M&HCV segment weighs heavy on CV sector's performance in June

Delayed purchase decision, lesser vehicle offtake due to increased axle load norm and continuing liquidity issues mean critical medium and heavy CV market is taking a beating and thereby impacting overall numbers.

The month-on-month declining sales trend in the Indian automobile market continued in June 2019 with most passenger vehicle and two-wheeler OEMs reporting substantially reduced numbers. The sales scenario in the commercial vehicle segment is no different as despatches of heavy trucks and buses, and light and small commercial vehicles declined sharply with OEMs cutting down on despatches in view of lethargic customer demand and also to reduce rising inventory levels at dealer points.

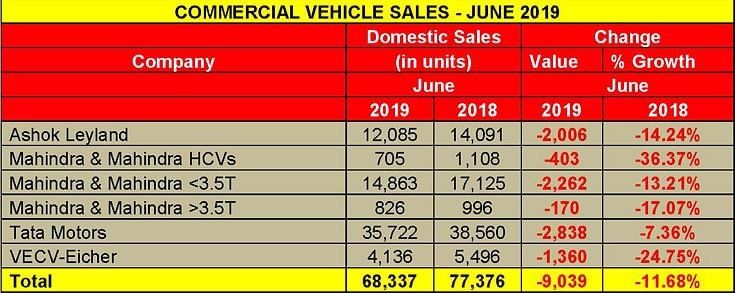

As per the wholesales numbers announced by various OEMs and Autocar Professional's, the top four CV players account for despatch of 68,337 units in June 2018, down 11.78 percent over year-ago figures (June 2018: 77,376).

Tata Motors and Ashok Leyland, the top two players in the critical M&HCV segment, have both registered a sales decline in June. Mahindra Trucks & Buses and VE Commercial Vehicles have seen their overall domestic sales post double-digit negative growth. Clearly, challenging times are back in the CV industry after around three years.

A high year-ago base effect, the recent increase in axle load norms with higher capacities in the market and delayed purchase decisions by fleet operators as well as drying up of finance due to the NBFC crisis are some of the factors that continue to impacting the CV sector adversely. The advancing monsoon across the country is also likely to impact transportation of goods, thus slowing down sales.

In the April-May 2019 period, total CV industry sales were 137,527 units, down 8.05 percent year on year (April-May 2019: 149,566). M&HCVs, which are the growth and margin drivers, sold 48,946 units, down 16.72 percent (April-May 2019: 58,773) while LCVs which include small CVs accounted for 137,527 units, down 2.44 percent YoY (April-May 2019: 149,566). From the looks of it, when the official June 2019 numbers come in from apex body SIAM next week, the fall just might be sharper.

How the OEMs fared in June

Like Maruti Suzuki is to the PV sector, Tata Motors is to the CV industry. In June 2019, Tata, the leader with an overall 41 percent share of the overall CV market, saw its numbers down by 7 percent at 35,772 units. (June 2018: 38,560).

Worryingly for the company, its M&HCV trucks have come under pressure, falling by 19 percent in the month to 9,358 units. Also, tipper segment sales have declined by 12 percent, indicating slowing activities in the infrastructure, construction and mining sectors. A positive for the company was the 3 percent growth in intermediate LCVs (ILCVs) with sale of 4,564 units and the commercial passenger carrier (bus) segment, which was up by 17 percent to 6,706 units.

Tata Motors’ popular cargo small CVs and pickups were down by 10 percent to 15,094 units.

Ashok Leyland registered a 14 percent drop in its overall domestic sales last month to 12,085 units (June 2018: 14,091). Like Tata, its M&HCV sales saw a double-digit 19 percent fall to 7,780 units; while truck numbers were down 23 percent, bus sales dipped by a marginal 2 percent. The LCVs too were not spared by the downturn, falling 4 percent YoY with sales of 4,305 units (June 2018: 4,475).

Mahindra Trucks & Buses’ overall sales were down by 15 percent to 16,394 units (June 2018: 19,229). M&HCVs were down by 36 percent to 705 units. CVs in the below-3.5T GVW segment sold 14,863 units, down 13 percent. (June 2018:17,125), and those in the above-3.5T GVW segment sold 826 units (-17%).

VE Commercial Vehicles’ sales declined by 24.7 percent June 2019, the company selling 4,136 units in the domestic market (June 2018: 5,496 units).

Growth outlook

The CV sector, which is keeping company with the PV and two-wheeler sectors in negative growth territory at present, will be banking on some relief – ideally a GST cut – from the upcoming FY2020-21 Union Budget to be announced on July 5. What could also give new legs to CV sales will be a good monsoon, continued spend on infrastructure by the government and the festive season which kicks in from September.

Finance minister Nirmala Sitharaman’s first Budget will be keenly watched because it has the potential to kick-start growth and in turn demand for CV services.

CV OEMs though will be keeping their fingers crossed that sales do not decline at a faster pace. Already engaged in the emission upgrade to BS VI, they have their hands full with the technology change and manpower training, what with also having to keep an eye open for the government’s electrification programme.

While it’s early days yet, OEMs will be looking forward to considerable pre-buying of BS IV vehicles months ahead of the BS VI mandate kicking in from April 1, 2020. Till then, however, they will have to contend with slow growth, fluctuation in diesel prices as politics dominates global crude supplies and an uptick in the domestic freight market. These constitute a number of variables, which means the sector will be navigating a potholed road for a few months more.

RELATED ARTICLES

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

VinFast’s second plant in Vietnam goes on stream ahead of India factory

Vietnamese EV maker’s second plant in its home market, which has a 200,000 EVs-per-annum capacity, will focus on produci...

Continental exits TBR market in India, shifts focus to car and SUV radials

German tyre manufacturer aims to tap the double-digit market growth opportunity for big SUV and luxury car tyres which w...

03 Jul 2019

03 Jul 2019

29169 Views

29169 Views

Autocar Professional Bureau

Autocar Professional Bureau