Maturing India car market sees shift to higher pricing dynamics of Rs 10 lakh and beyond

A big shift in favour of higher-priced SUVs has taken the average vehicle selling price to higher than Rs 10 lakh, indicating the ability of the growing middle-class to withstand a 15-20% rise in average selling price thanks to rising per capita

In what is a sign of the Indian market maturing and graduating to the next level, the average retail price of a car or an SUV sold in the country has exceeded Rs 10 lakh for the first time ever and, in 2022, touched Rs 10.32 lakh price band.

A big shift in favour of higher-priced SUVs has taken the average vehicle selling price higher than Rs 10 lakh for the first time. This rise has come in tandem with market growth, indicating an ability of the growing middle-class to withstand 15-20% rise in average selling price thanks to rising per capita. They are not only fulfilling their necessity of personal mobility but are also fulfilling their aspiration of owning a vehicle.

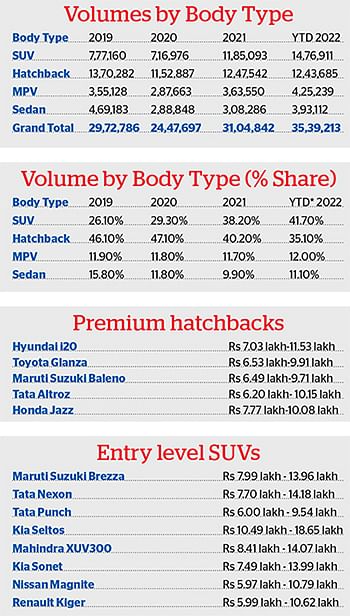

As per the analysis done by Jato Dynamics India, the core of the market has shifted from the Rs 500,000-to-Rs 10 lakh bracket to the Rs 10 lakh-to-Rs 15 lakh slot. In CY2021, about 1.8 million vehicles or 58% of total sales were in the Rs 500,000 to Rs 10 lakh bracket; this fell to 45% in CY2022, with vehicles priced from Rs 10 lakh to Rs 20 lakh and above accounting for over 55% of the overall market.

Ravi Bhatia, Managing Director of Jato Dynamics India, says the price is driven by technology, regulation and OEM pricing power. Also, the popularity of the SUV body style has allowed OEMs to realise higher prices. “As the supply chain was disrupted over the last few years, carmakers struggled to meet demand. However, with supply catching up now, we are beginning to see discounts and expect to see fewer price increases in 2023,” said Bhatia.

Data Source: Jato Dynamics India

Growing demand for aspirational products

Despite the recent disruption due to Covid-19 issues, economic growth in India has been one of the highest in the world between 2008 to 2018. The disposable income has been rising and along with a positive sentiment, it has created a demand for aspirational products.

Maruti Suzuki India's Shashank Srivastava: "Over the past few years, the propensity to spend is more than propensity to save. It is certainly linked to the younger population, who have more exposure to a globalised world and have a greater confidence in the nation to grow."

Maruti Suzuki India's Shashank Srivastava: "Over the past few years, the propensity to spend is more than propensity to save. It is certainly linked to the younger population, who have more exposure to a globalised world and have a greater confidence in the nation to grow."

The significant spike in demand is the cumulative effect of the pent-up demand seen in the past two years. Shashank Srivastava, Senior Executive Director, Sales and Marketing at Maruti Suzuki says average prices have been moving up due to increased regulatory costs, growing technology features, commodity prices, rise in registration and road taxes and insurance but what gives him confidence is the change in attitude towards consumption after Covid-19.

“Over the past few years, the propensity to spend is more than propensity to save. It is certainly linked to the younger population, who have more exposure to a globalised world and have a greater confidence in the nation to grow,” said Srivastava.

Industry players say that the rise in discretionary items happens when the overall sentiment is positive and there appears to be a structural change that might have happened on the consumption front.

There is an attitude towards progress in the future, the young demographic believes in spending for today unlike the past. “Youth is very clear, they are not bothered, their disposable income has gone up, the confidence is more, consumers are less hesitant to buy high value items and financing is considered as a positive thing,” explained Srivastava.

The financing cost has come down with longer tenure and flexible repayment terms. The attitude towards financing has changed. Earlier borrowing was considered a taboo in the savings-led economy. However, over the past decade, borrowing is seen as a logical decision with the spending basket getting diversified with the rising aspiration levels.

Srivastava says the effect of price increase is much lower on the high end and high on the lower end. “The price elasticity also depends not only on income level, but also the external environment. In socio-cultural price elasticity, a perceptible change is visible, the nation is becoming younger and the youth of India believes in living for the moment — which has led to a significant shift from saving to a spending economy,” felt Srivastava.

Experts say given the price elasticity and the younger demographics, it is possible that a numbers of two-wheeler customers can move up to the four-wheeler market if income growth is more secular. In other words, there could be a separate huge lift in car demand, which may pan out as the nation moves towards its vision of a $5 trillion economy.

Feature-laden cars driving up prices

The average prices have been moving up due to additional features like ABS, airbags and emissions’ kit mandated by regulators. Besides, consumers are also ordering cars with additional features and are willing to fork out the extra money for them.

Twenty percent of Hyundai Motor India’s PV sales comprise cars equipped with an automatic transmission, 26% come with a connected feature, and 38% with a sunroof. Increasingly, these features are becoming hygiene factors. Along with features, design has become a more important factor. The buying consideration is shifting from just functional factors to a complete package.

Hyundai Motor India's Tarun Garg: “Customers are no longer willing to compromise. They want everything – connectivity, space, technology, sunroof, automatic transmission – and want to fulfil both their functional as well as aspirational needs."

Hyundai Motor India's Tarun Garg: “Customers are no longer willing to compromise. They want everything – connectivity, space, technology, sunroof, automatic transmission – and want to fulfil both their functional as well as aspirational needs."

Tarun Garg, Director, Sales and Marketing at Hyundai Motor India, says buyer aspirations are rising and customers want higher trims and modern features. He believes the journey towards the Indian market maturing is accelerating and, in a trend akin to global markets, there is a shift towards SUVs, EVs and cars with a higher level of connectivity. This clearly highlights that the gap between the expectations of buyers globally and in India has definitely come down in the last two years.

“The Indian market is moving towards global maturity but at the same time the car penetration is still at around 30 cars per thousand people, which shows we have a long way to go yet. A lot of credit for the shift in demand towards bigger cars goes to development of road infrastructure. These are signs of the market taking off, the Indian market is expected to grow faster than many other global markets,” added the head of sales and marketing at Hyundai.

There is a clear shift towards bigger cars, higher trims, technology features like ADAS and connectivity features – this is in line with the needs of the global markets.

According to Garg, “Customers are no longer willing to compromise. They want everything – connectivity, space, technology, sunroof, automatic transmission – and want to fulfil both their functional as well as aspirational needs."

For Hyundai Motor India, for whom 45% sales come from the over Rs 10 lakh price bracket, has seen the average age of buyers falling. The share of buyers less than 30 years old has almost doubled to 24% in the last four years.

Experts say, the Indian market is more connected and globalised now thanks to the internet, exposure to foreign countries and frequent travel which has accelerated that maturing process. Earlier a feature would take years to translate into the Indian market to fit the wallet of the domestic buyers, today all the features are either introduced within a few months or at the same time.

Given people’s ability to pay more, which was also supported by lower interest rates, a lot of first-time buyers have jumped straight to SUVs, which are traditionally 50 percent to 100 percent higher priced in the majority of models in the Indian market. Vehicle makers started launching products with 15-17 versions of new products to straddle larger price segments, this a few years earlier was limited to three variants/trims. “The emphasis now is to present more options based on one model and straddle a wide price range,” concluded Jato Dynamics India's Bhatia.

ALSO READ:

Records tumble as Indian carmakers notch best-ever sales of 3.8m units in 2022

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

05 Jan 2023

05 Jan 2023

12057 Views

12057 Views

Autocar Professional Bureau

Autocar Professional Bureau