M&M Posts Strong Q3 with 20% Profit Growth

The Mumbai-based conglomerate saw its consolidated revenue grow 17% year-on-year to Rs 41,470 crore. The company strengthened its grip on the SUV market with a revenue market share of 23%, up 200 basis points.

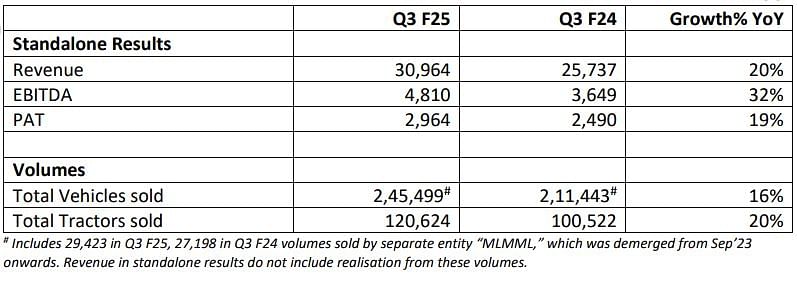

Mahindra & Mahindra (M&M) reported robust performance for the third quarter of FY25, with consolidated profit after tax rising 20% to Rs 3,181 crore, driven by strong showing across its automotive, farm equipment, and services businesses.

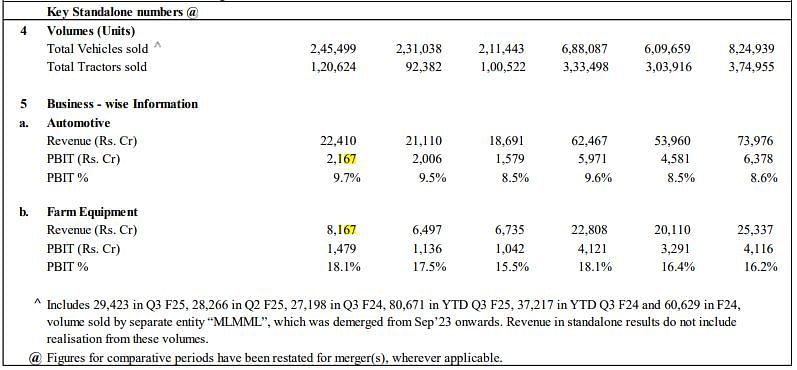

The Mumbai-based conglomerate saw its consolidated revenue grow 17% year-on-year to Rs 41,470 crore. The company strengthened its grip on the SUV market with a revenue market share of 23%, up 200 basis points, while SUV volumes surged 20% during the quarter.

In the farm equipment sector, M&M achieved its highest-ever Q3 market share of 44.2%, with volumes growing 20% to 120,624 units. The segment's standalone PBIT rose 42% to Rs 1,479 crore, while margins improved significantly by 260 basis points to 18.1%.

"Our businesses continue to demonstrate strength in execution. Auto and Farm delivered solid performance on market share and margins, on the back of focused execution," said Dr. Anish Shah, Managing Director & CEO of M&M Ltd.

"The transformation at TechM is gathering momentum. MMFSL continues to balance asset quality and growth priorities, with GS under 4% on the back of strong AUM growth," he added.

The company also marked significant milestones in its electric vehicle journey, with Mr. Rajesh Jejurikar, Executive Director & CEO (Auto and Farm Sector), highlighting the launch of their flagship Electric Origin SUVs, the BE 6 and XEV 9e.

"In Q3 F25, we were No. 1 in SUV revenue market share with 200 bps YoY increase. LCV <3.5T volume market share is at 51.9%, a gain of 230 bps. The Auto segment PBIT is up by 120 bps YoY. We achieved highest ever Q3 tractor market share at 44.2%, gain of 240 bps YoY, and farm PBIT is up by 260 bps YoY," he added.

RELATED ARTICLES

Noida International Airport Awards Ground Mobility Contract to Mann Fleet Partners

The agreement covers rental car services, intra-terminal bus shuttles, and intra-city connectivity linking the airport t...

Schaeffler India Q4 Revenue Rises 27%

For the year ended December 31, 2025, revenue from operations increased 16.3% year-on-year.

Maharashtra EV Policy Could Be His First Policy Failure in 36 Years, Says Rajiv Bajaj

In the CNBC-TV18 interview, Bajaj revealed that the company has received only a fraction of the subsidies owed by the Ma...

By Arunima Pal

By Arunima Pal

07 Feb 2025

07 Feb 2025

3675 Views

3675 Views

Sarthak Mahajan

Sarthak Mahajan