Maruti Suzuki India clocks 873,107 units in H1 FY24, registers 10% growth

India’s largest carmaker is witnessing a surge in demand for SUV models, which have registered a noticeable 88 percent uptick in the first six months of the ongoing financial year.

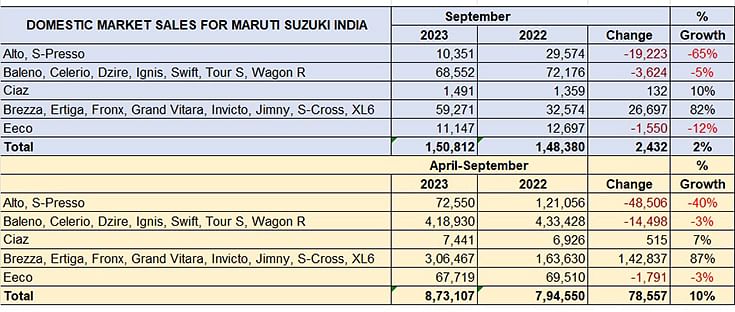

India’s largest carmaker Maruti Suzuki India (MSIL) has reported domestic passenger vehicle sales of 150,812 units in September, registering a marginal 1.63 percent year-on-year (YoY) uptick. While sales of its entry-level models – Alto and S-Presso – continued to be on a decline with a total of 10,351 units being despatched last month (September 2022: 29,574 / -65%), its SUVs have reported a strong performance.

MSIL’s SUV charge, which is led by the Brezza, Ertiga, Fronx, Jimny, Grand Vitara, Invicto, and XL6 registered a significant 82 percent YoY growth with total sales culminating at 59,271 units last month (September 2022: 32,574). SUVs went to comprise 39 percent of the carmaker’s total volumes last month.

On the other hand, sales of its compact hatchbacks and sedans, which include models like the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, and WagonR, also continued to show a downward trend, and registered a 5 percent YoY decline, with total despatches of 68,552 units in September (September 2022: 32,574). The company’s sole midsize sedan – Ciaz – registered a near-10 percent YoY growth with 1,491 units getting despatched last month (September 2022: 1,359 / +9.71%).

In terms of its half-yearly performance, the company clocked overall domestic passenger vehicle sales of 873,107 units in the first six months of FY24, registering a 10 percent YoY growth in the April-September 2023 period (H1 FY23: 794,550). The SUV portfolio witnessed a strong surge in demand to register a noticeable 88 percent YoY uptick in H1 FY24, with overall sales of 306,467 units (H1 FY23: 163,630).

In terms of its half-yearly performance, the company clocked overall domestic passenger vehicle sales of 873,107 units in the first six months of FY24, registering a 10 percent YoY growth in the April-September 2023 period (H1 FY23: 794,550). The SUV portfolio witnessed a strong surge in demand to register a noticeable 88 percent YoY uptick in H1 FY24, with overall sales of 306,467 units (H1 FY23: 163,630).

While the share of SUVs in MSIL’s half-yearly volumes stood at 35 percent, its entry-level cars, and compact hatchbacks and sedans, comprised over 56 percent of the company’s total volumes in H1 FY24. The Alto and S-Presso clocked 72,550 units in the April-September 2023 period, registering a 40 percent YoY decline. On the other hand, the clutch of compact hatchbacks and sedans, recorded total sales of 418,930 units in this period, to register a marginal 3 percent YoY decline.

In the H1 FY24 period, the Ciaz midsize sedan went home to 7,441 buyers, registering a 7.43 percent YoY growth, while the Eeco van recorded sales of 67,719 units in the April-September 2023 period, to register a YoY de-growth of nearly 3 percent.

According to Shashank Srivastava, Senior Executive Officer, Marketing and Sales, MSIL, “For H1 FY24, MSIL’s growth has been 10 percent, outpacing the market average of 5 percent. As a result, we have been able to increase our market share from 41 percent a year ago, to 42.3 percent between the April-September 2023 period.”

“There has been a notable uptick in the SUV penetration, which was pegged at 52 percent in September, and 48.3 percent for H1 FY24 for the entire PV industry,” he added.

The company says that most OEMs have surpassed the semiconductor issue, and are readying their network for the anticipated demand during the festive season, particularly from the Northern, Eastern, and Central parts of India. “The channel stock has gone to 331,162 vehicles, and the industry has crossed the 30-day-stock levels after a long time. While the current inventory is very high and similar levels were observed only around 5 years ago, presently, it is not a matter of concern as the expectations from the festive season are quite positive," Srivastava said.

He further added that despite growing costs, owing to the rising cost of input materials such as copper, aluminium, and steel, the company is watching the situation closely, and has not yet decided about a definite price increase on its offerings. The company continues to witness a slowdown in the entry-level segment, and is modulating the production of such cars to optimise retail.

With respect to headwinds, Srivastava cautioned that while the monsoon has largely been sufficient, with a minus 5 percent shortfall, inflationary pressures could lead to further increase in interest rates when lending enables almost 80 percent of the automotive retail business. “The high interest rates could eventually impact vehicle retail, and we continue to closely watch these parameters,” Srivastava said.

RELATED ARTICLES

Weekly News Wrap: EV push intensifies with Maruti’s eVitara pricing, Tata Punch.ev, Valeo India bet

Maruti Suzuki and Tata Motors launch new electric models as foreign suppliers and domestic manufacturers commit fresh ca...

India EV Sales Seen Topping 200,000 in FY26 as PV Market Nears 4.6 Million Units

As adoption in higher-priced segments remains strong, the next leg of growth will hinge on accelerating electrification ...

Hero Motocorp Stops Using ‘AERA’ Trademark After Trademark Dispute With Matter Motor

Delhi High Court accepts undertaking by Hero MotoCorp to stop using AERA marks, following trademark dispute with electri...

01 Oct 2023

01 Oct 2023

8247 Views

8247 Views

Autocar Professional Bureau

Autocar Professional Bureau

Mukul Yudhveer Singh

Mukul Yudhveer Singh