Maruti Suzuki India clocks best-ever sales in FY2019: 1.75m units domestic, 1.86m overall

The company, which is targeting combined sales of 2 million PVs in the year FY2020, is about 137,551 units short of that milestone in FY2019.

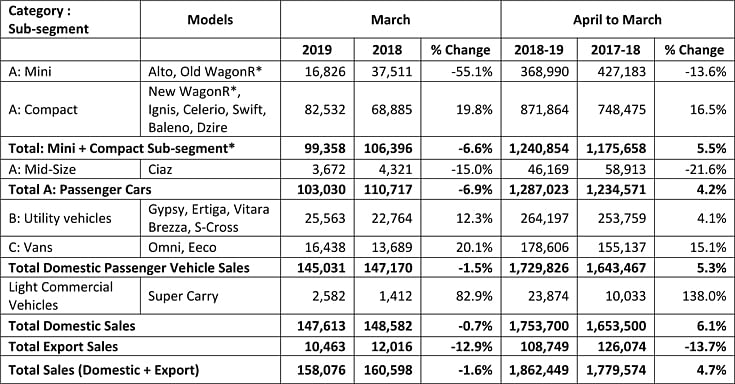

Maruti Suzuki India, the leader in the domestic passenger vehicle segment with an overall market share of over 51 percent, has sold a total of 1,729,826 units in FY2019, the fiscal year ended March 31, 2019. This marks 5.3 percent year-on-year growth (FY2018: 1,643,467). The numbers could have been better but for demand slacking for the entry level Alto and old Wagon R hatchbacks.

Domestic, LCV and export sales combined, Maruti Suzuki India has reported total numbers of 1,862,499 units, which constitutes 4.7 percent YoY growth (FY2018: 1,779,574). The company, which is targeting combined sales of 2 million PVs in the year FY2020, is about 137,551 units short of that milestone in FY2019.

Nevertheless, the company has ended FY2019 with its highest ever total sales of 1,862,449 units and highest ever domestic sales of 1,753,700 units.

Let’s take a closer look at how the sales came about segment-wise for the carmaker in FY2019. A big dampener came in the form of a sharp drop in demand for the entry level duo of the Alto and old Wagon R, whose sales of 368,990 units were down 13.6 percent on FY2018 (427,183). However, the six-car group of the new Wagon R, Ignis, Celerio, Swift, Baleno and Dzire made up for that with sales of 871,864 units, a smart growth of 16.5 percent (FY2018: 748,475). Consumer demand for the premium Ciaz sedan seems to be slowing – at 46,169, sales in FY2019 were down 21.6 percent on FY2018 (58,913).

On the utility vehicle front, thanks to continued demand for the No. 1 best-selling UV in the country – the Vitara Brezza – Maruti has clocked a 4.1 percent YoY increase in sales. The Brezza, along with the Ertiga MPV, Gypsy and S-Cross, sold a total of 264,197 units (FY2018: 253,759).

Demand for Maruti Suzuki’s vans – Omni and Eeco – continues to grow at a good pace, given the sales of 178,606 units, up 15.1 percent YoY (FY2018: 155,137).

Super Carry shines, exports down 13.7 percent

Maruti Suzuki India’s entry vehicle in the LCV segment – the Super Carry – has posted a robust performance, albeit it could have been better given the company’s standing in the Indian market. The Super Carry sold a total of 23,874 units, up 138 percent (FY2018: 10,033).

Maruti Suzuki has faltered on the export front, presumably because it has been busy feeding demand in the domestic market. In FY2019, the company shipped a total of 108,749 units, down is down 13.7 percent on the year-ago numbers (FY2018: 126,074).

Flat growth in March 2019

In the month of March, the company sold a total of 147,613 units as against 148,582 units sold in March last year, thus recording an overall decline of 0.7 percent.

What is rather alarming is the dramatic 55 percent slump in the sale of its entry-level models including the Alto and the Old Wagon R which collectively went home to 16,826 buyers (March 2018: 37,511). The shift could also be majorly due to the Wagon R shifting in its category from ‘mini’ to ‘compact’ with the new model launched in January this year gaining in dimensions and engine displacement.

The new compact category now comprises the Ignis, Celerio, Swift, Baleno, Dzire and the New Wagon R, which together brought in robust sales for the company, selling 82,532 units and registering growth of 19.8 percent (March 2018: 68,885). While the Ciaz continued with its slow run even in the closing month with net sales of 3,672 units (March 2018: 4,321 / -15%), Maruti’s UVs including the Gypsy, Ertiga, Vitara Brezza and the S-Cross clocked 25,563 units and grew a notable 12.3 percent (March 2018: 22,764). The two vans – Omni and Eeco – marched on in the fast lane with volumes touching 16,438 units (March 2018: 13,689) and growth being pegged at 20.1 percent.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

01 Apr 2019

01 Apr 2019

19655 Views

19655 Views