Tata Motors doubles its UV market share in FY2018

Tata Motors has been one of the quickest growing OEs in the UV segment in FY2018, selling a total of 51,891 units (+178.20%) in FY2019, compared to FY2017 sales of 18,652 units.

The Indian automobile industry is on a high and rightly so. Be it passenger vehicles, commercial vehicles, three-wheelers or two-wheelers, sales in FY2018 have hit record highs. PV sales have crossed the 3-million mark for the second straight year and the utility vehicle (UV) segment is resolutely driving towards the 1-million milestone in FY2019.

What's been giving the PV segment the sales boost is the surging consumer demand for SUVs. More importantly, the seemingly insatiable thirst for compact crossovers is driving buyers into showrooms and most manufacturers are looking to grab a share of the rapidly expanding UV category.

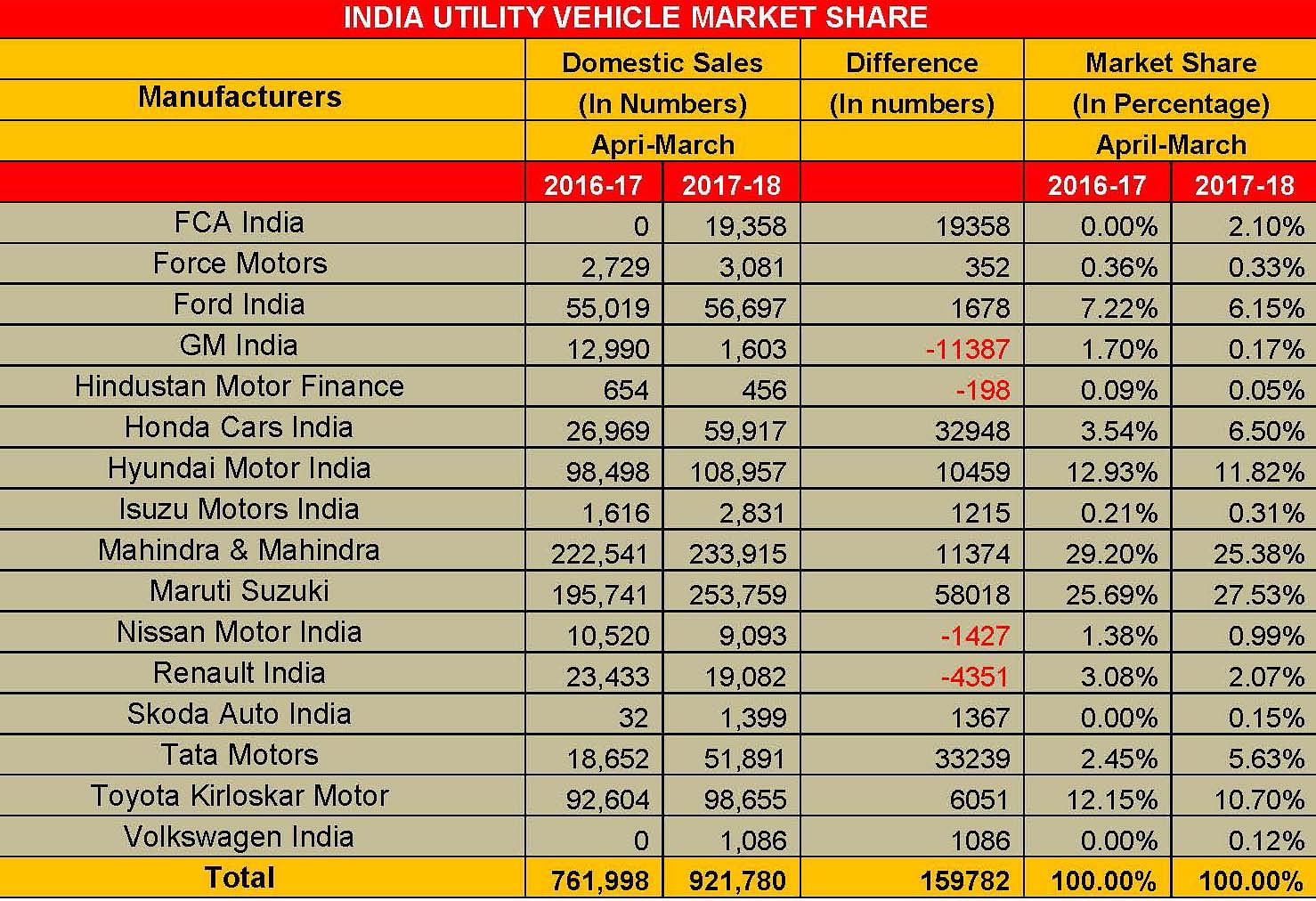

With sales of 921,780 units in FY2018, UVs accounted for 28.03 percent of the overall PV segment sales (3,287,965), up from 25 percent in FY2017. The fiscal saw a slew of new compact SUVs getting launched, with Honda’s WR-V, Jeep’s Compass and Tata’s Nexon being the most prominent introductions.

FY2018: a record-breaking year for India Auto Inc

While the Jeep Compass, launched in July 2017, gave a fillip to the sales of the iconic brand in India and made FCA almost instantly take hold of a 2 percent share of the UV market in the country with total domestic sales of 19,358 units, homegrown Tata Motors, on the other hand, also saw its UV share take a significant boost from being at 2.45 percent in FY2017, to reach 5.63 percent in FY2018, thus, doubling its performance.

Tata Motors has been one of the quickest growing OEs in the UV segment in FY2018, selling a total of 51,891 units (+178.20%) in FY2019, compared to FY2017 sales of 18,652 units. In the closing month of March 2018 alone, the company’s UV sales soared to 7,753 units, registering growth of 223 percent (March 2017: 2,401 units). The strong numbers are on the back of good demand for its Nexon crossover and the premium Hexa SUV, which also offers an automatic option in its trim-levels.

India’s leading carmaker, Maruti Suzuki India also saw its UV market share grow by 1.84 percentage points to reach 27.53 percent in FY2018 (FY2017: 25.69%).

While the Vitara Brezza continues to lead the UV charge for the company, with the crossover consistently being at the No. 1 spot in the Top 5 UVs for the fiscal, Maruti Suzuki gave a breath of fresh air to the rather premium S-Cross in November 2017 to drive the slowing sales of the compact crossover. The company’s bunch of UVs, including the Gypsy, Ertiga, Vitara Brezza and the S-Cross, cumulatively sold 253,759 units in the fiscal (FY2017: 195,741).

Japanese carmaker, Honda Cars India, too witnessed sweet success in the UV segment, with its WR-V crossover giving a much needed push to the company’s sales. Launched in March 2017, the WR-V went on to clock 51,856 units during the 12-month period of FY2018, and single-handedly helped Honda double its UV market share to reach 6.50 percent in FY2018 (FY2017: 3.54%) with sales of 59,917 units (FY2017: 26,969).

According to the company, the WR-V has gained popularity across markets with its sales fairly distributed across regions. While Tier 1 markets, comprising large cities, contributed to 38 percent of its nation-wide sales, the model has found equally strong resonance from Tier 3 markets due to its aspirational value and product strengths like high ground clearance.

The WR-V has seen maximum demand from North India (30%), followed by the western region (28%), then the eastern region (15%) and South India (27%). The top-end VX variant is the best-selling WR-V model and accounts for 80 percent of the vehicle's sales. The fuel-wise sale split for the WR-V till now is 42 percent petrol and 58 percent diesel.

While these were the key gainers, the expanding UV market also saw a lot of other OEs lose their market share in a nail-biting battle. Homegrown UV specialist, Mahindra & Mahindra saw its UV market share decline from being at 29.20 in FY2017, and slide down to reach 25.38 percent in FY2018. The company sold a total of 233,915 UVs in the fiscal (FY2017: 222,541), and also refreshed its model line-up, with the popular Scorpio and the KUV100 getting their mid-life updates, which were more based on customer-feedback, than being generic aesthetic changes.

While the Scorpio received a 16 percent performance bump up with a 140bhp tuned engine, along with getting a host of plush features like smart entry and touch screen infotainment system on its newly introduced S11 variant, the KUV100, on the other hand, received aesthetic updates like revised tail-lamps, to sort some of its visual customer dislikes.

While Mahindra’s market share saw a considerable decline by nearly four percentage points, the company still has reason to rejoice, with the Mahindra Bolero entering the select club of passenger vehicles which have crossed sales of a million units in India. The rugged warhorse of a vehicle was launched 18 years ago. The Mahindra Bolero, which re-entered the Top 10 passenger vehicle list in February 2018 with sales of 8,001 units, on the back of robust 24.20 percent YoY growth (February 2017: 6,442), remains an extremely popular choice in rural India. The seemingly ageless workhorse had made a comeback in the Top 10 best-selling PV list after 23 months.

The No. 2 carmaker by volumes, Hyundai Motor India, which sold a total of 108,957 UVs in FY2018 (FY2017: 98,498), registered a decline in its hold of the UV market by 1.11 percentage points to 11.82 percent (FY2017: 12.93%). The company’s Creta SUV continues to bring in the chunk of the UV sales, contributing a solid 98.32 percent with 107,136 units being sold in the fiscal. With a facelift due for introduction in the near term, expect the sales to soar higher for the popular SUV.

With growing sales of 56,697 units (FY2017: 55,019), American carmaker, Ford India still saw its UV market share de-grow to arrive at 6.15 percent (FY2017: 7.22%) in FY2018. The company had introduced the updated EcoSport in November 2017, and its domestic sales only saw an uptick in the last two quarters of the fiscal, with the crossover rekindling customer interest and going home to 19,478 units until February 2018.

Toyota Kirloskar Motor, with its line-up predominantly comprising UVs, sold a total of 98,655 units in FY2018 (FY2017: 92,604). However, with a growing UV market, the company saw its market share decline from being at 12.15 percent in FY2017 to 10.70 percent in FY2018.

Toyota’s immensely popular Innova Crysta MPV formed the bulk of the sales, contributing 75.15 percent of the company’s total UV sales until March 2018. On the other hand, with a total of 24,364 units, sales for its Fortuner SUV grew a substantial 83 percent in FY2018 (FY2017: 13,345).

FY2019 promises to be another fiscal of robust sales and manufacturers will be looking to ride the surging wave of demand for SUVs in India. Expect a fair number of new products, especially compact SUVs, to drive into showrooms this year.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

14 Apr 2018

14 Apr 2018

8768 Views

8768 Views

Autocar Professional Bureau

Autocar Professional Bureau