Maruti Suzuki clocks record sales of 1.65m units in FY2018

The company has driven past the 1.5 million sales mark for the first time and is resolutely headed for its target of 2 million sales in FY2020.

Fiscal year 2017-18 came to a close yesterday and the Indian passenger vehicle industry, along with the commercial vehicle and two-wheeler segments, is well set to notch record sales in the domestic market. Yes, FY2018 bids fair to be the best-ever fiscal for the Indian automobile industry. The final numbers will be known next week when apex automobile body SIAM announces the sales for March 2018 and FY2018.

This report is specific to the passenger vehicle (PV) industry and the reason for the optimism is that Maruti Suzuki India, the bellwether of the Indian PV industry, has announced record and its best-ever sales of 1,653,500 units, a 13.8% year-on-year growth on year-ago sales (FY2017: 1,443,641), which were its previous best in the domestic market.

Given Maruti's numbers, expect the overall Indian PV industry's sales in FY2018 to be around the 3.2 to 3.3 million units mark.

Interestingly, this figure is a a million units more (1,017,871) than the carmaker's sales in FY2007. Maruti sales first hit the million unit sales mark in a fiscal year in FY2011 and the company has never looked back since then (see 12-year sales details below).

MARUTI SUZUKI SALES IN INDIA

FY2007: 635,629

FY2008: 711,824

FY2009: 722,144

FY2010: 765,526

FY2011: 1,132,739

FY2012: 1,006,316

FY2013: 1,051,046

FY2014: 1,053,689

FY2015: 1,170,702

FY2016: 1,305,351

FY2017: 1,443,641

FY2018: 1,653,500

On the cumulative sales front, the market leader, which has an overwhelming 50.09% share of the PV market, sold a total of 1,779,574 units (domestic and exports) in FY2018, up 13.4% (FY2017: 1,568,603).

This number is just 220,426 units shy of the 2-million mark which is the number of new cars Maruti Suzuki has said it plans to sell by 2020. From the looks of it, that milestone could be attained before 2020 arrives, given the surging demand for Maruti models like the Baleno, Vitara Brezza and more recently the new Swift and also with new production capacity being generated at the Gujarat plant.

MODEL-WISE SALES IN FY2018

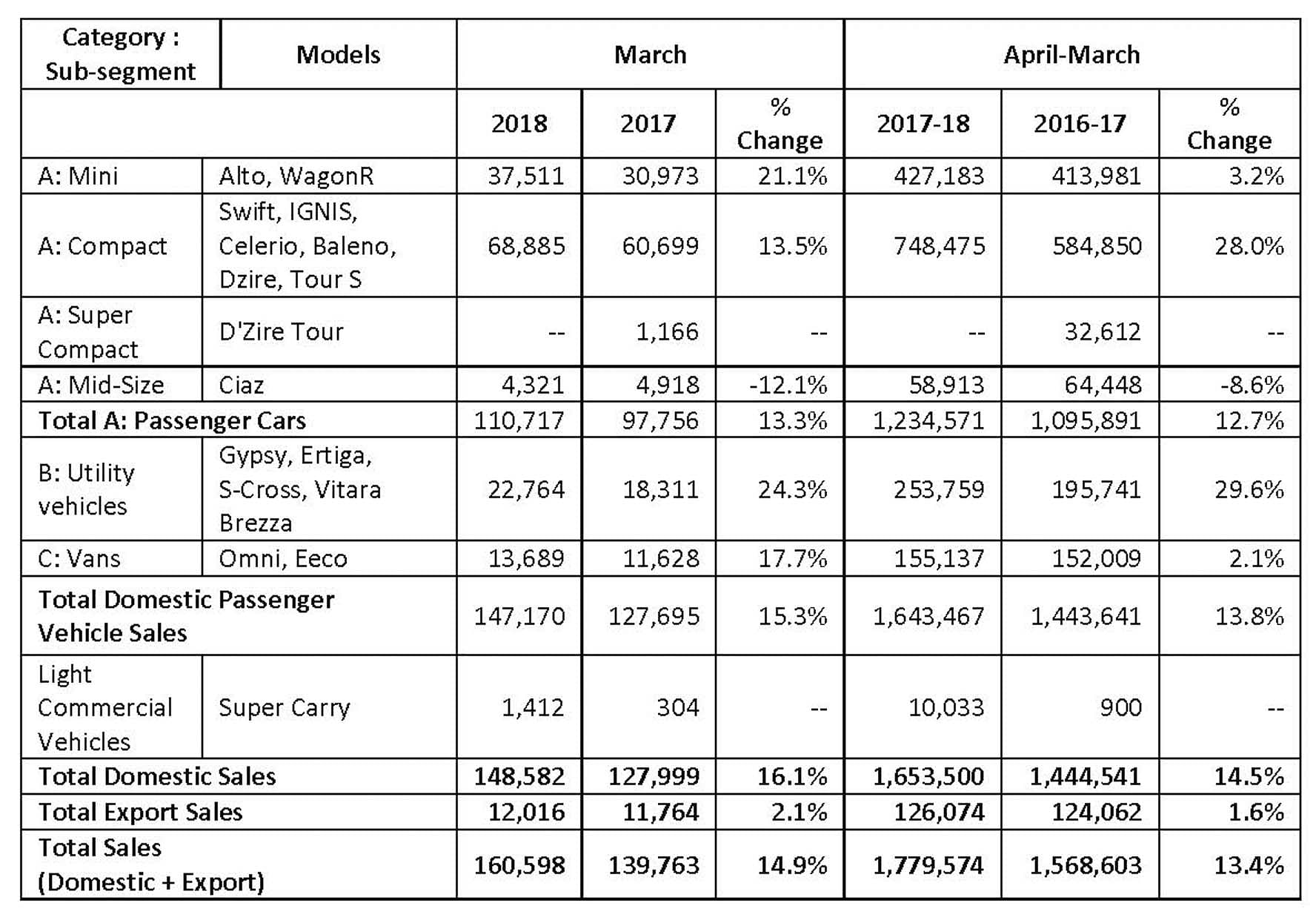

Let's take a closer look at the company's sales, model-wise, for March 2018 and also for FY2018.

In February 2018, the entry-level Alto and Wagon R siblings had registered nearly flat sales but in March demand picked up substantially for the duo to sell 37,511 units, up 21.1% (March 2017: 30,973). For FY2018, these two models together have sold 427,183 units, up 3.2% (FY2017: 413,981). The Alto, which has been the best-selling car in India for 14 consecutive years, recently entered a milestone-zone of its own when it surpassed sales of 3.5 million.

The quintet of compact cars (Swift, Baleno, Ignis, Celerio and Dzire) has seen accelerated sales in recent months, particularly after arrival of the new third-generation Swift following its launch at the Auto Expo. In March 2018, this lot sold a total of 68,885 units, up 1.5%, and cumulatively 748,475 units for FY2018, which is a robust 28% YoY growth (FY2017: 584,850)

Another growth driver for Maruti, and a massive one at that, is the UVs in the form of the Vitara Brezza, S-Cross, Ertiga and Gypsy. Here, the Vitara Brezza, the long-time leader in the Top 5 UVs, leads the charge. This quartet of UVs sold 22,764 units in March, a 24.3% YoY increase and a total of 253,759 units in FY2018, which marks sterling growth of 29% (FY2017: 195,741).

Maruti, which has a stranglehold on the passenger vehicle market with a 50.09 percent share, is attempting to do an encore in the UV segment where it currently has a 27.82% share, ahead of Mahindra & Mahindra's 25.21%.

If there is a worry for Maruti, which has a 'problem' of plenty of demand for most of its new models, then it is the Ciaz premium sedan. The Ciaz, which is now being sold through the Nexa premium car sales channel, its sales slide 16.8% to 4,897 units, and in March 2018 to 4,321 units, down 12.1% YoY (March 2017: 4,918).

In FY2018, the Ciaz was bought by 58,913 owners, which marks a sales decline of 8.6%(FY2017: 64,448). The new Hyundai Verna and the Honda City are giving it a tough time, and the fight is only set to become fiercer once Toyota introduces its Yaris sedan in the country in May 2018.

The two vans Omni and Eeco continue to see demand across the country and sold 13,689 units, up 17.7%. For FY2018, these two vans sold a total of 155,137 units, up 2.1% (FY2017: 152,009).

On the export front, Maruti Suzuki has had a subdued year, given that it is concentrating on rolling out cars for the domestic market. The company shipped a total of 126,074 cars overseas, which is a marginal increase of YoY 1.6% (FY2017: 124,0620.

As regards PV exports from India, Maruti will take third place. Ford India and Hyundai Motor India have been engaged in a pitched battle for No. 1 spot and the winner will be known when the two companies reveal their FY2018 numbers,

The detailed statistics of Maruti Suzuki India's sales performance in March 2018 and in FY2018 are depicted below.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

01 Apr 2018

01 Apr 2018

14356 Views

14356 Views

Autocar Professional Bureau

Autocar Professional Bureau