Hyundai Motor IPO marks the coming of age of Indian equity market

While Hyundai may have various reasons for listing its unit in India, including the valuation premium enjoyed by Indian stocks over their Korean counterparts, this is the first instance of a major foreign company voluntarily listing its subsidiary in India in recent times.

The initial public offer of Hyundai Motor India, the Indian unit of the eponymous South Korean automaker, marks the beginning of a new era — both for the company and the Indian equity markets.

Among other things, the move aims to leverage the favorable valuations enjoyed by Indian companies, thereby enhancing the market value of its parent company. But it also underscores the quality of equity opportunities available in Asia's third-largest economy. Notably, Hyundai Motor's stock on the Korean exchange hit a record high following the news of the IPO filing, taking its market capitalisation to USD 50 billion.

The listing of Hyundai Motor's local subsidiary, which commands a 14.5% market share in India, hence marks a significant moment for the Indian market. It represents the first instance in nearly four decades that a global company is voluntarily choosing to list its local unit. This reflects a shift from earlier listings resulting from regulations imposed by the Indian government, which required foreign companies either to list in India or to exit the market between 1974 and 1982.

Companies like ITC, Castrol, Nestle, and Colgate opted to list, while others such as Coca-Cola, Exxon Mobil, and IBM chose to exit. The impending listing of Hyundai Motor's local subsidiary signals changing winds, with numerous other multinational corporations now showing interest in India's capital market.

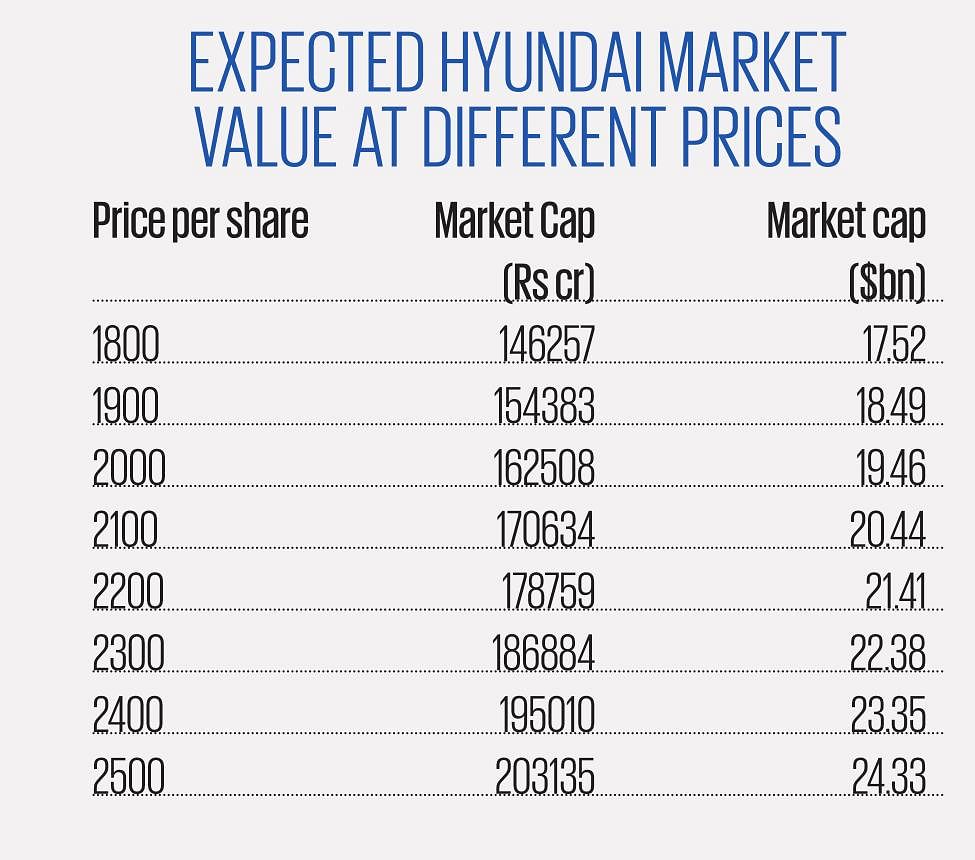

The Hyundai Motor listing is poised to set a new record for IPO proceeds in India, potentially raising around Rs 25,000-28000 crore, according to investment banking circles, which could value the Indian unit at USD 18-20 billion (Rs 1.5-1.66 lakh crore). If the rumours are correct, this would make it India’s largest ever IPO, overtaking the Rs 20,557 crore offering by Life Insurance Corporation of India two years ago. It would also mark the first IPO in the auto sector since India's largest carmaker, Maruti Suzuki, debuted on the bourses in 2003. The Hyundai IPO also underscores the growing stature of the Indian passenger vehicle industry, valued at approximately Rs 3.5 lakh crore, and its robust growth driven by premiumisation and the increasing share of high-value Sport Utility Vehicles (SUVs).

Hyundai Motor's decision to list its Indian subsidiary aims primarily to reduce the 'Korean discount' applied to its parent company. Korean firms typically trade at lower valuations than their global counterparts due to issues with corporate governance, capital allocation policies, and transparency concerns within familyrun conglomerates, known as Chaebols. Analysts tracking Hyundai Motor believe that listing its Indian subsidiary is part of the 'Value-up' program, aimed at narrowing this discount in financial markets. Korean automakers currently trade at low P/E ratios of 4.1-4.6 times, compared to Japanese and US automakers' average P/E ratios of 7.3 and 5.4, respectively. Hyundai Motors' Indian subsidiary, being a growth market, could potentially trade at a higher P/E multiple than its parent company.

The valuation of the Indian unit is based on projected earnings for the coming year. Hyundai Motor India reported an annualised profit of Rs 5,841 crore for the last fiscal year, extrapolated from nine-month profits disclosed in the DRHP. If the company achieves 10% earnings growth from FY24 to FY27, it could potentially generate profits of around Rs 7,000 crore in FY26, translating to a valuation of 23 times forward earnings, or three times that of its parent company. This is because Indian automakers typically trade at P/E ratios between 22-28 times.

The success of Hyundai Motor's IPO in India would also validate its bet on the Indian market, where it initially invested Rs 812 crore in 1996 and has since generated substantial returns. The cumulative IPO proceeds (approximately Rs 25,000 crore) and dividends totaling Rs 18,288 crore between FY21 and April 2024, exceed the company's total investment in its Indian operations, estimated at around Rs 30,000 crore. Given that the company had cash and cash equivalents of Rs 15,252 crore as of the end of Dec 31, 2023, and declared a dividend payout of Rs 10,782 crore between Jan 1 and the DRHP filing date, approximately 71% of the company's cash has been distributed before the IPO.

Additionally, Hyundai Motor has paid royalties totaling 2.5% of its total sales to its parent company since commencing operations in India, amounting to Rs 4,738 crore between FY21 and the nine months of FY24, indicating that returns from its Indian operations have outweighed its initial investments. However, it should be kept in mind that the company plans to invest over Rs 30,000 crore in coming years in capacity expansion and EVs.

Hyundai Motor India's stock is expected to attract significant attention from global and local institutional investors, potentially trading at a premium to sector averages and even at a higher multiple than India's largest carmaker, Maruti Suzuki, a subsidiary of Suzuki Motor Corporation. Hyundai's financial performance in India surpasses that of other automakers due to several cost factors that significantly enhance its return ratios.

The Return on Equity (RoE) – which compares a company’s net profit with the value of its assets – for Hyundai Motor's Indian unit stood at 29.3% for FY24 (annualised basis), compared to 16.8% for Maruti Suzuki, 20.3% for M&M, and 20.3% for Tata Motors' PV division, according to IIFL. Notably, Hyundai India's Return on Capital Employed (RoCE), excluding cash and investments, is an impressive 149%, while its peers range between 18-53%, reflecting the company's efficient operational management. Operational efficiencies across its manufacturing ecosystem have allowed Hyundai Motor India to maintain robust margins despite macroeconomic fluctuations.

So, what has contributed to such a high efficiency level? Firstly, its plant was working at an optimal level, and it remained close to capacity. Plant number one in Chennai had a utilisation level of 103% on an installed capacity of 293,000 units, while plant two at the same location had a utilisation of 92% on a capacity of 310,000 units. Going forward, utilisation levels would normalise thanks to the company's acquisition of the Talegaon plant from GM in December 2023, which would start operations in the second half of FY26, taking the total capacity to over one million units. Yet, the fact remains that the company has been sweating its assets better than its peers; and as a result, its turnover to net fixed assets ratio is about 8.38—nearly double that of its peers.

It is not just the superior returns that set the Korean company apart from its peers in India. Hyundai Motor India's realisation per unit — an i ndicator of the average selling price of its vehicles — stood at Rs 8.92 lakh, approximately 35% higher than Maruti Suzuki, driven by a higher share of SUVs in its domestic portfolio. The SUV segment, the fastest-growing segment in the PV space, accounted for 62% of Hyundai Motor India's total domestic sales in the first nine months of FY24, compared to 53% in FY23. Over the last five years, while the industry grew at a 5% CAGR, the SUV segment grew at over four times that rate, at 23% CAGR. This is largely due to more than 30 SUVs launched in the last five years, compared to only four hatchbacks and three sedans during the same period. The trend of superior SUV growth is expected to continue with an annual growth rate of 7-9% between FY24 and FY29, according to CRISIL, providing continued tailwinds for Hyundai Motor's earnings growth.

Interestingly, Hyundai's India unit has a lower gross margin compared to Maruti Suzuki, but they achieve a higher operating profit margin driven by lower employee costs and other expenses. Employee costs as a percentage of sales for Hyundai were 2.35% in the first nine months of FY24, whereas Maruti recorded it at 3.88% for FY24. This translates to significantly better revenue per employee compared to its counterparts. In addition, a range of operating efficiency measures across the manufacturing ecosystem have helped maintain margins within a narrow range despite macroeconomic fluctuations.

As a result, during the first nine months of FY24, Hyundai Motor India achieved an operating profit margin of 12.67%, approximately 100 basis points higher than Maruti Suzuki’s FY24 figure. However, there may be margin pressures post-listing, as the local subsidiary recently agreed to a new royalty rate of 3.5%, up from 2.3- 2.5%. The subsidiary paid out Rs 1,174 crore in royalties during the first nine months of FY24.

This feature was first published in Autocar Professional's July 1, 2024 issue.

RELATED ARTICLES

SWITCH Mobility Launches Electric Double Decker Bus Sightseeing Route in Delhi

The 'Dekho Meri Dilli' initiative deploys India's first electric double decker AC bus on a heritage sightseeing route, c...

Indonesia Postpones 105,000-Vehicle Import Plan From India, Bloomberg Reports

Citing senior officials, Bloomberg reported that Indonesia is reassessing its import plan over concerns about the domest...

INDEX Group Opens Bangalore Technology Center to Expand India Market Presence

The German CNC machine manufacturer has established a new branch with a showroom and demonstration facility near Bangalo...

By Autocar Professional Bureau

By Autocar Professional Bureau

13 Jul 2024

13 Jul 2024

9505 Views

9505 Views

Sarthak Mahajan

Sarthak Mahajan

Arunima Pal

Arunima Pal