Trust is a key differentiator for emerging business models at India Auto Inc

While physical and digital jostle for attention in the ever dynamic auto retail space, industry experts highlight the need for trust and transparency if customers are to adopt a digital-first policy.

The year 2020 will be remembered not just for how the world got overwhelmed by Covid-19 but also about how the novel coronavirus acted as the catalyst for change, especially for business. The automotive industry, for example, is making a speedy transition towards all aspects digital, from sourcing components to selling cars. Going digital pretty much sums up the journey in the past six months. But that has also impacted business models and customer choices. So how do vehicle preferences stack up now and what are the changes that OEMs undertaking to rev up demand? Most importantly, how are they looking to win customer trust amidst the new normal in play?

Autocar Professional’s two-part webinar series on 15th and 16th October, in association with Frost & Sullivan, sought answers on all these issues and a lot more. Quite appropriately Frost & Sullivan chose this webinar as the platform to unveil and present a study on 'Vehicle Purchase Preferences post Covid-19 in India'.

After the riveting session on October 15, the session on October 16 offered a deep insight on new trends in the retail space based on the topic, ‘Vehicle Purchase Preferences in India - Pre-Owned Vehicles & Digital Retail’. The panel of speakers comprised:

- Ashutosh Pandey, CEO, Mahindra First Choice Wheels

- Karan Jain, founder and MD, Revv India

- Sirish Batchu, MD, Danlaw Technologies

Autocar Professional’s Sumantra B Barooah moderated the session and Kaushik Madhavan of Frost & Sullivan kicked off the talks with key highlights from the in-depth report on consumer trends.

Kaushik Madhavan: ‘Trust a significant concern for most customers in online vehicle purchase models’

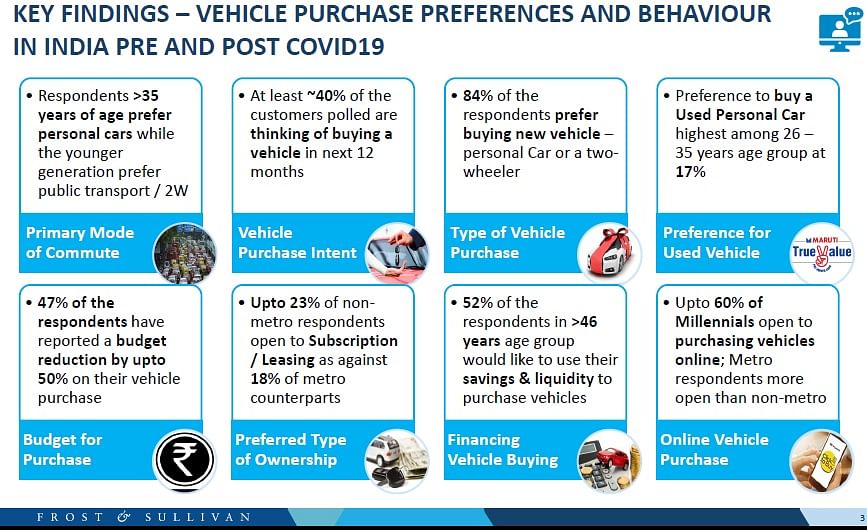

Kaushik Madhavan set the agenda of discussion with key highlights of the study on 'Vehicle Purchase Preferences post Covid-19 in India'. According to him, “40 percent of customers wanting to buy a new vehicle over the next 12 months is a positive sentiment.” But there are decided “concerns about 47 percent of respondents saying they had to reduce budget for new vehicles by up to 50%.”

Though he conceded that there is a lot more acceptance from metro as well as non-metro customers on new business models including subscription, there is a “drastic change in preference for personal mobility post-Covid, share of those preferring shared mobility has dropped significantly.”

He felt that, “shared mobility may not be the right/preferred mobility solution for people over short to medium-term. Vehicle subscription, short-term/long-term leasing gaining acceptance as alternative ownership models. Close to 13 percent of respondents, predominantly younger generation, are open to newer business models.”

The study highlights that as much as 16 percent of the respondents are willing to buy pre-owned vehicles. While the “cheaper price of used vehicles is the primary reason for customer preference, car makers need to adapt to current challenges and ensure the right messaging endeavour reaches the right type of customer.” He explained that this is because, “Vehicle purchase still an emotional, family decision, the touch and feel a key part of the decision making. Trust a significant concern for most customers in online vehicle purchase models. This is an area of improvement that OEMs can look at.”

Ashutosh Pandey: ‘Affordability is a key factor driving used car preference’

With more than 40 percent of respondents planning to buy a vehicle in the next 12 months, Ashutosh Pandey, CEO, Mahindra First Choice Wheels said that though the pre-owned vehicle market still remains unorganised, “increasingly large number of people are now looking at used cars as one of the options when they decide to buy a car.” The used car segment is seeing early signs of disruption as people do not want to sell their cars and new car exchanges have dropped. This, according to him, is one of the major challenges the industry is facing.

Pandey highlighted that, “Affordability plays a major role here. Then comes the vehicle preference. In Mahindra First Choice outlets, we have seen an increase in 16-20 percent in sales. Though this is partly an account of pandemic, the mix is very important. The popular cars that are advertised better are the more preferred one in the used car segments too. While buying a new car, customers tends to be 60 percent rational and 40 percent emotional it is vice-versa in the pre-owned segment.”

Pandey pointed out that though there is a “drop in repossession of vehicles and this has impacted supply of cars in the used car market. The highest booking is typically seen in highest priced model. Vehicle preference of new car space gets replicated in used car market. Many customers looking for convenience and higher priced vehicles while opting for a pre-owned vehicle. But he explained that this will be at different price points as most of the customers are climbers. New buyers will settle for a normal vehicle, while people using one will go a step higher.

Sharing his thoughts on the outlook of the pre-owned vehicle market, the CEO stated that even with the growth the penetration will be less when compared to the global markets. “In terms of market, the overall used car numbers in FY2020 is around 4.1 million. And, we expect this to reach seven million by FY2025, which is comparatively less than US and European markets. But, there is a structural issue in the online used cars as the inventory is controlled by the ownership. It is shaping up as an omni-channel strategy,” he added.

While Pandey feels that “Moving from physical to digital is inevitable but end-to-end online play is unlikely to be successful without any physical footprint. New car retail going online is a customer trend but OEMs are far more invested in their dealership network. Used vehicle inspection is the key trust-building factor, the prices are determined on the vehicle condition. Companies are looking at AI-based inspection and at inspecting key parts of the car, not just visual inspection is going to play a major role.”

Karan Jain: ‘Preference for personal mobility helping shore up subscriptions’

The on-going pandemic has provided a much-needed push for a subscription-based model of vehicle ownership, claims Karan Jain, founder and MD of Revv India, a self-drive car rental company.

According to Jain, rentals and subscription models of business played out differently during the pandemic, “Rentals took a big hit during the first few months of the pandemic, mostly due to lockdown. However, strong momentum seen over last 4-6 weeks. Business recovering on the rental side but still to reach pre-Covid times.”

On the other hand, “Subscription business shaping up very well. We clocked nearly 3.5 times the numbers we recorded pre-Covid. Preference for personal mobility helping shore up subscriptions.”

Jain outlined how the bookings in the subscription business has increased to about 2,000 bookings per month from around 600-650 monthly bookings about six months back. Jain attributed this to preference for personal mobility and economic uncertainties.

According to him, the “subscription business in the automotive sector is still at a nascent stage. (However, there are) strong tailwinds for subscription business in a post-Covid world.” Giving a break-up of demand demographics, Jain said a, “Demand for subscription in southern part of India is much higher but demand in rest of India is catching up.”

Sirish Batchu: ‘Trust a key factor in both pre-owned vehicles sales as well as digital sales models.’

Putting his perspective on the topic, Sirish Batchu, Managing Director, Danlaw Technologies highlighted that, “The behaviour between the pre-covid and post is entirely different. Online plays a huge role now. In the automotive field we see a lot of youngsters preferring online purchase.”

However in all these dealings, he identifies ‘trust’ as an integral part of the game plan. “Trust here plays a major role and it is an important factor. Whether a pre owned or a digital retail segment, how the trust being brought is important. The touch and feel of the car is also important. Keeping this in mind, a lot of OEMs have now come up with AR and VR technologies.”

He highlighted the specific challenges of the used car market and said, “he used car segment is a very tricky and digital space will help play a major role. Also, having the proper details including the repair schedule on the pre-owned vehicle is a must.”

The speakers agreed that while customer preferences are changing in a post-Covid market, there is a need for OEMs to adapt to these in a way that instils customer’s trust.

Read More

The changing dynamics of customer preferences and the emerging ownership models

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

16 Oct 2020

16 Oct 2020

8429 Views

8429 Views

Autocar Professional Bureau

Autocar Professional Bureau