The changing dynamics of customer preferences and the emerging ownership models

Ownership models are changing and affordability is key. As a result, gauging customer expectations and how they will shape demand for vehicles is crucial.

The dynamics of vehicle purchase behaviour is changing and customer perceptions and preferences in a post-Covid India are under the scanner. There are new trends, different expectation and renewed push towards personal mobility. The passenger vehicle industry in India has started showing some signs of revival, and going by expectations, the upcoming festive season is looked to drive in smart sales. Looking at the domestic sales the surging demand for SUVs powers PV sales in September, up 35%.

But the question is would the balance tilt in favour of two-wheelers or four-wheelers and would shared mobility solutions disappear completely? Ownership models are changing and affordability is key. As a result, gauging customer expectations and how they will shape demand for vehicles going forward became the subject of the latest webinar conducted by Autocar Professional in association with Frost & Sullivan.

Autocar Professional is hosting two-part webinar series spanning from October 15-16, in association with Frost & Sullivan which also presented its study on 'Vehicle Purchase Preferences post Covid-19 in India' during the webinar. Senior industry executives discussed, debated and shared insights on the finding of the study and the general direction in which customer preferences are shifting. The star-studded panel included

- Shashank Srivastava, ED - marketing & sales, Maruti Suzuki

- Tarun Garg, Director – marketing, sales & customer service, Hyundai Motor India

- Sohinder Singh Gill, CEO, Hero Electric and Director General, SMEV

- Vinkesh Gulati, President, FADA.

- Ramashankar Pandey, MD, Hella India Lighting

Autocar Professional’s Sumantra B Barooah moderated the discussion.

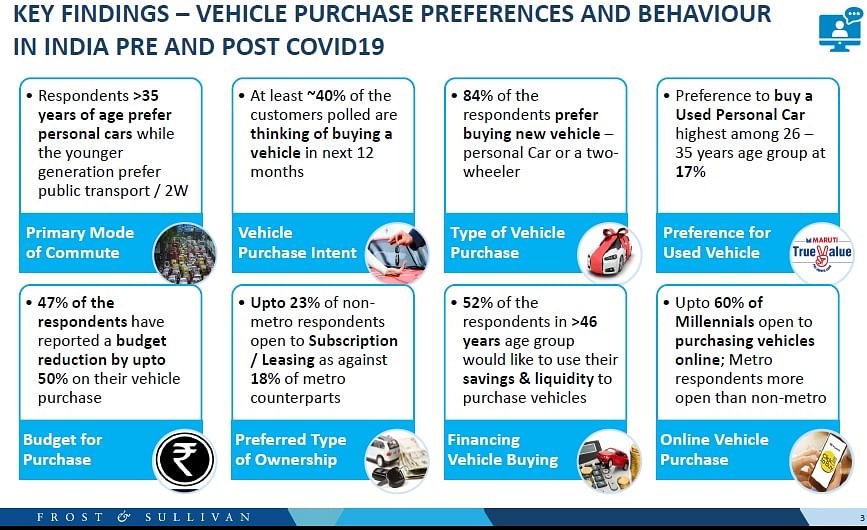

The Frost & Sullivan study

Findings of the recent Frost & Sullivan study on customer preferences set the stage for the detailed and in depth discussion. The highlights of this study highlighted the new trend of vehicle subscription which comes in the wake of millennials preferring to own an experience and give priority to convenience.

According to the study, personal car is a top priority for those above 35 years but the younger generation prefer public transport or two-wheelers. At least 40 percentage of the customers polled are thinking of buying a vehicle in next twelve months. Timing however, is a crucial factor here and the consensus is if the study was done later, perhaps the percentage could have been higher.

Nearly 84 percent of the respondents prefer buying new vehicle – personal car or a two-wheeler and the 26-35 years age group isn’t averse to the idea of buying a personal car too. The cost factor is crucial in this context. Almost, 47 percent of the respondents have reported a budget reduction by up to 50 percent in their vehicle purchase plan.

A region-wise analysis indicated that close to 23 percent of non-metro respondents are open to subscription/leasing as against 18 percent in metros. Almost 52 percent of the respondents in the under-46 years age group would like to use their savings and liquidity to purchase vehicles. However, almost 60 percent of Millennials open to buying vehicles online.

Shashank Srivastava: ‘Long-term trends point to more options for consumers including subscription’

Taking a cue from these findings, Shashank Srivastava, executive director, Sales and Marketing, Maruti Suzuki India, the country’s largest carmaker gave a brief overview of the current demand situation and said that while supply chain disruptions were aplenty through the first quarter of the ongoing FY2021, it is hard to conclude that the current pent-up demand will make up for the losses incurred thus far. He pointed out this is because, “replacement buying has reduced dramatically.”

However, the ace marketeer was optimistic that the market is gaining some bit of normalcy even as people are downgrading their choices for the potential loss of income and liquidity if a second wave of Covid-19 gets triggered.

Coming to the subscription-based ownership services also being offered by Maruti Suzuki, Srivastava added, “We have to clearly distinguish between the long-term trend from the short-term that is being witnessed right now. The current trend is reflective of the Covid-19 situation, but the long-term trend clearly shows an uptick towards on-demand mobility and subscription models.”

“The projection states that from the US $226 billion current market capitalisation, the domestic Indian automotive industry will grow to US$380 billions driven primarily by on-demand (10%) and connectivity services (16%). So, the long-term trends point more towards shared mobility solutions, while subscription is just another way of owning a car,” he added.

He further added, “It is not just one type of customer who is looking at subscription. There are four types –

- Aspiring millennials – want to own the experience without owning the asset

- Convenience seekers – want to avoid the hassle of insurance, registration that comes with buying a new car

- Prime buyers – want to change their cars very early and frequently

- Sub-prime buyers – don’t have the capital to finance but want to avail different options

As regards connectivity, Srivastava said, “We’re just starting to see the penetration of connectivity in cars and going forward, we would see standardisation coming in for the sake of data privacy and security which will induce a boom in the space.”

Tarun Garg: "Hyundai wants to be in every Indian customer's consideration"

Representing the country’s second largest carmaker, Tarun Garg, Director – marketing, sales & customer service, Hyundai Motor India shared his views on the trends in the domestic market. He believes that while Covid-19 has caused a lot of disruption, it has also led to “increased move towards personal mobility, disposable income has gone up so greater willingness to invest in big buys like cars.” This means consumers now want to own an asset such as a car, which als provides them safe mobility.

“There is off course fear about shared mobility, initially when Covid-19 happened, the general talk in the industry was that only entry level vehicle will see sales. But what we have seen is that SUV sales have grown too. In fact, the sales of the Hyundai Venue and Creta SUV is more than 20,000 units, contributing over 40 percent of our total sales,” explained Garg.

According to him it is not just about having new products, but also providing variety and options to the customer, be it fuel choice – petrol, diesel, electric – engine options such as turbo, or be it subscription model. “Customers are really willing to buy. OEMs needs to be problem solver, the brands who will be able to do that they will succeed well,” explained Garg.

In terms of demand, he believes that it is not just about the pent-up demand, but there is actual real demand in the market that is bringing sales.

Responding to a query on what have been the key learning for Hyundai Motor India, which was one of the early movers to introduce subscription-based car sharing model with Revv in August 2018. He said, “Hyundai has also believed that we want to be in consideration set for every Indian who is looking at the mobility space. That’s why we launched the subscription model, and already have over 3,600 subscribers. Before Covid-19 we were averaging around 200-225 subscription per month, in August it increased to 275 customers and in September it has grown to 325 customers, which means there is clearly a set of customers who are looking at smart mobility.”

According to him, while the customers for subscription service is comparatively low, there is a set of consumer who find this model that provides for a greater freedom in personal vehicle space, fulfilling all their needs, and being cheaper than other ownership models.

In terms of demand, the company says the highest number of customers for the subscription service is in Bangalore followed by Mumbai, Hyderabad and then Delhi-NCR. The average age of the customer is in the 26-35 age bracket, and this millennials have a salary of upto Rs 100,000.

“For them it is not just about affordability, it is also about convenience. As OEMs we have to keep investing in current business as well as future business. You have to be prepared for the future, as the customers and demand trends do change. We have to be prepared for global trends,” added Garg.

India is one of the fastest growing automotive market, and one of the most competitive too. In a country, where owing a vehicle is a status symbol, how does Hyundai Motor India aim to steer the growth momentum? “There are all types of customers, pride of ownership is off course has been a long-seen trend. But in the last 3-4 years there has been the rise of the millennial customers, who do not see find that pride in ownership, but are open to having all the features through subscription.

In the future, while this segment is small (subscription) we feel looking at the European and US market, this segment will expand. It may not become 30 percent of the total demand, but it will grow significantly and make it much more interesting to everybody,” concluded Garg.

Connectivity is another key theme driving automotive demand in India. Garg pointed out, “The response to Blue Link solution is encouraging, now being offered on every new model and is being constantly improved. Also offers the OEM a critical product differentiator. It is also about the new features that this connectivity can bring in.”

Sohinder Gill: ‘Overall, confident of exceeding last year’s sales numbers’

But in this entire scheme of things, demand for electric vehicles throw up some interesting trend. Sohinder Gill, CEO, Hero Electric stated that they had more or less similar sales figures as last year even after zero sales during the lockdown to contain spread of Covid-19.

According to Gill, "Except the e-buses which are on the government's agenda we are heading to a similar number as last year. In the two-wheelers we had reached 70 percent sales over the previous year and in three-wheelers around 80 percent of sales. But now, post the pandemic, we see three different types of buyers. Those who are looking for the lowest-cost product, those who want vehicles for weekend travels and those who look for value for money. The people who want vehicles for the weekend are the one who are adjusting to the new normal and working from home. We see this traction mostly in Bengaluru, Chennai and NCR for this.”

However he pointed out that the online sales has jumped six times over the previous average, “We have sold over 12000 units online in the five months. This is across the category and most people are committing to buy the vehicle without even looking at it. This has not happened before. So, customers can book a bike and can even return it within a 3 days period of time. We are substituting by giving him a window to return as they do not test the vehicle beforehand. The return has been so minimal which is three out of the 12000. Overall, things are shaping up after the loss of the first few months.”

Hero electric launched a series of electric models recently which had new extended ranges. The CEO said the last mile connectivity and delivery solutions are the specific areas they are looking for with these new models. This is one of the major reasons the range was higher in one of the new models. “We even offered new methods in terms of buying the vehicle. This will have the value for money that they look for,” he said.

Vinkesh Gulati: ‘Customer demand for entry-level segments and the new launches are growing’

Bringing in a dealer’s perspective on the demand scenario, Vinkesh Gulati, President, Federation of Automobile Dealers Associations (FADA) said, "At present, there is higher demand in the entry-level segments and new product launches at the moment. Customer demand in these two categories is growing, irrespective of the cost factor.”

According to Gulati, the automotive industry at present is on the cusp of festive season which acts as the biggest trigger for people to come and buy vehicles. India’s automotive industry is banking heavily on the current festive season to bring positive growth amidst the prolonged slowdown and impact of Covid-19.

Gulati claims that the vehicle exchanges have slowed down in current times as people are going slow on replacement buys and are looking to use their existing vehicle for an additional year or two amidst the economic uncertainties. Commenting on shared mobility, Gulati pointed out that demand for it will bounce back once the impact of Covid-19 starts waning.

Ramashankar Pandey: ‘See aftermarket as one of the key growth avenues going forward’

But how does the vehicle demand trends translate in terms of profitability for auto component suppliers and the aftermarket. Ramashankar Pandey, MD, Hella India Lighting sees growing, “need for personal transport, consumer sentiment in the context of the economic situation crucial.”

He signed off on a positive note with expectation of improved opportunities for the aftermarket, “See aftermarket as one of the key growth avenues going forward.”

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

15 Oct 2020

15 Oct 2020

12040 Views

12040 Views

Autocar Professional Bureau

Autocar Professional Bureau