Bajaj Finance Limited Auto Finance wheels in faster, easier lending journeys with Salesforce

Through smart automation and seamless API integrations, Bajaj Finance Limited Auto Finance is making it simpler and faster for customers to finance their favourite Bajaj bikes.

Rahul has his heart set on buying the new Bajaj Pulsar bike. But first, he needs to apply for a bike loan. In the past, that used to be a long-drawn-out process, rife with paperwork. But now, thanks to lenders like Bajaj Finance Limited Auto Finance (BFL-AF), Rahul can get a loan offer in minutes.

BFL-AF, a subsidiary of Bajaj Finance Limited, has empowered more than 11 million Indians to purchase their favourite Bajaj vehicles through simple, attractive financing schemes.

“We believe no one should have to leave a vehicle showroom empty-handed,” says Kevin D’Sa, President, Retail Finance. “Today, we offer bike loans on the spot – even to customers that don’t have a credit history.”

Financing your dream bike was never this easy. But to make it happen, there has to be seamless coordination across front-end systems and backend databases. "Salesforce sits at the centre of our loan origination ecosystem, consolidating customer and loan data from multiple sources into a single view. So, credit decisioning is faster and more accurate,” says Raul Verma, VP and Business Head, Motorcycle Business, BFL-AF.

Shifting gears: Adopting a digital, agile approach to lending

Earlier, BFL-AF processed leads and loans through multiple legacy systems - including a browser-based tool for customer acquisition, a lead management system, and a custom mobile app with a distinct look and feel.

Teams couldn’t get a full picture of the customer journey from these siloed systems, limiting their ability to deliver consistent experiences. Nor could they properly identify and segment high-value customers. Also, many of the systems weren’t enterprise-grade, and would often crash during festive seasons when customer data volumes soared.

“Today’s customers expect instant digital loans with minimal paperwork and more do-it-yourself options,” says Raul Verma, VP and Business Head, Motorcycle Business, BFL-AF. “To fulfil these needs, we had to innovate.”

BFL-AF began looking for a unified digital loan origination platform - one that would automate customer acquisition and loan sourcing, improve employee productivity, and digitally enable the dealer ecosystem.

“Of all the CRM platforms we evaluated, Salesforce stood out for its stability, scalability, and lower total cost of ownership,” says Rajendra Bisht, VP & Head of Technology and Digital. “The low-code/ no-code platform also helps us roll out new processes faster, thereby strengthening our competitive edge.”

Adds Verma, “We consolidated the functionalities of three major applications onto one platform. The result is a sleeker system with multiple APIs and integrations that are helping us be more agile.”

Enabling a smoother, faster ride across the lending journey

Leads from multiple channels flow into Salesforce Sales Cloud where they can be easily tracked, categorised, and assigned to the call centre for nurturing.

“Every day, we capture thousands of enquiries – which often double or triple during Dhanteras,” says Bisht.

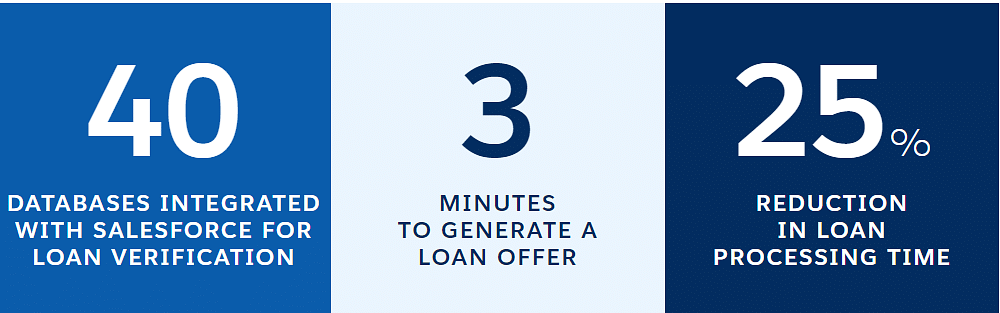

Prospects interested in a loan are guided through a streamlined and digitalised process of pre-qualification, verification, underwriting, credit decisioning, and customer onboarding. At the backend, BFL-AF has integrated Salesforce with 40 internal and external databases to ensure quick, seamless verifications.

As soon as a sales rep enters the customer’s phone number on their sales mobile app, it’s relayed to Bajaj’s customer and offer databases to come up with a pre-approved loan offer. Simultaneously, the customer’s identity is cross-checked with multiple KYC databases.

For more loan options, the customer’s KYC details are transmitted to various credit bureaus to generate a credit score. And for customers without a credit history, BFL-AF has designed a rule engine that uses customer segmentation and lookalike modelling to come up with an app score. These inputs then flow back into Salesforce for real-time credit decisioning.

“Salesforce sits at the centre of our loan origination ecosystem, consolidating customer and loan data from multiple sources into a single view,” says Verma. “This helps us make faster and more accurate credit decisions.”

Customers now get a loan offer in just three minutes, compared to eight minutes previously. Loan processing time has also reduced by 25%. And with process automation, BFL-AF is able to do more with less. For example, they’ve saved 40-50% of the costs involved in credit decisioning, which can now be used to hire more resources to serve more customers.

“Not only are we optimising our processes - we’re also seeing considerable cost-savings, higher productivity, and fewer errors,” notes Bisht.

Meanwhile, with Salesforce Marketing Cloud, teams can create and send out email and SMS campaigns at scale. They can also segment customers based on their credit scores, and personalise their journeys accordingly.

“Now that we know who our A+ or A customers are, we can differentiate their experiences to make them feel highly valued,” says Verma.

Putting customers in the front seat

Putting customers in the front seat

BFL-AF is now taking customer experiences from good to ‘wow’ with a new innovation - a QR code on a standee outside each vehicle dealership. As soon as a prospect scans a code, their data flows to the company’s call centre and field sales teams; thus, minimising lead leakage, enabling proactive follow-ups, and increasing conversions.

“We saw how ubiquitous QR codes had become for payments and services,” says D’Sa. “So, using our own QR code, along with our simplified 3-minute loan processes and Salesforce capabilities, we created an industry-first, best-in-class “instant loan approval” process and “instant sanction letter download” journey.”

To ensure that customer verification checks and credit scoring are completed in near real time, Salesforce has been integrated with an additional 20 databases.

“Customers can now confidently walk into a vehicle showroom with a pre-approved loan offer in hand, ready to purchase their dream bike,” says D’Sa.

Within a few days of its launch, the QR code was used by nearly 60,000+ customers. The QR code is now also included in all BFL-AF and Bajaj Auto marketing collateral.

“The QR code feature has been a game changer for lead management,” says D’Sa. “It also makes the financing process completely mobile-based. Customers can check their offers, and download their sanction letters anywhere, anytime.”

Revving up employee and partner confidence

Customers aren’t the only ones to benefit from BFL-AF’s digital transformation. Sales reps and dealers have also become more productive and confident.

“With the Salesforce mobile app, our workforce is a lot more agile,” says Bisht. “They can generate loan offers, and convert leads from anywhere.”

Adds Verma, “We’ve configured the system to be very intuitive. Earlier, around 30-40 sales reps wouldn’t be able to close a single loan in a month – but now, with process automation and faster credit decisioning, every rep is converting leads, and earning incentives.” Adoption of the solution is almost at 100%.

With more leads being converted, reps are earning more dealer trust.

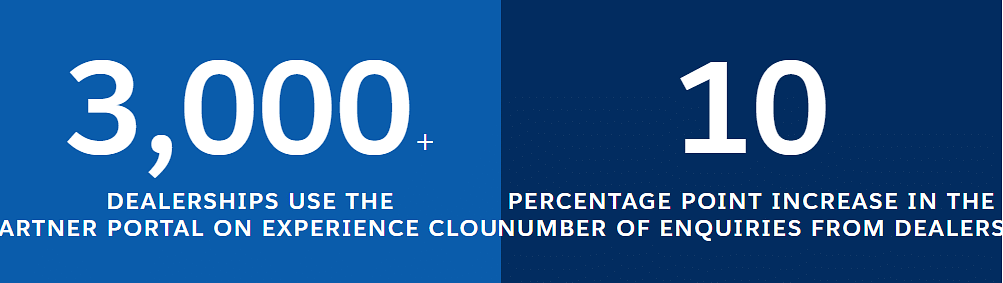

“The volume of enquiries coming in from dealers has increased from 60% to 70%,” says Verma. “That’s the biggest yardstick of our sales team’s success.”

BFL-AF has also built a partner portal on Salesforce Experience Cloud to engage and manage 3,000+ dealerships across India.

“Through the portal, we have better visibility into the loans disbursed at dealerships, the money owed, deductions, tax issues, and more,” said Verma.

Speeding towards a bright future

To implement Salesforce, BFL-AF partnered with a joint team from Persistent Systems and SaasWorx.

“The multi-vendor model worked very well for us,” says Bisht. “Our partners seamlessly collaborated as one team to implement Salesforce, and to roll out platform capabilities within three months.”

Bisht is also deeply appreciative of the role played by the Salesforce Professional Services team. "Salesforce Professional Services provided immense value, making our lending process faster and easier with on-target Salesforce implementation and maintenance services," he explains.

“They guided us in planning our strategic roadmap and ensuring that our platform is scalable and easy to maintain, minimising potential technical debt.”

BFL-AF is now in the process of integrating Sales Cloud with Marketing Cloud to streamline the entire lead and enquiry management process. Loan collections will also be moved onto Salesforce.

“We want to build a complete ecosystem around Salesforce by deploying Service Cloud for customer support, Einstein for AI/ML, and perhaps MuleSoft for API management,” says Bisht.

Adds Verma, “Our vision is to have a 360-degree view of the customer journey – from loan sourcing to collections. This will help us elevate customer experiences even further.”

RELATED ARTICLES

Mobileye Localising ADAS for India; Eyes Hands-off Driving by 2027

Company says India is a strategic market, localisation and regulation will drive rapid ADAS adoption.

Lumax Auto Technologies Reports 93% Profit Growth in Q3FY26

Consolidated revenue from operations reached ₹1,271 crore in Q3FY26, representing a 40% increase over the same quarter l...

Mahle Sees India’s Multi-Fuel Mix Boosting Global Aftermarket Growth

Mahle Lifecycle and Mobility views India as a core global aftermarket growth driver.

By Autocar Professional Bureau

By Autocar Professional Bureau

24 Jul 2023

24 Jul 2023

8749 Views

8749 Views

Darshan Nakhwa

Darshan Nakhwa

Arunima Pal

Arunima Pal

Kiran Murali

Kiran Murali