India's Auto Sector Records Strong Export Growth in FY25 After Previous Year Slowdown

Industry analysts expect continued momentum despite global uncertainties as manufacturers expand international footprint and focus on premium vehicle segments

India's automotive industry experienced strong export growth in FY25 following a period of decline in FY24, driven by improved economic conditions in key international markets and increased adoption of India-manufactured vehicles by global automakers.

The recovery comes after passenger vehicle exports declined to 13% of total production in FY21 from 17% in FY19, largely due to the COVID-19 pandemic's impact on global demand and the exit of major American automakers including Ford Motor Company and General Motors from the Indian market.

Strong Recovery in Both Vehicle Categories

Export Performance Across Vehicle Categories

Passenger vehicle exports, which account for 15% of total domestic sales, grew 15% year-on-year in FY25 after remaining nearly flat in FY24. This growth helped offset a slowdown in the domestic market, which expanded by only 2% during the same period.

Two-wheeler exports performed even better, recording 21% year-on-year growth in FY25 and representing 17% of total two-wheeler sales. This marked a significant turnaround after declines in FY23 and FY24, primarily attributed to currency devaluation issues in Nigeria, which accounts for 25% of India's two-wheeler export market.

The broad-based nature of the recovery was evident across manufacturers, with revenue contribution from exports increasing for eight of the top 10 passenger vehicle exporting companies and nine of the top 10 two-wheeler exporters.

Premium Vehicles Drive Export Growth

Market Dynamics and Strategic Shifts

Industry analysts point to several factors driving the export revival. Stabilizing inflation, lower interest rates, and preferential market access in key export destinations have boosted overseas demand. Additionally, weak domestic demand, particularly in the passenger vehicle segment, has incentivized manufacturers to pursue export-led growth strategies.

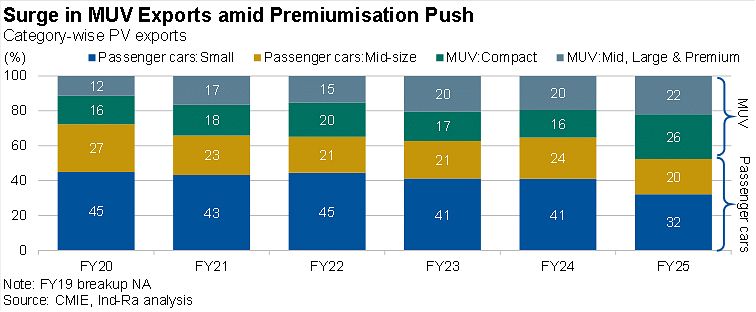

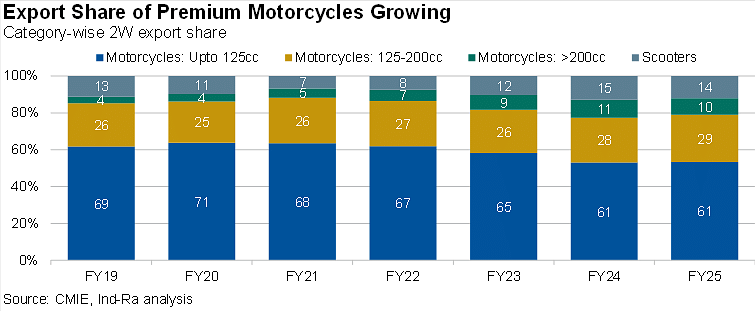

The export pattern shows a growing preference for higher-margin multi-utility vehicles and premium models in international markets. This shift is expected to improve profitability for original equipment manufacturers, particularly passenger vehicle companies that are expanding their presence in developed markets where unit realizations tend to be higher.

Diversification of Export Destinations

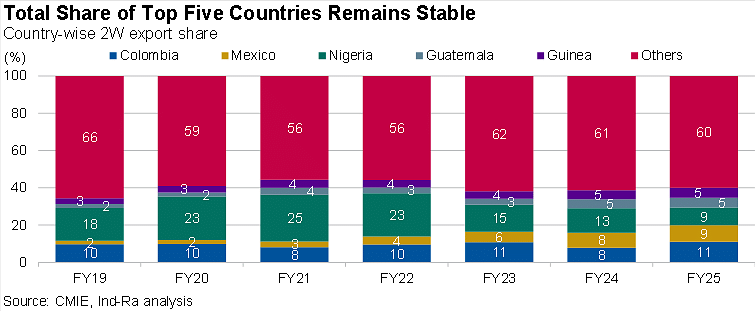

While the top five countries continue to account for the majority of exports, Indian manufacturers are gradually expanding their geographical reach. For passenger vehicles, key markets include South Africa, Saudi Arabia, Japan, Mexico, and the UAE, with the "Others" category showing growth from 52% in FY24 to 44% in FY25. In the two-wheeler segment, Colombia, Mexico, Nigeria, Guatemala, and Guinea remain the primary destinations, though Nigeria's share has stabilized after earlier currency-related challenges.

Economic Recovery in Key Markets Supports Growth

According to Shruti Saboo, Director of Corporate Ratings at India Ratings and Research, automotive exports are expected to continue growing in FY26 at rates ranging from high single digits to low double digits across industry segments. The growth is anticipated to be supported by improving macroeconomic conditions in key export markets, expansion into new geographical regions, and rising global acceptance of Indian-manufactured vehicles.

However, the industry faces potential headwinds from global economic uncertainty and geopolitical tensions. Despite these challenges, the structural alignment of India's automotive sector is expected to help navigate through uncertain conditions.

Strategic Positioning

Domestic manufacturers are increasingly viewing exports not only as a means to expand their global presence but also as a strategy to mitigate potential downturns in the domestic market. This approach reflects a broader trend toward diversification of revenue streams and reduced dependence on any single market.

The 'Make in India for the World' initiative has gained traction among global passenger vehicle and two-wheeler manufacturers, contributing to the sector's export momentum. This trend, combined with the diversification of global supply chains following the COVID-19 pandemic, has positioned India as an attractive manufacturing hub for export-oriented production.

The automotive sector's export revival represents a significant development for India's manufacturing economy, demonstrating the industry's resilience and adaptability in the face of global market changes.

RELATED ARTICLES

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

Tata Motors PV Expects 30–50% Jump in Punch.ev Volumes After New Launch

Automaker bets on higher range, faster charging, and accessible pricing to lift EV adoption in the entry segment.

By Angitha Suresh

By Angitha Suresh

14 Jul 2025

14 Jul 2025

4713 Views

4713 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa