Hyundai, HMSI, VECV clinch top spots in FADA Dealer Satisfaction Study 2023

Although the automobile dealer association’s latest Dealer Satisfaction Study shows growing optimism among vehicle retailers on the back of robust market demand, it also highlights concerns regarding dealership viability and policy collaboration with OEMs.

The Federation of Automobile Dealers Associations (FADA) has released its Dealer Satisfaction Study (DSS) 2023 conducted using a self-administered questionnaire, in collaboration with consumer-insights firm PremonAsia. The study which reached out to both FADA and non-FADA members, saw over 2,000 dealer principals representing more than 3,500 vehicle retail outlets across India, respond to the questions pertaining to all segments of the vehicle industry.

According to the latest report, while automobile dealers are increasingly becoming optimistic about the business potential based on a robust market demand, there are concerns related to dealership viability and policy collaborations with OEMs, particularly related to the OEM buyback of deadstock in the dealer’s inventory.

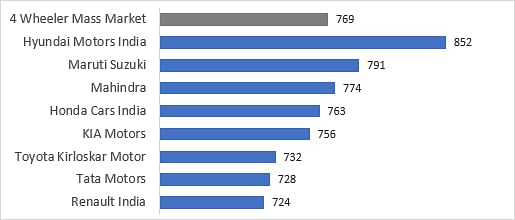

The DSS study which utilises six evaluative dimensions and 70 attributes to arrive at its findings, saw Hyundai Motor India (HMIL) emerge as the leader in the mass-market satisfaction segment in 2023, while Honda Motorcycle and Scooter India (HMSI) and Volvo Eicher Commercial Vehicles (VECV) retaining the top spot in two-wheelers, and commercial vehicles, respectively, for the third consecutive year.

The DSS study which utilises six evaluative dimensions and 70 attributes to arrive at its findings, saw Hyundai Motor India (HMIL) emerge as the leader in the mass-market satisfaction segment in 2023, while Honda Motorcycle and Scooter India (HMSI) and Volvo Eicher Commercial Vehicles (VECV) retaining the top spot in two-wheelers, and commercial vehicles, respectively, for the third consecutive year.

While the four-wheeler mass-market category average stood at 769 points, HMIL, with a score of 852 points, clinched the top spot, followed by Maruti Suzuki India (791 points) at the No. 2 position, Mahindra & Mahindra (774 points) at No. 3, and Honda Cars India (763 points) at the fourth spot. The report suggests that Honda Cars India has demonstrated a huge leap in this year’s study and escalated its score by 153 points to arrive at the No. 4 position.

Although passenger vehicle dealers expressed high satisfaction in terms of product reliability, the report highlights major concerns regarding deadstock and inventory buyback policies of OEMs, along with the involvement of dealers in the policy-making process. According to Manish Raj Singhania, President, FADA, “The improvements underscore the indispensable value of this annual study, and while automobile dealers are largely optimistic, high-impact areas such as unsold inventory clearance, and actions against multi-brand outlets (MBOs) offer ample scope for improvement.”

“Ensuring dealer viability, particularly related to OEM buyback of the deadstock and understanding the dealer cost structure are still flagged as concern areas across the industry. Addressing these concerns through involving dealers in the policy-making process and hearing them well will certainly go a long way in managing dealer expectations better,” PremonAsia Director, Rahul Sharma added.

HMSI shines in 2Ws, VECV leads CVs

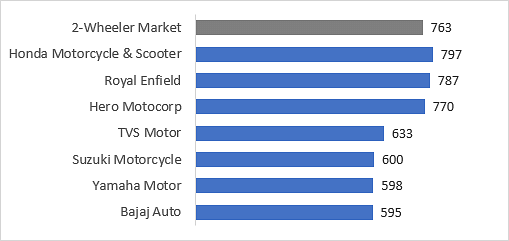

The DSS 2023 mass-market average in the two-wheeler segment was pegged at 763 points, and Japanese OEM Honda Motorcycle and Scooter India achieved the top spot with a score of 797 points. Royal Enfield, which improved its score by 96 points over last year to achieve a score of 787 points secured the No. 2 position, followed by Hero MotoCorp at 770 points, and TVS Motor Company at 633 points.

Like the four-wheeler segment, the study reveals that while two-wheeler dealers are generally satisfied with product reliability and the product range on offer, concerns about OEM buyback and deadstock policies, along with the dealer’s involvement in the policy-making process, remains.

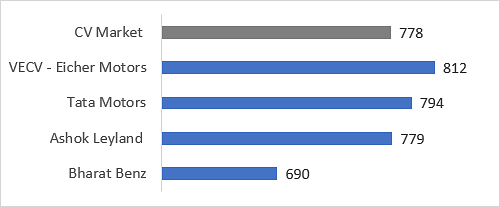

While the commercial vehicle (CV) segment saw the overall market average score at 778, Volvo Eicher Commercial Vehicles held the pole position with 812 points. Tata Motors (794 points), Ashok Leyland (779 points), and Bharat Benz (690 points) were the No. 2, 3, and 4 players, respectively.

While the commercial vehicle (CV) segment saw the overall market average score at 778, Volvo Eicher Commercial Vehicles held the pole position with 812 points. Tata Motors (794 points), Ashok Leyland (779 points), and Bharat Benz (690 points) were the No. 2, 3, and 4 players, respectively.

Given the industry’s recent transition to the BS VI emission norms, the study found an increased level of satisfaction among CV dealers, who voiced similar concerns of deadstock management and OEM inventory buyback policies.

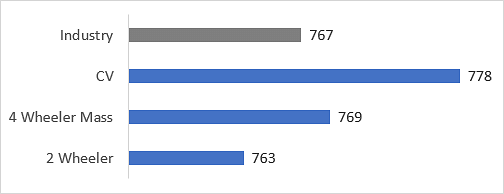

The DSS 2023 report saw the overall industry score register an increase of 48 points over last year to 767 points, with particularly the ‘Product’ standing out as the highest scoring factor across all categories. The report suggested that this trend underscores the automotive industry’s commitment to meeting growing consumer aspirations with world-class products. Despite the notable improvement over the previous year, the ‘Business and Viability’ criterion remained the lowest-scoring factory by participating dealers, and signalling need for attention and improvement, particularly around dealer deadstock buyback.

RELATED ARTICLES

Motherson and Marelli Inaugurate Automotive Lighting Plant in Sanand

The facility is the first in India capable of manufacturing edge-to-edge single-piece long lighting parts.

Nissan Motor India Offers 5.55% ROI Finance on Magnite Until March 2026

Scheme through NRFSI covers up to 100% on-road funding with loan tenures of up to seven years.

BorgWarner Secures European OEM Contract for Hybrid Range-Extended Vehicle Drive Module

The automotive supplier will deliver an 800V Integrated Drive Module combining generator and propulsion functions into a...

20 Sep 2023

20 Sep 2023

8459 Views

8459 Views

Shruti Shiraguppi

Shruti Shiraguppi

Sarthak Mahajan

Sarthak Mahajan