Dzire Defies SUV Wave to Emerge as India’s Best-Selling car in 2025

SUVs dominate the market, but Maruti’s Dzire holds its ground at the top

Maruti Suzuki’s Dzire emerged as India’s best-selling car in calendar year 2025, even as sport utility vehicles tightened their grip on the market, accounting for a record 55.3% of total passenger vehicle sales.

The compact sedan sold around 214,000 units during the year, retaining its leadership position despite a sharp shift in consumer preference toward SUVs. The milestone underlines the continued relevance of value-led sedans in a market increasingly dominated by higher-riding vehicles.

Speaking at the company’s December sales briefing, Partho Banerjee, senior executive officer – marketing and sales, said the Dzire’s performance demonstrated that strong product fundamentals continue to matter even in an SUV-heavy market.

“Despite the clutter in the SUV segment, the Dzire has emerged as the number one model. It shows that if you build a strong product with the right value proposition, customers continue to choose it,” Banerjee said.

In a market increasingly tilted toward utility vehicles, seven of the top ten best-selling models in 2025 were SUVs or SUV-derived crossovers, underscoring how decisively buyer preference has shifted. Against this backdrop, the Dzire’s position as the country’s best-selling car stands out, surprising many.

Its ability to hold ground amid SUV dominance highlights continued demand for efficient, value-led sedans, particularly among family buyers and fleet operators. Improved space, fuel efficiency, and lower total cost of ownership have helped the Dzire remain relevant even as taller, more feature-rich SUVs dominate showroom footfalls.

While SUVs now make up more than half of the overall passenger vehicle market, Maruti Suzuki’s own SUV contribution stood at 30.7% in the third quarter, up from 25.9% in the first half, reflecting a sharp increase in demand. The company’s SUV portfolio, led by the Grand Vitara and its derivative, the Victoris, crossed 500,000 cumulative sales during the year.

Top-10 models underline SUV-heavy landscape

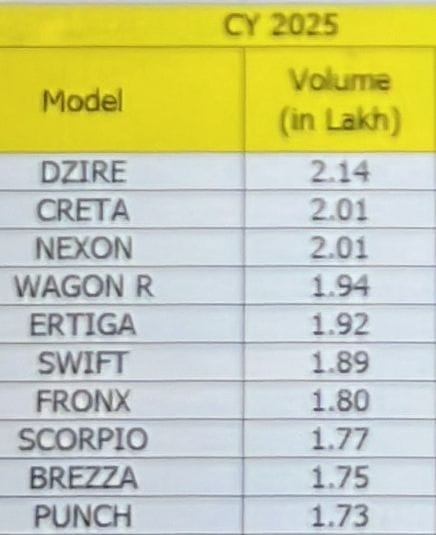

Data for calendar year 2025 underscores how dominant utility vehicles have become in the Indian passenger vehicle market, even as the Dzire retained the top spot. With 2.14 lakh units, the Dzire emerged as the highest-selling model, ahead of the Hyundai Creta (2.01 lakh) and Tata Nexon (2.01 lakh), both SUVs that continue to benefit from strong urban and semi-urban demand.

The top 10 list further reflects the shift toward higher-riding vehicles, with seven of the ten best-selling models being SUVs or SUV-derived crossovers. Models such as the Scorpio (1.77 lakh), Brezza (1.75 lakh), and Punch (1.73 lakh) reinforced the segment’s growing dominance, while the Fronx (1.80 lakh) also posted strong volumes, blurring the line between hatchback and SUV.

At the same time, traditional body styles retained relevance. The Wagon R (1.94 lakh) and Swift (1.89 lakh) continued to deliver scale, while the Ertiga (1.92 lakh) remained a strong performer in the MPV space, highlighting the breadth of demand across price points and body styles.

The data underscores a key shift in India’s car market. While SUVs now account for over half of total industry volumes, the top-selling model remains a compact sedan, reinforcing the continued importance of value, efficiency, and total cost of ownership in buying decisions.

At the same time, the company said its hatchback portfolio continued to deliver scale. The Baleno emerged as the best-selling model in December 2025, with sales of 22,108 units, underlining continued demand in the premium hatchback segment even as SUVs dominate the broader market.

Maruti Suzuki said the recovery in entry and compact segments was supported by improved affordability following the GST reset and easing financing conditions. The mini segment now accounts for 6.2% of total sales, with first-time buyers returning to the market.

“We are seeing demand across segments, and the challenge is to balance production so that no one category is constrained at the cost of another,” Banerjee said.

The company added that inventory levels remain tight, with dealer stock at around three days, as it continues to calibrate production amid strong demand.

With SUVs gaining share and core hatchback and sedan models holding ground, Maruti Suzuki expects a more diversified demand mix to define the market in 2026.

RELATED ARTICLES

Nissan exports from India to cross 1 lakh cars in 2026-27

The automaker’s product portfolio in India will have 4 models in FY27, including the mid-size SUV Tekton and a new 7-sea...

Global Automotive Leaders to Converge on Vienna for 47th International Motor Symposium

More than 1,000 engineers, executives, and policymakers from over 20 nations will gather at Vienna's Hofburg Palace from...

Nissan India's 2026 Plans - 3 New Products, Retail Network Expansion

Over the next one year, Nissan plans a portfolio of four products, addressing the Rs 6–20 lakh segment.

01 Jan 2026

01 Jan 2026

8149 Views

8149 Views

Kiran Murali

Kiran Murali

Sarthak Mahajan

Sarthak Mahajan