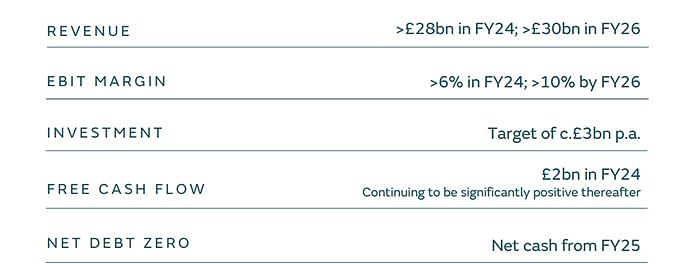

JLR targets Rs 3 lakh crore in turnover by FY26 and 10% EBIT margin

Having committed £ 15 billion in investment in the next five years, the marque brand from the house of Tatas will rely on alliances and partnerships to cut cost and deliver free cash flow by FY25.

Tata Motors-owned Jaguar Land Rover aims to cross Rs 3 lakh crore or £30 billion in turnover by FY26 in the next three years. The luxury carmaker is eyeing a 30% growth in revenues as part of its mid-term 'Reimagine Strategy'.

The new plan which is focussed on revenue and value over volumes at JLR, the company plans to deliver an EBIT (earnings before interest and tax) margin of 6% in the current financial year with an eventual plan to target 10% EBIT margin by FY26, the company shared with the investors on Monday.

Jaguar Land Rover says it will be investing £3 billion (Rs 30,579 crore) per annum as part of its mid-term plan and hopes to deliver free cash flow of £2 billion and a volume of 400,000 units in the current financial year. The company says it will be net debt zero by FY25.

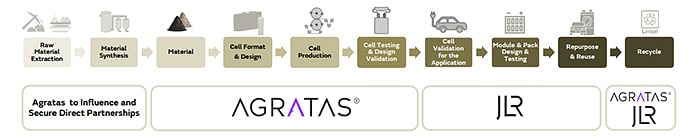

The company had announced plans of investing £15 billion (Rs 152,895 crore) in the next five years. On Monday, JLR said reduction in vehicle architectures from 7 to 3 and leveraging partnerships, e.g. Agratas investment in cell manufacturing, Nvidia and Tata Group has helped in pruning the investment cost.

Over the last five years, the company has reduced its breakeven point to 300,000 units, even as the average revenue per unit of the company increased to £70,000 (Rs 71.35 lakh) from about £43,000 (Rs 43.82 lakh) in FY19.

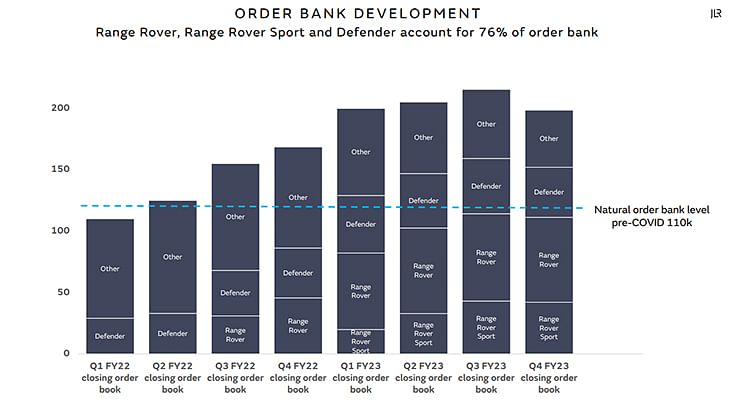

Strong order book of over 200,000 bookings

Strong order book of over 200,000 bookings

The company management told investors that JLR has been delivering results and there is a strong demand for its products. The company is sitting on the record order book of 200,000 units with the Range Rover, Range Rover Sport and Defender accounting for 76% of its total order book. The company claims the fulfilment rate continues to improve.

The management believes JLR has been resilient against headwinds so far, and it has plans in place to tide over key macro headwinds.

On the current global chip supply constraints, JLR said the scenario is gradually easing, and the inflationary pressures and energy price increases are being offset through operational efficiencies and it is continually monitoring the geopolitical landscape.

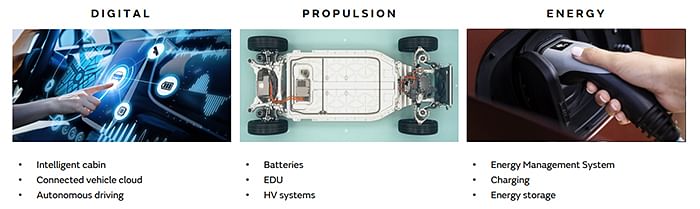

JLR says that it continues to enhance engineering capability in key technology areas.

Adrian Mardell, interim CEO of JLR asserted that delivering the “Reimagine strategy” continues to remain its priority.

Tata Motors is working on making JLR - the House of brands - modern luxury by design. Its engineering team is working on making architectures and powertrains - electrified, simplified and flexible. The company is banking on collaborations and synergies through partnerships with the Tata Group and other alliances.

Sustainability and the accelerated drive towards net zero

The Reimagine strategy has sustainability at the core of it. The company has defined a clear path to net zero carbon emission. The first Battery Electric Vehicle from Range Rover will be launched in 2024, this will be followed by the Jaguar brand going 100% electric by 2025.

JLR intends to transition all its products or brands to electric vehicle powertrain. It is confident of delivering zero tailpipe emission by 2036, before it reaches its goal of net zero carbon emission by 2039.

On the semiconductor front, the company is planning to set up a strategic partnership and it is looking for increasing involvement at the top management. JLR plans to develop new business models and develop direct CEO to CEO relationships, the presentation shared.

JLR is leveraging Tata Group synergies to benefit from best-in-class EV battery tech from Agratas Energy Solutions, which offers superior cell-to-pack efficiency, chemistry flexibility, topnotch fast charge and enhanced safety.

JLR is leveraging Tata Group synergies to benefit from best-in-class EV battery tech from Agratas Energy Solutions, which offers superior cell-to-pack efficiency, chemistry flexibility, topnotch fast charge and enhanced safety.

JLR will leverage synergies across 10 verticals of the Tata Group including the new Tata Agratas cell manufacturing business for which the Group has committed over US$ 1.3 billion. The partnership with Tata Technologies will also accelerate digital transformation at JLR's industrial strategy.

The company management stated that there is definite acceleration in electrification and JLR is transitioning in line with that trend.

Highlighting the portfolio development at JLR, the company’s chief commercial officer, stated that the 80% of the company’s portfolio will come from pure EVs by FY29.

RELATED ARTICLES

Tamil Nadu, Gujarat Lead India's Auto Retail in February 2026

Nationally, total retail registrations rose 25.6% on-year, surpassing the previous best February recorded in 2024.

KTM AG Prepays €450 Million Loan from Bajaj Auto Arm

The Austria-based motorcycle maker had secured a €550 million refinancing loan from an international banking consortium ...

Ind-Ra Maintains Neutral FY27 Auto Outlook, Projects 5-8% Volume Growth

India Ratings and Research forecasts moderate sales growth driven by GST rate cuts boosting personal mobility and infras...

13 Jun 2023

13 Jun 2023

8194 Views

8194 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa

Sarthak Mahajan

Sarthak Mahajan