Slower M&HCV offtake a drag on overall CV sales in February

All CV OEMs have registered negative sales in M&HCVs while LCV sales are growing in higher single digits.

After cruising along at a handsome 25 percent year-on-year growth rate for the first nine months of FY2019, despite headwinds such as shortage of finances due to the crisis in the NBFCs and new axle loads norm implementation, sales in India's commercial vehicle market have slowed down and how.

Now, growth has moderated considerably as demand for medium and heavy commercial vehicles (M&HCVs) slowed down in January and in February. Nevertheless, due to continued construction and infrastructure activities, the tipper truck segment has posted double-digit growth. All CV OEMs have registered negative sales in M&HCVs while LCV sales are growing in higher single digits.

While there is no clear cause of this sudden drop in demand for M&HCVs, factors like slowing down of the overall economic activity, high interest rates, and the prevailing effect of implementation of revised axle load norms, slowing industrial output and declining IIP growth index are certainly dampening buyer sentiment. Also, the statistics office yesterday said economic growth for the third quarter ended December 2018 slowed to 6.6 percent, the lowest in six quarters. These numbers are slightly lower than market expectations.

According to Tata Motors, “After the axle load norms implementation, the freight carrying capacity of the M&HCV parc has increased by 20 percent, but the freight growth has not been able to absorb this increased capacity resulting in lower demand for new trucks.”

Anuj Kathuria, President, Global Trucks, Ashok Leyland, speaking to Autocar Professional, said, “While the sales of M&HCV has come down in the last two months, but given the strong performance in the first half of this year, the industry would likely to register a growth of 12-15 percent in FY2019. This growth is reasonable considering last year’s high base.”

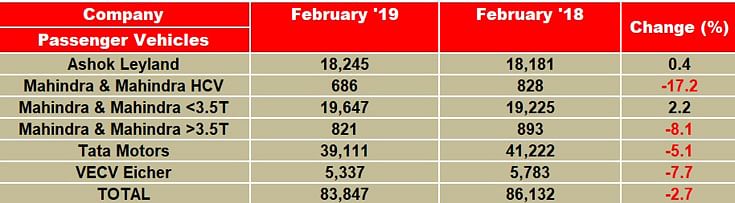

How the OEMs fared in February

Market leader Tata Motors' overall sales are down 5 percent with sales of 39,111 units in February 2019 (February 2018: 41,222). After January's single-digit drop, the M&HCV truck segment has come under pressure declining by 18 percent in the month to 12,437 units (February 2018:15,241). The ILCVs are up by a marginal 4 percent, selling 4,810 units. The cargo SCVs and pickups registered a growth of 9 percent to 17,417 units, while the commercial passenger carrier (bus) segment saw sales of 4,240 units (-18%) as the segment has been impacted due to the slowdown in the procurement of buses by STUs and the permits for private hiring.

Ashok Leyland registered flat growth in the month with sale of 18,245 units (February 2018: 18,181). The M&HCVs remains sluggish by de-growing marginal 3 percent with a total sale of 13,291 units, while the LCVs maintained double-digit growth of 11 percent YoY growth at 4,455 units sold (February 2018: 4,954).

Mahindra & Mahindra's overall CV sales were up by 1 percent to 21,154 units (February 2018: 20,946). Like other manufacturers, its M&HCV sales are down by 17 percent with 821 units sold. The below-3.5T GVW segment was up by just 2 percent YoY, selling 19,647 units (February 2018: 19,225), while those in the above-3.5T GVW segment declined by by 8 percent to 821 units (February 2018: 893).

VE Commercial Vehicles' sales declined by 8 percent in the month, the company selling 5,337 units in the domestic market (February 2018: 5,783 units).

Also read: Carmakers’ February sales impacted by weak market sentiment

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Mar 2019

02 Mar 2019

12216 Views

12216 Views

Autocar Professional Bureau

Autocar Professional Bureau