Revealed: Timeline for localisation of EV parts to avail FAME II subsidy

One of the interesting highlights of DHI’s latest notification is that it has relaxed its stance on indigenous sourcing, which implies domestically manufactured/assembled and tested parts.

The drive for electric vehicles (EVs) in India is finally gaining some momentum. After weeks of discussions between stakeholders and the Central government, the revised phase-wise localisation for xEV parts to be eligible under the FAME II scheme is out.

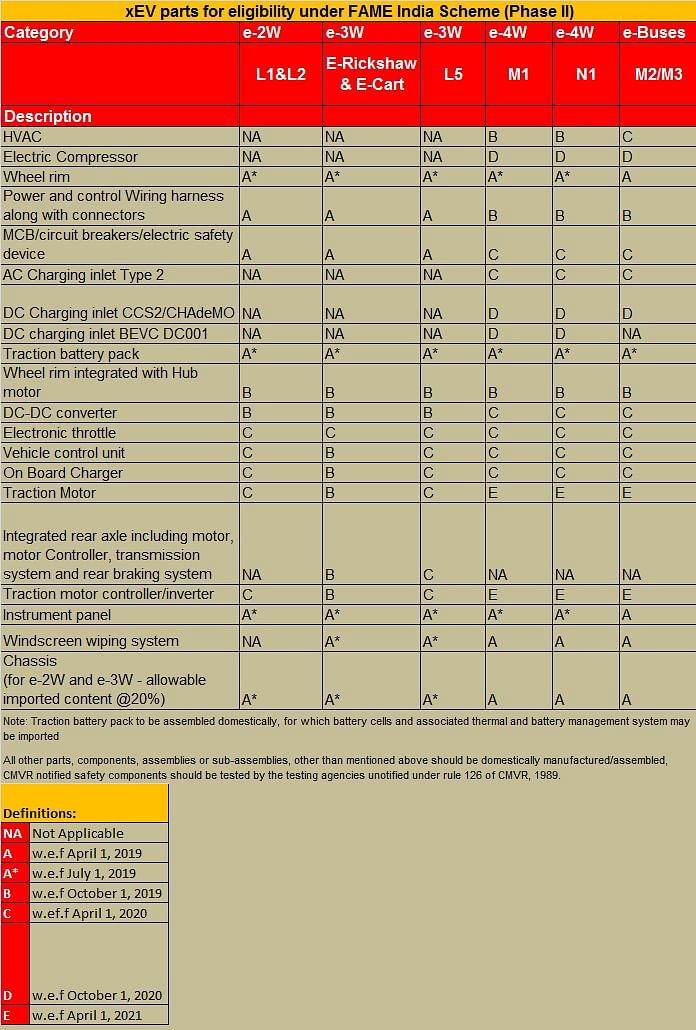

On April 29, the Department of Heavy Industry Ministry (DHI) released the revised eligibility timeline for localisation of EV parts for all vehicle categories — e2Ws, e-3Ws, e-rickshaw, e-cart, e-4Ws (M1 and N1), and e-buses (M2/M3). From April 1, 2019 the OEMs will need to begin heavily localising EVs in a phase-wise manner, with the exception of the traction motor, traction motor controller/inverter. The sole major exception is battery cells and associated thermal and battery management system (BMS) that may be imported.

The second phase of FAME scheme that kicked in from April 1, 2019 with a budget outlay of Rs 10,000 crore has received mixed opinion. The ambitious scheme which focuses on heavy localisation of EV parts, including lithium-ion and BMS, has led to quite a challenging situation. The nascent EV industry, which sees a fraction of sales compared to their ICE-counterparts, needs higher sales to encourage investments in localisation of parts.

The government's intent to push forward EV sales in the country can be seen in the constant revision of the FAME II policy. In March 2019, the government had come out with the minimum specification for EVs in terms of range, speed, energy consumption, acceleration, warranty and the maximum capacity of battery criteria (which replaces 20% cost of the vehicle cap), to ensure that the industry focuses more on efficiency, instead of fixing a higher price to pass on the benefits to the consumer.

One of the interesting highlights of DHI’s latest notification is that it has relaxed its stance on indigenous sourcing, which implies domestically manufactured/assembled and tested parts. What will be interesting to see is that while the sales of EVs in India crossed the 750,000 unit mark for the first time in FY2019, the industry sees sales dropping sigificantly in FY2020.

Also read: FAME II good but not enough, says India Auto Inc at Two-Wheeler Industry Conclave

Tork Motors urges government to increase FAME II electric 2W incentive limit

Heavy Industry Ministry scouts for 'Knowledge Partner' to promote FAME II

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

07 May 2019

07 May 2019

30134 Views

30134 Views

Autocar Professional Bureau

Autocar Professional Bureau