Petrol screams past Rs 113, diesel at Rs 104 a litre, 25-30% costlier than aviation turbine fuel

Fuel prices keep hitting new highs, hiked for third day in a row; compared to ATF at Rs 77.33 a litre, petrol costs 31% more and diesel 25% more.

Even as IPL wrapped up earlier this month and the cricketing world gets ready for the T20 World Cup which opens today, petrol and diesel are scoring ‘runs’ merrily, keeping the ‘score’ ticking every other day. Between yesterday and today, petrol has turned even costlier – by 34 paise – and diesel by 37 paise a litre for motorists in Mumbai.

Their fossil fuel-using brethren in the three other metros will also have their wallets lightened by similar amounts (see detailed price table below) following the price rise for the third day in a row.

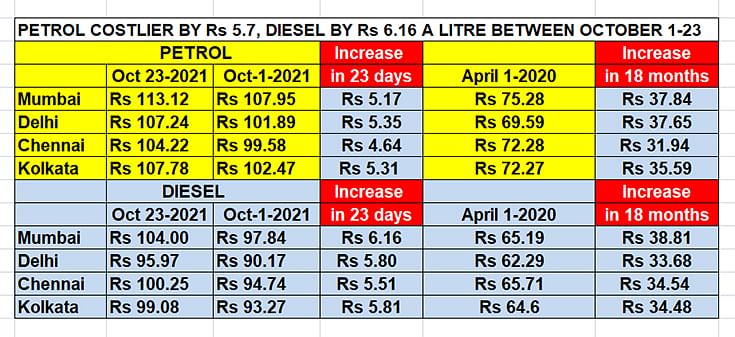

Over the first 23 days of October, the price of petrol has risen by Rs 5.7 a litre and that of diesel by 6.16 a litre in Mumbai. Depending on the level of state taxes (VAT), fuel prices differ across the country. Nonetheless, petrol is priced at over Rs 100 a litre in most parts of India while diesel has also hit the ‘century’ in over a dozen states and Union territories including Maharashtra, Andhra Pradesh, Telangana, Madhya Pradesh, Gujarat, Bihar, Karnataka and Kerala.

Over the first 23 days of October, the price of petrol has risen by Rs 5.7 a litre and that of diesel by 6.16 a litre in Mumbai. Depending on the level of state taxes (VAT), fuel prices differ across the country. Nonetheless, petrol is priced at over Rs 100 a litre in most parts of India while diesel has also hit the ‘century’ in over a dozen states and Union territories including Maharashtra, Andhra Pradesh, Telangana, Madhya Pradesh, Gujarat, Bihar, Karnataka and Kerala.

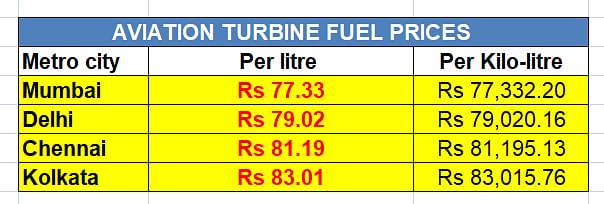

Interestingly, petrol and diesel cost far more than aviation turbine fuel (ATF) which is sold to airlines and on which aircraft are tanked up. The price of ATF, applicable from October 16, is Rs 77,332.20 a kilo-litre (1,000 litres) or Rs 77.33 a litre – which makes it costs Rs 35.79 (or 31.63%) cheaper than petrol and Rs 26.67 cheaper than diesel (or 25.64%) that is sold to motorists in Mumbai.

Highly taxed fuels: 54% for petrol, 48% for diesel

While there is little doubt that the daily petrol and diesel price increases are a result of soaring global crude oil prices – Brent crude is currently riding high at S85.71 a barrel (up from $84.84 a barrel on October 16), there is now a case for both the Central and state governments to seriously consider reducing taxes on these two fuels.

Unless the Central and State governments, which both levy stiff taxes on the two fuels, step in to cool the continuous price rise motorists will continue to pay the wallet-busting price at the fuel station. What’s more, in its meeting last month, the GST Council did not take any decision to bring these fuels under its purview.

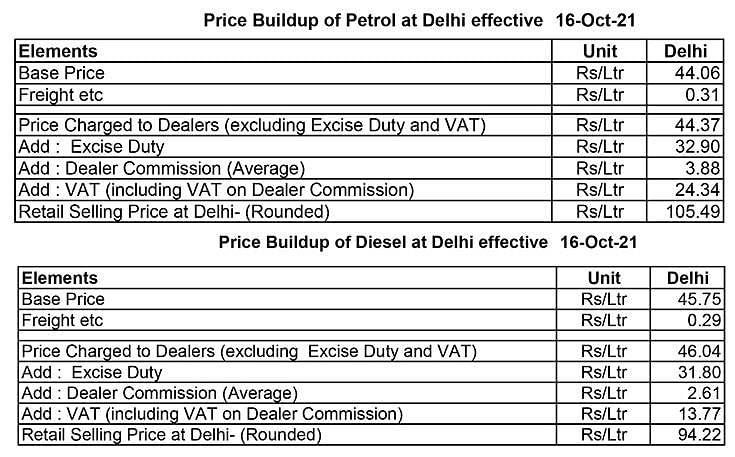

Take a look at the current taxation of petrol and diesel – both Central and State (as of October 16, 2021) – and you know why the motorist in India continues to fork out plenty of money for a litre of fuel. For instance, (on October 16), in Delhi, when petrol cost Rs 105.49 a litre, 31% (Rs 32.90) comprised excise duty and 23% (Rs 24.34) is State VAT (Value Added Tax). Club the two taxes and motorists are paying Rs 57.24 or 54% of each petrol litre as tax.

As regards diesel which cost Rs 94.22 a litre, the excise duty component is Rs 31.80 or 33.75%, while VAT is Rs 13.77 or 14.61% of the retail price. Together, the two taxes account for Rs 45.57 or 48% of the price a motorist pays to tank up on diesel. Since October 1, when diesel cost Rs 90.17 a litre in the capital city and included total taxes (excise + VAT) of Rs 44.99 or 49.89% of retail price, combined taxes have reduced by one percent

In FY2021, the Centre got Rs 334,894 crore excise duty from petrol and diesel. As Autocar Professional's Murali Gopalan wrote recently in his fuel pricing analysis, from the Centre’s point of view, it is only too well known that petrol and diesel account for a significant part of its revenue streams more so at a time when GST collections are little to write home about.

State governments across the country too mopped up significant revenue from taxes on petrol and diesel. States are also financially fragile which also puts in perspective the imperatives of levying value-added tax on auto fuels. While everyone is busy mopping up revenue during a difficult Covid period, it is the customer who is suffering silently. Or is being compelled to think electric. Meanwhile, CNG prices are also going up but that is a different story.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

23 Oct 2021

23 Oct 2021

6840 Views

6840 Views

Autocar Professional Bureau

Autocar Professional Bureau