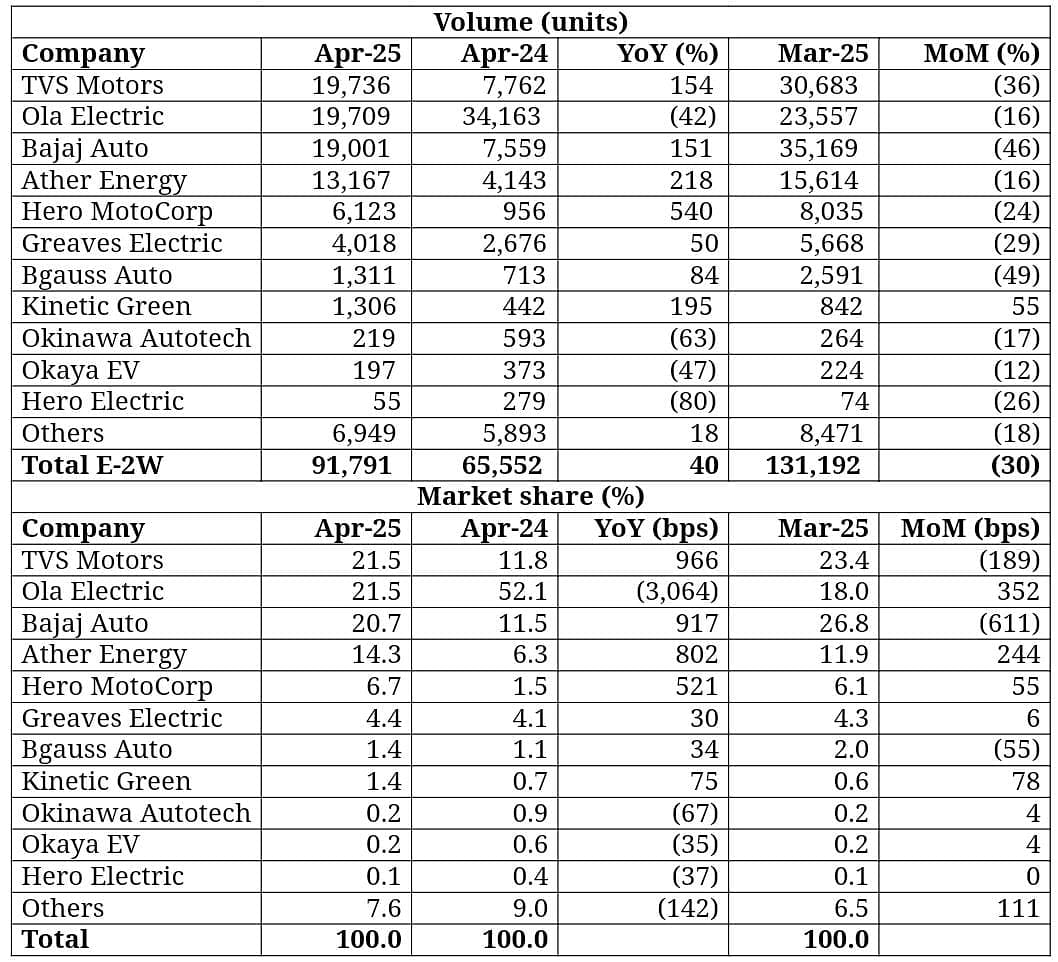

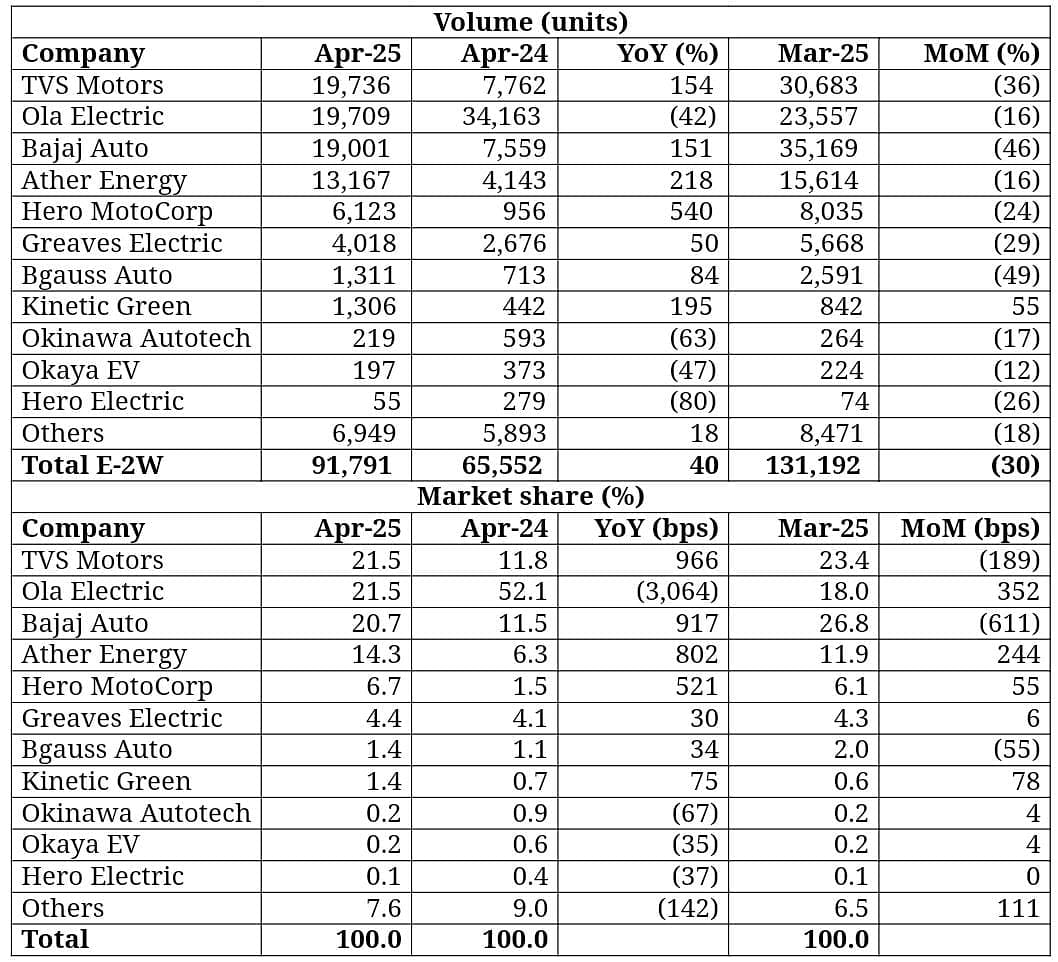

In a fiercely competitive month for the electric two-wheeler (E2W) segment, TVS Motors secured the No. 1 position in April 2025, registering 19,736 units—edging past Ola Electric (19,709 units) and Bajaj Auto (19,001 units).

These figures are based on Vahan registration data accessed around 3 PM on April 30, 2025.

The overall E2W market recorded 91,791 units in April, marking a 30% month-on-month decline following a subsidy-fueled spike in March. However, year-on-year growth remained strong at 40%, underlining the segment's long-term growth trajectory.

April 2025: Top 5 Electric Two-Wheeler Players

-

TVS Motors – 19,736 units (21.5% market share)

-

Ola Electric – 19,709 units (21.5%)

-

Bajaj Auto – 19,001 units (20.7%)

-

Ather Energy – 13,167 units (14.3%)

-

Hero MotoCorp – 6,123 units (6.7%)

Close Contest at the Top

TVS achieved 154% year-on-year growth, driven by the success of its iQube platform and expanded availability. Ola Electric, despite a 42% drop from last year’s inflated base, made a strong recovery from March, gaining 352 basis points in market share.

Bajaj Auto, the newest entrant in the high-volume e-scooter race, held its ground with an impressive 152% year-on-year growth, reinforcing its position as a top-tier EV player.

Ather Energy continued its steady climb, while Hero MotoCorp gained significant share—albeit from a relatively low base.

Collectively, these five players now command 84% of the E2W market, signaling rapid consolidation as smaller brands continue to lose ground.