Indian component industry clocks highest-ever turnover in FY2022, grows 23%, trade surplus for first time

Sales to OEMs rise 22% on back of market recovery; trade surplus of $700 million for the first time as exports jump 43% vs 33% rise in imports; aftermarket grows 15% to Rs 74,203 crore

The Automotive Component Manufacturers Association of India (ACMA) has announced the findings of its performance review for FY2022. And it’s all good news – turnover is up 23% at Rs 4.20 lakh crore (US$ 56.5 billion), sales to OEMs grew 22% on back of recovery in the market; exports have jumped 43% along with 33% rise in imports to see trade surplus for the first time. And aftermarket sales have increased 15% to Rs 74,203 crore. To briefly put it, this sector is optimistic as the Indian economy revives and vehicle demand exhibits stability.

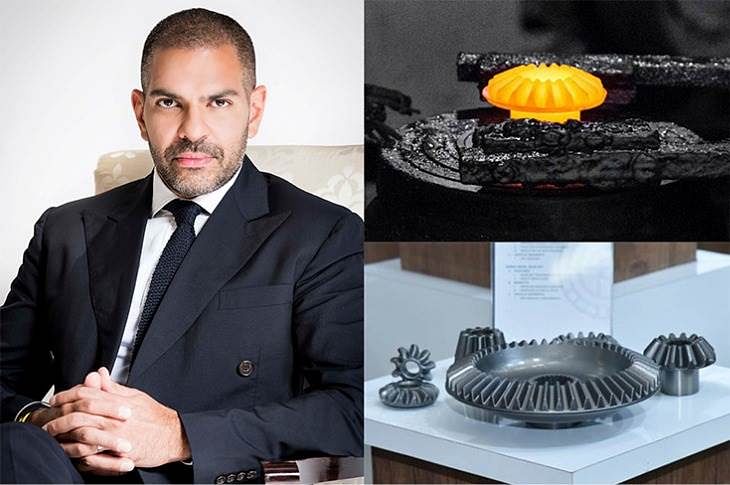

Commenting on the FY2023 performance, Vinnie Mehta, Director General, ACMA said, “Despite the supply-side issues, as vehicle sales and exports gradually gained traction, month-on-month, the auto component industry demonstrated a remarkable performance in FY2022. Significant growth was witnessed across all segments including supply to OEMs, exports as also the aftermarket."

He added, "In this backdrop the component industry sized up to Rs 4.20 lakh crore (US$ 56.5 billion) registering 23% growth, thus outpacing its highest ever turnover of Rs 3.95 lakh crore in FY2019. Exports grew by 43% to Rs.1.41 lakh crore ($19.0 billion) while imports grew by 33% to Rs.1.36 lakh crore ($ 18.3 billion) leading to trade surplus of US$ 700 million. The aftermarket, estimated at Rs 74,203 crore also witnessed a steady growth of 15%. Component sales to OEMs in the domestic market grew by 22% to Rs 3.41 lakh crore.”

Sunjay Kapur: "Increased value-addition to meet regulatory compliance, fast recovery in external markets and traction in the domestic market, both OEMs and aftermarket have contributed to the remarkable growth of the auto components sector in FY 2021-22.”

Sharing his insights, Sunjay Kapur, President, ACMA & Chairman, Sona Comstar said, “Whilst the automotive value-chain faced significant disruptions over the last two years in wake of the pandemic, vehicle sales, especially in the PV, CV and tractor segments now seem to have reached the pre-pandemic levels. Of late, there has been some moderation in the supply-side issues of availability of semiconductors, input raw-material costs and availability of containers. Increased value-addition to meet regulatory compliance, fast recovery in external markets and traction in the domestic market, both OEMs and aftermarket have contributed to the remarkable growth of the auto components sector in FY 2021-22.”

Elaborating on the mood of the industry and outlook for the near future, Kapur said, “Going forward, with a slew of new launches, vehicle sales are expected to gain traction during the festive season. Further, increased focus by the auto industry on deep-localisation and the announcements of the PLI schemes by the government on Advanced Chemistry Cell (ACC) Batteries and Auto & Auto Components will facilitate the creation of a state-of-the-art automotive value chain and aid in developing India into an attractive alternative source of high-end auto components. The component industry is also transforming itself as sales of two-wheeler and three-wheeler EVs gain traction. I am hopeful that the buoyancy in the market will continue through the year and that FY22-23 will witness a healthy performance.”

“Poor offtake of two-wheelers, increase in cost of insurance, high inflation, excessive fuel cost and extreme logistics costs are some of the issues of concern to the industry and do need urgent Government attention”, added Kapur.

Key findings of the FY2022 performance

Sales to OEMs: Component sales to OEMs, in the domestic market, at Rs.3.41 lakh crore grew 22% YoY. Enhanced raw material prices, consumption of increased value-added components and shift in market preference towards larger and more-powerful vehicles contributed to the increased turnover of the auto-components sector.

Exports: Exports rose 43% to Rs.1.41 lakh crore (US$ 19.0 billion) compared to Rs 0.98 lakh crore (US$ 13.3 billion) in FY2021. North America accounting for 32% of exports, saw a growth of 46 percent. Europe accounting for 31% and Asia for 25% grew 39% and 40% respectively.

The key export items included drive transmission and steering, engine components, body/chassis, suspension and braking.

Imports: Traction in the domestic market also reflected on imports of component into India. Component imports grew by 33% in FY2022 to Rs 1.36 lakh crore (US$18.3 billion) from Rs.1.02 lakh crore (US$ 13.8 billion) in FY2021. Asia accounted for 65% of imports followed by Europe and North America at 27% and 7% respectively. Imports from Asia grew 30%, while those from Europe by 39% and from North America by 36 per cent.

Aftermarket: Increased movement of vehicles post-pandemic and surge in demand for used- vehicles led to buoyancy in the aftermarket, across all segments. The turnover of the aftermarket in FY 2021-22 stood at Rs. 74,203 crore (USD10.0 billion) compared to Rs.64,524 crore (USD 8.7 billion) in the previous year.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

22 Aug 2022

22 Aug 2022

20857 Views

20857 Views