Five of India’s top 7 PV OEMs post robust gains in March and FY2018

With March sales numbers being announced, it’s amply clear that the automobile industry, as a whole, is set for a record performance with PVs pegged to cross the 3.2 to 3.3 million mark.

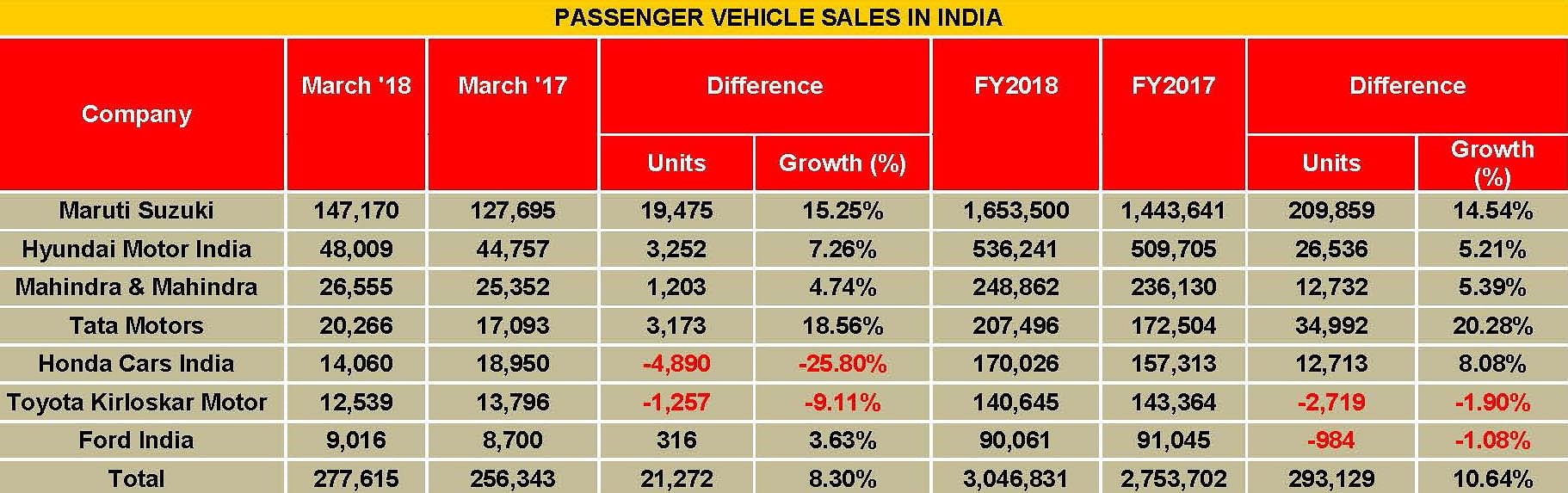

The Indian passenger vehicle segment has been performing consistently through the entire fiscal, posting smart growth right until February this year. Now, with March sales numbers being announced, it’s amply clear that that the automobile industry, as a whole, is set for a record performance, with PVs pegged to cross the 3.2 to 3.3 million mark, where the segment had just breached the 3-million mark in FY2017 with sales of 3,046,727 units.

While a host of exciting new products including the likes of Honda’s WR-V (March 2017), Maruti’s new Dzire (May 2017), Jeep’s Compass (July 2017), Hyundai’s Verna (August 2017) and Tata’s Nexon (September 2017) drove buyers into showrooms, it was in July 2017, when the country switched to the new GST regime, that gave wind to the sails of the PV segment with a substantial reduction in taxes as compared to the pre-GST structure.

Implemented from July 1, GST enabled price cuts in most PV categories, with cars benefitting by up to 8.6 percent (28% GST + 15% cess) and SUVs getting a massive breather of as much as 12 percent, coming down from the earlier 55 percent to the new 43 percent tax proposed under the new regime. While sales in July 2017 at 298,997 units rose 15.12 percent, the industry’s excitement was rather short-lived as the GST Council decided to revise the cess on SUVs and luxury cars (more than 4 metres long and with over 1200cc petrol/1500cc diesel engines) in August, from the erstwhile 15 percent to up to 25 percent. Nonetheless, with good market sentiments and an uptick in rural demand, the PV segment continued to march ahead in an accelerated mode until the end of the fiscal.

Maruti Suzuki India: This bellwether of the Indian PV industry has announced record and its best-ever domestic sales of 1,653,500 units, a 13.8 percent year-on-year growth on year-ago sales (April-March 2017: 1,443,641), which were its previous best in the domestic market.

The company registered sales of 147,170 units in the month of March, posting a notable growth of 15.3 percent (March 2017: 127,695). Overall, Maruti sold 1,779,574 units in FY2018 (Apriil-March 2017: 1,568,603 / +13.4%), with exports shipments accounting for 126,074 units (April-March 2017: 122,039) and growing 3.3 percent.

While sales for its entry-level segment offerings, the Alto and the Wagon R registered an uptick after experiencing a slight dip just in the previous month in February, the cars went home to 37,511 buyers in March, growing 21.1 percent (March 2017: 30,973). For FY2018, these two models together have sold 427,183 units, up 3.2% (FY2017: 413,981). The compact cars, on the other hand, including the Swift, Celerio, Ignis, Baleno and the Dzire registered a solid 13.5 percent growth with sale of 68,885 units (March 2017: 60,699). This lot sold cumulatively sold a total of 748,475 units through the entire FY2018, which is a robust 28 percent YoY growth (April-March 2017: 584,850).

The major contribution to these numbers could be attributed to the new third-generation of the Dzire compact sedan, which was introduced in May 2017, and set the sales charts on fire for the company. The car set a new record for the sub 4-meter sedan segment, selling a staggering 31,427 units in September 2017 alone, and surpassing the 100,000 units mark in October, within five and a half months of its launch.

On the other hand, Maruti’s sole C-segment offering, the Ciaz, has been reeling under times of trouble. The car clocked 4,321 units in March (March 2017: 4,918), witnessing a notable drop of 12.1 percent. The car has also seen its heydays, when it sold in much better numbers and clocked its best-performance in the fiscal in April 2017 with 7,024 units going home to buyers, with its diesel mild-hybrid variant bringing in the bulk of the sales. But, with the heavy tax levied on hybrids under the GST regime, the sedan has clearly borne the brunt with consistent slow sales through the rest of the year, only aggravated by stronger attack from rivals, including the latest Hyundai Verna.

UVs have been a soaring category in the PV segment, comprising over 27 percent of the total PV sales in FY2018. Maruti Suzuki, with its range of UV offerings led by the Vitara Brezza, has also made the best of the opportunity and seen substantial growth in the segment. Over the first 11 months of the fiscal, the company saw its UV market share surge from 25.93 percent to 27.82 percent, with cumulative sales of 230,995 units.

The pack of its five UVs, which includes the Gypsy, Ertiga, Vitara Brezza and the S-Cross, clocked 22,764 units in March, a sizeable 24.3 percent growth (March 2017: 18,311). The Brezza has been relentlessly charting Maruti’s way in the UV segment, consistently maintaining its top spot in the Top 5 UV charts month on month. The quartet cumulatively sold 253,759 units in FY2018, which marks sterling growth of 29 percent (April-March 2017: 195,741).

The two vans, including the Maruti Suzuki Omni and the Eeco sold a total of 13,689 units, putting out a considerable performance with a growth of 17.7 percent (March 2017: 11,628).

Hyundai Motor India: Hyundai Motor India closed FY2018 with sales of 48,009 units in March 2018, up 7.26 percent (March 2017: 44,757). The company registered its best-ever domestic sales in the fiscal and sold a total of 536,241 units between April-March 2018, registering a growth of 5.2 percent (April-March 2017: 509,705).

Hyundai introduced a couple of facelifts during the year through updates in its volume-grossing Grand i10 and the Elite i20 hatchbacks and also launched latest third-generation of the Verna sedan in August 2017. While the sedan has cumulatively sold 29,840 units since its launch, its popular sibling, the Hyundai Creta crossover has been one of the most successful contenders in the UV space and sold a total of 87,847 units in the first 11 months of FY2018 until February, averaging 7,986 units a month and saw its best monthly sales coming in July 2017 at 10,556 units. Launched in July 2015, the Creta has crossed the 250,000 milestone in March, coming up in less than two years of being on the roads.

According to YK Koo, MD & CEO, Hyundai Motor India, “With strong commitment to add brilliant moments to the lives of our customers through our modern premium product offerings and next level customer service experience, we have closed the financial year 2017-18 on a positive note with a growth of 5.2 percent and highest domestic volume of 5,36,241 units meeting our customer aspirations."

Mahindra & Mahindra: The home-grown UV specialist registered PV sales of 26,555 units for the closing month of March, recording a growth of 4.74 percent (March 2017: 25,352). Overall, M&M cumulatively sold 248,862 PV units in the fiscal, registering a growth of 5.39 percent (April-March 2017: 236,130).

Being a primary UV player, the company sold a total of 24,593 UVs in March 2018, a 3.21 percent growth (March 2017: 23,827). On the other hand, its passenger cars and vans including the Verito, Verito Vibe, e-Verito and the e2o Plus sold 1,962 units in total, posting 28.65 percent growth (March 2017: 1,525). M&M also brought in a slew of refreshes to its model line-up, with the popular Scorpio and the KUV100 getting their mid-life updates, which were more based on customer-feedback, than being generic aesthetic changes. While the Scorpio received a 16 percent performance bump with a 140bhp tuned engine, along with getting a host of plush features like smart entry and touch screen infotainment system on its newly introduced S11 variant, the KUV100, on the other hand, received aesthetic updates like revised tail lamps, to sort some of its visual customer dislikes.

M&M’s trusted workhorse – the utilitarian Bolero – a decade-old model which was once the undisputed king of the UV segment in FY2015-16 and had closed with sales of 67,484 units, again posted brisk performance in FY2018 and rose to the top to enter the list of Top 10 best-selling PVs in February, with sales of 8,001 units in the month.

Honda Cars India: The Japanese carmaker closed the fiscal with sales of 14,060 units in March, down a substantial 25.80 percent (March 2017: 18,950). However, cumulatively, for the fiscal it sold 170,026 units between April-March 2018, growing 8.08 percent (April-March 2017: 157,313).

The City sedan, which completed its 20-year journey of being a popular brand in the C-segment space in the country, and the WR-V crossover, together have been the shining stars for the company in FY2018. The Jazz-based WR-V, which was launched in March 2017, became an instant hit for the company selling 51,856 units in the fiscal and helping Honda single-handedly double its UV market share to 6.56 percent by end of February 2018, which stood at 3.17 percent a year ago. The City sold a total of 56,162 units in the entire 12-month period, contributing 33 percent of the company’s total sales.

According to the company, the WR-V has gained popularity across markets with its sales fairly distributed across regions. While Tier 1 markets, comprising large cities, contributed to 38 percent of its nation-wide sales, the model has found equally strong resonance from Tier 3 markets due to its aspirational value and product strengths like high ground clearance. The WR-V has seen maximum demand from North India (30%), followed by the western region (28%), then the eastern region (15%) and South India (27%). The top-end VX variant is the best-selling WR-V model and accounts for 80 percent of the vehicle's sales. The fuel-wise sale split for the WR-V till now is 42 percent petrol and 58 percent diesel.

While HCIL has experienced good growth during FY2018, the company has a slew of launches lined up, starting with the second-generation of its compact sedan, the Honda Amaze which was showcased at the Auto Expo in February and slated for rollout in the next couple of months. The Japanese carmaker later plans to introduce its premium CR-V crossover which will, for the first time, sport a diesel engine along with an automatic transmission.

Tata Motors: Tata Motors registered total PV sales of 20,266 units in March, recording a significant 18.56 percent growth (March 2017: 17,093) and closing the fiscal with cumulative sales of 207,496 units between April-March 2018, a notable 20.28 percent growth (April-March 2017: 172,504).

Tata launched a couple of new products in the fiscal, including the compact sedan sibling of its blockbuster Tiago hatchback – the Tigor, as well as the Nexon compact crossover. The company also introduced AMT options into the Tiago and the Tigor, which are accounting for good sales from urban sectors. While its passenger cars declined marginally by 4 percent, UVs, on the other hand, posted significant growth of 223 percent in the month of March.

Toyota Kirloskar Motor: The Japanese carmaker closed FY2018 with sales of 12,539 units, slumping 9.11 percent (March 2017: 13,796). The company registered cumulative sales of 140,645 units in the entire fiscal, however, de-growing at 1.89 percent (April-March 2017: 143,364).

Toyota’s immensely popular Innova Crysta MPV formed the bulk of the sales, contributing 52.44 percent of the company’s total sales until February 2018. On the other hand, sales for its Fortuner SUV grew a substantial 83 percent in FY2018, and the D-segment executive sedan, the Corolla Altis also saw a 16 percent growth in its numbers in the fiscal on a year-on-year basis.

According to N Raja, deputy managing director, Toyota Kirloskar Motor, “We are happy to have registered a positive growth of 3 percent in the first quarter of CY2018, as compared to January to March 2017. The customer bookings for the upcoming C-segment sedan Toyota Yaris will open from April and we expect customers will highly appreciate the product. Our dealerships are already getting good number of customer enquiries on the car.”

Ford India: The American carmaker registered domestic sales of 9,016 units last month (March 2017: 8,700), posting a marginal growth of 3.63 percent. Over the entire 12-month period of the fiscal between April-February 2018, the company sold 90,061 units and maintained flat sales when the numbers stood at 91,045 units a year ago.

Ford’s domestic sales started picking up only in November last year when the carmaker introduced the updated avatar of its EcoSport compact SUV, which has gone on to sell 19,478 units over the last four months until February. The company is now gearing up to launch another offering in the compact crossover space, albeit, a Figo hatchback-based crossover, which is set to receive a slew of updates over the regular car. Christened ‘Freestyle’ the crossover will be launched this month and will carry a few major updates including spruced up suspension setup, raised ground clearance and a new touch screen infotainment system on the inside.

According to Anurag Mehrotra, president and managing director, Ford India “Listening to our customers and bringing what they want and value is core to whatever we do in India, and is getting reflected in our continued sales growth. Be it partnership with Mahindra or the upcoming launch of our compact utility vehicle - Ford Freestyle, we are committed to offering the best vehicles, technologies and services that fit the lifestyles of Indian consumers.”

Given the smart resurgence of PV sales and the continued surge of consumer demand for SUVs, the growth outlook for the sector in FY2019 will be a strong one. Stay tuned for further updates.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Apr 2018

02 Apr 2018

6692 Views

6692 Views

Autocar Professional Bureau

Autocar Professional Bureau