Retail fuel price close to one-year high across India

International crude prices hovering close to six-month highs but Goldman says upside is limited.

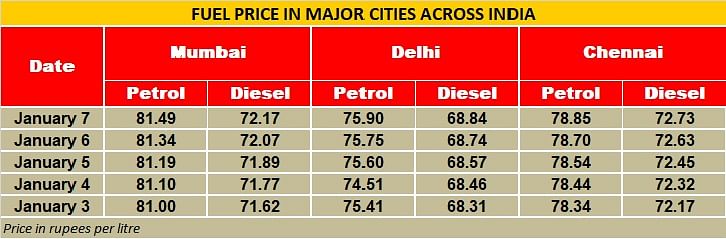

Retail fuel prices have spiked across India and currently petrol and diesel rates are at one-year high as a result of the recent rise in global crude oil prices. But quite contrary to the general sense of apprehension all around, Goldman Sachs analysts say that the upside from current levels could be fairly moderate. That's according to a Bloomberg report.

The international oil price movement has a significant bearing on the net import bills for India. Industry estimates indicate that if crude prices rise by $1 per barrel, the net import bill will increase by Rs 3,029 crore. Further, if exchange rate rises by a rupee to a dollar, the net import bill will increase by Rs 2,473 crore.

The international oil price benchmark, Brent crude futures have shot up by about six percent since the US strike killed a top Iranian general last week. Generally, the retail fuel prices are maintained at a 14-day average after India adopted the daily pricing mechanism as a part of the fuel price deregulation.

According to a note released by Goldman Sachs, as per the Bloomberg report, the flare up in the US-Iran tension may be keeping oil prices elevated, but an actual disruption to global crude supplies is needed to keep the prices at current levels for long. “Oil was already trading above the bank’s fundamental fair value of $63 a barrel prior to the attack, buoyed by an over-enthusiastic December risk-on rally despite limited evidence of an acceleration in global growth.”

Further commenting on the global oil industry’s ability to bounce back even in case of actual attack, Goldman added, “The September strike on key oil producing facilities in Saudi Arabia indicated that the market has significant supply flexibility. There is only moderate upside from current levels, even if an attack on oil assets actually occurs.”

How does rise in oil prices affect the Indian economy?

Any increase in the price of crude oil is always going to be a cause of concern for India considering the country imports more than 80% of its oil requirements. In the current financial year, India has imported 4.5 million barrels per day of crude oil between April-November 2019. India's import dependency based on consumption has increased to 84.5% compared to 83.3% a year ago, says CARE Ratings.

- At the macro level with imports of 1,634 million barrels of crude oil in FY2020, a dollar increase in prices on a permanent basis would increase the bill by roughly $1.6 billion per annum.

- Increase in crude prices also has a significant impact on inflation

- Crude oil and its products have a weight of 10.4% in the Wholesale Price Index

- In terms of the Consumer Price Index, fuel related items have a weight of nearly 2.7-2.8% directly.

Therefore, ahead of the Union Budget 2020 next month, oil prices could pose an additional challenge for the government and motorists.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

07 Jan 2020

07 Jan 2020

9564 Views

9564 Views

Autocar Professional Bureau

Autocar Professional Bureau