Luxury car owners in India showing preference for digital services: JD Power

Luxury car owners in India show growing preference for digital engagement with the OEM and authorised dealer.

Compared to owners of mass market cars, luxury car owners in India prefer non-intrusive and digital methods when scheduling future appointments, making payments and when receiving post-service follow-up from dealers. This information comes from the findings of the JD Power 2018 India Customer Service Index (Luxury) study, released today.

The study finds that while the majority of car owners say they will continue to schedule an appointment for their future service visits over the phone, 16 percent would prefer to schedule their appointments via the manufacturer’s website or app. Luxury car owners also have a preference for being kept informed of their vehicle’s service progress via digital methods, with 61 percent indicating a desire to receive updates via email/ text message or via a mobile app.

Kaustav Roy, regional director, Automotive Practice, JD Power said: “While personal interaction is still the most common way for customers to communicate with their service dealer, premium automotive manufacturers need to incorporate more digital methods that are transparent and time-efficient in order to engage with customers. With more younger buyers considering luxury models, the rules of doing business are rapidly changing. Luxury car manufacturers will have to continue to extend the focus on the brand-customer relationship and stay ahead of the curve by leading in areas of digital convenience.”

Key findings of the study

Home/ Office delivery after service improves satisfaction: The overall satisfaction among luxury car owners whose vehicle was delivered to their home/office after service is 40 points (on a 1,000-point scale) higher than among those who had to come back to the dealer to pick up their vehicle (916 vs 876, respectively).

Website/App issues deter customers from scheduling online: Most luxury car owners do not schedule their service via the internet. Among these owners, 53 percent said that the website/ app is difficult to use/ does not provide enough information and 36 percent shared that they didn’t schedule their service online because they needed the service to be carried out as quickly as possible, among other reasons.

Same-day service expected, preferably within three hours: The study found that nearly three-fourths (74 percent) of luxury vehicle owners had their vehicles serviced within the same day. Overall satisfaction among customers whose vehicle is ready in three or fewer hours is higher than among those whose service takes more than three hours (910 vs. 868, respectively).

Satisfaction with dealer service drives customer loyalty: Among vehicle owners who are highly satisfied with their dealer service (overall satisfaction scores of 966 or higher), 89 percent say they ‘definitely will’ revisit their service dealer for post-warranty service, compared with only 33 percent of highly dissatisfied customers (819 and lower) who say the same.

Mercedes-Benz India tops in aftersales

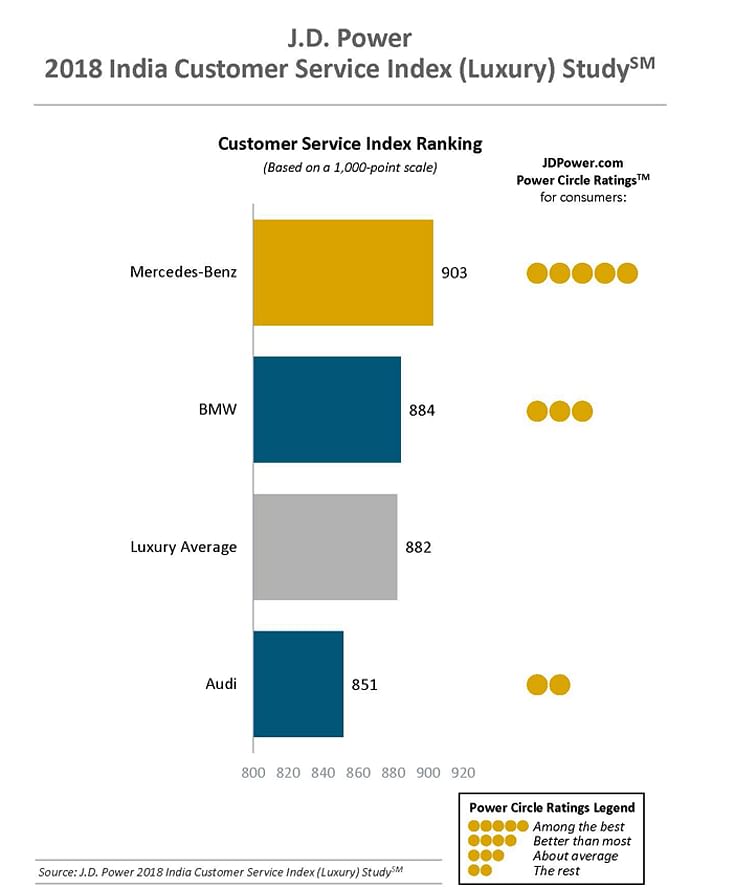

As per the study rankings, the German carmakers scored the most points when it came to customer satisfaction. The country’s largest luxury carmaker (in volume terms) Mercedes-Benz India ranks highest in aftersales service satisfaction, with a score of 903, followed by BMW India which scored 884 points.

The 2018 India Customer Service Index (Luxury) study is based on responses from 301 new-vehicle owners in the luxury segment who purchased their vehicle between March 2015 and August 2017. The study was fielded from March through August 2018.

Now in its sixth year, the study measures new-vehicle owner satisfaction in the luxury segment with the aftersales service process by examining dealership performance in five factors (listed in order of importance): service quality (30%); service initiation (18%); service facility (18%); service advisor (17%); and vehicle pick-up (17%).

Also read: India's luxury car market feels the sting of a challenging 2018

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

31 May 2019

31 May 2019

12845 Views

12845 Views