Normal monsoon to help tractor sales to see just 1% drop

CRISIL says the rural supply chains for tractors have been quick to bounce back from the lockdown, too, with more than 75 percent dealerships having reopened.

The automotive industry in India may have witnessed one of the worst periods in a decade, and the ongoing Covid-19 pandemic just further added to it. But going by the gradual restarting of industry, and expectation of a well-distributed and normal monsoon – as forecast by the Indian Meteorological Department (IMD) recently – rating agency CRISIL expects there will be just 1 percent contraction in tractor sales volumes this fiscal.

The company says despite a 37 percent YoY decline in April and May combined, tractor volumes will likely be barely a percent below last fiscal’s level, in sharp contrast to a double-digit decline expected for the rest of the automobile industry. That, and lower raw material costs and strong balance sheets bode stable credit outlook for tractor makers this fiscal.

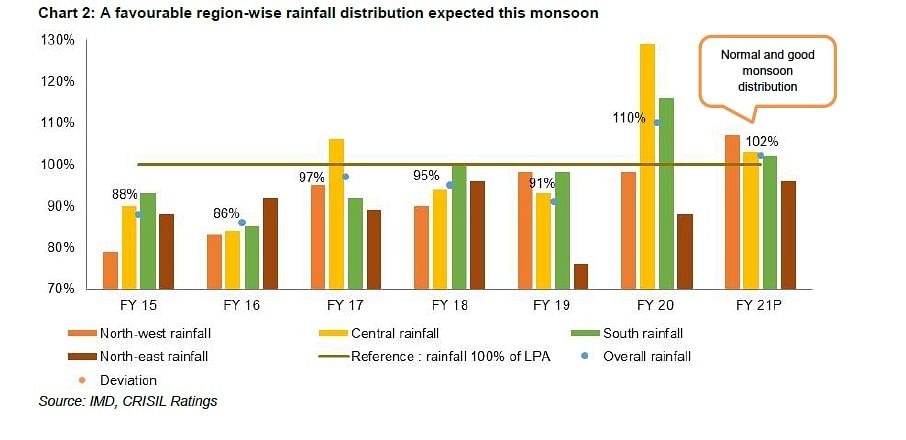

The IMD has forecast the south-west monsoon to be at 102 percent of the long period average (LPA) in calendar 2020. Crucially, it sees rains well-distributed at 96-107 percent of the LPA in all the four regions. The monsoon’s approach so far has been timely with rains 21 percent above normal in June to date. The forecast for July and August – crucial months for kharif crop – is also encouraging at 103 percent and 97 percent respectively.

Manish Gupta, senior director, CRISIL Ratings said: “Apart from overall adequacy, monsoon needs to be spatially well-distributed – by geography and timeliness (June-September) – to propel farm incomes and stoke demand for tractors. The IMD’s forecast is very encouraging for tractor volumes this fiscal.”

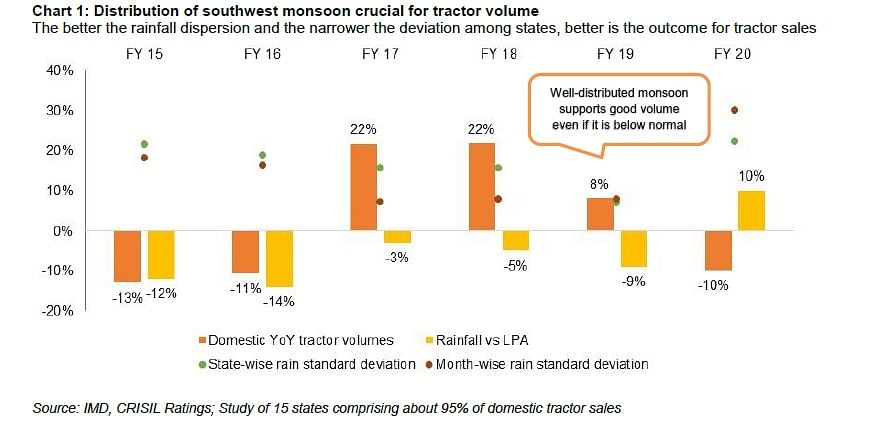

The rating agency says that the favourable distribution of rains can even offset the adverse impact of a below-normal monsoon, such as in fiscal 2019 when domestic tractor sales volume grew a strong 8 percent on a high base and despite monsoon being 9 percent below the LPA. In fiscal 2020, on the other hand, poor month-wise distribution and large state-wise variation in rains – despite an above-average monsoon season overall – contributed partly to a 10 percent decline in tractor sales volume.

Additionally, agriculture will be supported by high reservoir levels, seen at a massive average of around 94 percent higher than last year and 71 percent above the average of the past decade. The recent hike in minimum support prices (MSP) for major crops by 3-8 percent this kharif season also augurs well for rural incomes – more so as this follows a bumper Rabi crop. While the recent locust attack could still play spoilsport, it came when most of the Rabi crop had been harvested, and sowing was yet to commence for the kharif season.

Operating profitability for OEMs to remain strong at 15%

CRISIL says the rural supply chains for tractors have been quick to bounce back from the lockdown, too, with more than 75 percent dealerships having reopened. That, along with some pent-up demand from March, led to 4 percent growth in domestic tractor sales volume in May, despite the impact of the pandemic.

The sustained volumes, combined with benign raw material prices (80% of total costs), will support tractor profitability (EBIT margins) this year. The prices of key inputs such as steel and iron are expected to reduce by 4-6 percent, which would provide manufacturers the headroom to increase discounts to stimulate volumes, if needed. Incidentally, even in fiscal 2020, lower commodity prices had helped the industry maintain margins despite a 10 percent volume decline.

Naveen Vaidyanathan, associate director, CRISIL Ratings said: “Operating profitability of tractor makers should remain strong at 15 percent this fiscal. Given limited capex needs, credit profiles are expected to remain healthy, with the debt-to-equity ratio for the industry likely to sustain below 0.1 time.”

CRISIL says the pandemic’s progress, the distribution and volume of rains, and timely containment of the locust attack will be key monitorable from here.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

29 Jun 2020

29 Jun 2020

7002 Views

7002 Views