Q1 FY2019 (April-June 2018) was a confidence-boosting quarter for the Indian automobile industry, what with all vehicle segments firing on all cylinders. The passenger vehicle (PV) segment with near-20 percent growth has been one of the talking points.

As OEMs reveal their sales numbers for July 2018, the bullishness stemming from the strong Q1 is warranted even though in actual numbers year-on-year growth in July 2018 seems tepid. That’s primarily because the industry witnessed a sales surge a year-ago when GST-led tax benefits brought a boost to overall industry numbers.

July 2017 had seen overall PV sales soar to 298,997 units (+15.12%), following substantial tax cuts, which had kept customers withholding their purchase decisions to only materialise once the GST kicked in from July 1. A relatively high year-ago base means that even though OEs have sold decent volumes last month, their performance is overshadowed by July 2017 numbers.

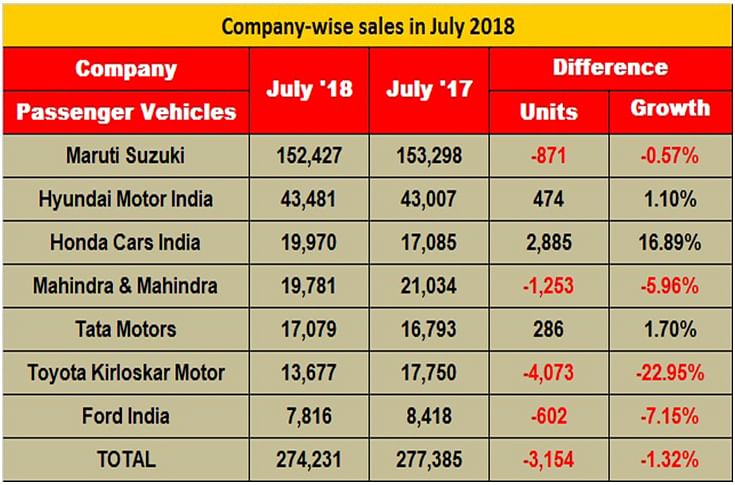

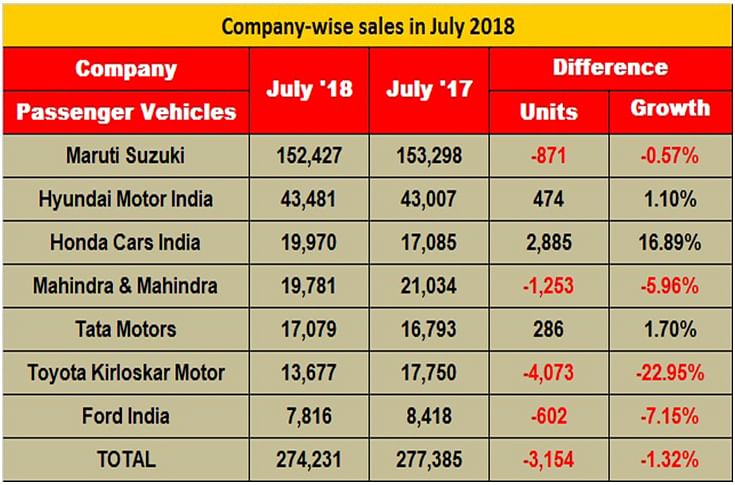

Maruti Suzuki India: India’s No. 1 carmaker registered cumulative domestic sales of 152,427 units, recording de-growth of 0.6 percent on a year-on-year basis (July 2017: 153,298), which is somewhat unusual for the bellwether of the Indian PV segment. Even though its growth is near-flat, Maruti is gunning strongly towards its aim of 2 million annual volumes by 2020.

Key drivers to Maruti’s volumes were the Swift and the Dzire siblings, as well as the Baleno premium hatchback, which has surpassed the 400,000 sales milestone since its launch in October 2015. Combined with the Ignis and the Celerio, the five compact cars collectively went home to 74,373 buyers, growing 17.8 percent (July 2017: 63,116).

Of these, however, the Swift and the Dzire remain the top grossers with the hatchback and the compact sedan siblings in their latest third-generation avatar having become hot customer favourites in their respective segments.

Its UV sales, on the other hand, coming on the back of Gypsy, Ertiga, Vitara Brezza and the S-Cross slumped marginally, with overall sales clocking 24,505 units (July 2017: 25,781). The decline, however, indicates at a likely production shift to better manage the strong initial demand for the new Swift, and also stability in the sales, of especially the Vitara Brezza, which contributes to over 60 percent of the company’s total UV volumes.

Hyundai Motor India: The No. 2 player by sales volumes, Hyundai Motor India sold 43,481units in July, remaining flat at 1.1 percent, when July 2017 sales stood at 43,007 units. The Korean carmaker has been seeing consistent demand for its i20 hatchback and the Creta SUV, and has recently unfolded a future new model strategy, eyeing introduction of 8 new products in the country by 2020, including EVs. The company also announced to expand the production capacity at its plant from the current 700,000 units to 750,000 units annually.

Mahindra & Mahindra: UV specialist, Mahindra & Mahindra (M&M) saw its sales decline with overall PV numbers at 19,781 units, down 5.96 percent (July 2017: 21,034). While sales of its passenger cars remained flat, at 1,902 units (July 2017: 1,882), UVs were down 7 percent, with volumes pegged at 17,879 units (July 2017: 19,152).

According to Rajan Wadhera, president, Automotive Sector, M&M, “The auto industry has been subject to certain uncertainties with the truckers strike and sluggishness on the retail front which has impacted the passenger vehicle segment. As we move into the festive season, we are confident of seeing a turnaround in the overall buying sentiment, coupled with the just- announced Mahindra Marazzo, which is scheduled for launch next month.”

Honda Cars India: In an otherwise scenario of low growth, Honda Cars India posted a robust performance, selling 19,970 units in the month, and growing a notable 17 percent (July 2017: 10,180), primarily on the back of good demand for the recently launched, second-generation Honda Amaze compact sedan. Between April and July 2018, the company has recorded overall sales of 62,579 units, registering a growth of 12.5 percent (April-July 2017: 55,647).

According to Rajesh Goel, senior VP and director, Sales & Marketing, Honda Cars India, “We have recorded our best-ever July sales, thanks to the overwhelming response to the all-new Amaze and sustained momentum for City and WR-V. We have been maximising the supply of the new Amaze to reduce its waiting time. The onset of festive season in many regions from August will give another boost to our sales and ensure sustained good performance in future months.”

Toyota Kirloskar Motor: Toyota Kirloskar Motor’s sales stood at 13,677 units, recording a substantial decline of 23 percent over the July 2017 numbers of 17,750 units. The UV segment, which, with its massive tax cut of around 12 percent with the implementation of GST, was supposed to be the biggest beneficiary of the regime, and had led to a dramatic 43 percent jump in Toyota’s sales a year ago.

The company largely remains a UV player, with its Innova Crysta MPV and the Fortuner SUV offerings contributing to the bulk of its volumes. The company has seen volumes of the Innova grow 21 percent between June and July 2018.

Ford India: The American carmaker registered cumulative domestic sales of 7,816 units in July, de-growing by 7.15 percent (July 2017: 8,418). While it had introduced the Freestyle cross-hatch in April, the company still garners majority of its domestic volumes through the EcoSport crossover, which, in its latest avatar offers ample kit in the form of 17-inch alloys, touchscreen infotainment system, sunroof as well as the famed 1.0-litre Ecoboost turbocharged petrol motor, which had been discontinued by the company for a while.

According to Anurag Mehrotra, president and managing director, Ford India, “The transport strike impacted both the production as well as shipment of Ford vehicles in July.”

Tata Motors: The company’s Passenger Vehicles Business Unit has reported domestic market sales of 17,079 units in July 2018, which is 1.70 percent YoY growth (July 2017: 16,793 units). Tata Motors says it continues to see strong demand for the Tiago, Tigor, Hexa and Nexon. The recently launched Nexon AMT has received an overwhelming response and is witnessing good traction in the market. Cumulative sales of PVs for the April-July 2018 are 70,016 units, a growth of 24 percent compared to 56,506 units for the same period, last fiscal.

From a volumes perspective, the industry is following a solid trajectory and also looks set to continue on its path. However, the lower YoY growth rates could still prevail in the coming months as well, given that the impact of GST on vehicle volumes had created a ripple effect and lasted well for a few months after July 2017.