FY2018: a record-breaking year for India Auto Inc

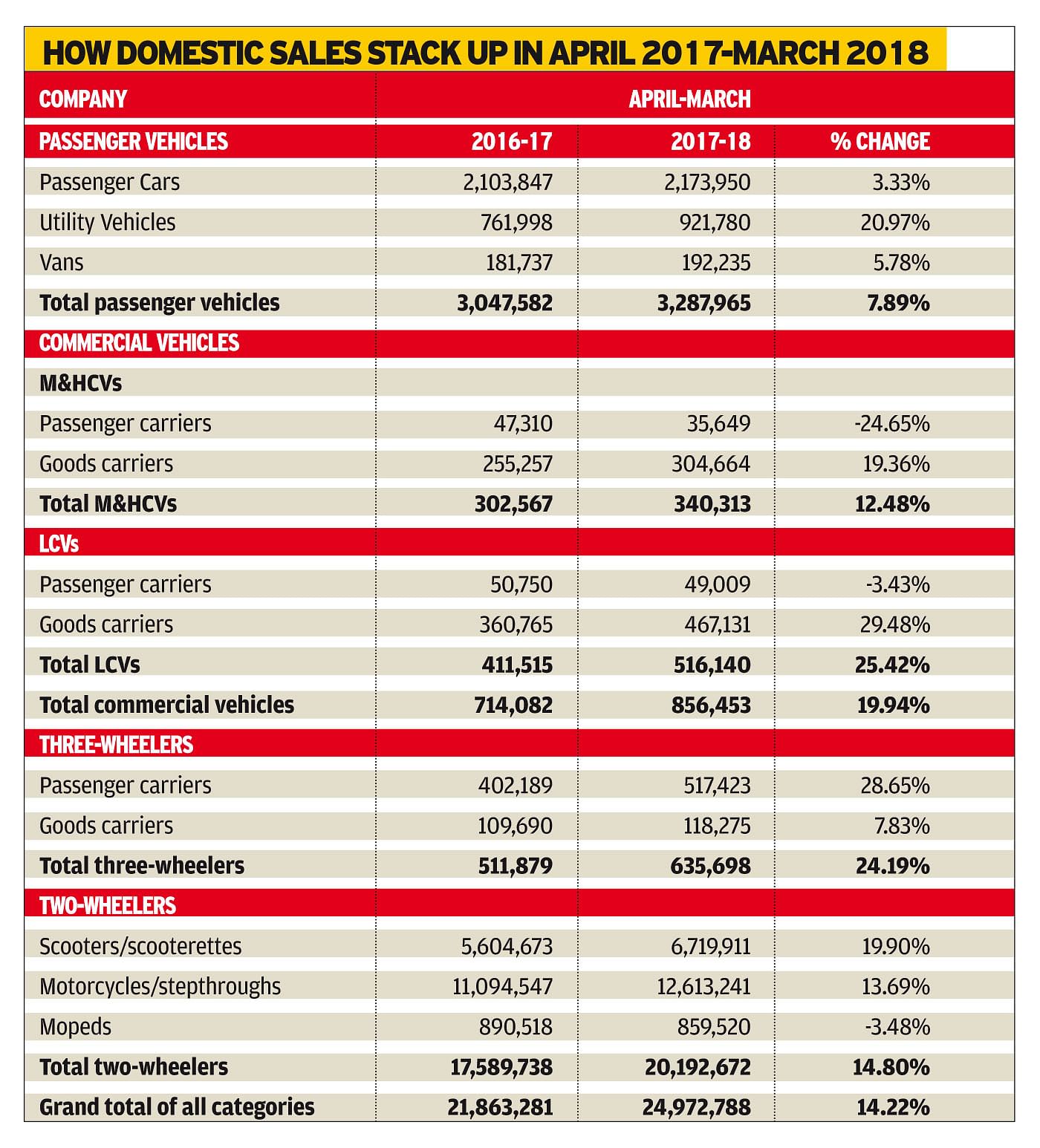

All the vehicle segments – passenger vehicles, commercial vehicles, three-wheelers and two-wheelers – are in the black. Other than PVs (+7.89%), all the others have all notched double-digit growth.

As estimated by Autocar Professional, the Indian automobile industry has notched record high sales of 24,972,788 units in the fiscal ended March 31, 2018, barely 27,212 units shy of the 25-million units mark.

Importantly, all the vehicle segments – passenger vehicles, commercial vehicles, three-wheelers and two-wheelers – are in the black. Other than PVs (+7.89%), the others have all notched double-digit growth.

Highlights of FY2018

- Passenger vehicle sales touches 3.3 million mark.

- Passenger vehicle production crosses 4 million mark. Utility vehicle production crosses 1 million.

- Highest sales and production in passenger car and utility vehicle segments.

- Maximum two-wheeler sales at 20.2 million.

- Maximum two-wheeler production at 23 million, production of scooters crosses 7 million and motorcycles crosses 15 million.

- Maximum commercial vehicle sales at 856,000

- Highest sales in scooters and motorcycles segments.

- Maximum two-wheeler exports and double-digit growth.

- Highest exports of scooters and motorcycles.

- Three-wheeler production crosses 1-million mark, sales at 635,000 highest ever.

CV sales accelerate and how

The big news though is the smart return of good times to the commercial vehicle industry: at 856,453 units sold, CV manufacturers have recorded robust 19.94 percent YoY growth. And this comes across both the M&HCV and LCV sub-segments. While a total of 340,313 M&HCVs were sold (+12.48%), 516,140 LCVs (+25.42%) were also bought, albeit demand for buses is still down.

The CV sector has been through tough times and in FY2014 had seen sales down by 20.23 percent to 632,851 units. While FY2015 was saw numbers slide further to 614,961 units (-2.83%), recovery began in FY2016 with sales of 685,704 units (+11.50%), growing to 714,232 units in FY2017 (+4.16%) and this year to 856,453 units (+19.91%).

On March 17, Autocar Professional had forecast a record year for the domestic CV industry. Clearly, demand is back on the back of the increased government spend on infrastructure and the speedy growth of last-mile transportation, which has given a fillip to sales of small CVs.

SUVs empower PV numbers

The PV sector, like the two-wheeler industry, continues to fire on all cylinders and has crossed the 3-million sales mark for the second year in a row.

With total sales of 3,287,965 units, PV manufacturers posted 7.89 percent YoY growth. While demand for passenger cars, as in FY2017, was above the two-million mark at 2,173,950 units, the surging demand for SUVs, particularly compact SUVs, is helping boost overall PV numbers. A total of 921,780 UVs (+20.97%) were sold in FY2018 and give the accelerating pace of demand, expect UV sales to cross the one-million mark in FY2019.

Demand for UVs is slowly eating into the passenger car market. In FY2018, UVs accounted for 28.03 percent of overall PV sales as compared to 25 percent in FY2017, up 3 percent YoY. Passenger cars accounted for 66.11 percent of overall PV sales in FY2018, down nearly 3 percent from FY2017.

Scooters become the SUVs of the two-wheeler market

Scooters are to the two-wheeler segment what SUVs are to the PV segment. In fact, their YoY growth rates almost mirror each other – UVs at 20.97 percent and scooters at 19.90 percent. The growing scooterisation movement across the country, and more recently in rural India, has seen a total of 6,719,911 scooters being bought, which is strong 19.90 percent YoY growth.

Like SUVs, scooters are making inroads, albeit slowly, into the motorcycle market. In FY2018, scooters accounted for 33.27 percent of overall two-wheeler sales, up 2.27 percent over FY2017. Meanwhile, motorcycles accounted for 62.46 percent of overall two-wheeler industry sales, down from 63.07 percent in FY2017.

On April 4, Autocar Professional had estimated that the Indian two-wheeler industry would ride past the 20-million units sales milestone in the domestic market for the first time. Now, apex industry body, the Society of Indian Automobile Manufacturers (SIAM) has today confirmed that estimate. Final sales numbers for FY2018 are: 20,192,672 units.

Surpassing the 20-million mark also means that the Indian two-wheeler industry has post double-digit growth after six years. The last time was in FY2012 when it grew 12.25 percent with sales of 13,435,769 units.

Given FY2018's robust sales, the growth outlook for the Indian automobile industry remains strong albeit rising prices of petrol and diesel, which have hit four-year highs, remains a worry and could prove to be a sales speedbreaker.

What is also key from an industry perspective is that the numbers translate into actual sales and not as shipments from vehicle manufacturers to their dealers. Stay tuned for further updates on the sales front.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

10 Apr 2018

10 Apr 2018

18070 Views

18070 Views