M&A driven deals to add Rs 12,000 crore to Motherson Sumi's biz, topline may cross Rs 1 lakh crore by FY25

With the growth in existing business and the closure of merger and acquisition (M&A)-driven revenue, the company is expected to touch Rs 1,00,000 crore in topline by FY25, as per Autocar Professional's research.

In a bid to achieve its aspirational goal of ‘Vision 2025’, auto component major Samvardhana Motherson (SAMIL) has signed seven acquisition deals since April 2023, which are expected to add Rs 12,000 crore to its revenue by the financial year (FY) 2024–25, senior company executives said. The company's revenues increased 23 percent to Rs 78,701 crore in FY23, which is also the highest-ever yearly revenue for the company.

According to brokerage firms, the company's revenue is expected to grow at a CAGR of 6.5-7 percent between FY 2023 and FY 2025. With the growth in existing business and the closure of merger and acquisition (M&A)-driven revenue, the company is expected to touch Rs 1,00,000 crore in topline, as per Autocar Professional research.

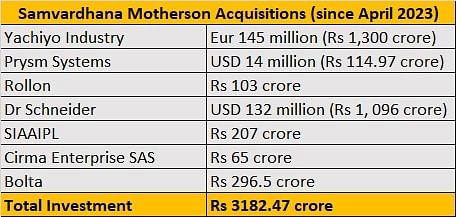

For these seven M&A deals, the Noida based company has invested over Rs 3,180 crore in the current fiscal year. Three of the major acquisitions, Yachiyo, Dr. Schneider, and CIRMA, where SAMIL invested Rs 1,300 crore, Rs 1,096 crore and Rs 65 crore respectively, will be completed by March 2024.

Of the total revenue during April-June (Q1 FY24), about Rs 26 crore was from acquisitions done by the company. In the last financial year, the company announced six acquisitions with a pro forma gross revenue of USD 4.9 billion and net revenues of about USD 1.1 billion. Currently, the company has already closed three out of seven M&A deals in the ongoing financial year.

“We are happy to highlight that we have closed seven acquisitions since April 2023. We have added 41 facilities to the Motherson ecosystem, and we also welcome 8,500 employees of these new companies into the Motherson family. On top of this, three M&As that we have announced are still pending closure, Cirma, Yachiyo, and Dr. Schneider, which will further add revenues of USD 1.4 billion (over Rs 12,000 crore) next year,” Laksh Vaaman Sehgal, Director, SAMIL said over a conference call.

He further said that the faster integration of these assets will enable the company to go after even more M&As. "The automotive industry continues to evolve with changing technologies required for zero emission vehicles and the premiumization of vehicles. As a result, we believe there are even more opportunities and customer driven deals with fewer players to really be able to conclude them. We believe we are in a driving position here, and exciting times are up ahead for Motherson,” the director added.

He also opined that the impact of M&As would start getting reflected in the second quarter (July-September) with the completion of the SAS Autosystemtechnik deal. SAS Autosystemtechnik is a provider of assembly and logistics services for the automotive industry.

Capex

SAMIL, the specialized automotive component manufacturer's capex, is set to grow from Rs 2,183 crore to Rs 3,300 crore this year, equivalent to an increase of over 51 percent. It is worth noting that, before the pandemic, the group’s investment budget remained steady at Rs 2,000 crore a year.

“We believe the better availability of semiconductors has aided in th stabilisation of volumes as the demand supply lag is improving while the supply chain is also easing. We are seeing strong growth coming from the organic side due to stabilising automotive production and tailwinds on accounts of an uptick in zero emission vehicles and premiumization, which ducktails well with our new order wins, resulting in seven new greenfields being set up in emerging markets We expect the capex for the year to be in the upper band of Rs 3,300 crore, with this growth momentum,” Laksh Vaaman Sehgal said.

Notably, emerging markets accounted for more than 50 percent of the group’s total revenues in the last financial year. The company has opened six greenfield plants in India, and one of them is in China.

Financials

During Q1, consolidated net profit jumped over fourfold to Rs 601 crore for the first quarter ended June 30, 2023. The company reported a net profit of Rs 141 crore for the April-June quarter of the last fiscal year.

Total revenue from operations rose to Rs 22,462 crore in the June quarter as against Rs 17,654 crore in the year-ago period. Strong revenue growth was driven by a combination of end-industry growth on a low base, a continued trend of premiumization resulting in rising value added per vehicle, and increased execution of recently added orders. However, no major impact from the recently concluded large deals on the financials was seen in this quarter.

"We have delivered another quarter of strong performance. The automotive industry is stabilizing with new cost structures, and Motherson continues to adapt to the evolving landscape," Motherson Chairman Vivek Chaand Sehgal said.

RELATED ARTICLES

Indonesia Postpones 105,000-Vehicle Import Plan From India, Bloomberg Reports

Citing senior officials, Bloomberg reported that Indonesia is reassessing its import plan over concerns about the domest...

INDEX Group Opens Bangalore Technology Center to Expand India Market Presence

The German CNC machine manufacturer has established a new branch with a showroom and demonstration facility near Bangalo...

India Holds Fourth Place in Global Consumer Sentiment Rankings Amid Declining Confidence

The LSEG-Ipsos survey finds India's consumer outlook softening in February 2026, even as the country outperforms many ad...

24 Aug 2023

24 Aug 2023

27686 Views

27686 Views

Arunima Pal

Arunima Pal

Sarthak Mahajan

Sarthak Mahajan