Construction Equipment Industry Domestic Sales Down 10% Amid Infrastructure Slowdown

Slower government project awards, particularly in roads and highways, railways, and other infrastructure segments, have directly impacted equipment demand.

India's construction equipment (CE) industry is grappling with significant domestic demand challenges, recording a 10% decline in sales during the first nine months of the current financial year, even as robust export performance offers a silver lining to the beleaguered sector.

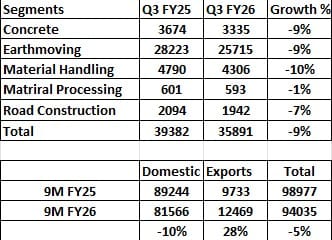

According to data released by the Indian Construction Equipment Manufacturers Association (ICEMA), the only authoritative source for Indian CE industry statistics, domestic sales plummeted from 89,244 units in the year-to-date period of FY 2024-25 to 81,566 units in YTD FY 2025-26 (April-December 2025). The decline reflects a confluence of challenges including slower infrastructure activity, project execution bottlenecks, financing constraints, and subdued near-term demand across key equipment segments.

Q3 Performance Highlights Persistent Challenges

The industry's struggles continued into the third quarter of FY26, with total CE sales, including domestic sales, OEM exports, and unauthorized exports—reaching 35,891 units, marking a 9% year-on-year decline compared to Q3 FY25.

Breaking down the performance by equipment category reveals widespread weakness across the sector:

Earthmoving Equipment, which commands the largest market share, recorded sales of 25,715 units in Q3 FY26, down 9% from the previous year's corresponding quarter. This segment remains the backbone of the industry but has been hit hard by reduced infrastructure activity.

Material Handling Equipment sales totaled 4,306 units, experiencing a 10% year-on-year decline in Q3 FY26, reflecting reduced activity in logistics and construction sectors.

Concrete Equipment sales stood at 3,335 units, falling 9% YoY, as residential and commercial construction activity remained subdued.

Road Construction Equipment reported sales of 1,942 units, declining 7% year-on-year, despite India's ambitious road infrastructure targets.

Material Processing Equipment proved the most resilient segment, accounting for 593 units with a marginal 1% decline from Q3 FY25.

Export Surge Cushions Overall Industry Decline

While domestic sales paint a concerning picture, the industry found respite in international markets. Exports surged by an impressive 28% during the nine-month period, demonstrating India's growing competitiveness in global construction equipment markets.

This strong export performance helped cushion the overall industry decline to just 5% in the first nine months of FY26, with total sales reaching 94,035 units compared to 98,977 units in YTD FY25. The contrast between domestic contraction and export expansion underscores both the challenges at home and opportunities abroad.

"The export growth reinforces India's competitiveness in international markets and our ability to diversify market presence," noted industry observers. However, experts caution that export gains alone cannot fully compensate for domestic market weakness in the long term.

Unauthorized Exports Emerge as Major Industry Concern

Adding to the industry's woes, ICEMA highlighted the growing problem of unauthorized exports, particularly affecting backhoe loaders and excavators. In these cases, equipment sold by original equipment manufacturers (OEMs) in the domestic market is subsequently exported without informing the OEM or financing companies.

This practice poses significant loan repayment default risks to financial institutions and distorts market data. Industry representatives stress that if unauthorized exports were excluded from reported figures, the actual decline in legitimate industry activity would be even more severe.

Multiple Factors Behind Domestic Demand Weakness

Industry leaders point to several interconnected factors driving the domestic sales decline:

The implementation of CEV Stage V emission standards created a period of adjustment for customers, impacting the asset value of existing equipment. While these stricter environmental norms position India favorably for future export markets by opening up new geographies, the transition has been challenging for domestic buyers.

Slower government project awards, particularly in roads and highways, railways, and other infrastructure segments, have directly impacted equipment demand. Land acquisition delays and approval bottlenecks have moderated the execution pace of road construction projects, despite a healthy underlying pipeline of sanctioned projects.

Financing constraints have also played a role, with some customers facing difficulties in securing loans for equipment purchases. This has been exacerbated by concerns over unauthorized exports affecting loan repayment confidence among financial institutions.

Industry Leaders Voice Concerns and Expectations

Deepak Shetty, President of ICEMA and CEO & Managing Director of JCB India Ltd., acknowledged the challenging environment: "The domestic demand for YTD FY 25-26 has remained muted. The growth of our industry is significantly dependent on infrastructure development projects where we experienced some headwinds."

Shetty emphasized the adjustment period following CEV Stage V emission standards but expressed optimism about future export competitiveness. "As the industry adapts the new emission norms, export competitiveness is expected to strengthen with new geographies opening up as export destination for India," he said.

Highlighting the sector's economic importance, Shetty noted that "The Indian CE Industry is the 3rd largest industry in the world, employing more than 3 million people directly and indirectly and plays an important role in employment generation and nation building."

He remained hopeful about domestic recovery, stating: "At a broader level we remain hopeful of domestic demand coming back as infrastructure development is a consistent focus area for the Government, particularly Rural Infrastructure, which is a key growth driver for our Industry."

Ramesh Palagiri, President Designate of ICEMA and Managing Director & CEO of Wirtgen India Pvt. Ltd., struck an optimistic note despite current challenges: "Although domestic demand has been impacted by slower project awarding and execution, we are optimistic of a turnaround. With strong export performance and the hope of front-loaded awarding of projects and higher infrastructure capex in the upcoming Budget, we believe domestic CE demand will strengthen and contribute to a sustained industry recovery in 2026."

Vivek Hajela, Convener of ICEMA's Industry Analysis & Insights Panel and Executive Vice President & Head of Construction & Mining Machinery Business at L&T Construction & Mining Machinery, provided perspective on the road construction segment: "While execution pace and contract award in road construction has moderated due to land acquisition and approval delays, the underlying pipeline of projects remains healthy with significant sanctioned projects and improved awarding activity. With streamlined processes and focused execution, we expect this to translate into stronger domestic CE demand in the coming months as infrastructure progress accelerates."

The industry is now pinning its hopes on the upcoming Union Budget, with expectations centered on three key areas:

Increased Infrastructure Capital Expenditure: Industry stakeholders are looking for strong capex allocations to revive infrastructure spending and project activity.

Expeditious Project Awards: Faster awarding of government contracts across roads, highways, railways, and other infrastructure segments is seen as critical to demand recovery.

Supply Chain Localization Support: The industry seeks government backing for migrating supply chains to India, aligning with the Atmanirbhar Bharat (self-reliant India) vision for foundational industries like construction equipment.

Industry representatives emphasize that meaningful revival will depend on several factors working in tandem: expediting project contract awards, ensuring faster on-ground execution, maintaining timely fund disbursements, and creating a supportive policy environment to restore buyer confidence and sustain investment momentum.

Looking Ahead

Despite current headwinds, the construction equipment industry remains fundamentally optimistic about medium-term prospects. With infrastructure development continuing as a government priority, particularly in rural areas, and India's position as the world's third-largest CE market, the ingredients for recovery are in place.

The sector's ability to capture significant export growth even amid domestic challenges demonstrates the underlying strength and competitiveness of Indian manufacturers. As project execution bottlenecks are addressed and government spending on infrastructure accelerates, the industry anticipates a return to growth trajectory in the coming quarters.

RELATED ARTICLES

Yogi, Aakash Minda Discuss Manufacturing Collaboration in Tokyo After ₹522 Cr UP Land Allotment

High-level engagement follows December’s 23-acre Yamuna Expressway land allotment to Minda Corporation for a major autom...

Domestic PV Dispatches Likely to Hit Record 4.3-4.5 Lakh Units in February

Domestic dispatches for February are estimated to be close to 4.5 lakh units; passenger vehicle wholesales growth has be...

Shell Releases India Energy Scenarios Sketch Mapping Three Transition Pathways to 2050

The report, launched at the TERI World Sustainable Development Summit, maps geopolitical, digital, and climate forces sh...

By Arunima Pal

By Arunima Pal

12 Jan 2026

12 Jan 2026

1069 Views

1069 Views

Sarthak Mahajan

Sarthak Mahajan