India-UK FTA to Cut Import Duties on Goods Vehicles to 8.8% Over 5 Years

Quota-linked tariff relief to boost UK-made goods vehicle exports to India; out-of-quota duty to drop to 22% by 10th year

In a move poised to reshape the import dynamics of commercial vehicles, India will progressively reduce duties on completely built units (CBUs) of internal combustion engine (ICE) goods vehicles imported from the United Kingdom under the India–UK Comprehensive Economic and Trade Agreement (CETA).

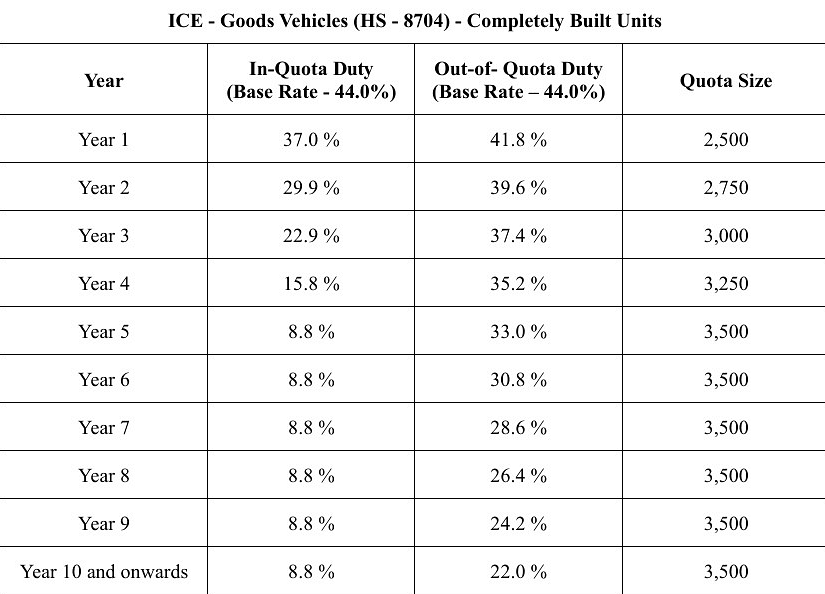

According to a document from the Ministry of Commerce, the current base rate of 44% on such imports will drop significantly to 8.8% within five years, provided the imports remain within defined annual quotas. This concessional tariff regime will be applicable to goods transport vehicles classified under HS Code 8704.

Tariff Reductions in Stages

In the first year of the agreement, the in-quota duty for UK-origin trucks will be reduced to 37%, covering up to 2,500 units annually. In the second year, the concessional rate will be further cut to 29.9%, with a slightly increased quota of 2,750 units. By the fifth year, the import duty will fall to 8.8%, with a quota of 3,500 units—a level that will remain constant from Year 5 through Year 10 and beyond.

Beyond Quotas

Notably, vehicles imported beyond the quota thresholds will continue to attract higher “out-of-quota” duties, though these too will be eased over time--from 41.8% in Year 1 to 22% by Year 10.

The gradual tariff reduction reflects the government's calibrated approach to balancing domestic manufacturing interests with trade liberalisation goals under its growing network of bilateral trade agreements.

“This TRQ (Tariff Rate Quota) mechanism could be a game changer for UK-based commercial vehicle OEMs seeking to penetrate or expand their presence in the Indian market. It also provides a framework for Indian logistics and fleet operators to access global vehicle technology with reduced landed costs over time,” said an analyst.

“However, it may also raise competitive pressures for domestic commercial vehicle manufacturers like Tata Motors, Ashok Leyland, and VE Commercial Vehicles, particularly in the higher-end or niche segments where imported trucks could offer advanced specifications,” the analyst added.

RELATED ARTICLES

Nishant Arya Receives Recognition at Hurun India Youth Series Awards 2026

JBM Group Vice Chairman Nishant Arya was honoured at the Avendus Wealth - Hurun India Uth Series Awards 2026 in Mumbai, ...

Ethanol, Biogas can Accelerate India’s Clean Mobility Transition, says Maruti Suzuki’s Tarun Aggarwal

India needs clean mobility that works at scale today, not just EVs, Maruti Suzuki executive says.

JBM Auto Revenue Rises 15.6% in Q3FY26 on OEM, E-bus Momentum

Strong OEM performance and expanding electric bus deployments support top-line growth.

By Darshan Nakhwa

By Darshan Nakhwa

25 Jul 2025

25 Jul 2025

2026 Views

2026 Views

Sarthak Mahajan

Sarthak Mahajan

Anurag Chaturvedi

Anurag Chaturvedi

Mukul Yudhveer Singh

Mukul Yudhveer Singh