November two-wheeler sales in slow lane as OEMs prepare for BS VI transition

Most two-wheeler companies clocked double digit drop in November sales but Bajaj Auto clocks highest ever monthly exports and Suzuki sees green in an otherwise muted market.

Like the passenger vehicle and commercial vehicle segment, the Indian two-wheeler sector is actively engaged in the technology shift to BS VI emission norms. Given the large number of models and their variants across commuter, executive and premium sub-segments, almost all OEMs are putting their shoulder to the BS VI wheel.

In the April-October 2019 period, total two-wheeler sales comprised 11,453,997 units, down 15.92% year on year. While scooters at 3,697,553 units are down 15.90%, motorcycles are down 15.34% with 7,363,858 units. Moped sales, with TVS as the sole player, are 25% at 392,586 units.

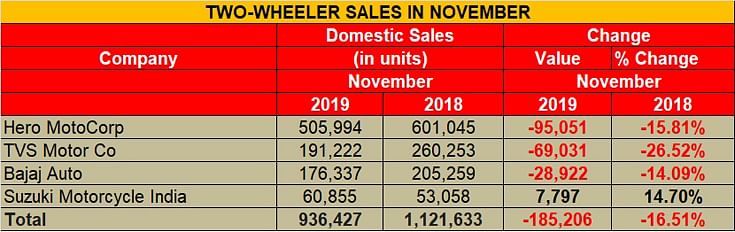

Now, with some two-wheeler OEMs announcing their sales / despatch numbers for November 2019, it looks like sales will continue to remain in slow lane for the next few months if not till beyond Q1 of FY2021. November numbers released by four leading OEMs — Hero MotoCorp, Bajaj Auto, TVS Motor Co and Suzuki Motorcycle India — show cumulative sales 936,417 units (November 2018: 1,121,633 units), a YoY drop of 16.51 percent.

Hero MotoCorp, which has rapidly expanded its global footprint to almost 40 countries across Asia, Africa and South & Central America, clocked 15.81 percent drop in November sales at 516,775 units (November 2018: 601,045 units). The OEM adds that it has scaled up the production of its BS VI vehicles, while discontinuing the production of several BS IV models in an effort to migrate seamlessly to the new emission era. The company has stopped production of more than 50 BS IV variants while rapidly increasing the production of BS VI vehicles.

Bajaj Auto has reported sales of 176,337 motorcycles in India, down 14 percent (November 2018:). But even as the motorcycle manufacturer rides out the storm in the domestic market, it stands secure in the fact that it is well buttressed by its strong export market performance. Bajaj Auto registered its highest-ever monthly export sales in November 2019 – 167,109 units, a sharp 18.27% year-on-year growth (November 2018: 141,285).

TVS Motor recorded the sharpest drop in the two-wheeler space. The November sales numbers are down 26.52 percent at 191,222 two-wheelers (November 2018: 260,253 units).

Suzuki Motorcycle India, which has been recording robust growth despite a dampened market scenario, has notched 14.7% YoY growth in domestic market sales last month (November 2018: 53,058). Commenting on the sales performance, Koichiro Hirao, MD, Suzuki Motorcycle India said, “Suzuki has maintained a momentum of accelerated growth after the festive season. We have also forayed into pre-owned two-wheelers business with the launch of ‘Best Value’ showrooms in Bangalore, Aizawl and Surat.”

Also read: India's GDP slows to 4.5% in Q2 FY2020, M&HCV sales to continue to bear the blow

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Dec 2019

02 Dec 2019

14896 Views

14896 Views

Autocar Professional Bureau

Autocar Professional Bureau