Tata Motors plots aggressive turnaround strategy

In line with its reorganisation programme, the company has embarked on an aggressive game-plan to achieve market share growth and improve profitability across both its passenger vehicle and commercial vehicle divisions.

Tata Motors, which has embarked on a mega re-organisation strategy, today revealed an aggressive strategy aimed at turning around its passenger vehicle business and also re-energise its market-leader status in the commercial vehicle sector.

The company’s turnaround plan has a three-pronged 'attack' game-plan – cost control, filling of product gaps and a comprehensive supply chain strategy. The immediate target is to achieve market share growth and improve profitability.

That's imperative considering Tata Motors reported a loss of Rs 2,800 crore despite a Rs 49,100 crore sales turnover in 2016-17.

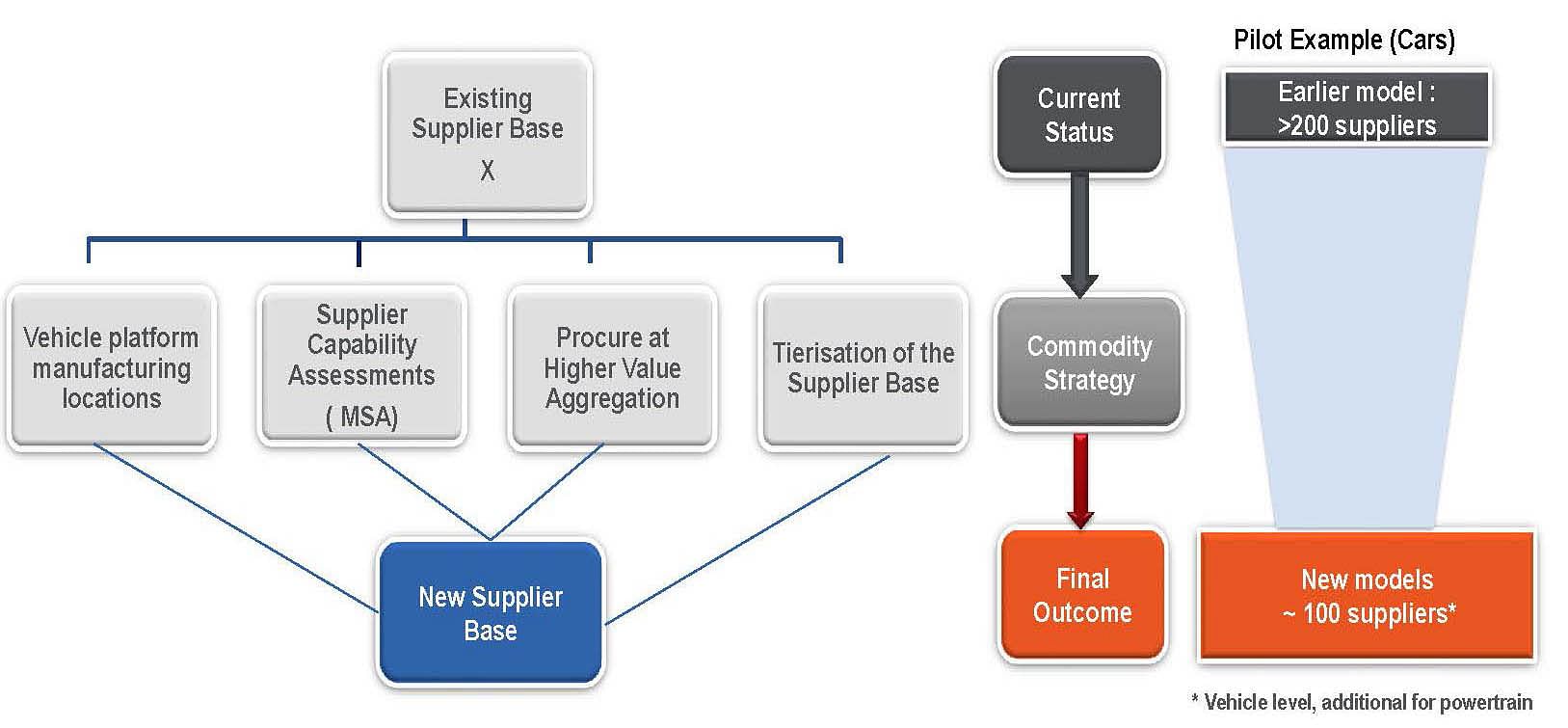

While rigorous cost reduction is expected to be across all categories and functions and by raising the bar for IMPACT projects, there will be a sharper focus on bringing products to market faster. Importantly, Tata Motors is working towards a strategic supplier base designed to build a lean and capable supply chain.

Tata Motors today also announced a new corporate identity, titled ‘Connecting Aspirations’ that aims to define the company “as a brand that intuitively understands people and imagines mobility in all its forms.”

Targeting organisational effectiveness

In its quest to be leaner and stronger organisation, Tata Motors kicked off a new structural revamp programme designed to bring about ‘speed, simplicity and agility’. This involves sharply reducing managerial levels from 14 to five, ensuring empowerment within business units and more frontline-facing roles to improve customer centricity. This, combined with an intense topline focus and agile cost management, is aimed creating a positive bottom line and bringing momentum to the entire organisation.

Stemming the flow of red ink in the PV business

Tata Motors's passenger vehicle business has been making huge losses and a lot is riding on the new crop of technology-laden products like the Tiago hatchback, Tigor compact sedan and the Hexa crossover. All three vehicles have given the company an uptick in sales as well as PV market share.

For the April-July 2017 period, Tata has sold a total of 56,506 units (+7.81% YoY) and currently has a PV market share of 5.50 percent. In Q1 FY2018, the company also signed a contract with the Indian Armed Forces for supply of 3,192 Tata Safari Storme 4x4s.

The next – and absolutely critical – product for the company is upcoming Nexon compact SUV, which is to be launched next month and Tata’s answer to the Ford EcoSport and the Maruti Brezza. It will be the last of the ‘bridge products’ or those on legacy platforms. The Nexon, which will be the company's first compact SUV, also promises to deliver fatter margins and stem the flow of red ink in the PV division.

Speaking at the media meet in Mumbai today, Guenter Butschek, managing director, Tata Motors, confirmed that Tata Motors will launch new five- and seven-seater SUVs in FY2018-19.

With its Advanced Modular Platform (AMP), it plans to cut the number of component suppliers from 200 to under 100. The first car to be built on AMP will be a premium hatchback (codename X451) slated for rollout in 2019. The estimated initial investment will be Rs 2,500 crore.

The company, which has a product plan ready till FY2022 to leverage the full benefits of the modular platform as well as structural cost reduction, is targeting No. 3 position in the Indian PV market.

Bringing the fizz back into CVs

Meanwhile, Tata Motors looks to be putting its shoulder to the wheel of its commercial vehicle business. Once the bulwark of the company, the CV business has taken a beating over the past few years. While Tata continues to be the market leader, numbers and market share have dropped considerably. In 2013-14, it had a market share of 50.23 percent; barely three years later, in 2016-17, its CV market share has fallen to 42.79 percent. As per the latest April-July 2017 CV numbers, this is further down to 40.99 percent.

Now, there is a promise of concentrated focus to turnaround the CV business. MD Guenter Butschek said today, “We have been far too complacent.”

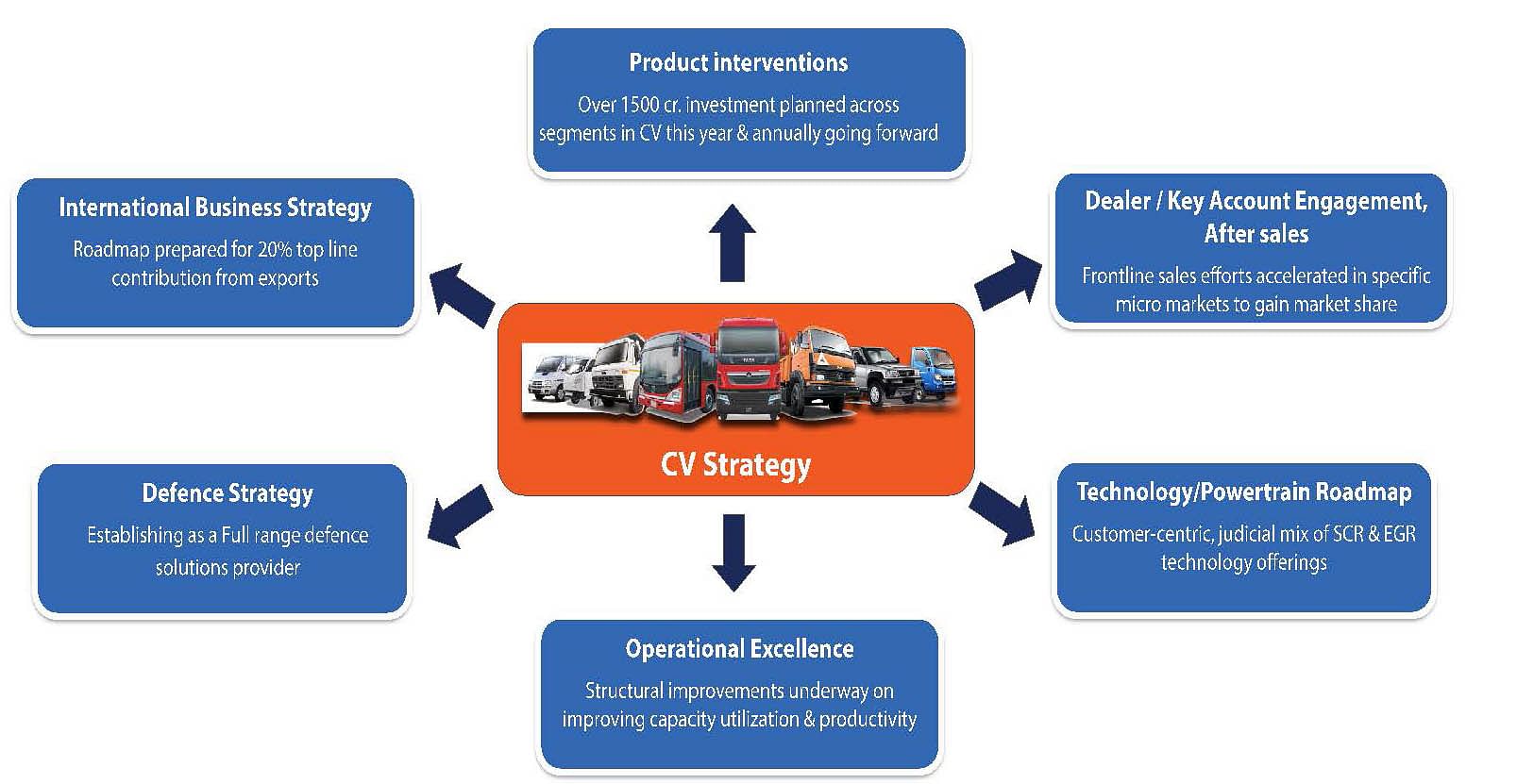

The company aims to benefit from modular platforms, reducing complexity and increase flexibility. While the overarching goal is to produce more products at lower costs, the comprehensive CV strategy involves an over Rs 1,500 crore investment across CV segments this year and annually; 20 percent topline contribution from CV exports; developing a full range of products for the defence sector; achieving operational excellence in capacity utilisation and productivity; and a customer-centric mix of SCR and EGR emission reducing technology offerings.

In line with this, Tata Motors today revealed plans to introduce a new range of LCVs and M&HCVs that help meet growing customer demand for CVs with higher payload and improved total cost of ownership (TCO). It has planned six new M&HCV launches and four new intermediate CVs in FY2018. The company is also targeting leadership status in M&HCV buses.

On the small CV front, a segment in which Mahindra & Mahindra has taken the lead, Tata Motors has aggressive plans to introduce technologically advanced products in last-mile connectivity and passenger solutions.

While the CV business de-grew by 17 percent in Q1 FY2018, the company says early signs of reversal are visible in July. Some of the key highlights of Q1 this fiscal are a 500-bus order from the Ivory Coast, launch of AMT in 9-12 metre-long fully built buses, introduction of EGR and SCR BS IV technologies and the successful trial of the Tata Ultra Electric 9m bus that covered 160km on a single charge.

Tata also says it is taking the leading in alternative fueled mobility. In the past year, it has developed and showcased its Starbus Hybrid, India’s first LNG bus and fuel cell bus.

Also read: Tata Motors realigns people strategy to be leaner and stronger

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

21 Aug 2017

21 Aug 2017

26733 Views

26733 Views