Indian EV Market Faces Challenges as Subsidies Decline in April 2025

The reduction in PM E-DRIVE subsidies has created short-term challenges, particularly for E2Ws, but the report expects the market to adapt.

The Indian electric vehicle (EV) market experienced a mixed performance in April 2025, with significant impacts from reduced subsidies under the PM E-DRIVE scheme, according to a recent report by BNP Paribas Exane. The report, titled "EVolution: Lowered Incentive Impact on 2W Electrification," highlights a slump in two-wheeler (E2W) electrification, steady passenger vehicle (EPV) penetration, and improved three-wheeler (E3W) volumes.

Two-Wheeler EVs: Subsidy Cuts Hit Hard

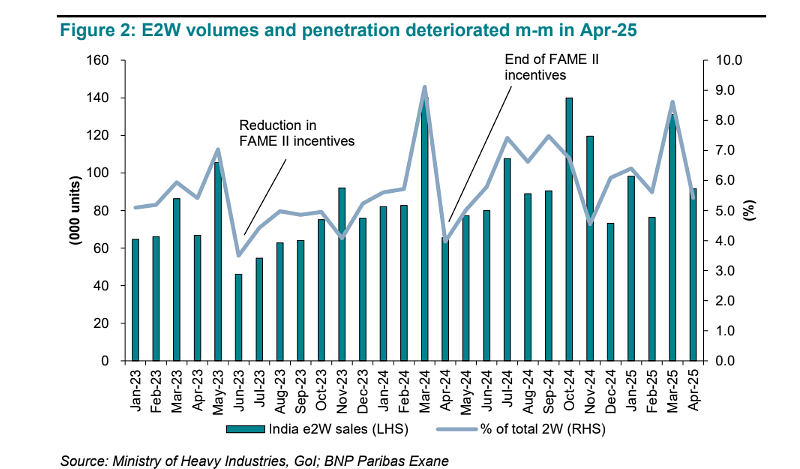

The E2W segment faced a sharp decline in April 2025, with sales volumes dropping by approximately 30% month-on-month (m-m) and penetration falling to 5.4% from 8.6% in March 2025. This downturn was primarily driven by a reduction in PM E-DRIVE subsidies, which decreased from Rs 5,000/kWh (capped at Rs 10,000/vehicle) in FY25 to Rs 2,500/kWh (capped at Rs 5,000/vehicle) in FY26. Despite the monthly decline, E2W volumes grew by about 40% year-on-year (y-y) due to a low base.

- Market Share Shifts: Ola Electric saw a significant recovery, gaining 591 basis points (bps) m-m to reach a 21.5% market share, nearly matching TVS Motor (TVSL) at 21.6%. Bajaj Auto (BJAUT) lost the most ground, with its share dropping 658 bps to 20.8%. Hero MotoCorp (HMCL) and Ather Energy gained 151 bps and 108 bps, reaching 6.7% and 14.4%, respectively.

- Regional Trends: E2W penetration deteriorated across states, with Maharashtra seeing the steepest decline (from 16.4% to 8.0%). Bihar experienced the least decline, dropping by 1 percentage point to 1.7%. Kerala led in penetration at 16.7% for April 2025.

The report anticipates that E2W volumes will stabilize in the coming months as the market adjusts to the lower subsidies.

Passenger Vehicle EVs: Steady Penetration, Strong Growth

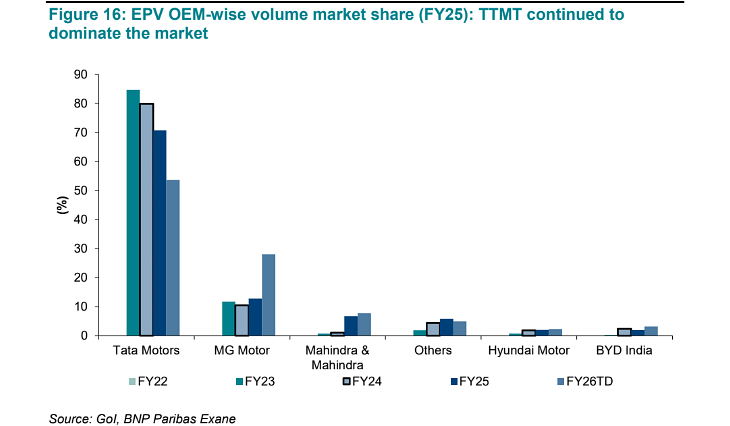

Electric passenger vehicle (EPV) sales showed resilience, with a 60% y-y volume increase, though they moderated by 5% m-m. Penetration remained steady at 3% in April 2025. Mahindra & Mahindra (M&M) emerged as a standout performer, boosted by its recently launched battery electric vehicles (BEVs), XEV 9e and BE 6e.

- Market Leaders: M&M gained 833 bps m-m, reaching a 24.4% market share. Tata Motors (TTMT) retained its leadership with a 36.2% share, despite losing 140 bps. MG Motor saw the largest decline, dropping 331 bps to 28.4%.

- Upcoming Launches: The report notes a robust pipeline for 2025, including Tata Motors’ Harrier EV and Sierra EV, M&M’s XUV.e5, and Maruti Suzuki’s e-Vitara. These launches are expected to drive EV adoption, though hybrid models may gain traction in the coming quarters.

- State Performance: Gujarat saw the most improvement in EPV penetration, while Delhi experienced the largest decline. Kerala led with a 6.9% penetration rate in April 2025.

The report highlights 2025 as a pivotal year for EPV adoption, with new launches expected to bolster market growth.

Three-Wheeler EVs: Robust Growth Continues

The E3W segment performed strongly, with volumes rising 47% y-y and 5% m-m. Penetration improved to 61.8% from 59.3% in March 2025, reflecting growing acceptance of electric three-wheelers.

- Market Dynamics: M&M maintained its leadership with a 9.1% share, despite losing 220 bps m-m. Bajaj Auto followed closely with an 8.9% share, down 5 bps. The E3W market remains highly fragmented, with multiple players vying for share.

- Regional Insights: Kerala saw the most significant m-m increase in E3W penetration, while Maharashtra recorded the largest decline. Uttar Pradesh led overall with an 87.0% penetration rate in April 2025.

Mahindra & Mahindra: A Strong Investment Case

The report provides an in-depth investment analysis of Mahindra & Mahindra, rating it as "Outperform" with a target price of Rs 3,600. M&M’s success in utility vehicles (UVs) and tractors, coupled with its EV strategy, positions it for strong growth.

- Investment Case: M&M’s recent launches, including XUV3XO, Thar Roxx, XEV 9e, and BE 6, are expected to drive double-digit volume growth in FY26. Planned launches in CY26, including three internal combustion engine (ICE) SUVs, two BEVs, and two light commercial vehicles (LCVs), will sustain this momentum. The company’s tractor segment is also gaining market share, and potential listing of its auto and farm businesses could unlock significant value.

- Valuation: M&M’s Farm Equipment Segment is valued at 22x Mar-27E EV/EBIT, while its automotive business is valued at 25x Mar-27E EV/EBIT, reflecting a premium over peers like Maruti Suzuki and Ashok Leyland.

- Risks: Upside risks include a tractor demand recovery and faster production ramp-up. Downside risks include potential market share losses in UVs, competitive pressure in LCVs, emission regulations, and commodity inflation.

The reduction in PM E-DRIVE subsidies has created short-term challenges, particularly for E2Ws, but the report expects the market to adapt. The subsidy cuts apply across segments, with E3Ws and e-rickshaws also seeing reduced incentives (from Rs 5,000/kWh to Rs 2,500/kWh, capped at Rs 25,000/vehicle). Despite these challenges, the Indian EV market is poised for growth, driven by new model launches and increasing consumer acceptance.

RELATED ARTICLES

Weekly News Wrap: Budget 2026-27 Sets Tone, India-EU FTA Lands, January Sales Pop, Duster Returns

From Semiconductor Mission 2.0 and rare-earth corridors to a duty glidepath under the India-EU FTA, the week deli...

India’s PV Market Estimated To Have Clocked Record January Sales With 4.5 Lakh Units

Lean dealer inventories and robust retail demand after the GST cut helped the industry start 2026 on a strong note.

Budget FY27: Allocation estimate for PM E-Drive Scheme at Rs 1,500 Cr

The subsidies for electric two-wheelers and three-wheelers are set to expire by March 31, 2026, while incentives for ele...

By Arunima Pal

By Arunima Pal

06 May 2025

06 May 2025

3842 Views

3842 Views

Darshan Nakhwa

Darshan Nakhwa

Ketan Thakkar

Ketan Thakkar