SIAM moots standard GST rate for cars and SUVs

Apex industry body recommends cutting down of existing four slabs of duty rates to two standards rates for conventional fuelled vehicles.

The Society of Indian Automobile Manufacturers (SIAM), the voice of the Indian motor industry which supports and promotes its members’ interests to the government and stakeholders, has made rate recommendations to the government as regards the upcoming Goods & Services Tax (GST).

The industry body says it has studied the draft GST law in detail and given detailed feedback to the government for its consideration. It adds that while some of the transition issues may have serious short-term implications for the economy, if not addressed swiftly, in the longer run the GST framework currently contemplated will be best for the economy.

Indian automakers have been awaiting GST for long since in its present manufacturing process, the industry accumulates a lot of embedded taxes and duties which make manufacturing in India less competitive. A GST regime will help bring in transparency and predictability and also help streamline sourcing and logistics operations.

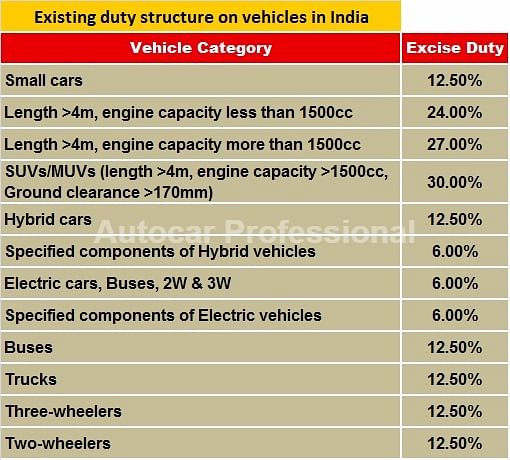

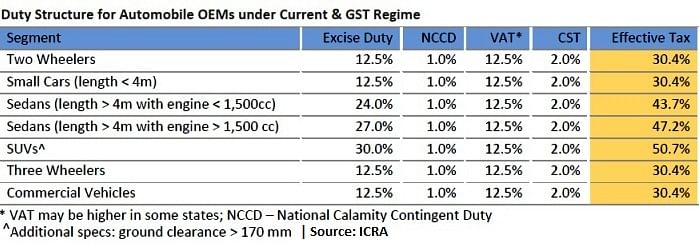

SIAM says that while earlier there were only two rates of excise duties on passenger cars, in recent years the excise duties on bigger cars have fragmented. Currently, the industry sees four rates for passenger cars excluding Electric Vehicles and hybrid electrics for which lower rates are applicable. Therefore, SIAM argues, there is a need to take a closer look at the GST rate for automobiles.

The Indian auto industry has four different slabs of excise duty based on dimensions and engine capacity ranging from 12.5% for small cars, CVs, 2- and 3-wheelers to 30% for luxury cars and SUVs. In addition, the government imposed an infrastructure cess ranging from 1-4%. Under the GST regime, SIAM expects these rates to be converged to a maximum of two rates, thereby making the tax structure on automotive industry more simple and structured.

SIAM says. . .

The industry association says there should be only two rates for conventional vehicles:

- A standard GST rate should be applicable on small cars, MUVs, two-wheelers, three-wheelers and commercial vehicles.

- Cars other than small cars should attract a GST rate which is 8% more than the standard rate.

There should be a lower GST rate for electric vehicles, hybrid electric vehicles and other alternative fuel vehicles. This rate should be at least 8% less than the standard rate.

Many SIAM members, who have made huge investments in locations falling under the Area Based Exemption scheme in places like Uttarakhand and Himachal Pradesh, say that the duration of the scheme is still not over and there is a need to protect the benefits to those units under the GST regime till the end of the scheme.

SIAM also says that road tax and registration tax, which add to overall vehicle costs, still remain outside the GST framework. Therefore, road taxes needs to be subsumed in GST.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

06 Oct 2016

06 Oct 2016

9826 Views

9826 Views