41% Plan Vehicle Purchase This Festive Season as GST Cuts Drive Optimism

Grant Thornton survey reveals hybrid vehicles overtaking petrol as preferred choice amid growing safety consciousness and digital adoption.

India's passenger vehicle market is witnessing a surge in consumer confidence this festive season, driven by recent tax reforms and evolving buyer preferences, according to a comprehensive survey by Grant Thornton Bharat.

The study, titled 'Festive drive: What consumers want in their next ride', surveyed over 2,800 respondents across cities and age groups, revealing that 41% plan to purchase a vehicle in the next 3-4 months. Significantly, 72% of potential buyers had deferred their purchase decisions in anticipation of GST rationalisation, highlighting the policy's impact on consumer sentiment.

GST 2.0 Reshapes Affordability

The GST Council's recent reforms mark a pivotal shift for the automotive sector. Small cars now attract an 18% GST rate, down from the previous 28%, potentially reducing acquisition costs by up to Rs 1 lakh. This change is expected to revive the entry-level segment, which had declined from 31% of total passenger vehicle sales in FY2024-25 to 27% between April-July 2025.

The reforms come at a critical time for India's automotive industry, which had experienced modest growth of 1.3% in passenger vehicle production and a 2.3% decline in domestic sales during April-August 2025. However, the post-GST period has shown promise, with passenger vehicle retail growing 5.8% year-on-year in September and an unprecedented 34.8% during Navratri 2025.

In a notable shift, 38% of respondents expressed preference for hybrid vehicles, surpassing petrol vehicles at 30% and electric vehicles at 21%. Diesel vehicles garnered only 8% preference. This trend reflects practical concerns about EV charging infrastructure, particularly in Tier 2 and Tier 3 cities, while hybrid technology offers fuel efficiency without compromising convenience.

State-level incentives, including road tax waivers in Delhi and Uttar Pradesh for strong and plug-in hybrids, have made these vehicles more financially attractive. Over 15 hybrid models were launched in the past year, with at least 8 more expected by March 2026.

SUVs maintain their stronghold on consumer preference, with 64% of respondents choosing them as their preferred category. This aligns with market data showing SUVs and MPVs contributing 65% to India's total passenger vehicle sales in FY25, up from 50.4% in FY23. Sedans followed at 21%, while hatchbacks accounted for 10% of preferences.

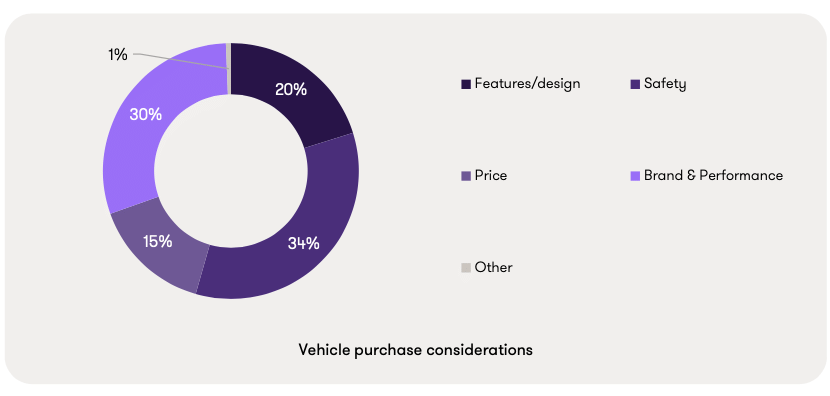

Safety Overtakes Price as Priority

A significant shift in consumer mindset sees 34% of respondents prioritising safety over price and mileage. This evolution reflects the impact of mandatory six-airbag regulations, the Bharat NCAP crash testing programme launched in 2023, and increased awareness of safety ratings among buyers.

"This festive season is not just a sales window, it signals deeper shifts in consumer behaviour," said Saket Mehra, Partner and Automotive Industry Leader at Grant Thornton Bharat. "The growing preference for hybrids, rising safety consciousness, and willingness to pay for premium features reflect a more informed and aspirational buyer."

The survey reveals growing appetite for premium features, with over 35% of respondents willing to pay more for high-end variants. Notably, 65% indicated that a 10-15% price premium over base models is acceptable, signalling a shift toward aspirational, feature-rich mobility.

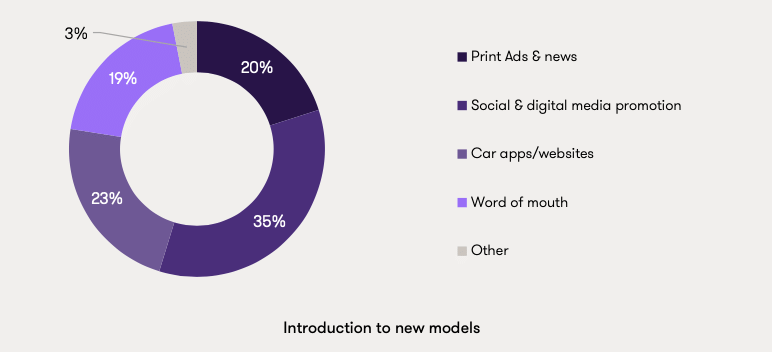

Consumer research habits have evolved significantly, with 52% of respondents using both online and offline channels before purchase. Social media platforms lead the discovery phase at 35%, followed by car apps and websites at 23%. However, traditional dealership visits remain crucial, with 39% preferring physical test drives before committing.

Technology integration has become a decisive factor, with 65% considering connected car features, infotainment systems, and smart interfaces critical to their buying decision.

The survey findings emerge against a backdrop of supportive macroeconomic conditions. The Reserve Bank of India has maintained its repo rate at 5.5% with a neutral stance, supporting consumer credit growth. Car loans are available at 8.5-13% interest rates, with over 65% of respondents preferring a mix of loans and self-funding for their purchases.

Government initiatives, including income tax reforms raising exemption limits to Rs 12 lakh and EV subsidies, are enhancing affordability and disposable income. With inflation forecast at 2.6% for FY26 and GDP growth outlook of 6.8%, India's macroeconomic stability supports sustained automotive demand.

Despite this momentum, India's vehicle ownership remains underpenetrated at 163 vehicles per 1,000 people in 2023, projected to reach 309 per 1,000 by 2050, indicating significant growth potential.

The survey indicates growing awareness of alternative ownership models, with 37% of respondents considering leasing and subscription-based options, primarily to save money. Only 16% were unaware of such models, down from 21% last year, suggesting improving market maturity.

Several automakers have introduced flexible ownership solutions, including subscription plans ranging from 12-36 months with zero down payment, maintenance coverage, and insurance handling.

The confluence of policy reforms, evolving consumer preferences, and digital transformation positions India's automotive market for what industry observers anticipate could be its most successful festive season in recent years.

RELATED ARTICLES

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

Tata Motors PV Expects 30–50% Jump in Punch.ev Volumes After New Launch

Automaker bets on higher range, faster charging, and accessible pricing to lift EV adoption in the entry segment.

By Shristi Ohri

By Shristi Ohri

16 Oct 2025

16 Oct 2025

2934 Views

2934 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa