesh, Rajasthan and Delhi continue to bolster the demand for higher-tonnage vehicles. Various sectors like auto carriers, 3PL players, cement, steel, and oil tankers are also driving growth.

Sales of intermediate LCV trucks was at 3,229 units up by 94 percent over last April on the back of new product launches, growth in the e-commerce segment and increasing rural consumption due to farm loan waivers, rising rural wages and increased minimum support price (MSP) for crops.

Tata Motors’ SCV cargo carriers and pickups segment sold a total of 14,620 units, up by 84 percent over last year. With the hub-and-spoke model developing, small vehicles are in demand for last-mile connectivity across both the rural and urban markets. The need for inter-city and intra-city trips, narrow village roads and long highway hauls carrying small loads is driving demand for SCVs.

Meanwhile, on the buses front, Tata sold 4,399 units, a 46 percent increase over last April. This was led by the robust demand for school buses with the onset of the annual school season.

Ashok Leyland sales zoomed to 12,677, which is 79 percent growth (April 2017: 7,090). Its M&HCV numbers almost doubled to 8,968 units, up 98 percent (April 2017: 4,532) while LCV sales grew by a strong 45 percent YoY with 3,709 units sold (April 2017: 2,558).

For Mahindra & Mahindra, overall CV sale was up by 26 percent to 18,963 units in the month (April 2017: 15,060). M&HCV sales are up by 225 percent with sales of 904 units (April 2017: 278). The below-3.5T GVW segment has grown by 22 percent YoY, selling 17,495 units (April 2017: 14,360), while those in the above-3.5T GVW segment registered growth of 34 percent with sales of 564 units (April 2017: 422).

VE Commercial Vehicles continues its strong growth with sales of 3,389 units up by 31.5 percent. (April 2017: 2,578 units).

RELATED ARTICLES

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

10 May 2018

10 May 2018

9421 Views

9421 Views

Autocar Pro News Desk

Autocar Pro News Desk