India shifts to SUVs, sales cross 8 million units in 15 years

India’s SUV market has been firing on all cylinders for a while now. Some number-crunching reveals various interesting facts.

The one vehicle segment that took the least bit of a hit in the Covid pandemic year that was has been that of Utility Vehicles (UVs) or more commonly referred to as the Sports Utility Vehicle (SUV) segment. While all vehicle segments – Passenger Vehicles (17,77,874 / -16%), Commercial Vehicles (358,203 /- 37%), Three-Wheelers (130,601 / -74%) and Two-Wheelers (1,07,65,788 / -22%) – and their sub-segments have witnessed a double-digit sales year-on-year decline in the April-December 2020 period, the UV sub-segment is the sole one to see a single-digit fall in YoY sales (677,107 / -6.69%).

The reason is not difficult to fathom. In line with the global trend, the past few years have seen a surging wave of demand for this category of vehicle, particularly compact SUVs. Therefore, it is not surprising that most passenger vehicle (PV) OEMs, having recognised the huge potential in this segment, are rushing to introduce new products or strengthen their SUV portfolio.

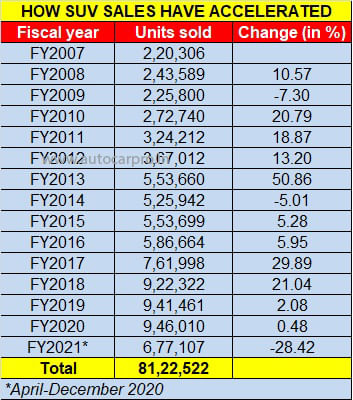

How SUV sales stack up since FY2007

Some number-crunching of 15 years of market sales reveals interesting highlights of the SUV market in India. From total sales of 220,306 units in FY2007, where UVs accounted for 16% of total PV sales, demand for this vehicle category grew massively to 946,010 units in FY2020, contributing to 34% of PV sales. The same 15-year period saw the share of passenger cars drop from 78% (10,76,582 units) in FY2007 to 61% (16,97,545 units) in FY2020.

Autocar Professional’s data analysis reveals that over 15 years – from FY2007 through to FY2021 (April-December 2020), a total of 81,22,522 units or 8.12 million UVs have been sold in India, accounting for 22% of total PV sales of 3,64,17,725 units till end-December 2020.

A glance at the statistic-laden table of the 8 million UVs sold since FY2007 reveals that while the first 4 million units took all of 10 years, the next 4 million units halved that to five years. What helped, of course, is the shift in consumer preferences and demand and the fact that from 25 UV models in FY2007, there are a total of 80 UV models in FY2021 and counting.

SUVs: the cars for all reasons and all seasons

The all-encompassing appeal of the SUV is not difficult to fathom. Bigger and taller than regular cars, they give the driver a better view of the road ahead – so important in a country like India. And, the raised ground clearance is always helpful when it comes to driving over rugged terrain.

Furthermore, being larger than hatchbacks and some sedans, they also pack ample storage space, have cavernous boots and have plenty of room at the rear to stretch out. Just right to be used as a family car. But big can also be small because with the advent of the sub-4-metre compact SUV category in India, these SUVs can easily manoeuvre through dense traffic and also fit into tight spots armed as they are these days with driving aids.

Tanking up is also not a hugely expensive affair as it used to be with SUVs in the past. OEMs and engine engineering have made huge advances over the years, which is why SUVs in recent years are both fuel efficient and also more eco-friendly.

Of course, when it comes to ride and handling, SUVs are the vehicle you’d like to have when you are driving in bad weather conditions or unknown roads. Sizeable weight, bigger and wider wheels and robust nature ensure they deliver improved grip and stability. Safety is paramount and today most SUVs come with ABS, EBD, ESP and even hill-hold and hill-descent control in some cases.

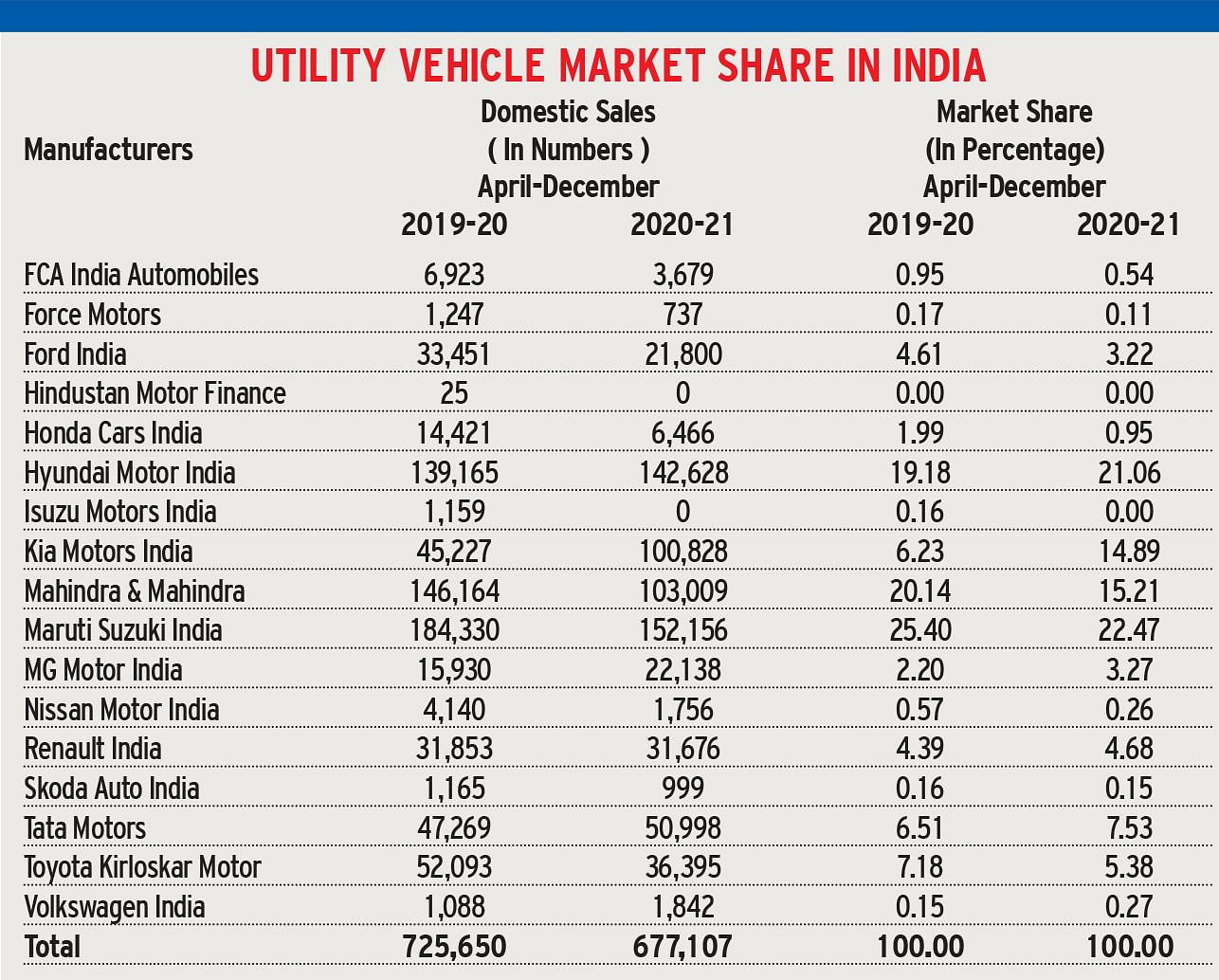

How the OEMs stack up, market share-wise

In a vehicle segment where sales are booming, rivalry can only be intense which is amply seen in the UV market share statistics for the April-December 2020 period (see detailed table below).

While Maruti Suzuki India, the UV market leader with 152,156 units has a 22.47% market share, a hard-charging Hyundai Motor India with 142,628 units is close behind with a 21.06% share. Mahindra & Mahindra, which had slipped one rank in April-November 2020, is back at No. 3 position with 103,009 units and 15.21%.

Kia Motors India, with 100,828 units and 14.81 units, is in fourth position – a remarkable achievement having launched its first product — the Seltos — barely 16 months ago. A resurgent Tata Motors, with 50,998 units is at No. 5 with a UV market share of 7.53%, up from 6.51% a year ago.

Things turn interesting when Hyundai and Kia sales and market share are clubbed together. With a total of 243,456 units, the two Korean OEMs have the majority UV market share of 35.95 percent.

Growth outlook: SUV-ival of the fittest

In line with world trends, the SUV wave will also continue in India as consumers look for a set of wheels that can prove to be do-it-all products. Being less vulnerable to traffic in the city due to their muscular build or having the inherent capability to wander anywhere over the weekends, SUVs are increasingly being preferred for their added benefits on the Indian roads compared to hatchbacks or sedans.

The booming SUV market is set to turn even more exciting this year what with the (clockwise from top left) Renault Kiger, Citroen C5 Aircross, Volkswagen Taigun and Skoda Kushaq slated to roll out.

Moreover, in India, demand for sub-four-metre compact SUVs seems insatiable and OEMs are going all out to introduce new products. 2021 will see a number of new models getting introduced including the likes of Mahindra’s new XUV500, Renault Kiger, Skoda’s Kushaq, Volkswagen’s Taigun and Citroen’s C5 Aircross. Clearly, lots of action on the UV front in 2021. Stay tuned to more number crunching coming your way.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

31 Jan 2021

31 Jan 2021

84915 Views

84915 Views

Autocar Professional Bureau

Autocar Professional Bureau