India Auto Inc on a high but rising fuel prices may play party pooper in FY2019

The PV, CV and two-wheeler sectors sales have notched robust sales in FY2018 and are well set to accelerate growth but the speedy rise in petrol and diesel prices threatens to spoil the OEM party.

The Indian automobile industry is firing on all cylinders. Be it is the passenger vehicle (PV), the commercial vehicle (CV) or the two-wheeler segments, they all have reported robust sales for the fiscal year just ended March 31, 2018.

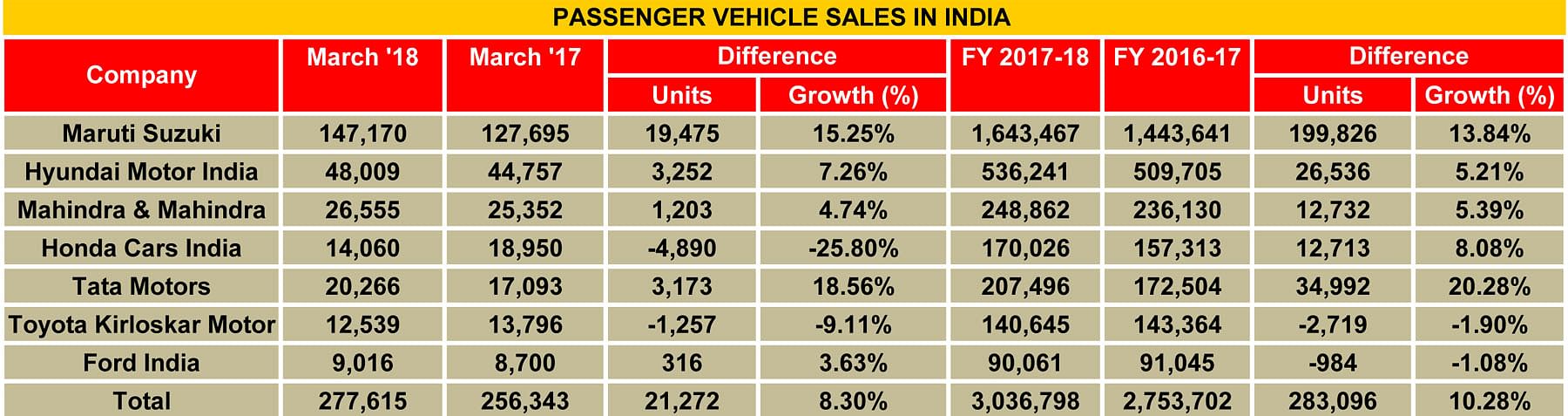

The PV segment, the one which is always in the news thanks to the surging demand for SUVs, has been leading the charge and in the first 11 months of FY2018 sold a total of 2,987,259 units (+8.04%). In FY2017, a total of 3,046,727 PVs were sold and marked the first time that the Indian car industry drove past the 3-million unit sales mark.

With FY2018 having ended three days ago, top PV manufacturers have announced their sales in FY2018. As per the data tabulated by Autocar Professional, sales numbers from the top seven of the 16 OEMs which reveal their sales numbers to apex industry body SIAM, reveal that at 3,036,798 units (see detailed table below) the 3-million mark has been crossed for the second year running and looks set to cross the 3.10 million mark.

COMMERCIAL VEHICLE OEMS POWER ONTO GROWTH ROAD

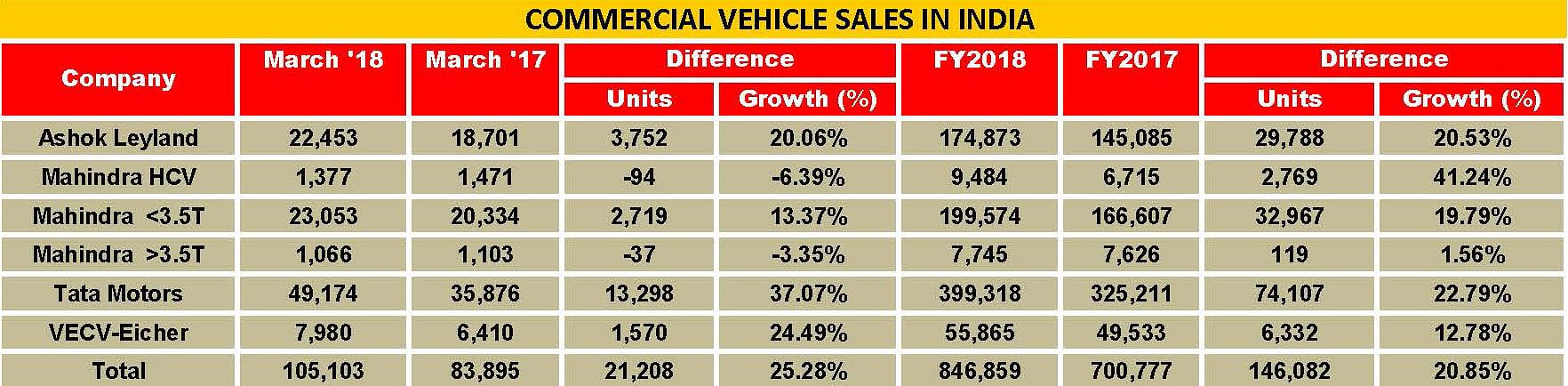

FY2018 also bids fair to be the best year for the CV industry. Coming after five years of tepid growth, this segment, which is the barometer of the country’s economy, is now firmly positioned on growth road and sales of both the critical medium and heavy commercial vehicle (M&HCV) and light commercial vehicle (LCV) segments are accelerating.

Given the many headwinds the industry faced at the beginning of FY2018, overall year-on-year CV industry growth was expected to be a modest 6-7 percent. However, between April-February 2017-18, the sector has clocked over 19 percent and should maintain the momentum when official SIAM figures are revealed for the full fiscal.

Cumulative sales of the top four of the 12 CV OEMs in the country total 846,859 units, which is an 18.56 percent YoY growth (FY2017: 714,232). Importantly, all manufacturers are in the black and notching double-digit growth. Market leader Tata Motors has sold a total of 399,318 units (+22.79%) even as Ashok Leyland, a hard-charging Mahindra Truck & Bus and VE Commercial Vehicles are also making smart gains.

2-WHEELER INDUSTRY CROSSES 20 MILLION SALES MARK

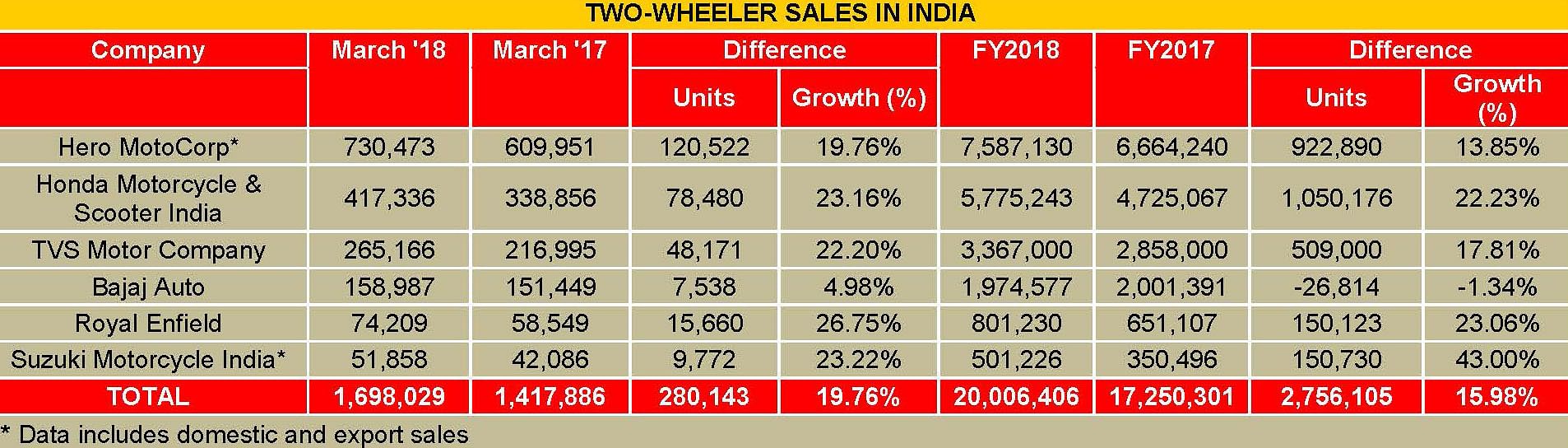

Like the PV sector, the two-wheeler segment's sales are accelerating and how. The six OEMs which have announced their sales for FY2018, put together, have sold 20,006,406 units, which marks a smart 16 percent year-on-year growth rate.

Of these, market leader Hero MotoCorp has sold a record 7,587,130 units (+13.85%), which marks the first time that the company has surpassed the 7.5 million unit mark in overall sales. Honda Motorcycle & Scooter India with 5,775,243 units (+22.23%) and TVS Motor Co with 3,367,000 units (+17.81%) are second and third placed in the fiscal results.

Bajaj Auto sold a total of 1,974,577 motorcycles (-1.34%) while Royal Enfield, which today announced a Rs 800 crore capital expenditure programme to expand capacity to 950,000 units and also set up two new subsidiaries overseas, sold 801,230 motorcycles (+23.96%). Suzuki Motorcycles, which sold 501,226 units, notched handsome growth of 43 percent.

What has given wind to the sails of the two-wheeler OEMs is the sharp spurt in demand for scooters which, like SUVs in the PV segment, are proving to be the growth accelerator.

From the looks of it, the Indian auto industry's smart performance in FY2018 will have beaten SIAM's growth outlook but we will ahve to wait until next week for the final statistics to be revealed. Nonetheless, vehicle manufacturers will be a happy lot. But there's a new worry to contend with: rising fuel prices.

RISING PETROL-DIESEL PRICES WILL BE GROWTH SPOILER

Three days in FY2019 and with SIAM yet to announce the final sales numbers for all four vehicle segments (PVs, Cvs, three and two-wheelers), it can still be surmised that the Indian automobile industry is well set to clock a record fiscal.

However, vehicle manufacturers could likely face a sales speedbreaker in the form of rising fuel prices. Dynamic pricing or daily fuel revision, which kicked in on June 16, 2017, continues to give considerable heartburn to scores of motorists in India, on two-, three-, four and more set of wheels.

The price of petrol has scaled a new high of Rs 81.69 a litre in the financial capital of Mumbai with diesel also keeping pace with an all-time high of Rs 68.89. Petrol price is now at a four-year high in Mumbai – on September 14, 2013, petrol cost Rs 83.62 while diesel on that day was priced at Rs 58.86.

On April 2, motorists tanking up on petrol had to pay Rs 73.83 in New Delhi, Rs 76.54 in Kolkata, Rs 76.59 in Chennai and Rs 81.69 in Mumbai. And those who fill diesel had to shell out Rs 64.69 in New Delhi, Rs 67.38 in Kolkata, Rs 68.24 in Chennai and Rs 68.89 in Mumbai.

And it looks like high prices for fossil fuels are likely to stay for some time and motorists will have to resign themselves to having lighter wallets on account of a higher spend on costly fuel.

Meanwhile, the government is unlikely to make any immediate reduction in excise duty to cushion the rise in global oil prices. According to PTI, when finance secretary Hasmukh Adhia was asked whether a second round of excise duty cut was in the offing, said: "Not as of now. Whenever we review it, we will let you know."

Yesterday, Oil Minister Dharmendra Pradhan said the government is keeping a close eye on international prices but said there is no going back on free market pricing. He said consumers will benefit if petrol and diesel are brought under Goods and Services Tax (GST) regime at the earliest.

"India needs market pricing to provide oil to all," Pradhan said at an event organised to mark the launch of Euro-VI / BS VI grade petrol and diesel in the national capital. Fuel pricing is based on a transparent mechanism, he said, attributing the spurt in rates to happening in international market. "When crude oil prices rise, naturally consumer feels a pinch," he said.

"We are concerned (about the impact on consumers). We are keeping a close eye on the developing international oil scenario," he said. He, however, did not offer any hint of a government intervention like cutting excise duty to give relief to consumers.

"Centre and state bank on tax revenues to meet developmental needs. 42 percent of collections from excise duty (on petrol and diesel) goes to states and out of the remaining 60 per cent is used to fund centre's share in development schemes in states," he said.

Pradhan said the GST Council – the apex decision making body of the new indirect tax regime – should in the "interest of energy security and consumers" include petroleum products in GST.

Petrol, diesel, natural gas, crude oil and jet fuel (ATF) are currently not included in GST, which essentially leads to producers not being able to set-off tax paid on inputs from final tax on product.

The government, he said, had cut excise duty on petrol and diesel by Rs 2 per litre in October and some states had followed it up with a reduction in VAT (value added tax). "When there is a pricing issue, states should respond and cut VAT," he said.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

04 Apr 2018

04 Apr 2018

10982 Views

10982 Views